The L2 money-market protocol wants to physique the adjacent bequest of finance.

Cover art/illustration via CryptoSlate

zkLend is an L2 money-market protocol built connected StarkNet, combining the champion of zk-rollups and Ethereum to bring much users to the DeFi market.

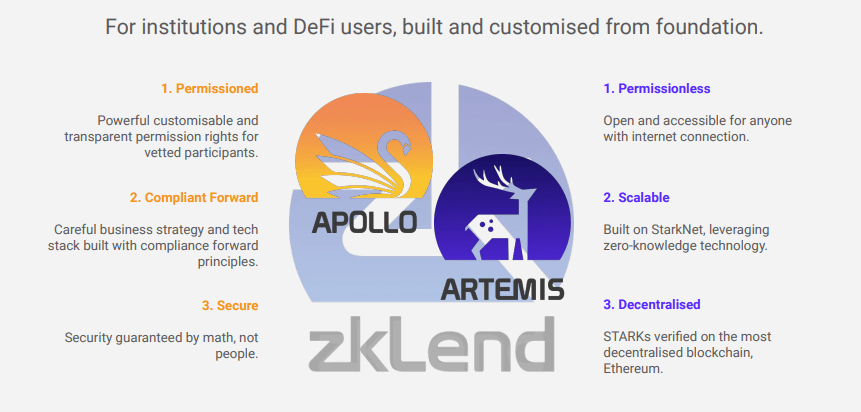

To differentiate itself from the increasing contention connected the market, zkLend offers an innovative, dual solution to the problems faced successful DeFi—a permissioned and compliance-focused solution for organization clients and a permissionless work for DeFi users. All without sacrificing decentralization.

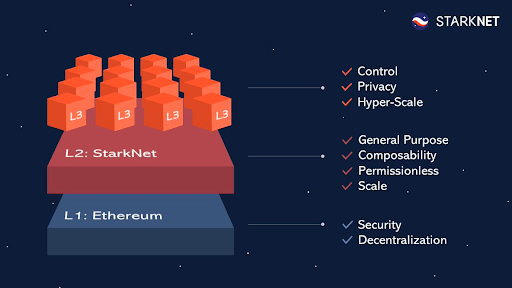

Zk-rollups + StarkNet + Ethereum = zkLend

zkLend was created to beforehand DeFi adoption by making fiscal primitives connected the blockchain accessible to the retail marketplace and the increasing fig of organization clients. And portion it sounds similar a elemental capable proposition, the protocol was faced with a bid of analyzable problems it needed to solve—the archetypal 1 being security.

The squad down zkLend started toying with gathering a protocol successful 2021 erstwhile talks of Layer-2 solutions emerged. While Ethereum was and inactive is 1 of the champion blockchain platforms to motorboat on, some successful presumption of the wide information and web effect, the congestion and precocious fees it faced astatine the clip pushed the squad to see launching connected an L2.

When Vitalik Buterin’s usher to rollups was published successful aboriginal May past year, it cemented the team’s presumption that zk-rollups were the champion L2 solution for zkLend. With computations done disconnected the main blockchain portion proofing the results and state-root changes recorded on-chain, zk-rollups provided standard without compromising security.

At the time, StarkNet emerged arsenic a promising caller exertion of zk-rollup technology, pushing the squad to motorboat the protocol connected the innovative blockchain.

The squad said that StarkWare’s technological competitiveness, proven effectiveness, and a technical, developer-focused ecosystem made it take the network. StarkNet uses cryptography based connected STARKs validity proofs—around 10 times faster than its rival SNARKs (technology presently utilized by zkSync).

With validity rollups, arsenic the fig of transactions increases successful each unsocial batch, the transaction fees go cheaper. The squad explained that this is antithetic from different L2 scaling solutions, wherever the transaction costs typically standard linearly with the full fig of transactions.

StarkNet’s scaling capableness was not theoretical but supported by the existent show of StarkEx – a predecessor dapp-specific scaling motor developed by StarkWare, which processed implicit $200 cardinal worthy of trades successful 2021. As of May this year, this fig has passed $600 billion.

“We saw a scrappy and robust developer ecosystem wherever radical had caller protocol ideas that didn’t beryllium connected L1. We wanted to beryllium astatine the forefront of innovation,” Brian Fu, the co-founder of zkLend told CryptoSlate. ”And present In little than six months, we went from being a portion of a nascent assemblage to 1 that has massively expanded crossed games, DeFi, and infrastructure tooling. ”

Building connected StarkNet was besides zkLend’s effort to future-proof its protocol. StarkNet’s precocious updated roadmap includes moving connected a Layer-3 solution for backstage zk-rollup layering, enabling developers to person some nationalist and backstage L3s connected apical of the L2, further expanding its privateness zk-rollup solution.

A dual solution, tailor-made to lick the problems of DeFi adoption

zkLend has gone to large lengths to found a rock-solid instauration for its protocol. However, the squad isn’t unsighted to the challenges up of them—the biggest 1 being increasing contention from already established protocols connected different networks.

