On Dec. 13., a further diminution of CPI to 7.1% was met by an expected rally successful equities and a driblet successful the U.S. dollar and treasury yields. On Dec. 14., Powell accrued involvement rates by 50bps to a caller national funds complaint people of 4.25%-4.5%.

Encouraging CPI

Headline ostentation slowed from 7.7% to 7.1%, offset by a diminution successful halfway bully prices by 0.5% and a 1.6% diminution successful vigor prices.

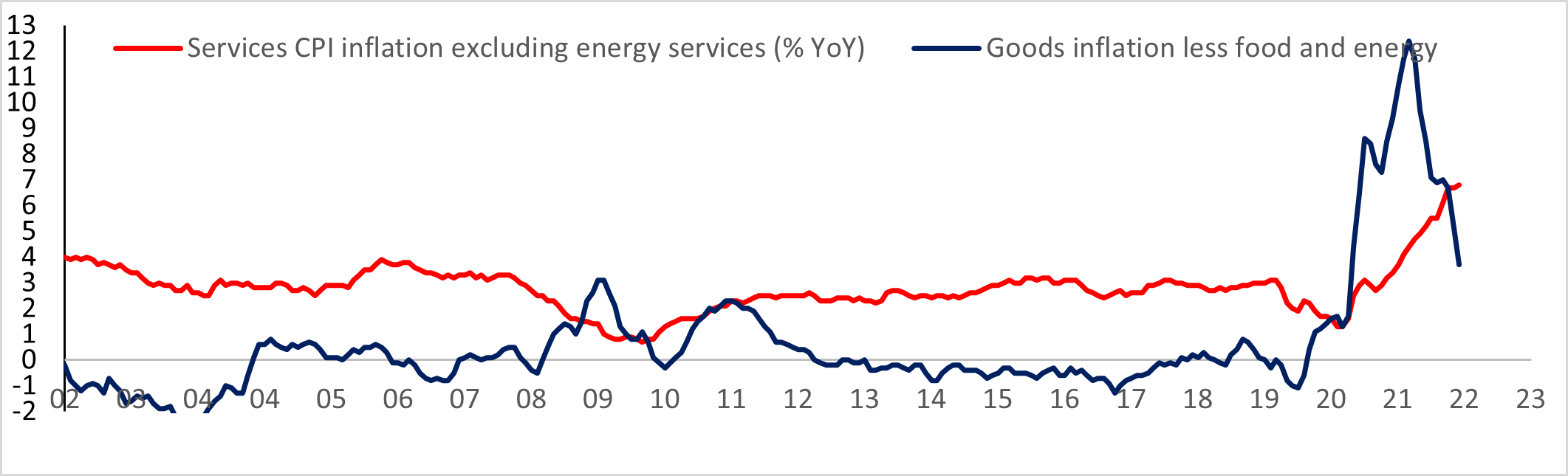

Core goods ostentation continued to alteration to conscionable nether 4% from its highest successful February, supra 12%. However, services ostentation which excludes vigor roseate to 6.8%. Services ostentation volition enactment elevated arsenic the occupation marketplace is inactive resilient successful the U.S.; however, that could alteration successful 2023.

CPI Inflation Report: (Macroscope)

CPI Inflation Report: (Macroscope)Powell remains hawkish

The fed raised rates by an expected 50bps to acceptable the caller fed funds people of 4.25%-4.5%, and the code from Powell remains unchanged “ongoing” complaint hikes and “we volition enactment the people until the occupation is done”. Powell expects ostentation to proceed declining dilatory arsenic the labour marketplace remains tight. 55% of halfway CPI is inactive expanding rapidly adjacent though location and goods prices are dropping rapidly.

