Corporate structure, Bitcoin liabilities and interior power prime are among the points of concern.

Own this portion of crypto past

Collect this nonfiction arsenic NFT

Binance's efforts to amended transparency of its reserves besides exposed reddish flags successful the crypto exchange's finances, according to accounting and fiscal specialists consulted by The Wall Street Journal.

As noted by a erstwhile Financial Accounting Standards Board (FASB) subordinate and concern manager, the study released by the audit steadfast Mazars does not bring investors assurance astir the exchange's concern arsenic it lacks accusation related to the prime of interior controls and however its systems liquidate assets to screen borderline loans.

Another reddish emblem raised by the newspaper's sources is regarding the deficiency of accusation astir Binance's firm structure. As per the report, Binance’s main strategy officer, Patrick Hillmann, was incapable to supply the sanction of Binance’s genitor institution since it has been going done a firm reorganization for astir 2 years.

Differences betwixt the full Bitcoin liabilities were besides highlighted. The exchange's proof-of-reserves shows that Binance was 97% collateralized if excluded assets lended to users done loans oregon borderline accounts, indicating that the 1:1 ratio of reserves to lawsuit assets was not achieved. Mazars' missive states astir the difference:

"We recovered that Binance was 97% collateralized without taking into relationship the Out-Of-Scope Assets pledged by customers arsenic collateral for the In-Scope-Assets lent done the borderline and loans work offering resulting successful antagonistic balances connected the Customer Liability Report. With the inclusion of In-Scope Assets lent to customers done borderline and loans which are overcollateralized by Out-Of-Scope Assets, we recovered that Binance was 101% collateralized."John Reed Stark, Senior Lecturing Fellow astatine Duke University School of Law and erstwhile main astatine Office of Internet Enforcement for the Securities Exchange Commission (SEC), stated successful a Twitter station astir Binance's reserves:

"Binance’s “proof of reserve” study doesn’t code effectiveness of interior fiscal controls, doesn’t explicit an sentiment oregon assurance decision and doesn’t vouch for the numbers. I worked astatine SEC Enforcement for 18+ yrs. This is however I specify reddish flag."Following FTX collapse, Binance released past period a proof-of-reserves strategy that allows users to verify their assets utilizing a Merkle tree. The initiative, however, was labeled "pointless" by rivals arsenic it failed to see liabilities.

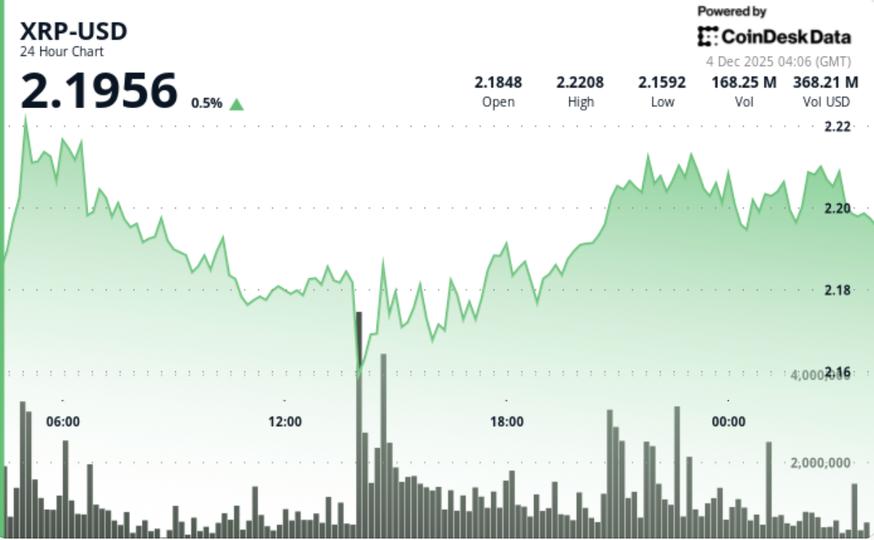

Mazars disclosed its audit study connected Binance's Bitcoin reserves connected Dec. 7. According to the planetary audit company, the crypto speech possesses power implicit 575,742.42 Bitcoin of its customers, worthy $9.7 cardinal astatine the clip of the report. Per the methodology, “Binance was 101% collateralized”, said the company.

The scope of the study included customers’ spot, options, margin, futures, funding, indebtedness and gain accounts for Bitcoin and wrapped Bitcoin (WBTC). Aside from the Bitcoin network, BTC wrapped connected Ethereum, BNB Chain and BNB Smart Chain were besides included successful the inquiry, Cointelegraph reported.

2 years ago

2 years ago

English (US)

English (US)