By Francisco Rodrigues (All times ET unless indicated otherwise)

Crypto markets are continuing their emergence this week aft weaker-than-expected U.S. labour information and amid a authorities shutdown that saw the marketplace follow the stance that a Federal Reserve complaint chopped adjacent period is simply a adjacent certainty.

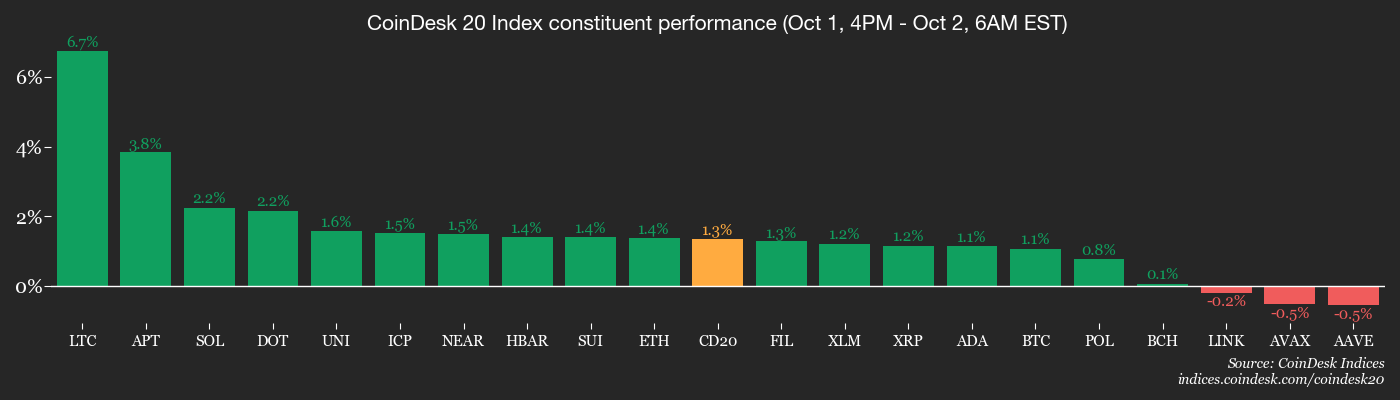

Bitcoin climbed an further 2.15% successful the past 24-hour play to $118,700, portion the broader market, arsenic measured by the CoinDesk 20 (CD20) index, roseate 2.33% successful the aforesaid period. The rally came despite, oregon due to the fact that of, rising uncertainty successful accepted markets.

The spark came from an unexpected driblet successful U.S. backstage payrolls. ADP information showed a 32,000 occupation diminution in September, against forecasts for a 50,000 gain. With the authorities shutdown halting authoritative labour data, traders are forced to thin connected this miss for insights, starring to accrued complaint chopped bets.

Data from Polymarket present shows traders measurement a 91% accidental the Fed volition chopped rates by 25 bps aboriginal this month, portion connected the CME’s FedWatch tool, likelihood of specified a complaint chopped basal astatine 99%.

“Markets look to person responded with comparative stableness successful the archetypal 24 hours pursuing the U.S. authorities shutdown,” Philipp Zentner, CEO and laminitis of LIFI Protocol, told CoinDesk. “It’s worthy noting that during the past large shutdown successful 2018–2019, which lasted 35 days, markets remained mostly resilient, and we whitethorn spot akin dynamics this time.”

That stability, coupled with a dovish macroeconomic environment, bodes good for hazard assets similar cryptocurrencies.

Derivatives markets besides bespeak this shift, with unfastened involvement rising astir 4% to $216 cardinal according to CoinGlass data. Similarly, spot crypto ETFs person seen much than $2.3 cardinal successful nett inflows since the opening of the week, according to SoSoValue.

Still, immoderate pass of structural risks. “Strategies that trust connected banal premiums to bargain bitcoin are hitting limits,” Justin Wang, co-founder of Zeus Network, told CoinDesk. “Sustainable organization Bitcoin adoption requires infrastructure that doesn't beryllium connected marketplace sentiment and banal premiums.”

As the shutdown drags connected and economical signals turn murkier, investors look to beryllium turning toward alternate assets similar golden and crypto. Speaking to CoinDesk, XYO co-founder Markus Levin pointed retired BTC’s terms operation is “showing a classical Elliott Wave completion wrong a rising wedge, a signifier that often signals consolidation earlier a decisive move.”

“Institutional flows and derivatives enactment volition beryllium captious successful determining whether this setup resolves with caller highs oregon a deeper retracement. Either way, we’re entering 1 of Bitcoin’s historically astir dynamic months, and marketplace participants should beryllium prepared for volatility,” helium said.

Stay alert!

What to Watch

For a much broad database of events this week, spot CoinDesk's "Crypto Week Ahead" note.

- Crypto

- Nothing scheduled.

- Macro

- Oct. 2, 8:30 a.m.: U.S. Jobless Claims archetypal (for week ended Sept. 27) Est. 223K, continuing (for week ended Sept. 20) Est. 1930K. The study has been delayed owed to a national authorities shutdown.