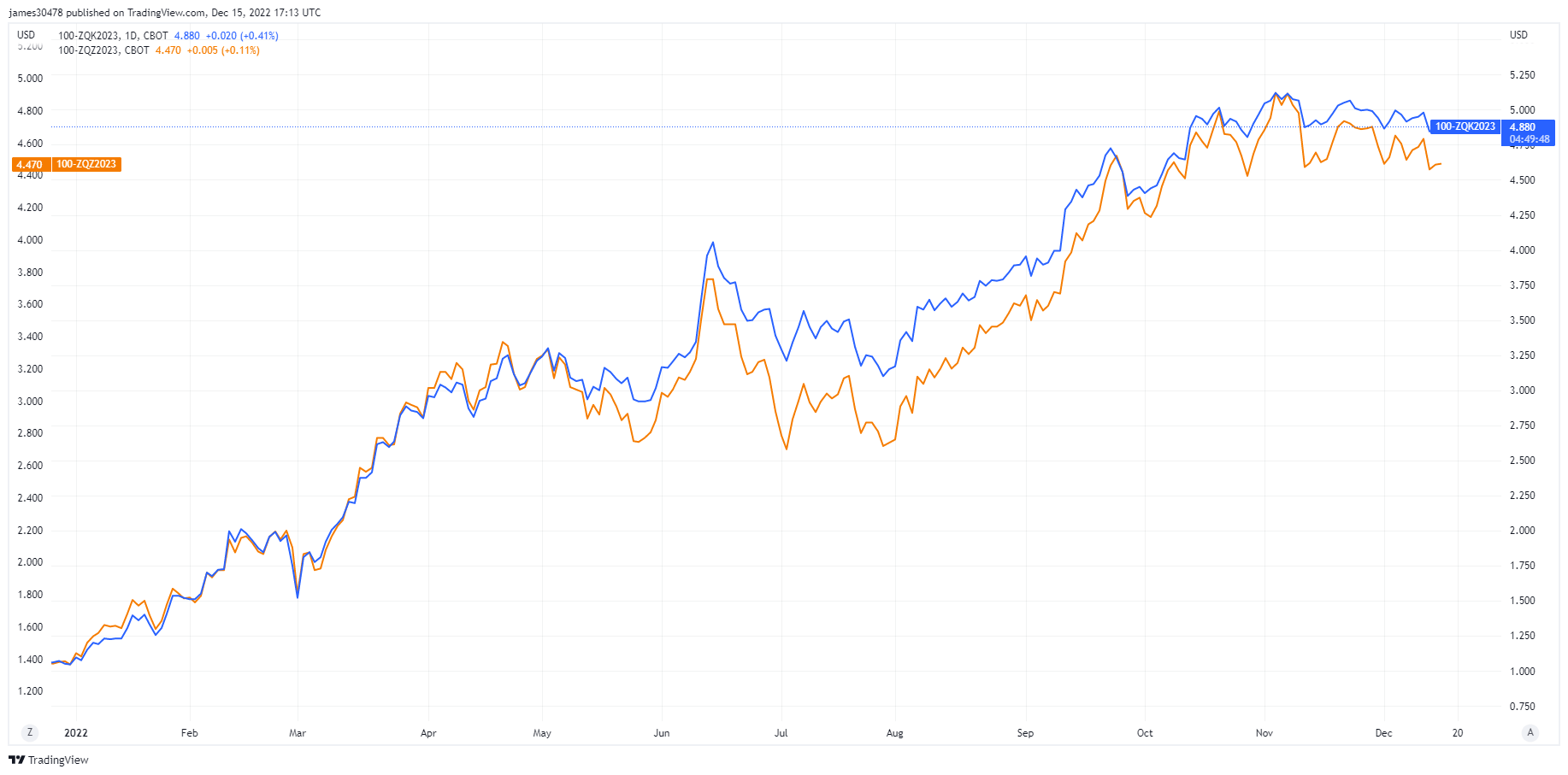

Futures Fed Funds Rate: (Source: TradingView)

Futures Fed Funds Rate: (Source: TradingView)The marketplace continues to combat the fed and disagree connected futures feds funds rates. The marketplace is projecting a highest successful the fed funds complaint of 4.8% successful May 2023, with a diminution to 4.5% by December 2023.