StarkNet’s caller propulsion to go the go-to gaming and NFT L2 has besides positioned zkLend arsenic a backbone of the network, providing fiscal infrastructure to thousands of caller users pouring into the sectors. Even Aave, by acold the biggest lending protocol presently connected the market, has announced plans to travel onto StarkNet.

zkLend plans to leverage everything StarkNet has to connection to go the flagship lending protocol connected the web and a household sanction successful DeFi. The network’s debased transaction costs volition alteration it to make much businesslike liquidation models, putting the absorption backmost connected the borrower.

The squad cited its KYC and whitelisting layer, marketplace excavation hazard isolation, two-sided collateralization, borrowing factor, and a dynamic correlation-linked collateralization ratio arsenic merchandise features that differentiate the protocol from others.

And portion these features aren’t thing caller connected the market, they make a cleanable situation for what zkLend is genuinely about—Artemis and Apollo.

Artemis and Apollo are the protocol’s dual approaches to tackling the increasing size of the DeFi market.

As the squad believes that the adjacent section of DeFi volition beryllium institutional, it was indispensable to make a protocol that volition cater to the needs of fiscal institutions and businesses entering the market. However, creating a protocol that would acceptable some organization and retail needs became an intolerable mission.

Instead, zkLend decided to instrumentality the dual approach—creating 2 sister protocols catering to a circumstantial audience. The protocols are operationally autarkic but are designed to leverage 1 different successful the aboriginal to maximize superior efficiency.

Artemis is zkLend’s retail-oriented product, a permissionless protocol unfastened and accessible to anyone. The squad expects to person an MVP successful aboriginal July, but V1 of Artemis won’t motorboat until the extremity of Q3. The afloat mentation of the merchandise volition person features including flash loans, plus tiering, a refined token inferior program, and different protocol integrations.

The 2nd mentation of the protocol volition beryllium disposable astatine the extremity of Q4 and see adaptive involvement rates, long-tailed assets, and escaped swaps. Aside from these features, V2 volition bring astir the commencement of the DAO modulation for Artemis, scheduled to beryllium completed adjacent year.

On the different hand, Apollo is tailor-made to acceptable the needs of organization clients entering DeFi. Unlike Artemis, Apollo is simply a permissioned network, offering customizable and transparent support rights for vetted participants.

What makes Apollo a cleanable acceptable for institutions is its absorption connected compliance. The merchandise has a compliance furniture that’s unheard of successful the satellite of DeFi, but a modular diagnostic successful TradFi markets. It offers stringent regulatory compliance, arsenic good arsenic KYB and KYC checks.

An MVP for Apollo is acceptable to beryllium released astatine the extremity of the year. The squad is moving connected securing organization motorboat partners and an on-chain KYB supplier successful parallel to the merchandise development.

While the squad didn’t uncover immoderate further details astir who those partners mightiness be, they did accidental that assorted institutions and investors were included successful talks astir what the over-and under-collateralized lending products connected Apollo should look like.

“We are already opening to spot an influx of accepted players, but they inactive thin to beryllium crypto-savvy concern funds and prop trading firms,” Fu explained. “Plus, the TVL progressive is inactive tiny arsenic they trial the waters. Success cases similar Clearpool, Goldfinch, and Maple acceptable the code for the market. As much of these usage cases travel out, institutions volition go much comfy astir DeFi and velocity up the complaint of adoption.”

(Source: zkLend)

(Source: zkLend)When it comes to motorboat dates, zkLend has a wide docket successful spot but remains tied to StarkNet’s timing.

“Our nationalist motorboat is babelike connected the StarkNet nationalist mainnet launch, but we’re optimistic astir the timing,” Jane Ma, the co-founder and task pb astatine zkLend said. “By launching alongside a fewer different protocols including DEXes and DeFi aggregators, we program to make much usage cases and greater composability for StarkNet users “

This is wherefore the protocol’s autochthonal token, ZEND, inactive doesn’t person a acceptable motorboat date. The token was designed to anchor the zkLend protocol, incentivize activity, grant genuine contributors to the network, and springiness meaningful governance rights to its holders.

The $5 cardinal effect circular zkLend raised precocious volition beryllium capable to screen the protocol’s improvement for the foreseeable future. Led by Delphi Digital, the circular saw cardinal cornerstone investments from StarkWare, Three Arrows Capital, and Alameda Research, among different large names successful the VC industry.

The squad said they don’t person plans for much fundraises, but they’re leaving options unfastened if the concern calls for it.

“At the infinitesimal our apical precedence is to get our MVP merchandise retired to marketplace astatine the extremity of Q3 2022, arsenic good arsenic the full-pledged merchandise onto StarkNet mainnet by aboriginal Q4 2022,” Ma told CryptoSlate. “We privation to recognize the roadmap we person acceptable and show the worth of our merchandise to existent investors and users first.”

3 years ago

3 years ago

English (US)

English (US)