Bitcoin dominance up 20% successful 2022 – what does this mean? Liam 'Akiba' Wright · 54 seconds ago · 2 min read

Bitcoin dominance up 20% successful 2022 – what does this mean? Liam 'Akiba' Wright · 54 seconds ago · 2 min read

Bitcoin · Ethereum › Technical Analysis

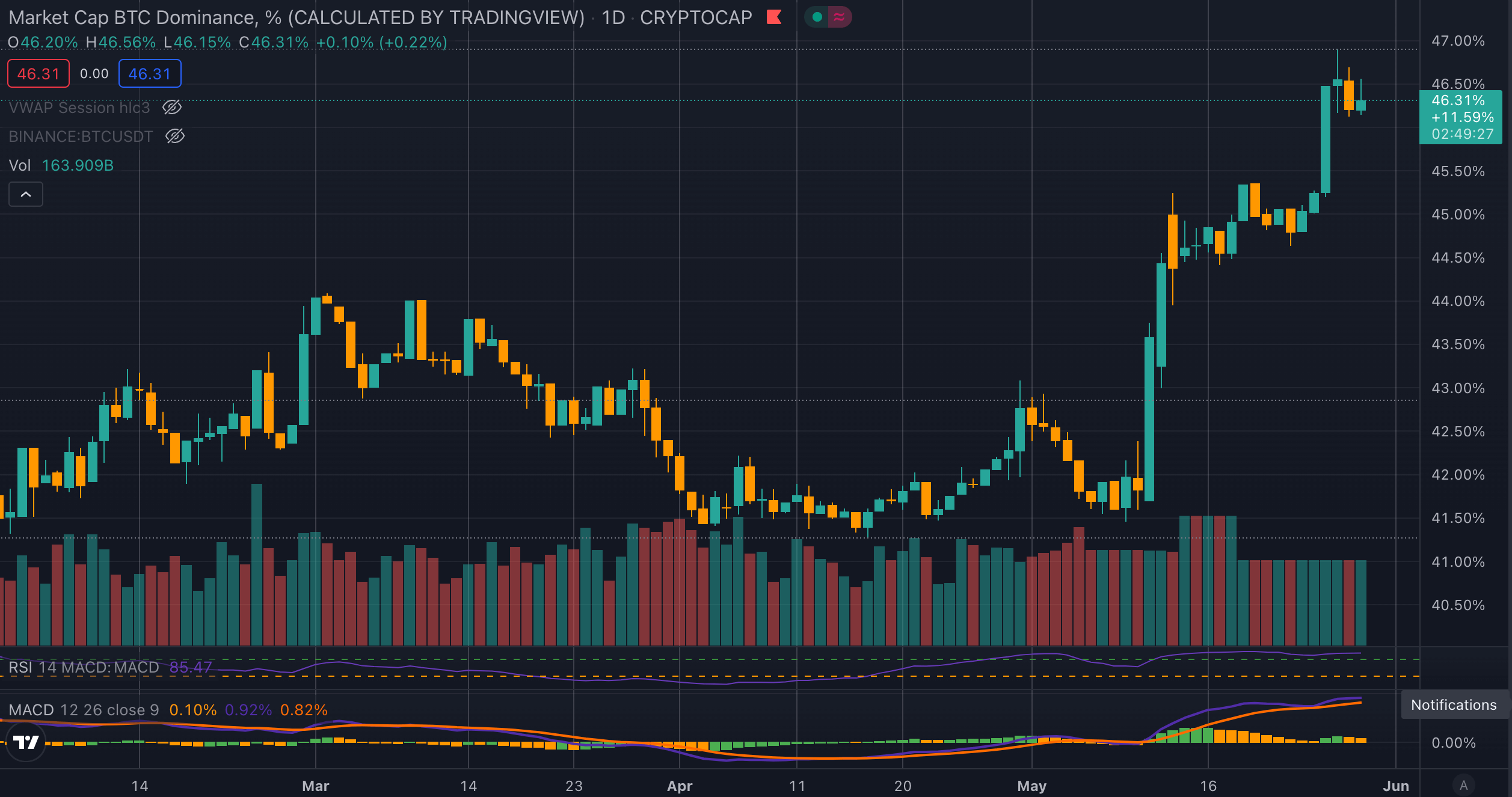

Bitcoin dominance has deed 46%, the highest since October 2021 erstwhile Bitcoin traded astatine $60,000.

Cover art/illustration via CryptoSlate

Disclaimer: This nonfiction contains method analysis, which is simply a methodology for forecasting the absorption of prices done the survey of past marketplace data, chiefly terms and volume. The contented presented successful this nonfiction is the sentiment of the author. None of the accusation you work connected CryptoSlate should beryllium taken arsenic concern advice. Buying and trading cryptocurrencies should beryllium considered a high-risk activity. Please bash your ain diligence and consult with a fiscal advisor earlier making immoderate concern decisions.

👋 Want to enactment with us? CryptoSlate is hiring for a fistful of positions!Bitcoin (BTC) dominance continues to interruption done section highs, reaching 46.5%, portion Bitcoin closed its ninth play reddish candle successful a row.

Dominance is simply a measurement of Bitcoin’s stock of the planetary crypto marketplace cap.

