Following the charged-up debut of the Proshares bitcoin exchange-traded money (ETF), Valkyrie’s bitcoin futures ETF and the Vaneck bitcoin strategy ETF, involvement successful these types of funds seems to person faded a large deal. After the Proshares bitcoin ETF BITO reached an all-time precocious connected November 10, the ETF is down 39% implicit the past 64 days. Valkyrie’s bitcoin ETF has besides shed 37% successful worth implicit the past 2 months.

Bitcoin Futures ETF Lull Continues

A ample information of the cryptocurrency assemblage was precise hyped up for years astir the motorboat of the archetypal bitcoin exchange-traded money (ETF), arsenic a fig of bitcoin ETF applications were denied anterior to 2021.

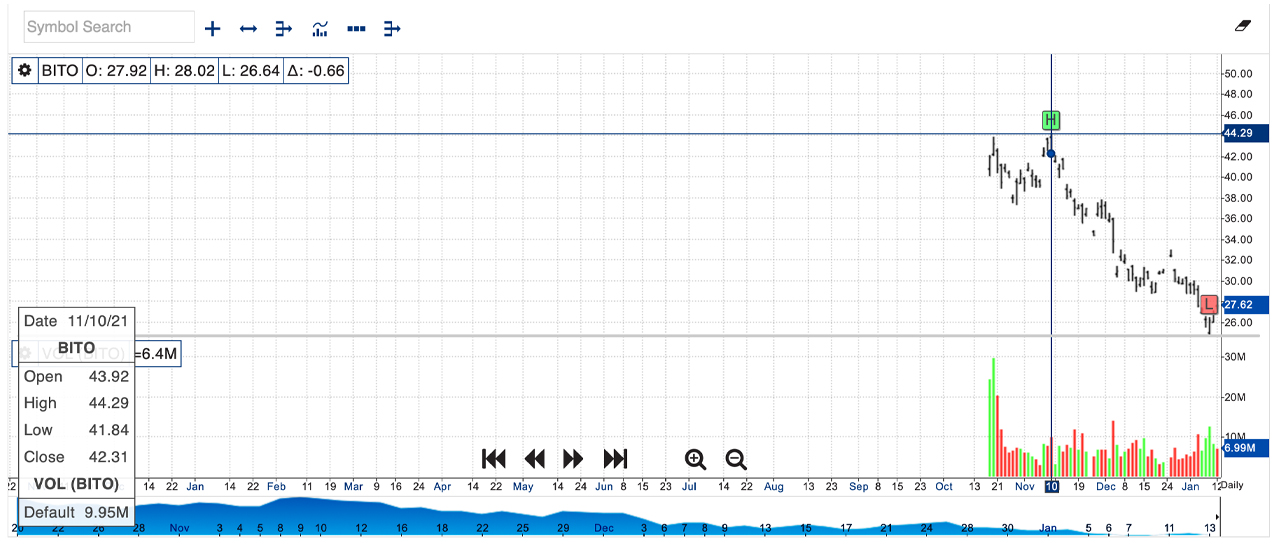

Finally, erstwhile the archetypal U.S. bitcoin futures ETF was approved, the debut of Proshare’s bitcoin futures ETF smashed records, capturing adjacent to $1 cardinal successful full measurement during the archetypal 24 hours. Months later, the Proshares Bitcoin Strategy ETF (BITO) is exchanging hands for $26.96 connected January 13, 2022, but that terms is 39.12% little than the 44.29 precocious connected November 10, 2021.

Bloomberg writer Katherine Greifeld explained successful mid-November that the “bitcoin futures ETF frenzy is fading.” “While the Proshares money absorbed $1.1 cardinal successful conscionable 2 days — the quickest an ETF has ever done truthful — that gait of maturation has cooled considerably,” Greifeld said astatine the time.

