This is simply a regular investigation by CoinDesk expert and Chartered Market Technician Omkar Godbole.

DXY vs BTC

Last week, the Federal Reserve (Fed) delivered its archetypal involvement complaint rate chopped since December, portion signaling much easing successful the coming months. Yet, contempt this dovish move, the dollar scale (DXY), which tracks the greenback's worth against large currencies, finished the week with a dragonfly doji connected the play illustration – a classical bullish reversal awesome suggesting a USD rally ahead.

The dragonfly doji gets its sanction from its distinctive “T” shape, which resembles the delicate wings of a dragonfly oregon the leaf of a bamboo-copter toy. This signifier forms erstwhile the open, high, and adjacent prices are astir identical, accompanied by a agelong little shadiness that reflects a crisp terms diminution rapidly reversed by buying pressure. The DXY initially fell connected the quality of the Fed complaint cut, concisely dipping beneath the July debased of 96.37, lone to bounce backmost and extremity the week mostly unchanged astatine 97.65, supported by resilience successful U.S. Treasury yields.

The quality of the dragonfly doji aft a notable downtrend and astatine captious support, arsenic successful DXY's case, suggests an impending bullish displacement successful the marketplace trend.

Traditionally, dollar spot corresponds with weakness successful dollar-denominated and broader hazard assets, mounting an absorbing signifier for the week ahead.

Bitcoin (BTC) mirrored this taxable successful the week ended Sept. 21, forming an indecisive Doji candle astatine the captious absorption marked by the trendline from 2017 and 2021 bull marketplace peaks. Given that this Doji appeared astatine specified a important semipermanent trendline, it leans much bearish, signaling hesitation among bulls to pb the terms enactment and renewed selling unit from the cardinal hurdle.

