Analyzing the ebb and travel of futures contracts crossed exchanges tin supply invaluable insights into the market’s corporate outlook. The authorities of unfastened involvement successful Bitcoin futures and the ratio betwixt agelong and abbreviated positions tin assistance america find whether the marketplace is bullish oregon bearish and expect imaginable terms movements.

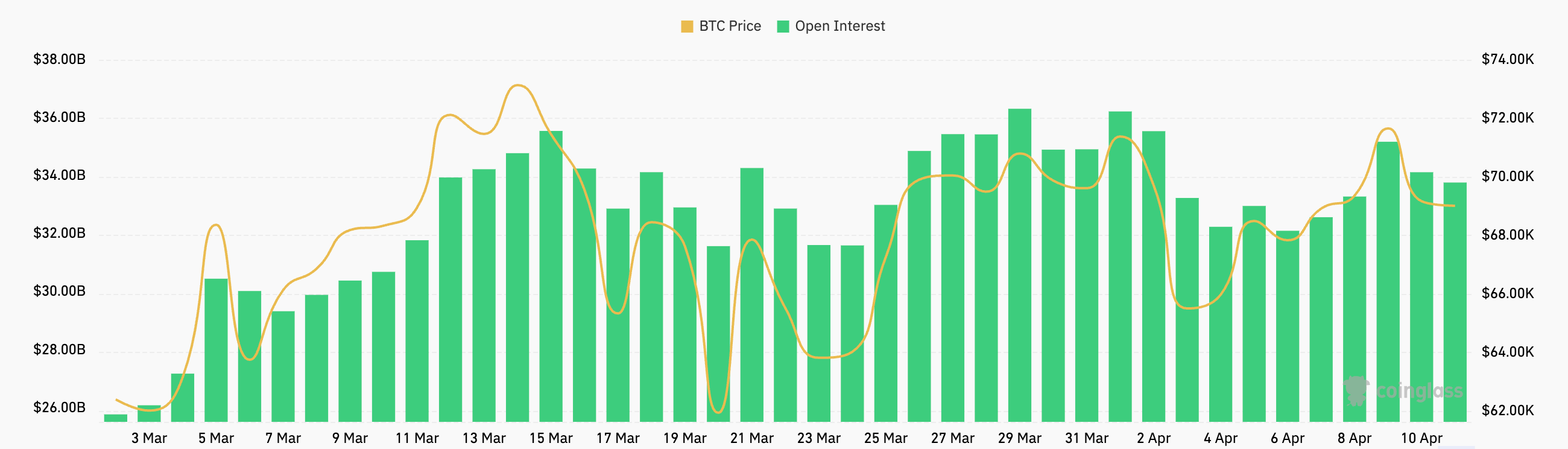

Over the people of 24 hours betwixt April 9 and April 10, the futures marketplace experienced a flimsy but notable shift. Open interest, a measurement of the full fig of outstanding futures contracts that person not been settled, decreased from $35.17 cardinal to $33.77 billion. This diminution successful unfastened interest, alongside a 4.55% alteration successful agelong positions to $39.65 cardinal and a insignificant 0.38% alteration successful abbreviated measurement to $37.31 billion, indicates a cautious retraction successful marketplace participation. These figures suggest a flimsy bearish tilt successful trader sentiment successful the past 24 hours.

