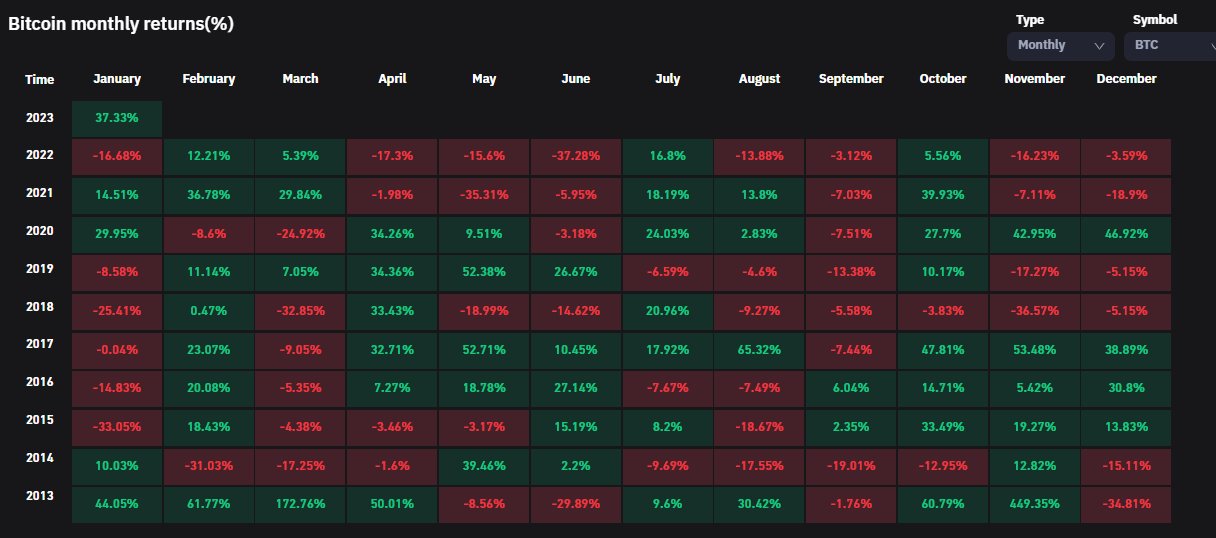

Bitcoin (BTC) has shown the highest return since October 2022 and has the champion January successful 10 years successful monthly returns.

BTC Yearly Returns

BTC Yearly ReturnsSince the commencement of the year, BTC has enjoyed singular growth from $16,583.18 to $23,060.14 arsenic of property clip – amounting to astir 39% instrumentality successful 23 days.

Over this month, the system has grown crossed aggregate sectors, with golden and the S&P500 up 19% and 13%, respectively, since past November. BTC has established itself arsenic an important portion of concern portfolios portion experiencing outstanding terms rallies.

However, since the coin exceeded implicit $69k successful November 2021, BTC has struggled for stability. For astir of 2022, BTC plummeted owing to macro factors successful the planetary market, insolvencies, and controversies rocked the industry. The coin with the highest marketplace headdress mislaid a important information of its value, dipping to $15,700 past November.

Possible factors down the caller terms rally

Crypto whales are apt down the terms surge, according to caller marketplace research by Kaiko. As revealed, commercialized sizes person accrued connected Binance, which reflects that Whales are gaining assurance successful the market.

Likewise, ostentation is slowing down successful the U.S. aft a bid of combative measures from the Fed. The user terms scale decreased 0.1% successful December each month, accordant with Dow Jones estimates.

Further, arsenic bitcoin prices person dropped, respective miners person been forced to leave the industry. Miners often accumulate monolithic amounts of integer currency, which makes them immoderate of the biggest sellers. When miners merchantability off their bitcoin holdings to wage disconnected debt, they remove overmuch of the remaining selling pressure.

Furthermore, Bitcoin’s upcoming halving sometime betwixt March and May 2024 could supply traders with immoderate excitement for New Year’s.

What the Future holds

While attraction is presently connected the adjacent Fed meeting, experts are watchful that the result of the gathering tin marque oregon interruption the bull tally of BTC. Due to adjacent year’s halving lawsuit for BTC, they judge things volition amended for BTC successful the future.

When the halving events took spot years ago, the terms of BTC soared. The past event, which took effect successful 2020, saw BTC soar from $8,821 to $10,943 wrong 150 days. Mostly, the crypto assemblage viewed the halving lawsuit to person a singular interaction connected the terms of BTC arsenic it helps to declaration proviso and summation its value.

Professor Carol Alexander of the University of Sussex told CNBC successful December that bitcoin volition spot a “managed bull market” successful 2023, reaching $30,000 successful the archetypal 4th and $50,000 successful the second.

According to a CryptoSlate analysis of Bitcoin (BTC) metrics, the marketplace has reached its bottommost arsenic investors proceed accumulating BTC and pushing illiquid proviso to 80%.

Bitcoin’s existent marketplace headdress stands astatine $445.58 billion – up from 407.38 cardinal a week ago.

The station Bitcoin continues terms rally, posts champion January returns since 2013 appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)