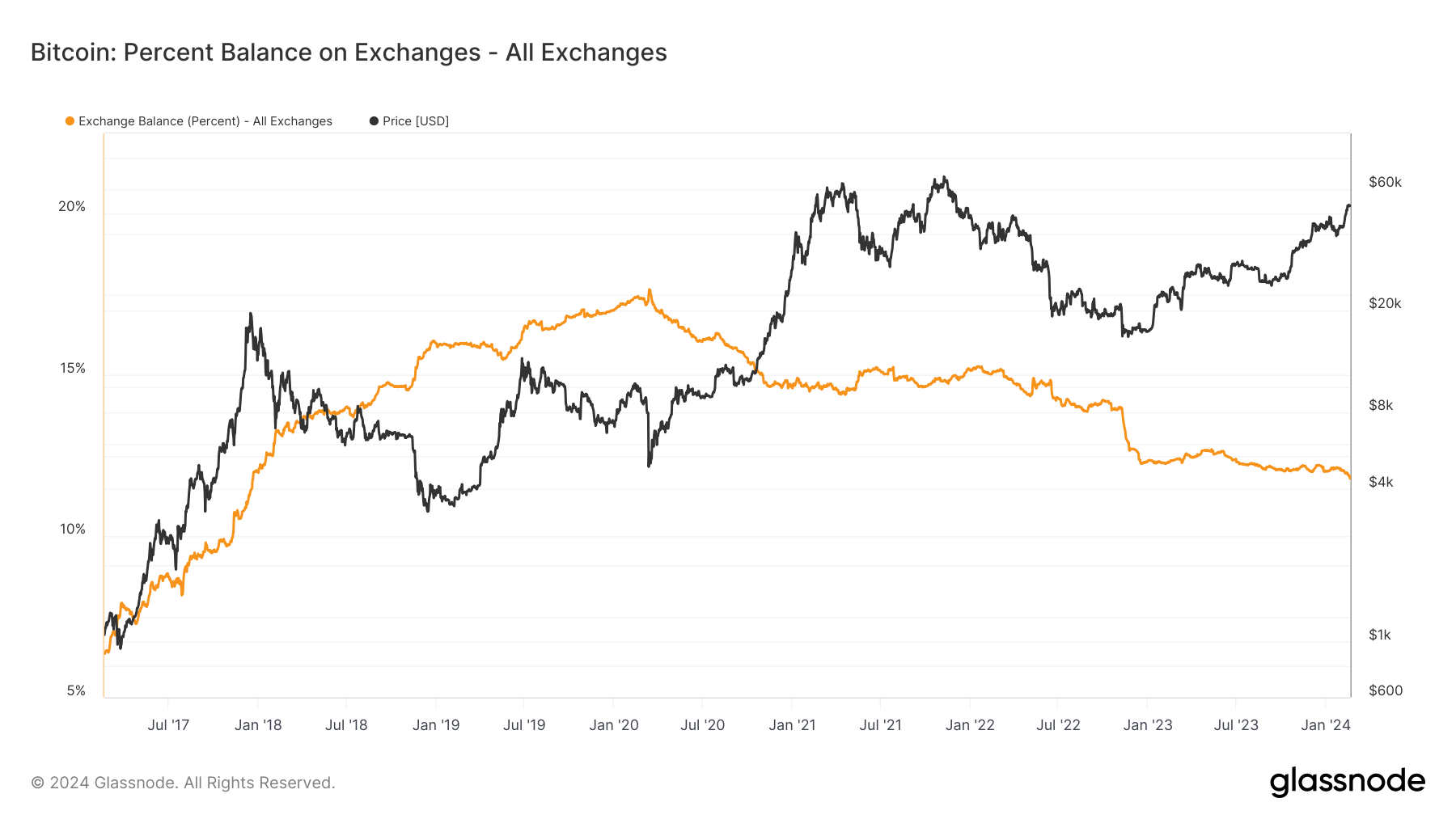

Since mid-March 2020, determination has been a notable decline successful the measurement of Bitcoin stored successful speech wallets, marking a important displacement successful capitalist behavior.

At the time, implicit 17% of Bitcoin’s full proviso was housed connected exchanges, a grounds high. This inclination of declining speech balances has continued unabated, adjacent done Bitcoin’s 2021 bull run, which saw its terms highest astatine $69,000 successful November of that year.

This trajectory has extended into 2024, with CryptoSlate’s investigation of Glassnode information revealing a persistent alteration successful Bitcoin holdings connected exchanges.

From Jan. 1 to Feb. 19, the magnitude of Bitcoin successful speech wallets fell from 2.356 cardinal BTC to 2.314 million, the lowest since April 2018. Meanwhile, the percent of Bitcoin’s proviso successful speech wallets decreased from 12.03% to 11.79%.

