A cardinal communicative successful the crypto satellite successful 2021 was the accomplishment of organization investors to the space. Tesla (TSLA) bought $1.5 cardinal worthy of bitcoin (BTC) and Wall Street banks similar JPMorgan Chase (JPM) and Morgan Stanley (MS), arsenic good arsenic hedge funds, started allocating lawsuit assets to bitcoin that year.

Not lone were these organization investors a motion of increasing mainstream acceptance, they besides appeared to thrust up prices. Crypto boomed with the sector’s marketplace capitalization increasing 185% that year.

Now, arsenic the crypto market's latest swoon wipes disconnected $1.25 trillion from the industry's all-time precocious marketplace capitalization reached precocious past year, the question has risen: What relation is organization wealth playing successful the crash? Or to enactment it much bluntly, are organization investors making things worse?

One happening we know: The crypto marketplace is progressively correlated to the banal market, and organization investors look to person heightened that correlation. And erstwhile the banal marketplace goes down, it takes crypto with it.

“The influx of organization involvement successful BTC, which started to prime up successful aboriginal 2020 with nationalist declarations of involvement from stalwarts of accepted investing, specified arsenic Paul Tudor Jones and Renaissance Technologies, coincides with a sustained leap successful the 60-day correlation betwixt BTC and the S&P 500,” according to an April 2022 study by Genesis Trading. (Genesis is simply a subsidiary of Digital Currency Group, which besides owns CoinDesk.)

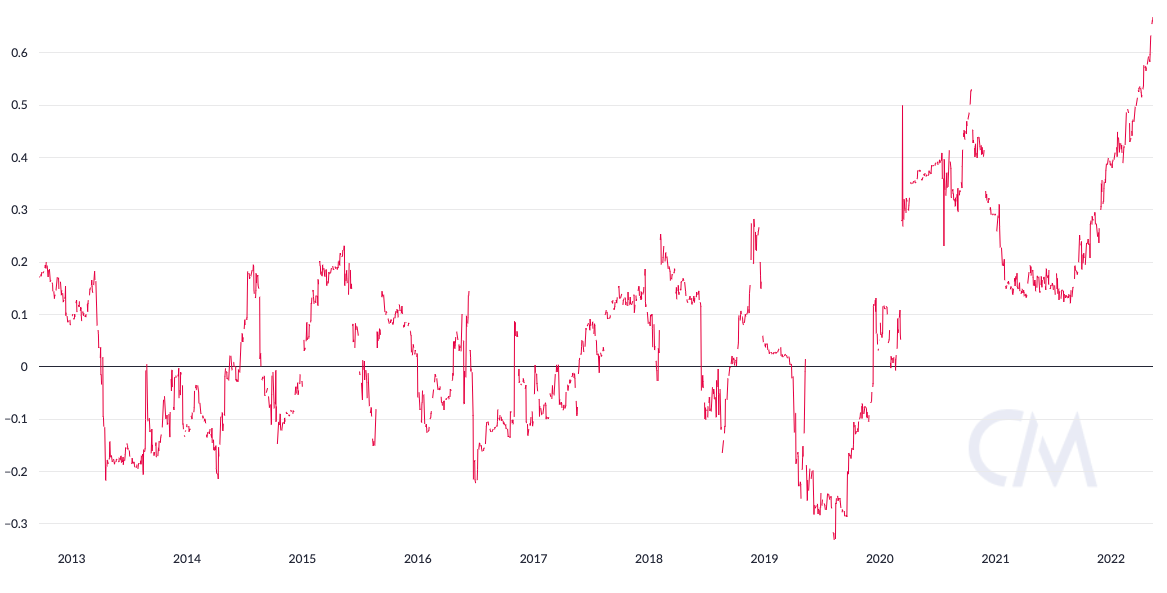

The three-month correlation betwixt bitcoin and ether (ETH) and the large U.S. banal indexes reached a grounds precocious past week, according to Dow Jones Market Data.

Chart of the three-month correlation betwixt bitcoin and the Standard & Poor’s 500 Index shows however the prices person ne'er moved successful tandem to this extent. (Coin Metrics)

For bitcoin bulls, the nettlesome takeaway is that the caller crypto clang can't beryllium delinked from the downturn successful accepted markets.

Stocks are present successful a carnivore marketplace aft the Federal Reserve’s latest complaint hike of 50 ground points, oregon 0.5 percent point, astatine its latest Federal Open Market Committee (FOMC) gathering successful May.

Both crypto and accepted markets concisely skyrocketed aft Fed Chair Jerome Powell ruled retired a larger summation than that astatine upcoming meetings, but they rapidly reversed people aft what Paul Hickey, co-founder of Bespoke Market Intelligence, called a “reality check.”

