The SEC’s lawsuits against Binance and Coinbase created a discernable displacement successful the market, starring to important changes successful the exchanges’ plus balances.

The lawsuits, filed connected June 5 and June 6, impeach Binance and Coinbase of a assortment of securities instrumentality violations. These ineligible encounters person created a domino effect successful the ineligible sphere and caused changes successful the exchanges’ marketplace performance, including fluctuations successful Coinbase’s banal terms and a driblet successful Binance’s marketplace share.

Bitcoin’s terms experienced a crisp driblet connected June 6, mirroring the absorption of the broader crypto industry. Despite this abrupt downturn, BTC managed to recover, demonstrating the resilience inherent wrong the sector.

Another effect of the lawsuits tin beryllium seen successful the changes successful the exchanges’ plus balances. Evaluating withdrawals of the large assets — Bitcoin, Ethereum, and stablecoins — tin assistance gauge the wide marketplace interaction of these lawsuits.

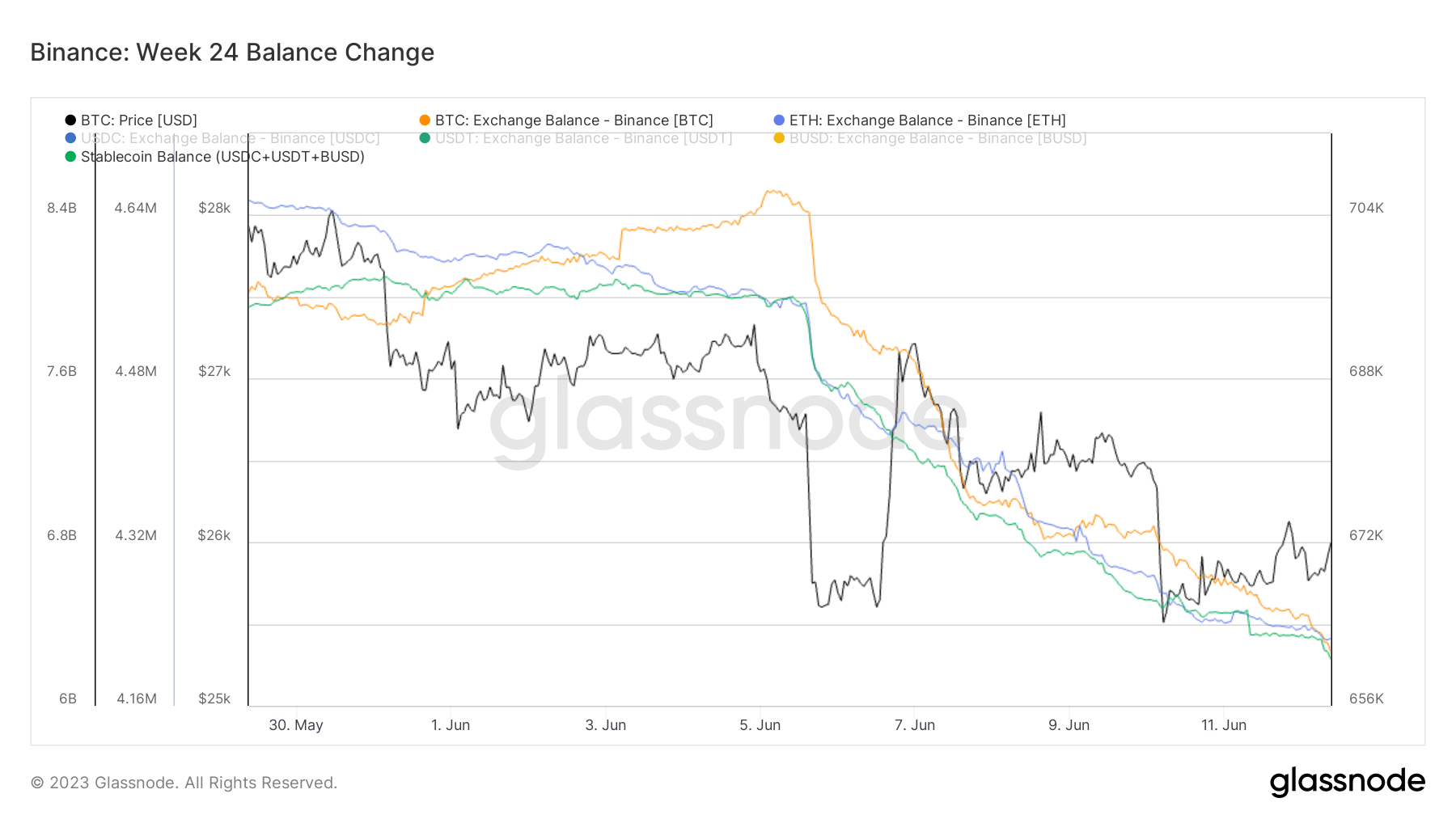

Data from Glassnode reveals a important outflow of assets from Binance pursuing the SEC lawsuit. Approximately 20.9% of Binance’s full USDT, USDC, and BUSD balance, astir $1.6 billion, has been withdrawn by users. Similarly, Binance’s reserves of Bitcoin and Ethereum person shrunk by 5.7% and 7.1%, respectively.