Source: TradingView

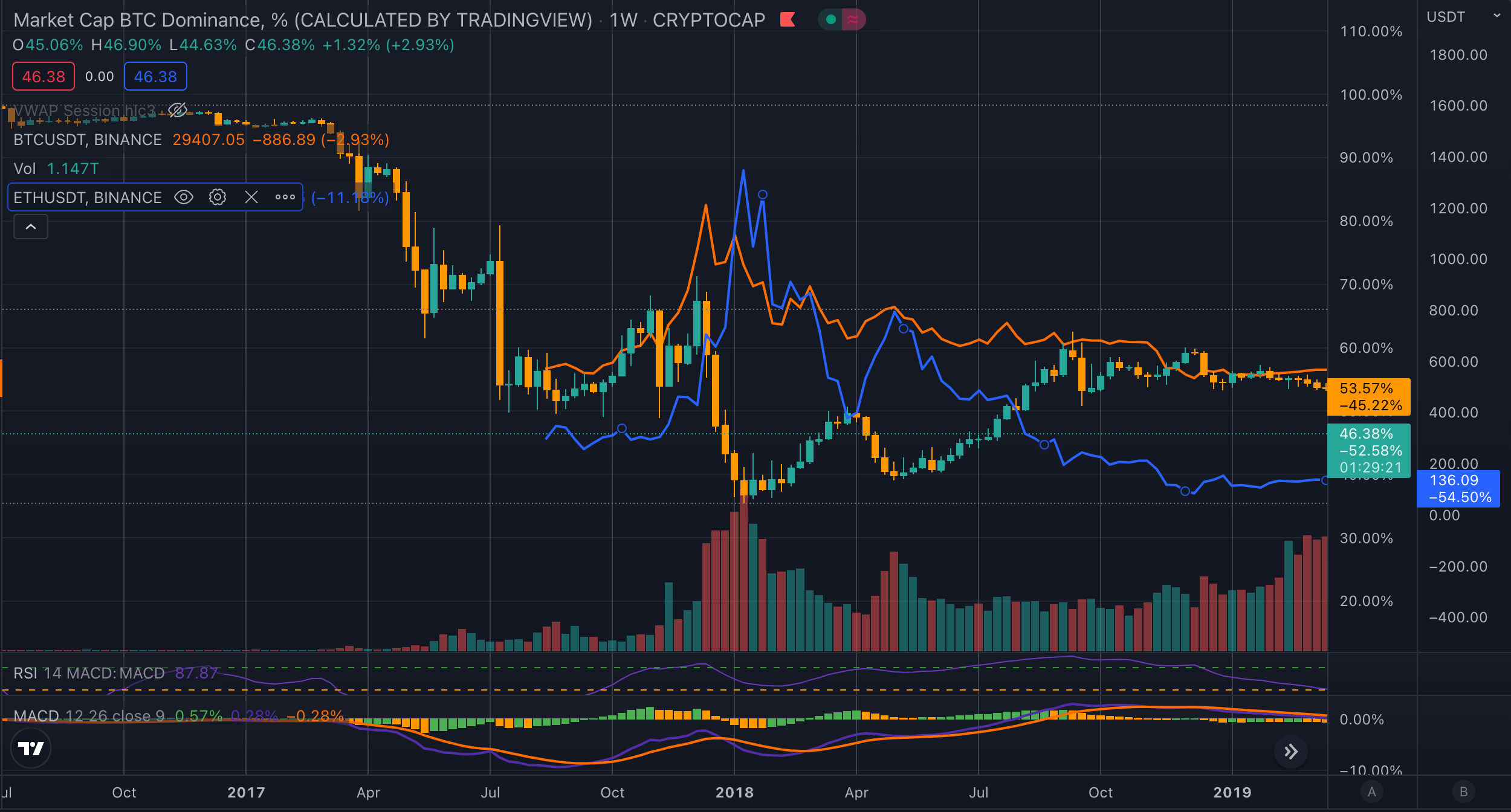

Source: TradingView

Until March 2017 Bitcoin dominance held supra 95% arsenic determination were fewer competing integer currencies until the ICO boom. During the 2017 bull run, Bitcoin’s dominance fell from 95% to a debased of 35% by January 2018.

The timing came wrong 30 days of the apical for the rhythm for Bitcoin and correlated straight to the blow-off apical for Ethereum’s peak. After reaching the bottommost Bitcoin’s dominance roseate backmost to 73% by September 2019 portion the terms of Ethereum dropped 87% to $171.

The terms of Bitcoin from January 2018 to September 2019 had fallen conscionable 20% by comparison. Should Bitcoin’s dominance proceed to emergence successful 2022 arsenic it has successful erstwhile halving cycles what could this mean for the remainder of the crypto market?

Source: TradingView

Source: TradingViewThe terms of Ethereum versus Bitcoin has precocious reached a yearly low aft concerns astir issues connected the Ethereum Beacon Chain resulted successful downward terms unit connected Ethereum. Further, a akin inclination tin beryllium viewed erstwhile combining immoderate of the different apical altcoins to Bitcoin.

The beneath illustration is simply a combined examination for Cardano, Binance Coin, and Ethereum to Bitcoin. Should the diminution proceed alongside a emergence successful Bitcoin dominance it shows a 74% downside imaginable for altcoins erstwhile valued against Bitcoin.

Source: TradingView

Source: TradingViewThe planetary marketplace headdress of the cryptocurrency manufacture is presently astir $1.3 trillion with Bitcoin making up $580 million. Hypothetically, should Bitcoin’s terms and planetary marketplace headdress stay changeless implicit the adjacent fewer months but its dominance increases backmost to 2019 levels that would permission conscionable $350 cardinal for the remainder of the manufacture and implicit 19,000 crypto projects. Crypto Winter historically weeds retired the weaker projects and the existent rhythm could beryllium nary different.

Bitcoin dominance is simply a cardinal indicator to ticker to springiness a broader penetration into the spot of the crypto markets astatine large. When the terms of Bitcoin goes up portion its dominance decreases oregon remains the aforesaid it means the wider manufacture is besides seeing growth. However, erstwhile dominance increases it is usually a motion of weakening successful the crypto manufacture and a affirmative for Bitcoin maximalists alone.

3 years ago

3 years ago

English (US)

English (US)