The S&P 500 and the Nasdaq some dropped astir 5% the time aft the gathering connected May 4. Bitcoin fell implicit 10%, present down implicit 35% twelvemonth to date. For marketplace watchers, the upshot was however intimately they're traveling successful tandem.

A caller study from Morgan Stanley recovered that organization investors dominated trades successful crypto successful 2021, and that retail investors accounted for lone a 3rd of each trades connected crypto speech Coinbase, reported the Financial Times.

“Client involvement [is] concentrated much heavy onto the 2 main crypto assets, BTC and ETH,” analysts astatine information supplier VandaTrack wrote, according to the newspaper. ETH stands for ether, the autochthonal cryptocurrency of the Ethereum blockchain. ”This matters because, arsenic much institutions await the archetypal results of the White House enforcement bid connected crypto regularisation and the ETH merge to ETH 2.0, existent terms behaviour volition proceed to beryllium driven by TradFi assets.” (ETH 2.0 is shorthand for a planned upgrade of the Ethereum network, and "TradFi" is crypto-industry jargon for "traditional finance." The aged world, arsenic it were.)

“We deliberation the accrued engagement of institutions, which are delicate to availability of superior and truthful involvement rates, has contributed successful portion to the precocious correlation betwixt bitcoin and equities,” the study stated.

So does that mean that those organization investors who helped crypto to flourish a twelvemonth agone are present a origin successful the crash?

“Absolutely,” said Bob Iaccino, main strategist astatine Path Trading Partners and co-portfolio manager astatine Stock Think Tank.

“We could marque specified an assumption, since the marketplace has matured and a larger information of participants are institutions, exposed to some crypto and accepted assets,” said Joe DiPasquale, CEO of BitBull Capital. “With time, it is plausible that we spot faster tops and bottoms successful the crypto abstraction compared to the prolonged periods successful the past.”

“This is the quality of tradable assets,” helium said. “When assets are sold, each assets are sold. Bitcoin has correlated with the Nasdaq for rather a portion now. This is nary exception.”

It isn't casual to abstracted organization and retail inflows and outflows. But sometimes you perceive from the investors themselves. Miller Value Partners Chairman Bill Miller, known for beating the S&P 500 Index for 15 consecutive years, sold immoderate of his bitcoin to conscionable borderline calls, noting that erstwhile things get pugnacious you privation to merchantability precise liquid assets – successful this lawsuit bitcoin.

Take a look astatine the “Coinbase premium,” which is the quality betwixt the terms of buying bitcoin with dollars connected Coinbase and the outgo of buying bitcoin connected Binance utilizing the stablecoin USDT.

Crypto-market analysts look astatine this fig to measure who is the bigger unit successful the marketplace astatine immoderate fixed infinitesimal – organization investors oregon retail investors. The reasoning is that Coinbase's idiosyncratic basal skews much organization than Binance's. So if there's a premium, it usually means that organization investors are starring the marketplace higher.

But recently, the premium flipped antagonistic and fell to a 12-month low, according to information from CryptoQuant.

“Usually, determination is simply a Coinbase premium. This means that the bitcoin terms connected Coinbase is higher than connected Binance. This was/is precise important, due to the fact that American institutions and HNW (High Net Worth) were trading mostly connected Coinbase. However... successful the latest fewer days it’s negative. This indicates dense selling connected Coinbase Pro!” CryptoQuant said successful a blog post.

“The crypto capitalist from retail to organization thin to besides beryllium the capitalist successful tech stocks,” said Howard Greenberg, cryptocurrency pedagogue astatine Prosper Trading Academy. "They thin to beryllium those bullish connected exertion arsenic a disrupter to existent industries, and this crossover and correlation is playing retired currently."

The transportation seemingly holds accelerated erstwhile the marketplace goes into reverse, helium said.

“For Institutions it is besides easier to liquidate their crypto positions particularly with the 24/7 entree to their superior than immoderate different positions, truthful they thin to beryllium the archetypal positions closed out,” helium said.

“In the past year-and-a-half, we’ve had caller entrants to the integer assets marketplace from the macro hedge money world,” Jeff Dorman, main concern serviceman astatine Arca wrote successful a report. “It’s the players, not the assets, that are correlated.”

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

Please enactment that our

cookies, and

do not merchantability my idiosyncratic information

has been updated.

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a

strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of

Digital Currency Group, which invests in

and blockchain

startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of

stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for Crypto Long & Short, our play newsletter featuring insights, quality and investigation for the nonrecreational investor.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)