Graph showing the changes successful large plus balances connected Binance from May 30 to June 12, 2023 (Source: Glassnode)

Graph showing the changes successful large plus balances connected Binance from May 30 to June 12, 2023 (Source: Glassnode)Meanwhile, stablecoin balances connected Coinbase remained comparatively dependable betwixt June 5 and June 12, with Bitcoin balances seeing a insignificant alteration of 0.5%.

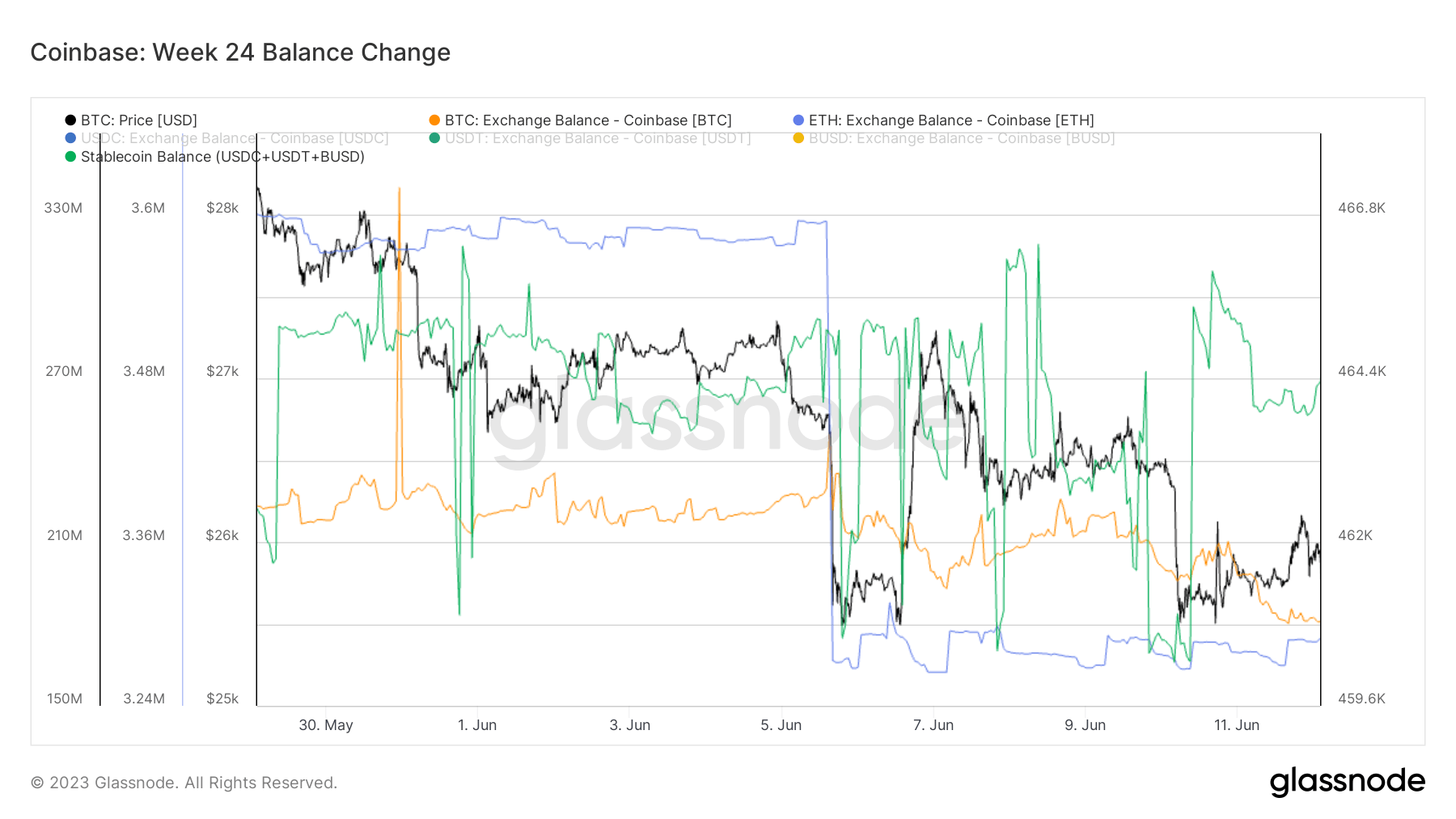

However, Ethereum was deed harder with a important withdrawal of 291,000 ETH, accounting for astir 8% of the full equilibrium of ETH connected Coinbase.

Graph showing the changes successful large plus balances connected Coinbase from May 30 to June 12, 2023 (Source: Glassnode)

Graph showing the changes successful large plus balances connected Coinbase from May 30 to June 12, 2023 (Source: Glassnode)This discrepancy successful withdrawals betwixt the exchanges tin beryllium attributed to respective factors. The much important outflow of Ethereum from Coinbase apt stems from regulatory uncertainties astir its Earn product, which offered staking services for assorted cryptocurrencies, including ETH, pushing galore investors to divest.