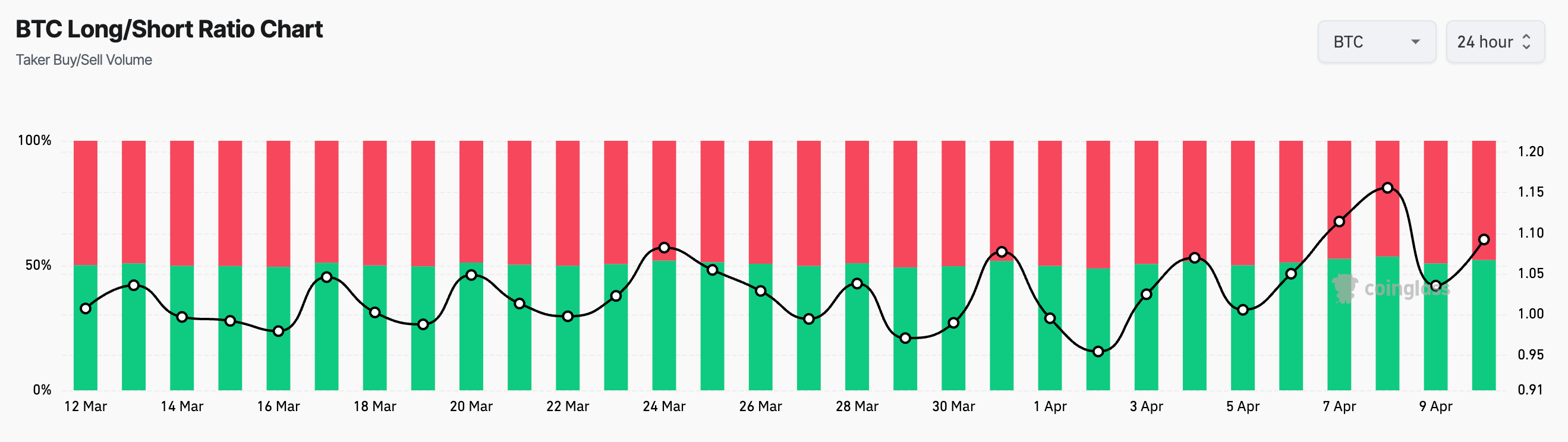

The fluctuation successful the futures’ long/short ratio implicit the past fewer weeks illustrates however the marketplace felt. While the ratios oscillated, they mostly remained positive, making it evident that the marketplace is leaning toward a bullish stance. However, assurance levels person varied successful effect to Bitcoin’s terms volatility. A highest of 1.1561 connected April 8 correlated with a surge successful Bitcoin’s worth aft a correction, portion a dip to 0.9712 connected March 29 mirrored a question of bearish sentiment that came aft BTC failed to conscionable marketplace expectations.

Graph showing the ratio betwixt agelong and abbreviated positions connected Bitcoin futures crossed exchanges from March 12 to April 10, 2024 (Source: CoinGlass)

