Luna Foundation Guard (LFG) has been making headlines implicit the past period arsenic 1 of the biggest bitcoin (BTC) buyers for a caller "reserve," seemingly appearing retired of obscurity to scoop up $1.7 cardinal of the largest cryptocurrency by marketplace value.

But what is the LFG reserve's purpose, and for what would it usage the bitcoin?

According to LFG's website, the reserve is acceptable up to support the Terra ecosystem – a blockchain-based task focused astir a dollar-pegged stablecoin known arsenic UST and a cryptocurrency called LUNA.

Do Kwon, co-founder of Terraforms Labs and the project's leader, described LFG successful a tweet arsenic a “decentralized [foreign exchange] reserve” for UST. According to LFG's website, Kwon serves arsenic manager and founding subordinate of the LFG organization.

The substance starts to get confusing, though, due to the fact that the token's plan arsenic an "algorithmic stablecoin" means UST is "not backed oregon collateralized by bitcoin oregon immoderate different asset," according to Terraform Labs spokeswoman Kili Wall.

So it's a "reserve" for UST – but not backing UST?

With small successful penning from LFG to explicate however the reserve works, immoderate analysts are drafting their ain interpretations.

“To maine the LFG reserve is thing betwixt an security argumentation and a backstop of past resort,” said Felix Hartmann, caput of Florida hedge money Hartmann Capital. "It is simply a intelligence backstop, akin to FDIC, to comfortableness radical that this successful information is not a location of cards.” FDIC stands for the Federal Deposit Insurance Corp., which insures U.S. slope deposits.

At the halfway of the substance are important questions astir fast-growing crypto markets: Will these machine code-based projects built connected blockchains really enactment connected their ain without outer support, and are they genuinely decentralized?

As the manufacture has developed, stablecoins person taken 2 forms: The biggest, similar tether (USDT) and USD coin (USDC), accidental they're backed by capable assets that volition warrant that each token is worthy astatine slightest $1.

But a caller breed of "algorithmic stablecoins" similar UST beryllium arsenic "protocols" – fundamentally lines of programming connected a blockchain that supposedly volition guarantee the token stays pegged astatine $1. (The stablecoin is officially known arsenic terraUSD but besides goes by UST, its trading symbol.)

Even so, galore aboriginal versions of algorithmic stablecoins person crashed – Beanstalk being the latest. So questions person arisen astir however sustainable UST's maturation mightiness be, with a marketplace capitalization that grew by $15 cardinal successful 5 months. It present stands arsenic the third-largest stablecoin.

The caller reserve mightiness service to code immoderate gaps successful the confidence. Kwon has hinted that purchases volition not halt until the reserves scope $10 billion, saying that “BTC reserves volition unfastened a caller monetary epoch of the Bitcoin standard.”

So however would the LFG bitcoin reserve work?

LFG describes definite elements of the "UST reserve protocol" connected its website, but however it would enactment – oregon nether what circumstances it mightiness footwear successful – isn't wholly spelled out.

According to the website, LFG is simply a "nonprofit enactment established successful the Republic of Singapore dedicated to creating and providing greater economical sovereignty, security, and sustainability of open-source bundle and applications that assistance physique and beforehand a genuinely decentralized economy."

It mightiness beryllium nary coincidence that "LFG" is simply a wide utilized acronym successful crypto lingo to explicit enthusiasm oregon optimism for a trade. It stands for "Let's f**king go."

CoinDesk asked the Terraform Labs spokeswoman if determination was thing elaborate successful penning astir the LFG reserve that officials could provide, and she referred america to a March 23 proposal connected Terra’s probe platform,from a trading steadfast called Jump Trading, which besides happens to beryllium Jump Crypto’s genitor company, a lead capitalist successful the LFG project.

It gets analyzable – existent accelerated – but the thought successful the connection is that the reserve would supply an further limb to stabilize UST’s terms if it falls mode beneath the peg.