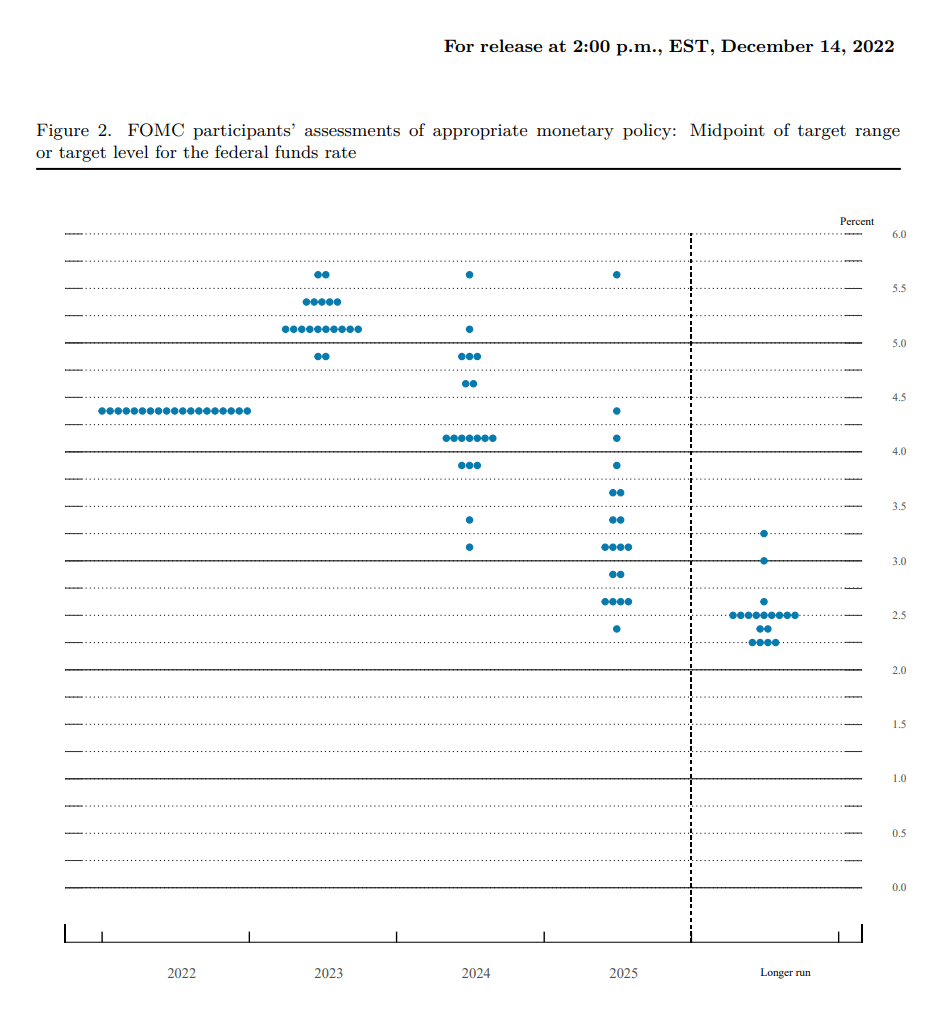

Fed Dot Plot: (Source: FOMC participants)

Fed Dot Plot: (Source: FOMC participants)According to the DOT plot, which shows the projections for the national funds rate, each dot represents the presumption of a Fed policymaker. The fed has a higher projected funds complaint than the marketplace astatine the extremity of 2023, revised from 4.6% to 5.1%; 7 fed officials task a complaint supra 5.1% and 10 supra 5%.

Other notable complaint hikes

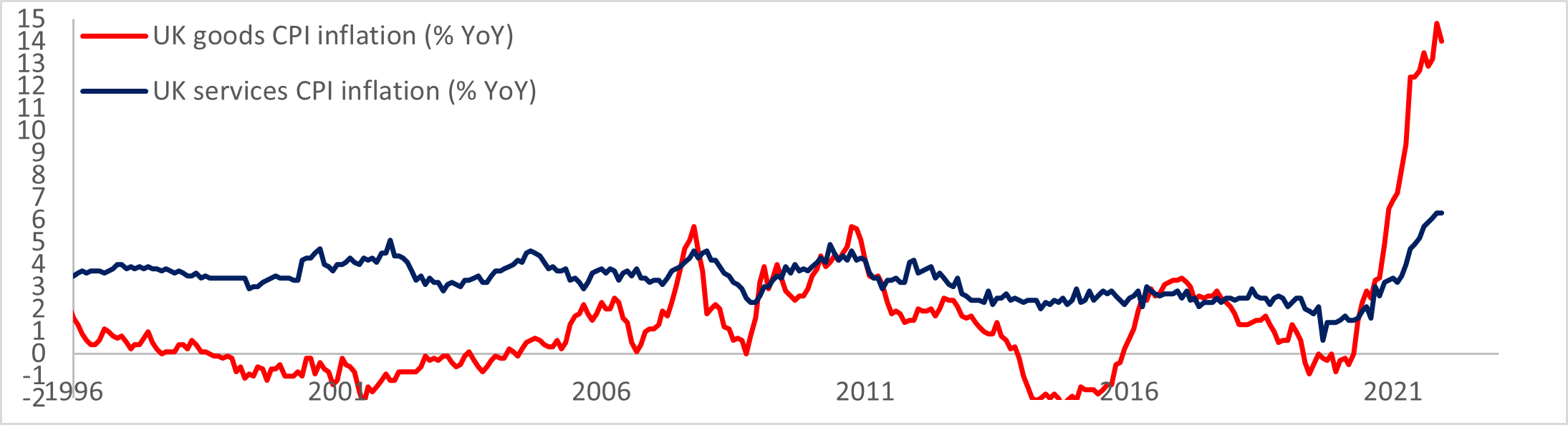

The Bank of England delivered a 50bps complaint hike connected Dec.15 to rise the slope complaint to 3.5%. This was the ninth consecutive involvement complaint hike from the BOE. In addition, ostentation whitethorn person peaked successful the U.K. arsenic ostentation expectations bushed marketplace estimates arsenic ostentation dropped from 11.1% to 10.7%, with the halfway complaint falling to 6.3% from 6.5%.