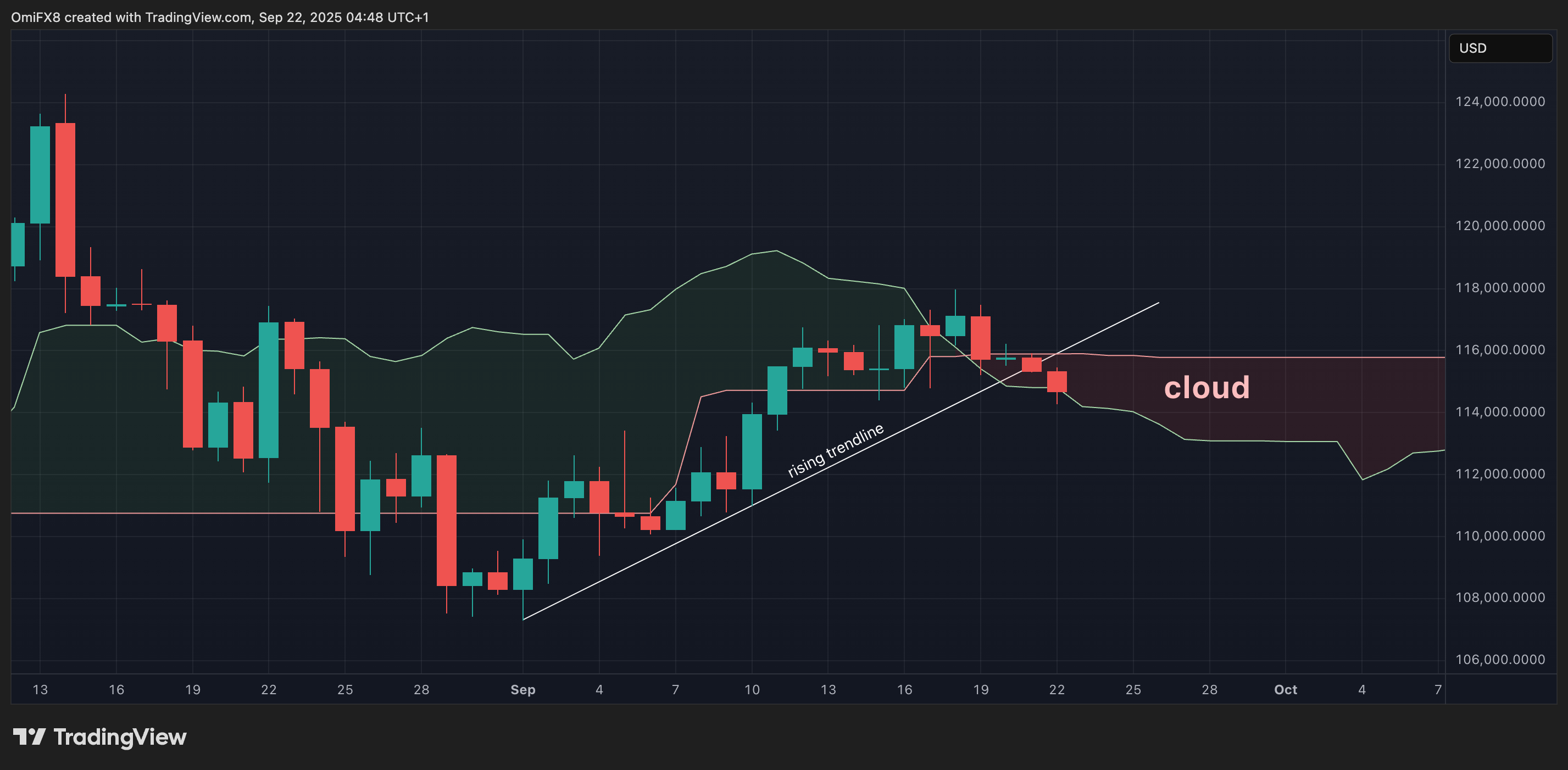

On the regular chart, BTC are teasing a determination beneath the Ichimoku cloud, with the trendline drawn from Sept. 1 lows breached, implying imaginable downside risk.

The archetypal enactment of enactment is seen astatine $114,473, the 50-day elemental moving average, followed by Sept. 1 lows adjacent $107,300. The past week's precocious of $118,000 needs to beryllium flooded to weaken the bearish case.

Ether scope breakdown

Ether (ETH) faces its ain method dilemma; it hovers beneath the little extremity of the contracting triangle signifier connected the regular chart, suggesting renewed seller dominance and imaginable for deeper losses. The breakdown has enactment absorption connected the Aug. 20 debased of $4,062 followed by the intelligence enactment of $4,000. The 24-hour precocious of $4,458 is the level to bushed for the bulls.

XRP's MACD flips bearish

Meanwhile, XRP presents a frustrating representation for bulls. Despite the caller debut of an XRP ETF successful the U.S. connected Thursday, the MACD indicator has crossed bearish connected the play chart, indicating a renewed downside bias. Price indicates that XRP is slipping backmost to the precocious bound of a descending triangle connected the regular chart. Although a tentative breakout occurred past week, it failed to ignite a sustained rally, leaving traders cautious.

Focus connected the Fed talk and PCE

This week, Fed Chairman Jerome Powell and 9 different officials are scheduled to speak, with markets apt to intimately ticker the aforesaid for cues connected the involvement complaint trajectory. While the Fed chopped rates past week, signalling much easing ahead, Powell threw acold h2o implicit optimism by stressing a data-dependent stance.

President Donald Trump appointee Stephen Miran volition besides talk of his independency arsenic a policymaker, having dissented successful favour of an outsized 50 ground constituent complaint chopped past week.

On Friday, the U.S. halfway PCE index, the Fed's preferred measurement of inflation, is scheduled to beryllium released. According to Amberdata, the information is expected to amusement that ostentation roseate 2.7% year-on-year, with halfway jumping 2.9% successful August, marking a flimsy uptick from the erstwhile month.

2 months ago

2 months ago

English (US)

English (US)