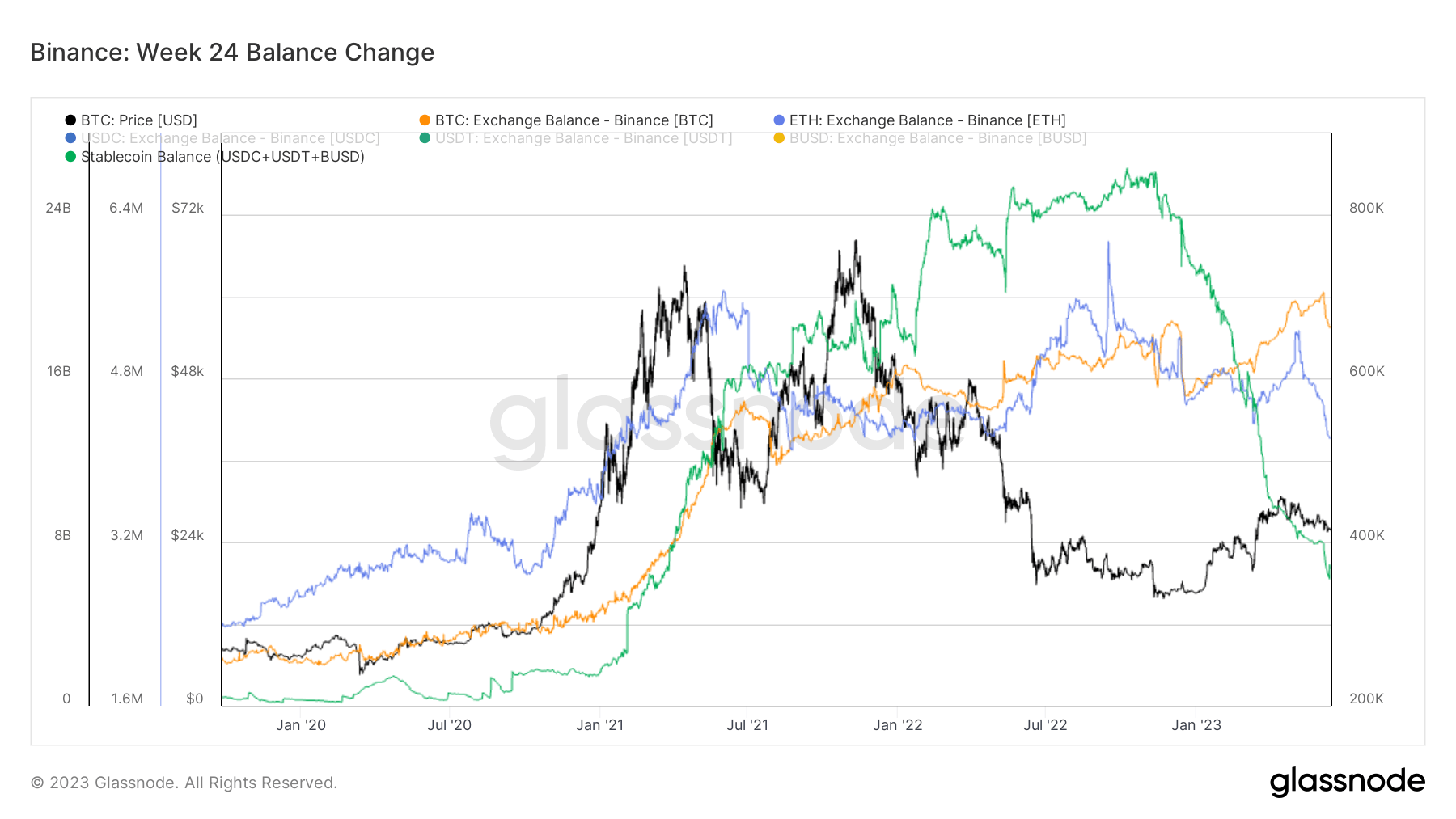

The large-scale withdrawal of stablecoins from Binance continues a inclination initiated successful October 2022. Since then, the speech recorded a 75% driblet successful its stablecoin balance.

Graph showing the changes successful large plus balances connected Binance from September 2019 to June 2023 (Source: Glassnode)

Graph showing the changes successful large plus balances connected Binance from September 2019 to June 2023 (Source: Glassnode)This inclination escalated successful February 2023, erstwhile the SEC issued a Wells announcement against Paxos implicit its issuance of the Binance-backed BUSD. Paxos stopped minting caller BUSD and entered a redemption-only mode, allowing users to person their BUSD to USDP.

As the astir liquid exchange, Binance traditionally held important amounts of stablecoins. Still, the ongoing regulatory turbulence and fears of imaginable withdrawal restrictions could person prompted users to determination their assets elsewhere.

The station Binance vs. Coinbase: Analyzing plus withdrawals successful the aftermath of SEC lawsuits appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)