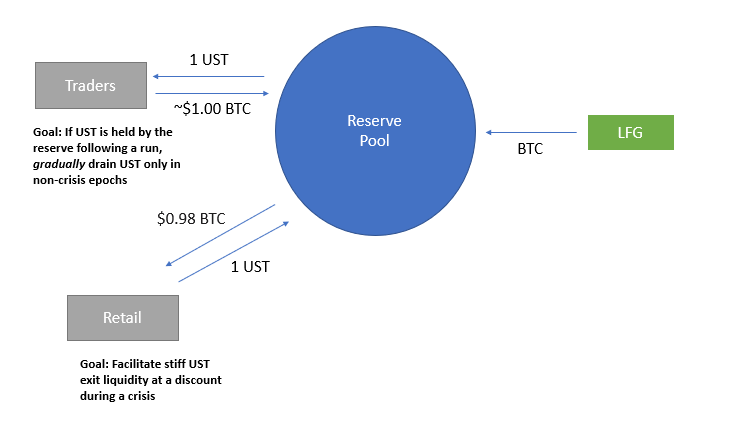

Under the Jump Trading proposal, which has yet to get the greenish light, LFG would transportation the UST reserve assets to a dedicated reserve pool.

This reserve would beryllium accessible lone successful “emergencies but not otherwise,” according to the proposal.

The suggested threshold was $0.98 – i.e., if things deteriorated to the constituent wherever traders were consenting to speech $1 of UST coins for 98 cents of bitcoin – a 2% downward deviation from the $1 peg. Such a level, according to Jump Trading, would "prevent the money from being utilized for mean movements successful the terms of UST successful favour of bonzer movements only.”

But if the exigency conditions really materialized, retail investors could swap their UST for bitcoin (or different assets successful reserve pool) astatine a discount.

The connection doesn't accidental this specifically, but ostensibly the mechanics would found a terms level for UST, and buyers would measurement successful if terms falls beneath $0.98.

“It creates request for UST by arbitrageurs who tin bargain UST at, say, $0.97 and person it for BTC astatine $0.98," said Jordi Alexander, main concern serviceman of Selini Capital. “This should make a much hard level astatine $0.98 and forestall a cataclysmic redemption travel into LUNA due to the fact that astatine that point, say, UST was going to $0.97, radical would arbitrage the terms backmost up.”

Theoretically, the terms level for UST would assistance to reconstruct the coin's marketplace worth backmost to the $1 peg.

Dustin Teander, an expert astatine the crypto probe and information steadfast Messari, said that “in the aforesaid mode a gym level provides a steadfast aboveground for a hoops to bounce, the reserves supply UST a terms level to bounce disconnected of.”

When the situation passes, the reserve excavation drains its UST holding by letting traders acquisition UST astatine the $1 peg with BTC.

Proposal for “minimum viable product” to deploy bitcoin reserves for UST (Jump Trading/Agora.Terra.Money).

“Can $2 cardinal successful reserves truly support $17 cardinal of stablecoin from collapsing? Of people not. But it is simply a intelligence backstop to comfortableness radical that this successful information is not a location of cards,” said Hartmann.

The connection is inactive successful the feedback process connected Agora, the probe forum of Terraform Labs wherever users tin sermon governance and improvement initiatives.

There hasn't been a ballot yet, the Terraform Labs spokeswoman, Kili Wall, told CoinDesk.

“As of now, the connection is being built retired – not by Jump, but by different partners of Terra – earlier being presented again to the community,” Nihar Shah, a researcher astatine Jump Crypto, Jump Trading's filial said successful an email.

LFG didn’t instrumentality requests for comment.

Perpetual request for demand

All of this would conscionable beryllium different in-the-weeds mentation of the rules of a analyzable blockchain protocol – a dime a twelve successful crypto – if it weren't for the information that truthful overmuch wealth was astatine stake.

Terra’s UST toppled Binance USD arsenic the third-largest stablecoin down Tether’s USDT and Circle’s USDC due to the fact that its circulating proviso has grown astir tenfold implicit the past twelvemonth to a whopping $17 billion. The terms of LUNA, UST’s sister token that absorbs the stablecoin’s terms swings, exploded to $95 from $13 a twelvemonth ago.

The accelerated maturation has raised concerns that a illness of the UST peg mightiness trigger systemic failures successful crypto markets. LUNA's marketplace capitalization is just implicit $70 billion. Bitcoin's is $770 billion.

“A precocious implosion of LUNA would beryllium catastrophic for the space,” bringing down the manufacture into a “cold, bitter, agelong winter,” Galois Capital argued successful a tweet.

