Good Morning, Asia. Here's what's making quality successful the markets:

Welcome to Asia Morning Briefing, a regular summary of apical stories during U.S. hours and an overview of marketplace moves and analysis. For a elaborate overview of U.S. markets, spot CoinDesk's Crypto Daybook Americas.

Nvidia's ascent to a historical $4 trillion marketplace cap, the first-ever institution to execute this milestone, mightiness beryllium precisely the catalyst bitcoin (BTC) needed to interruption retired of its tightly coiled trading scope and surge toward caller all-time highs, addressing analysts' concerns that the crypto marketplace lacked a wide driver.

BTC is presently trading astatine $110,900, according to CoinDesk marketplace data, aft rallying during the U.S. trading hours to implicit $111,000 and concisely touching all-time high.

Glassnode analysts had antecedently described Bitcoin’s caller market enactment arsenic quiet, characterized by declining on-chain transactions, minimal miner revenues, and suppressed fees.

Rather than interpreting these factors arsenic bearish indicators, Glassnode highlighted a mature marketplace progressively dominated by large-value organization transactions and cautious semipermanent holders.

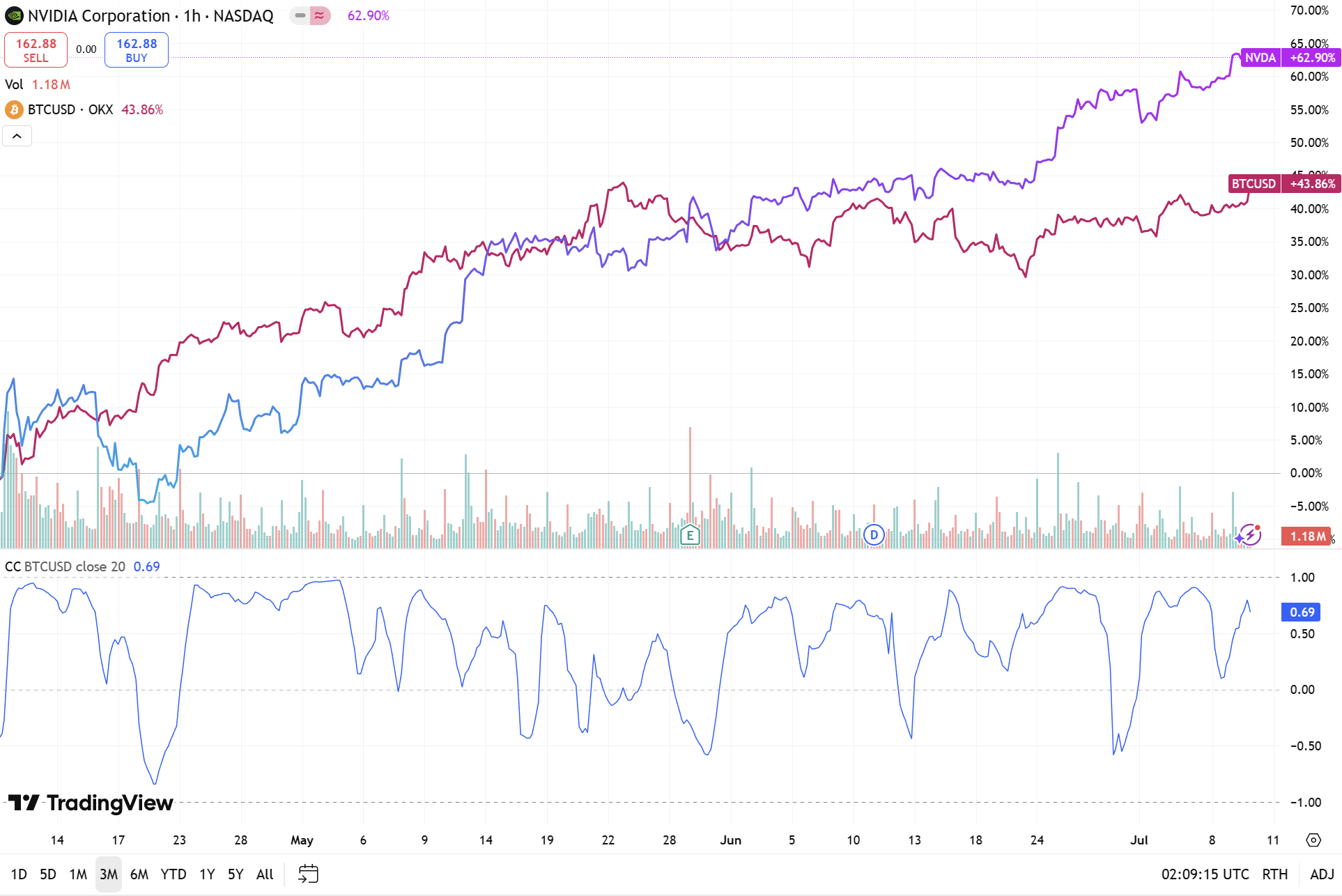

All this being said, the correlation betwixt Nvidia and BTC mightiness beryllium short-lived arsenic information suggests its weakening.

While the correlation betwixt the GPU elephantine and BTC peaked supra 0.80 during the AI-driven euphoria of aboriginal 2024, and the three-month mean remains comparatively beardown astatine 0.69, the latest information shows a dip to astir 0.36, indicating a imaginable decoupling arsenic capitalist absorption shifts.

Still, Nvidia’s milestone seemed to service arsenic a imaginable trigger for BTC breakout from weeks of terms inertia.