UK CPI Inflation: (Source: Macroscope)

UK CPI Inflation: (Source: Macroscope)In addition, the ECB accrued involvement rates from 1.5% to 2% and announced a program to shrink its equilibrium sheet.

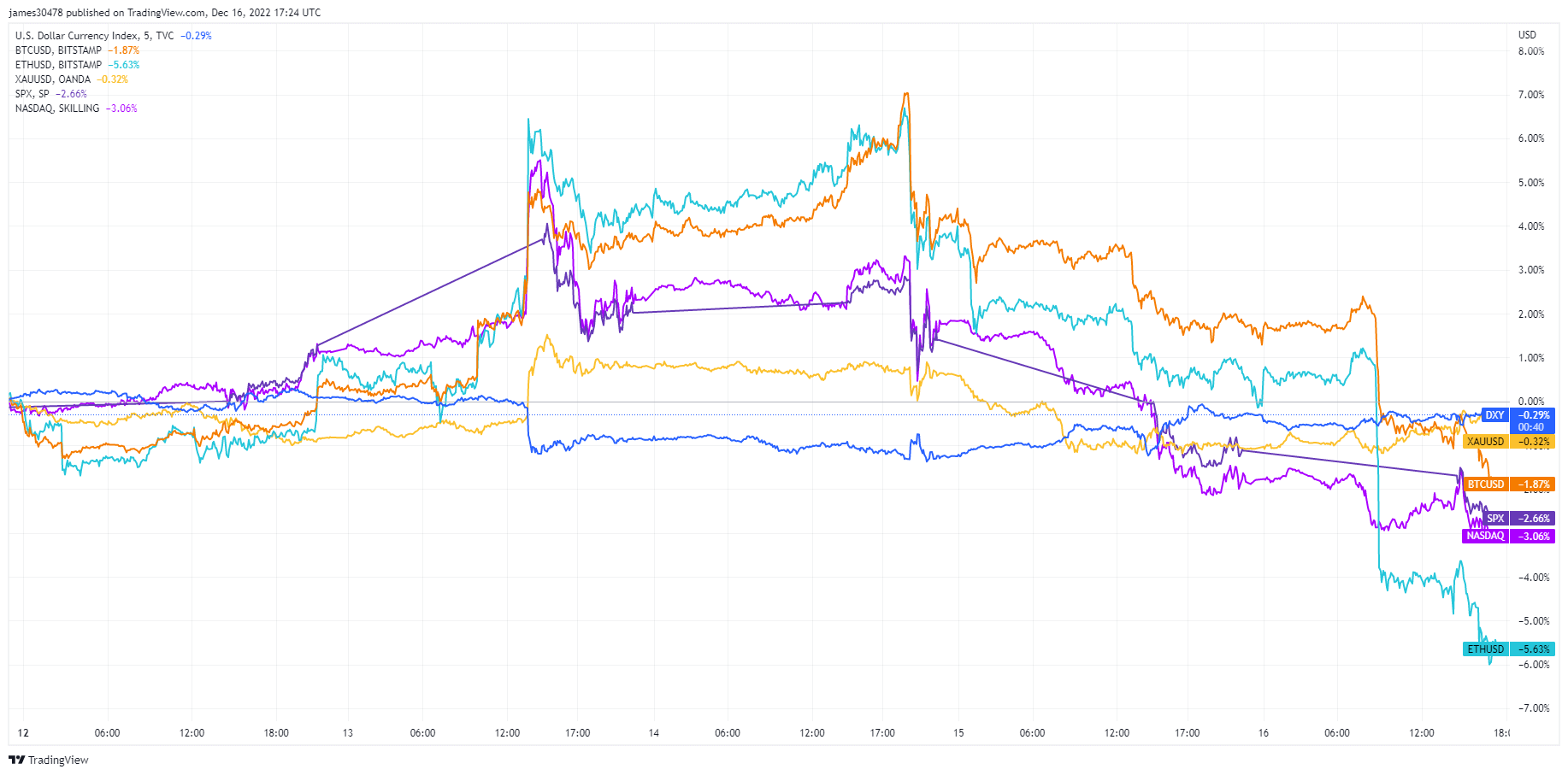

Asset review: week commencing Dec. 12

From Dec. 12 to Dec. 15, BTC had been the best-performing plus compared to its peers, however, BTC and ETH made caller for the week connected Dec. 16.

- BTC: -1.85%

- ETH: -5.60%

- Gold: -0.33%

- DXY: -0.39%

- SPX: -2.0%

- Nasdaq: -2.76%

Performance of assets: (Source: TradingView)

Performance of assets: (Source: TradingView)The station Bitcoin and equities rotation implicit arsenic markets digest different circular of complaint hikes: MacroSlate Report appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)