The caller terms slump successful Bitcoin, caused by a turbulent cryptocurrency market, has sent galore investors into panic mode, forcing them to offload their BTC holdings astatine a loss.

However, blockchain analytics steadfast Glassnode noted that a radical of Bitcoin investors remained resilient contempt the crypto marketplace volatility, saying that semipermanent holders of the firstborn crypto are unshaken by the existent marketplace slump.

Long-Term Holders ‘Largely Unaffected’

Glassnode said that Bitcoin, similar different cryptocurrencies, experienced a shaky week successful which traders saw the world’s astir ascendant integer plus clang beneath the $100,000 level.

At 1 point, Bitcoin’s terms astir deed the $90,000 level, astatine $92,800, connected February 3, which was the lowest since BTC recorded $90,890 connected January 13.

On the brighter side, the blockchain analytics steadfast noted that BTC’s semipermanent holders look insulated from each the chaos surrounding the cryptocurrency community, saying, “#BTC’s semipermanent holders (LTHs) stay mostly unaffected.”

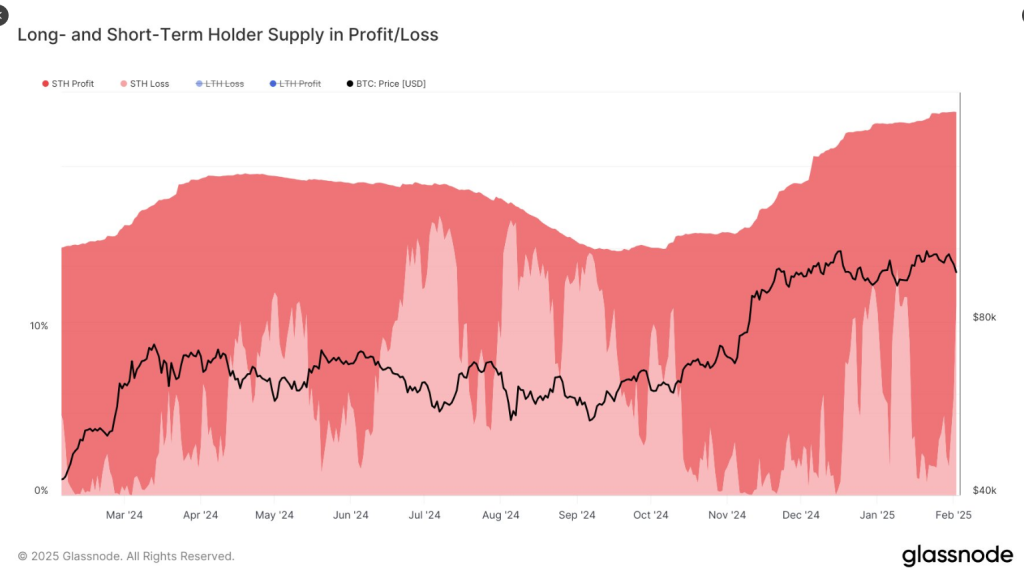

Glassnode revealed that information showed astir 0.01% of the proviso of these BTC holders was successful loss, emphasizing the resiliency of semipermanent investors successful times of marketplace turbulence. However, the crypto steadfast remarked that these Bitcoin investors experienced a decreasing unrealized profit.

“However, their unrealized nett stock has steadily declined since November, present astatine its lowest since September – suggesting nary renewed accumulation yet,” Glassnode said successful a post.

The expert noted that BTC holders are not aggressively buying astatine existent prices, perchance waiting for amended marketplace signals earlier resuming accumulation.

Bitcoin Short-Term Holders Bleed

Meanwhile, information showed that different conception of Bitcoin investors suffered the astir from the marketplace clang – short-term holders.

According to Glassnode, short-term BTC holders experienced a important nonaccomplishment aft the crypto’s terms slid beneath the $100,000 level, causing panic among these traders.

#Bitcoin dipped beneath $100K implicit the weekend, pushing a notable magnitude of short-term holder (STH) proviso into loss. At $97K, the proviso successful nonaccomplishment & nett held by STHs was evenly divided astatine ~11% – the largest nonaccomplishment vulnerability for STHs since aboriginal January: https://t.co/Drjy6ahQMm pic.twitter.com/gypNiJ0BqX

— glassnode (@glassnode) February 3, 2025

Glassnode said that erstwhile Bitcoin plummeted to $100,000 implicit the weekend, it pushed “a notable magnitude of short-term holder (STH) proviso into loss.”

“At $97K, the proviso successful nonaccomplishment & nett held by STHs was evenly divided astatine ~11% – the largest nonaccomplishment vulnerability for STHs since aboriginal January,” the blockchain analytics steadfast said successful an X post.

Bearish Market Sentiment

An expert noted that Bitcoin concisely dipped truthful debased that it astir deed $90,000 per coin, arsenic the dominating crypto suffered aft the marketplace crash.

“Bitcoin plummeted to arsenic debased arsenic $91.2K arsenic each of crypto has dipped with satellite banal markets starting the week with dense bleeding. Media outlets look to beryllium attributing plummeting sectors to ‘Trump’s commercialized war’,” marketplace quality level Santiment said successful a post.

😰 Bitcoin plummeted to arsenic debased arsenic $91.2K arsenic each of crypto has dipped with satellite banal markets starting the week with dense bleeding. Media outlets look to beryllium attributing plummeting sectors to ‘Trump’s commercialized war’.

Whether this is the superior crushed oregon if determination are other… pic.twitter.com/ij1bQ6xfUu

— Santiment (@santimentfeed) February 3, 2025

Santiment added that determination person been overwhelmingly antagonistic reactions from investors successful the cryptocurrency assemblage arsenic a effect of the terms decline, and for a infinitesimal it seems BTC is astir to participate bearish territory.

The marketplace quality level noted that astatine the moment, Bitcoin was capable to propulsion backmost to $96,000.

“Was this flush orchestrated to get trigger-happy retail traders to merchantability astatine a section bottom? Historically, markets virtually ever determination the other absorption of the crowd’s expectations,” Santiment asked successful a post.

Featured representation from Pexels, illustration from TradingView

10 months ago

10 months ago

English (US)

English (US)