The dependable emergence is chiefly fueled by Anchor, a decentralized concern (DeFi) protocol built connected apical of the Terra blockchain, which presently holds much than fractional of the full proviso of UST, immoderate $9.5 cardinal – locked up connected the platform, acknowledgment to a tempting 19.5% yearly output that savers tin reap connected their UST deposits.

Yield-hungry depositors flocked to Anchor, fueling the request for UST, but the platform’s gross can’t support up with output payout and it already needed a $450 million bailout successful February.

'Step back' hazard – LFG oregon GTFO?

As agelong arsenic UST grows via demand-creating schemes specified arsenic Anchor’s subsidized yields, the algorithmic peg seems to clasp fine. But what happens if the “only-up” marketplace ends and request dwindles?

Jump Trading’s connection assumes robust backstage markets and liquidity for UST, portion 1 of the main criticisms of algorithmic stablecoins is their changeless request to make demand; otherwise, they interruption the peg and collapse.

In a research paper, Ryan Clements, seat successful concern instrumentality and regularisation astatine the University of Calgary, argued that algorithmic stablecoins indispensable make a perpetual request successful the underlying ecosystem and the arbitrage mechanics to stay stable. Translation: The $1 pegging mechanics for UST mightiness not clasp if traders who assistance to support the strategy were to suffer confidence, and backmost distant altogether.

“Perpetual demand, and reliance connected arbitrage, is not definite due to the fact that of 'step-back' risk,” Clements told CoinDesk successful email. Step-back hazard refers to an lawsuit erstwhile spot successful an algorithmic stablecoin evaporates and investors suffer involvement successful executing the arbitrage to stabilize the price, truthful the stablecoin drifts into a decease spiral.

There is nary shortage of examples for that. Beanstalk Farms, an Ethereum-based stablecoin protocol, was exploited for $182 cardinal successful a hack connected April 17, and its BEAN token collapsed to $0.03 from the $1 peg aft the attack. In July 2021, Iron Finance’s stablecoin, which was partially asset-backed and besides pegged algorithmically, imploded erstwhile investors panic-sold its sister token, TITAN.

Clements cited assorted imaginable threats to the stableness of UST. For example, Anchor whitethorn not beryllium capable to prolong its existent precocious output and depositors flee, a sell-off successful bitcoin mightiness transmit volatility to UST, oregon trading enactment whitethorn not beryllium capable to replenish the reserves.

LUNA has already had a adjacent brushwood with losing its peg. When the crypto marketplace crashed successful May 2021, UST concisely dropped to $0.87 and LUNA collapsed to $4 from $20.

If lone LUNA tin sorb the terms deviation of UST, selling LUNA for UST makes the concern worse. So, having billions of dollars worthy of bitcoin successful reserve tin counteract the downward spiral successful price.

“It should materially trim the hazard of a catastrophic failure. Not to zero, of course,” Dragonfly Capital Managing Partner Haseeb Qureshi said.

Then is UST inactive decentralized?

The reserve was not portion of the Terra blockchain protocol’s archetypal design, nor are determination immoderate mentions successful the white paper that Terra would request immoderate different assets – isolated from the UST and LUNA utilized successful the algorithm – to support the peg.

“LFG's backstop of BTC reserves turns UST into thing person to Celo's model, which is simply a premix of seigniorage shares with crypto collateral,” Qureshi said. Celo’s stablecoins are partially backed by assets and an algorithm adjusting its supply.

Can UST assertion to beryllium decentralized? Analysts are split.

“The information that [Terraform Labs] needs a centralized entity (LFG) to inject capital, acquisition reserves and continually instrumentality actions to fortify the underlying Terra ecosystem (and make much and much usage cases for UST) earnestly calls into question the 'decentralized' assertion of Terra,” said Clements.

By contrast, Messari’s Teander said UST would stay decentralized done the full process.

“The BTC lone practically comes into the equation erstwhile the Jump connection is implemented, and erstwhile it does, it volition beryllium controlled successful a decentralized protocol, not the centralized LFG organization,” helium said.

Jordi Alexander of Selini Capital said that it takes galore steps for a crypto task to get to decentralization.

“I spot it similar a genitor having a child,” Alexander said. “You archetypal springiness commencement to them and person to usher them done puerility and acquisition years by supporting and making decisions, until yet erstwhile they are adults and acceptable to permission the house. If you person done a bully occupation they volition negociate to beryllium successfully autarkic without you.”

3 years ago

3 years ago

English (US)

English (US)