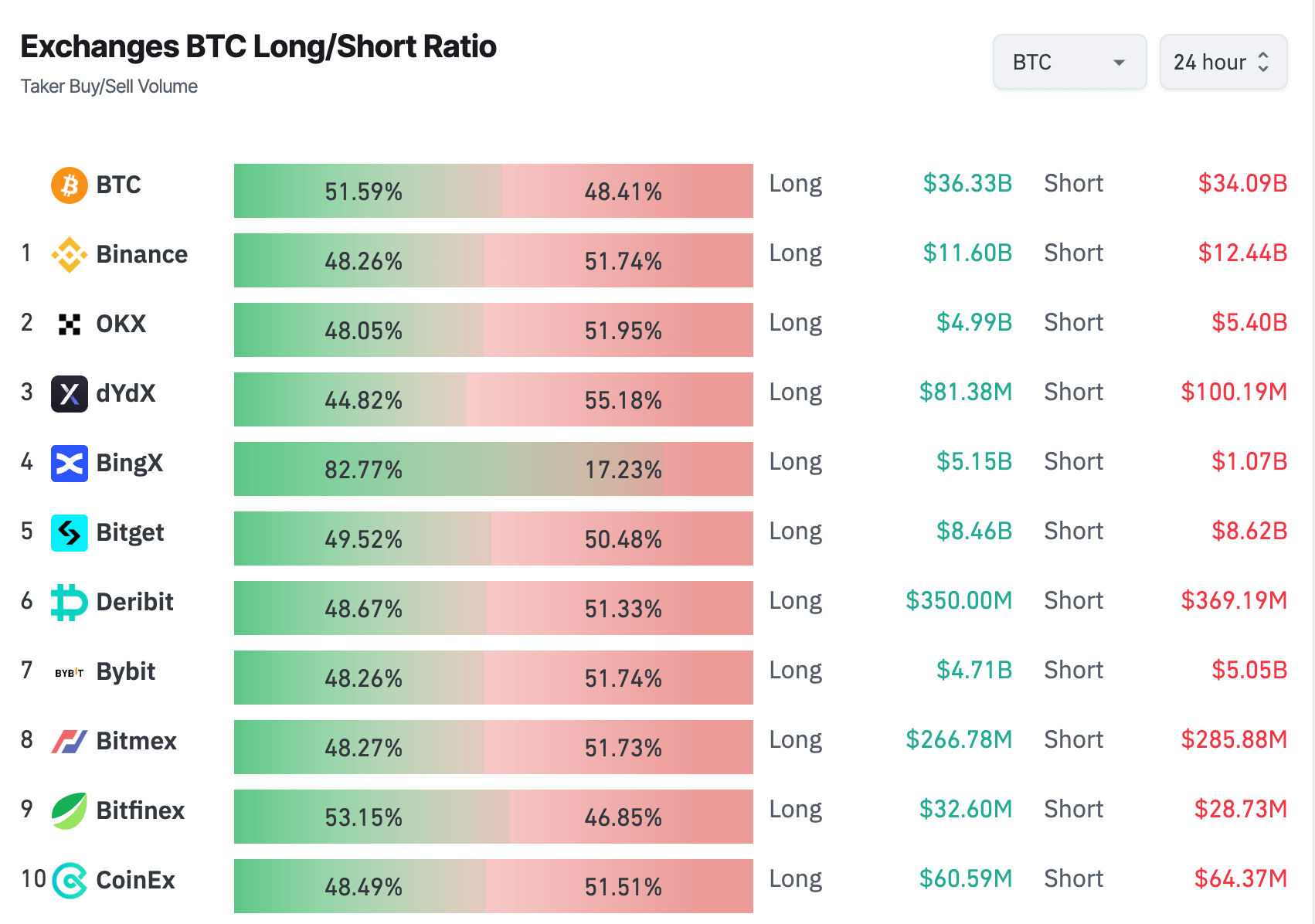

Graph showing the ratio betwixt agelong and abbreviated positions connected Bitcoin futures crossed exchanges from March 12 to April 10, 2024 (Source: CoinGlass)A person look astatine the organisation of agelong and abbreviated positions crossed assorted exchanges reveals a precise divers scenery of trader sentiment and strategy. For instance, BingX stands retired with a importantly higher proportionality of agelong positions (82.77%) than shorts (17.23%), indicating a peculiarly bullish sentiment among its idiosyncratic basal oregon strategical positioning of the exchange’s traders.

On the different hand, platforms similar Deribit and Bitget, with ratios hovering astir 50%, bespeak a much evenly divided marketplace outlook. The opposition betwixt Binance’s predominant abbreviated presumption bias (51.74%) and BingX’s bullish leanings shows however varied strategies and perceptions crossed trading platforms are, with Binance’s abbreviated positions importantly outnumbering BingX’s agelong bets.

Table showing the long/short ratio for Bitcoin futures crossed exchanges betwixt April 9 and April 10, 2024 (Source: CoinGlass)

Table showing the long/short ratio for Bitcoin futures crossed exchanges betwixt April 9 and April 10, 2024 (Source: CoinGlass)The flimsy dip successful unfastened involvement the marketplace has seen successful the past 24 hours suggests a corporate determination towards caution. This tin effect from galore antithetic factors, but broader marketplace uncertainty arsenic Bitcoin continues to conflict to regain the $70,000 mightiness beryllium the biggest one. The contraction successful OI tin besides bespeak a broader hesitation among traders to perpetrate to semipermanent positions.