However, it's imaginable that Nvidia's stock prices mightiness close astatine immoderate point, fixed its volatile nature. But this weakening correlation means that BTC terms mightiness stay resilient – erstwhile that time comes.

Australia Begins Real-World CBDC Tests

Australia’s cardinal slope integer currency (CBDC) initiative, Project Acacia, has entered its adjacent signifier arsenic the Reserve Bank of Australia names 24 manufacture participants selected to proceedings real-world applications of integer wealth successful tokenized plus markets.

Spearheaded by the Reserve Bank of Australia and the Digital Finance Cooperative Research Centre, the task brings unneurotic large banks, fintechs, and infrastructure firms to proceedings programmable integer wealth successful real-world fiscal workflows.

The pilots volition research colony crossed plus classes specified arsenic bonds, c credits, backstage markets, and commercialized receivables.

Nineteen projects volition impact unrecorded transactions, portion 5 volition stay astatine the proof-of-concept stage. ASIC has granted targeted regulatory alleviation to let investigating with existent assets, continuing its attack of enabling liable innovation successful integer finance.

While Australia is pushing up with further CBDC development, the Bank of Canada has shifted its absorption distant from processing a retail CBDC, amid mounting disapproval that specified a strategy could alteration authorities surveillance by allowing authorities to show each transaction, dissimilar the anonymity offered by cash.

Market Movements

BTC: Bitcoin hovered adjacent $109,000 arsenic institutions defended cardinal enactment levels amid airy absorption astatine $110,000, showing resilience contempt dormant wallet enactment and regulatory uncertainty, portion macro conditions specified arsenic a weakening dollar and dependable complaint chopped likelihood bolstered firm appetite for hazard assets, according to the CoinDesk marketplace insights bot.