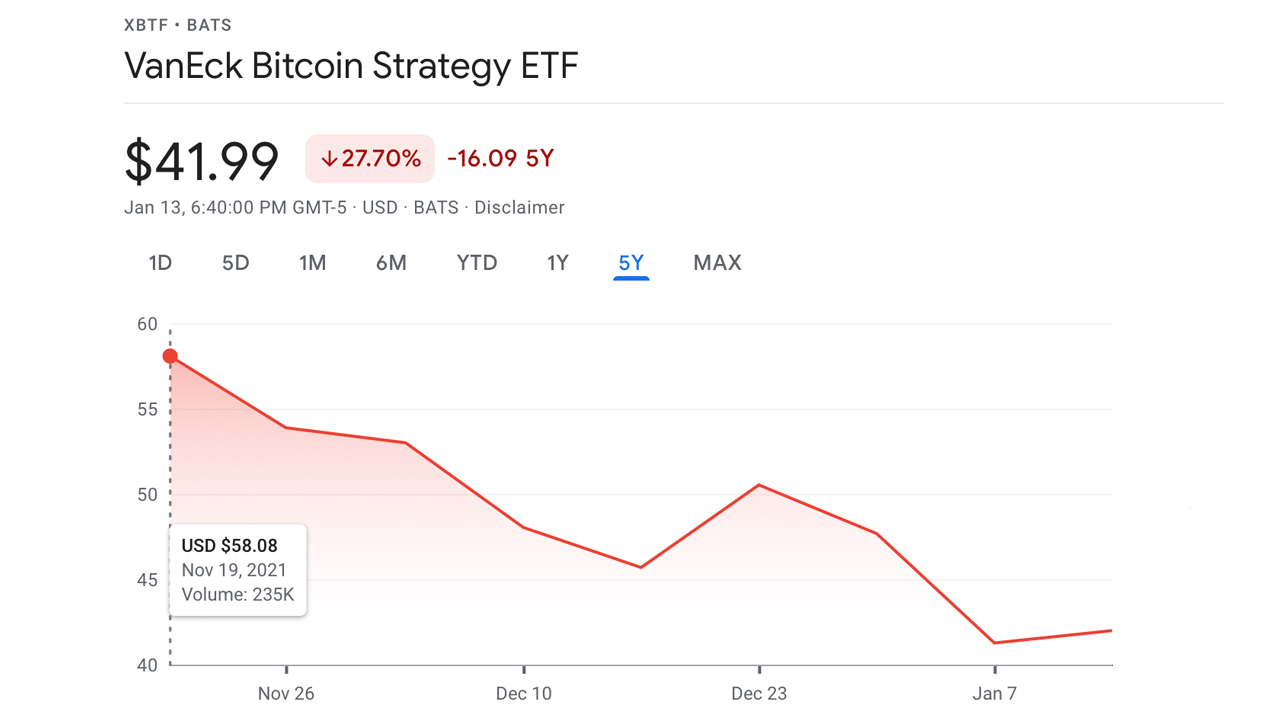

The fiscal writer further discussed the Vaneck ETF, arsenic she noted that little absorption fees could differentiate the money from the rest. At the time, Greifeld quoted Bloomberg Intelligence elder ETF analyst, Eric Balchunas, who said:

There’s decidedly a lull going connected close present comparative to the motorboat mania and truthful Vaneck has their enactment chopped retired for them successful trying to get radical excited again.

Valkyrie’s BTF Down 37%, Vaneck’s XBTF Is Down 27%, Aggregate Bitcoin Futures Open Interest Across Cryptocurrency Exchanges Slid by More Than 38%

The aforesaid tin beryllium said for the Valkyrie Bitcoin Strategy ETF (BTF) erstwhile it reached an all-time precocious (ATH) of $26.67 per stock connected November 9, 2021, and contiguous it’s changing hands for $16.70 per portion oregon 37.38% down from the ATH.

The Vaneck Bitcoin Strategy ETF (XBTF) is lone down 27.70%, arsenic the ETF exchanged hands for $58.08 per portion connected November 19, 2021, and contiguous it’s trading for 41.99 per unit. While Proshares and the Valkyrie ETFs debuted good earlier Vaneck’s offering, each of the funds person a beardown narration with spot terms of bitcoin and the crypto asset’s futures markets.

Futures markets person seen a diminution successful unfastened interest, arsenic total bitcoin futures unfastened interest crossed cryptocurrency exchanges has declined since mid-November arsenic well. The highest fig of bitcoin futures unfastened involvement was connected November 11, 2021, with implicit $28 billion.

Today, the aggregate unfastened involvement crossed the astir fashionable derivatives exchanges is $17.22 billion. That equates to a nonaccomplishment of 38.50% implicit the past 2 months and the signifier is rather akin to bitcoin’s (BTC) spot marketplace terms action.

Tags successful this story

1 billion, ATH, Bitcoin, Bitcoin (BTC), Bitcoin Spot markets, bito, BTC, BTF, derivatives, Eric Balchunas, ETF, ETF analyst, ETF performance, ETF Volume, etfs, exchange traded fund, First Bitcoin ETF, First US Bitcoin ETF, market updates, NYSE, nyse arca, October 19 debut, price of bitcoin, Proshares, Proshares ETF, SEC, tomorrows volume, Valkyrie, Valkyrie Bitcoin Strategy ETF, vaneck, Wall Street, XBTF

What bash you deliberation astir the 3 bitcoin futures ETFs and their wide show during the past fewer months? Let america cognize what you deliberation astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 5,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Google, NYSE, Nasdaq,

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

3 years ago

3 years ago

English (US)

English (US)