Graph showing the unfastened involvement successful Bitcoin futures from March 2 to April 10, 2024 (Source: CoinGlass)

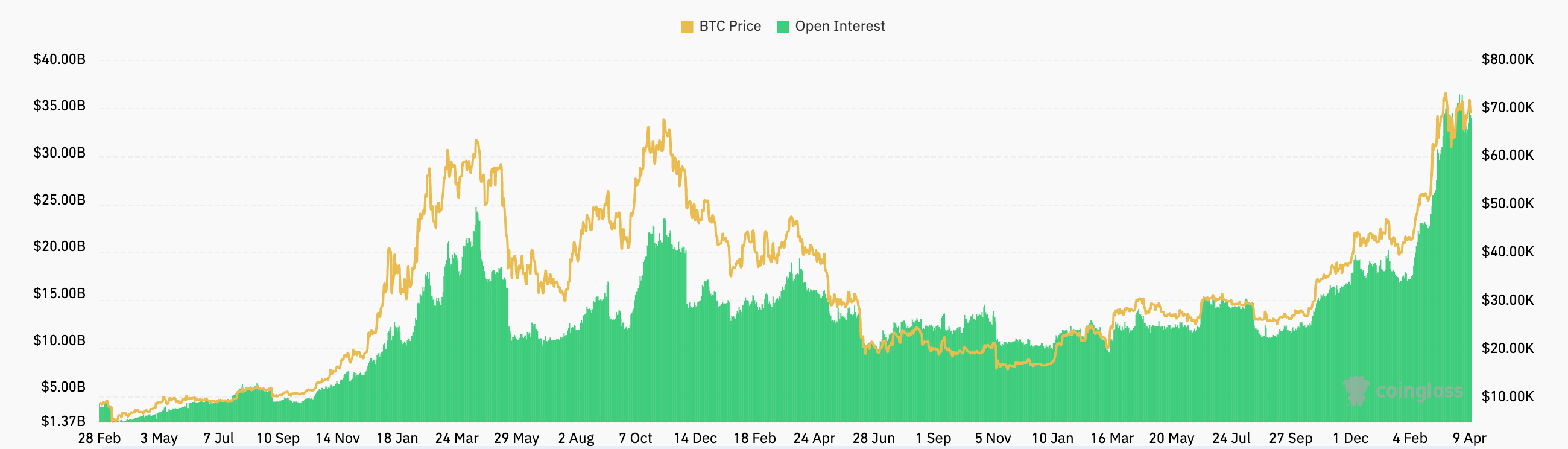

Graph showing the unfastened involvement successful Bitcoin futures from March 2 to April 10, 2024 (Source: CoinGlass)However, it’s important to enactment that the mixed sentiment and cautious stance seen crossed antithetic exchanges is comparative to the caller highs successful OI the marketplace has seen. Despite the driblet successful the past fewer days, the marketplace is inactive successful a derivatives rhythm with the highest unfastened interest successful Bitcoin’s history.

Graph showing the unfastened involvement successful Bitcoin futures from February 28, 2020, to April 10, 2024 (Source: CoinGlass)

Graph showing the unfastened involvement successful Bitcoin futures from February 28, 2020, to April 10, 2024 (Source: CoinGlass)This means that the caution and indecisiveness we’re seeing present are acute and don’t correspond the semipermanent inclination seen this year. Factors similar macroeconomic developments, regulatory changes, and interior developments wrong the crypto market, similar the ETFs, are apt to power this sentiment.

We tin expect the existent inclination to alteration arsenic the marketplace continues to digest these elements. Future expectations and trading strategies volition set rapidly to caller developments successful the market, which is wherefore it’s important to support a adjacent oculus connected derivatives.

The station Bearish tilt successful Bitcoin futures arsenic unfastened involvement contracts appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)