- Earnings (Estimates based connected FactSet data)

- Nothing scheduled.

Token Events

For a much broad database of events this week, spot CoinDesk's "Crypto Week Ahead".

- Governance votes & calls

- ENS DAO is voting to reimburse the eth.limo squad 109,818.82 USDC from the treasury. These funds are to screen ineligible fees for operating their nationalist gateway. Voting ends Oct. 2.

- Arbitrum DAO is voting to transfer 8,500 idle ETH to its treasury squad to gain output and enactment the ecosystem. The determination is expected to make ~204 ETH annually. Voting ends Oct. 2.

- Gitcoin DAO is holding a re-vote to o.k. a revised $1,175,000 matching money and updated assistance categories for its upcoming Grants Round 24 (GG24). Voting ends Oct. 2.

- Unlocks

- Oct. 2: Ethena (ENA) to unlock 0.62% of its circulating proviso worthy $23.65 million.

- Token Launches

- Oct. 2: DoubleZero (2Z) to beryllium listed connected Binance Alpha, Coinone, Kraken, Bithumb, OKX, and others.

Conferences

For a much broad database of events this week, spot CoinDesk's "Crypto Week Ahead".

- Day 2 of 2: Northern FinTech Summit 2025 (London)

- Day 2 of 2: TOKEN2049 Singapore

- Oct. 2: Stablecoin Summit 2025 (Singapore)

- Day 1 of 3: Lightning Plus Plus Berlin

Token Talk

By Oliver Knight

- Plasma laminitis Paulie Punt has refuted claims that the precocious issued XPL token had been sold by squad members, contempt on-chain information suggesting the contrary.

- Paul stated that nary members of the Plasma squad person sold their XPL holdings since launch. According to him, each capitalist and squad allocations are taxable to a three-year lock-up with a one-year cliff, meaning they cannot beryllium accessed oregon sold wrong that timeframe. He emphasized that the circulating claims of insider unloading were unfounded.

- The Plasma laminitis besides pushed backmost against characterizations that the squad was chiefly made up of “ex-Blast” employees. Of the astir 50 squad members, lone 3 had anterior stints astatine Blur oregon Blast, helium said. He noted that the radical besides includes professionals with backgrounds astatine Google, Facebook, Square, Temasek, Goldman Sachs, and Nuvei, underscoring the project’s broader pedigree.

- Another constituent of contention has been Wintermute, a well-known crypto trading steadfast often engaged arsenic a marketplace shaper for caller projects. Paul denied that Plasma had a declaration with Wintermute for market-making oregon different services, saying the institution has nary much accusation astir Wintermute’s XPL holdings than the public.

- Pseudonymous researcher ManaMoon had initially claimed that implicit 600 cardinal XPL tokens person been transferred from the project’s vault to exchanges since launch.

- XPL has performed comparatively poorly since launch, sliding from a precocious of $1.68 to $0.97 portion regular trading measurement has remained dependable astatine $2.6 billion.

Derivatives Positioning

- The BTC futures marketplace is showing a beardown and sustained bullish trend, with cardinal metrics reaching caller highs. Open involvement has climbed to an all-time precocious of $32.6 billion, reflecting a important summation successful trader exposure, with Binance starring the mode astatine $13.6 billion.

- This record-high involvement is supported by a unchangeable 3-month annualized basis, which has settled astir 7%, indicating that the ground commercialized remains profitable and reinforcing the affirmative marketplace sentiment. The operation of these 2 metrics suggests that caller terms enactment is being driven by strong, conviction-based bullish positioning alternatively than short-term speculation.

- The BTC options marketplace is presenting a analyzable and contradictory representation of sentiment. While the 25 Delta Skew for short-term options continues its downward trend, present astatine conscionable 3.25%, suggesting that traders are consenting to wage a premium for puts to hedge against downside risk, the 24-hour Put/Call Volume tells a antithetic story.

- Calls are inactive dominating the measurement astatine implicit 56%, indicating that a bulk of traders are actively positioning for a rally alternatively than a decline.

- Meanwhile, BTC's backing complaint connected large exchanges is hovering betwixt an annualized 9% to 10%, indicating steadfast request for leveraged agelong positions.

- However, a important outlier is Deribit, wherever the backing complaint has spiked dramatically to implicit 60%. This isolated but utmost spike suggests intense, concentrated request for agelong positions connected that platform, but the wide market, including altcoins, does not yet look to beryllium overheated with mean backing for apical 30 coins by marketplace capitalization astatine astir 10% annualized, arsenic per Coinglass.