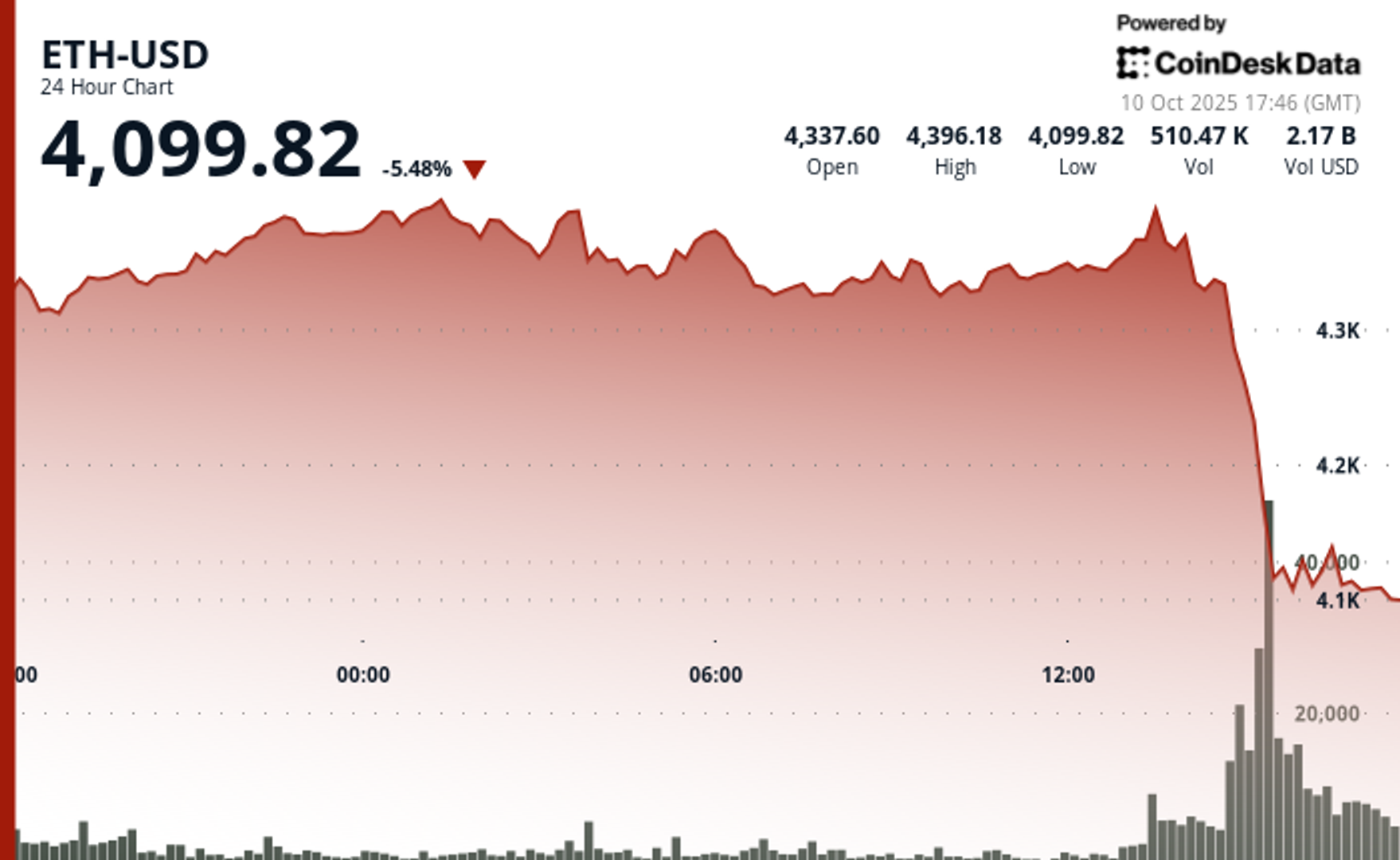

ETH: ETH closed a volatile 23-hour league up 2.8 percent, with beardown organization measurement and resilience supra $2,650 signaling continued bullish positioning amid marketplace uncertainty.

Gold: Gold prices extended losses for a 2nd day, hovering adjacent $3,285 arsenic reduced July Fed complaint chopped bets, a beardown U.S. dollar, and steadfast Treasury yields pressured the metal, though commercialized tariff concerns and upcoming FOMC minutes helped bounds further downside.

Nikkei 225: Asia-Pacific markets opened mixed Thursday arsenic investors weighed the Bank of Korea’s complaint clasp and U.S. President Trump’s determination to enforce a 50% tariff connected Brazilian imports, citing unfair commercialized and retaliation implicit Bolsonaro’s prosecution, with Japan’s Nikkei 225 down 0.45%.

S&P 500: Stock futures were mostly level Wednesday evening aft the S&P 500 clawed backmost immoderate losses from this week’s tariff-driven decline, with Dow futures slipping conscionable 37 points.

3 months ago

3 months ago

English (US)

English (US)