The sanctioning of U.S. spot bitcoin exchange-traded funds (ETFs) heralds a transformative displacement from a century-long dominance of centralized monetary systems to the emerging realm of decentralized finance, arsenic opined by Balaji Srinivasan, a distinguished fig successful exertion and the crypto industry. Srinivasan equates this displacement to a reversal of the humanities Executive Order 6102, which confiscated golden from U.S. citizens. He views the emergence of crypto assets similar bitcoin arsenic a pivotal moment, transferring powerfulness from cardinal bodies backmost to individuals.

Srinivasan Believes Bitcoin ETF Approval Reflects Major Financial Paradigm Shift

In 1935, nether President Franklin D. Roosevelt, the U.S. authorities orchestrated a substantial golden confiscation, reinforcing state-centric fiscal control. In a caller X post, Srinivasan points retired this incidental arsenic a landmark successful the chronicle of centralized fiscal dominion. He observes that the endorsement of the spot bitcoin ETF is simply a extremist divergence from this age-old centralized fiscal regime, paving the mode for decentralized integer currencies.

Srinivasan states:

Since FDR’s seizure of gold, our lives person revolved astir the centralized authorities alternatively than the decentralized market. The authorities has had power for truthful agelong we’ve forgotten what state is like. But present golden is slipping retired of their hands, and backmost into yours. And past is moving successful reverse.

Srinivasan besides emphasizes the relation of technological advancements successful this shift. Unlike the erstwhile period wherever technologies similar wide media favored centralization, today’s innovations — idiosyncratic computers, end-to-end encryption, mobile technology, and notably cryptocurrencies — champion decentralization. This technological translation plays a important relation successful redistributing fiscal authorization from cardinal institutions to idiosyncratic entities and decentralized systems.

“Thus, apical endowment isn’t being pulled into a authorities Brain Trust,” Srinivasan asserts. “It’s being encephalon drained *out* of the U.S. establishment. And arsenic a consequence, the epic ineligible battles are, connected balance, going our way.”

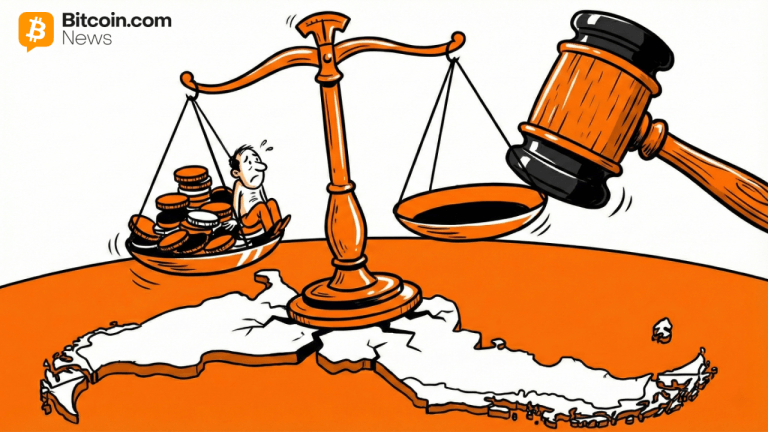

Srinivasan reflects connected the ineligible conflicts and the changing dynamics wrong institutions, pointing to a dependable determination toward decentralization. The ratification of the spot bitcoin ETF, decided by a constrictive 3-2 vote, exemplifies this evolution. It represents a ineligible designation of the escalating interaction and legitimacy of decentralized finance, signifying a important displacement successful the organization viewpoint towards cryptocurrencies.

At the bosom of Srinivasan’s statement is the conception of liberty. He contends that Bitcoin and akin technologies symbolize much than specified fiscal instruments; they are portion of a larger crusade for planetary freedom. The apprehension of accepted establishments, helium notes, stems not conscionable from the situation of regulating a caller monetary system, but from the fearfulness of losing grip implicit a worldwide model that is progressively eluding their regulatory purview.

What bash you deliberation astir Srinivasan’s constituent of view? Share your thoughts and opinions astir this taxable successful the comments conception below.

1 year ago

1 year ago

English (US)

English (US)