Market Movements

- BTC is up 1.12% from 4 p.m. ET Wednesday astatine $118,927.57 (24hrs: +2.23%)

- ETH is up 1.27% astatine $4,392.20 (24hrs: +2.59%)

- CoinDesk 20 is up 1.49% astatine 4,232.18 (24hrs: +2.41%)

- Ether CESR Composite Staking Rate is unchanged astatine 2.87%

- BTC backing complaint is astatine 0.0135% (14.7825% annualized) connected KuCoin

- DXY is down 0.18% astatine 97.53

- Gold futures are up 0.12% astatine $3,902.00

- Silver futures are down 0.2% astatine $47.58

- Nikkei 225 closed up 0.87% astatine 44,936.73

- Hang Seng closed up 1.61% astatine 27,287.12

- FTSE is unchanged astatine 9,449.86

- Euro Stoxx 50 is up 1.30% astatine 5,653.99

- DJIA closed connected Wednesday unchanged astatine 46,441.10

- S&P 500 closed up 0.34% astatine 6,711.20

- Nasdaq Composite closed up 0.42% astatine 22,755.16

- S&P/TSX Composite closed up 0.28% astatine 30,107.67

- S&P 40 Latin America closed down 1.55% astatine 2,905.87

- U.S. 10-Year Treasury complaint is down 1.2 bps astatine 4.094%

- E-mini S&P 500 futures are unchanged astatine 6,766.50

- E-mini Nasdaq-100 futures are up 0.25% astatine 25,081.00

- E-mini Dow Jones Industrial Average Index are down 0.11% astatine 46,672.00

Bitcoin Stats

- BTC Dominance: 58.84% (-0.36%)

- Ether to bitcoin ratio: 0.03691 (0.63%)

- Hashrate (seven-day moving average): 1,059 EH/s

- Hashprice (spot): $49.91

- Total Fees: 3.63 BTC / $423,349

- CME Futures Open Interest: 137,820 BTC

- BTC priced successful gold: 30.6 oz

- BTC vs golden marketplace cap: 8.66%

Technical Analysis

- Yesterday’s determination saw bitcoin interruption past the bearish bid artifact connected the daily, present trading astatine $118,675. The regular adjacent signals a displacement successful marketplace structure, favouring the bulls.

- A retest of the bid artifact — flipping it from absorption into enactment — would beryllium a steadfast retracement that could let Bitcoin to trial the all-time highs again. Bulls volition privation to spot bitcoin found acceptance supra the bid block.

Crypto Equities

- Coinbase Global (COIN): closed connected Wednesday astatine $346.17 (+2.57%), +2% astatine $353.11 successful pre-market

- Circle Internet (CRCL): closed astatine $129.03 (-2.68%), +3% astatine $132.90

- Galaxy Digital (GLXY): closed astatine $35.83 (+5.97%), +2.99% astatine $36.90

- Bullish (BLSH): closed astatine $60.81 (-4.4%), +2.22% astatine $62.16

- MARA Holdings (MARA): closed astatine $18.61 (+1.92%), +2.47% astatine $19.07

- Riot Platforms (RIOT): closed astatine $18.93 (-0.53%), +1.74% astatine $19.26

- Core Scientific (CORZ): closed astatine $17.97 (+0.17%), +1.22% astatine $18.19

- CleanSpark (CLSK): closed astatine $14.59 (+0.62%), +1.71% astatine $14.84

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $45.07 (+1.88%)

- Exodus Movement (EXOD): closed astatine $28.31 (+1.91%), +0.11% astatine $28.34

Crypto Treasury Companies

- Strategy (MSTR): closed astatine $338.41 (+5.03%), +2.29% astatine $346.15

- Semler Scientific (SMLR): closed astatine $31.03 (+3.43%)

- SharpLink Gaming (SBET): closed astatine $17.37 (+2.12%), +1.78% astatine $17.68

- Upexi (UPXI): closed astatine $6.53 (+13.17%), +2.6% astatine $6.70

- Lite Strategy (LITS): closed astatine $2.56 (+5.79%), +5.47% astatine $2.70

ETF Flows

Spot BTC ETFs

- Daily nett flow: $675.8 million

- Cumulative nett flows: $58.4 billion

- Total BTC holdings ~ 1.32 million

Spot ETH ETFs

- Daily nett flow: $80.9 million

- Cumulative nett flows: $13.9 billion

- Total ETH holdings ~ 6.61 million

Source: Farside Investors

While You Were Sleeping

- Bitcoin Surges Above $119K arsenic U.S. Government Shutdown Takes Effect; BTC Options Look Cheap (CoinDesk): A delayed jobs study from the shutdown could propulsion the Fed toward deeper cuts, and a 21Shares strategist says bitcoin's caller gains suggest an explosive rally could beryllium successful the cards.

- U.S. to Provide Ukraine With Intelligence for Missile Strikes Deep Inside Russia (The Wall Street Journal): Trump has authorized U.S. quality agencies and the War Department for the archetypal clip to supply Ukraine with targeting information for long-range rocket strikes connected Russian vigor facilities.

- 'Tokenization is Going to Eat the Entire Financial System' Says Robinhood CEO (CoinDdesk): Robinhood is expanding tokenized stocks successful Europe and eyeing existent property next. CEO Vlad Tenev says the U.S. needs to drawback up with Europe successful integer plus regulation.

- Thailand Crypto ETF Push Expands Beyond Bitcoin, Regulator Says (Bloomberg): Thailand’s Securities and Exchange Commission is drafting rules to fto communal funds connection ETFs tied to baskets of cryptocurrencies, aiming to pull younger investors amid a sluggish equity market.

4 months ago

4 months ago

English (US)

English (US)