Graph showing the fig of Bitcoins held connected speech addresses from February 2017 to February 2024 (Source: Glassnode)

Graph showing the fig of Bitcoins held connected speech addresses from February 2017 to February 2024 (Source: Glassnode)The diminishing beingness of Bitcoin connected exchanges suggests a increasing penchant among holders to transportation their assets distant from these platforms. This question whitethorn bespeak a broader strategy displacement towards semipermanent holding oregon a absorption to prevailing marketplace conditions.

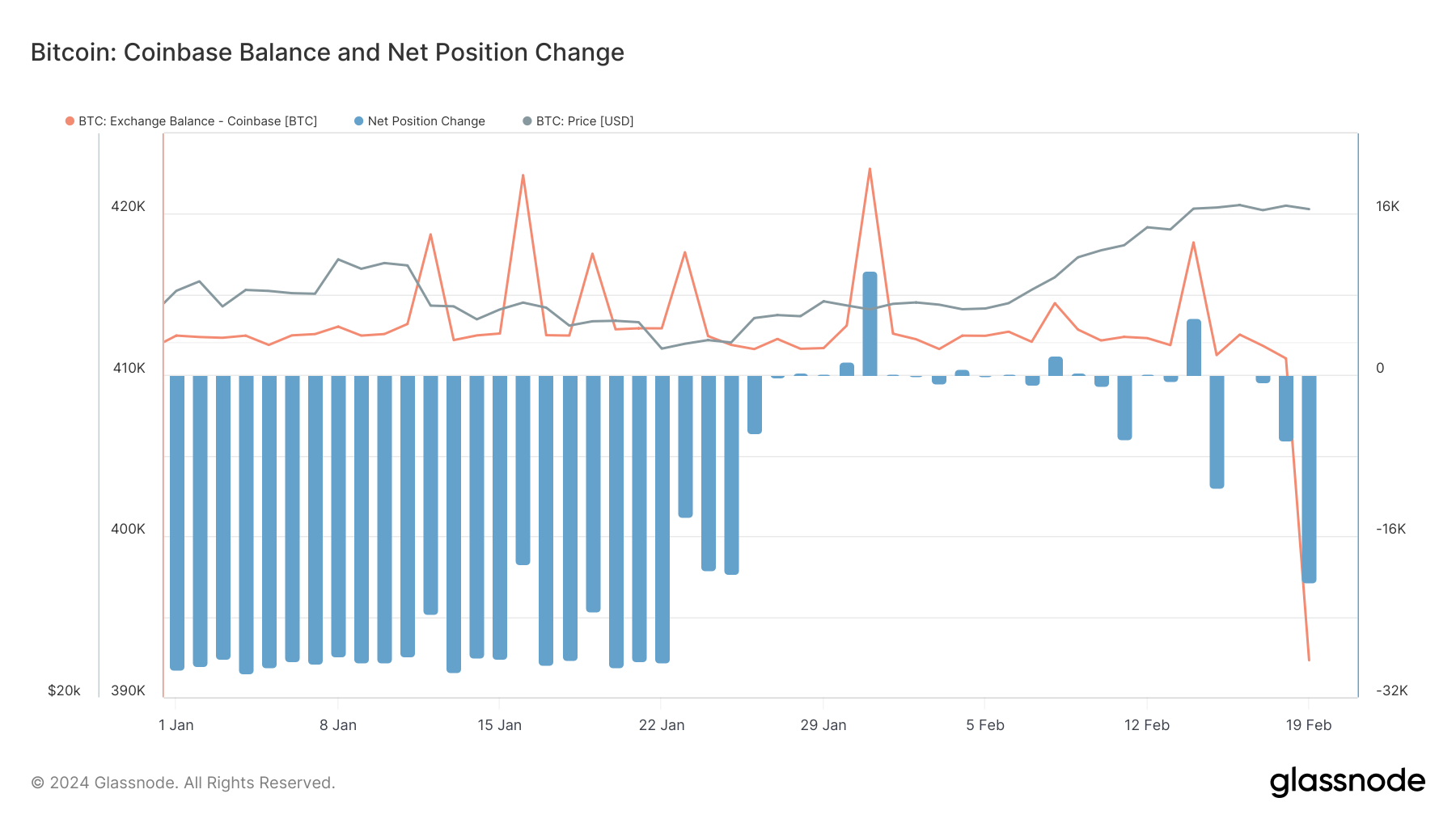

Examining circumstantial exchanges reveals nuanced trends and exceptions wrong this broader pattern.

Coinbase experienced a marked simplification successful its Bitcoin balance, shedding implicit 20,000 BTC from Jan.1 to Feb. 19, with accordant nett outflows since the extremity of January.

Graph showing the Bitcoin equilibrium and nett presumption alteration connected Coinbase successful 2024 (Source: Glassnode)

Graph showing the Bitcoin equilibrium and nett presumption alteration connected Coinbase successful 2024 (Source: Glassnode)Binance besides saw a notable simplification successful its Bitcoin equilibrium this year. The exchange’s equilibrium initially accrued until Jan. 26, erstwhile it began declining, with nett outflows starting connected Feb. 8.

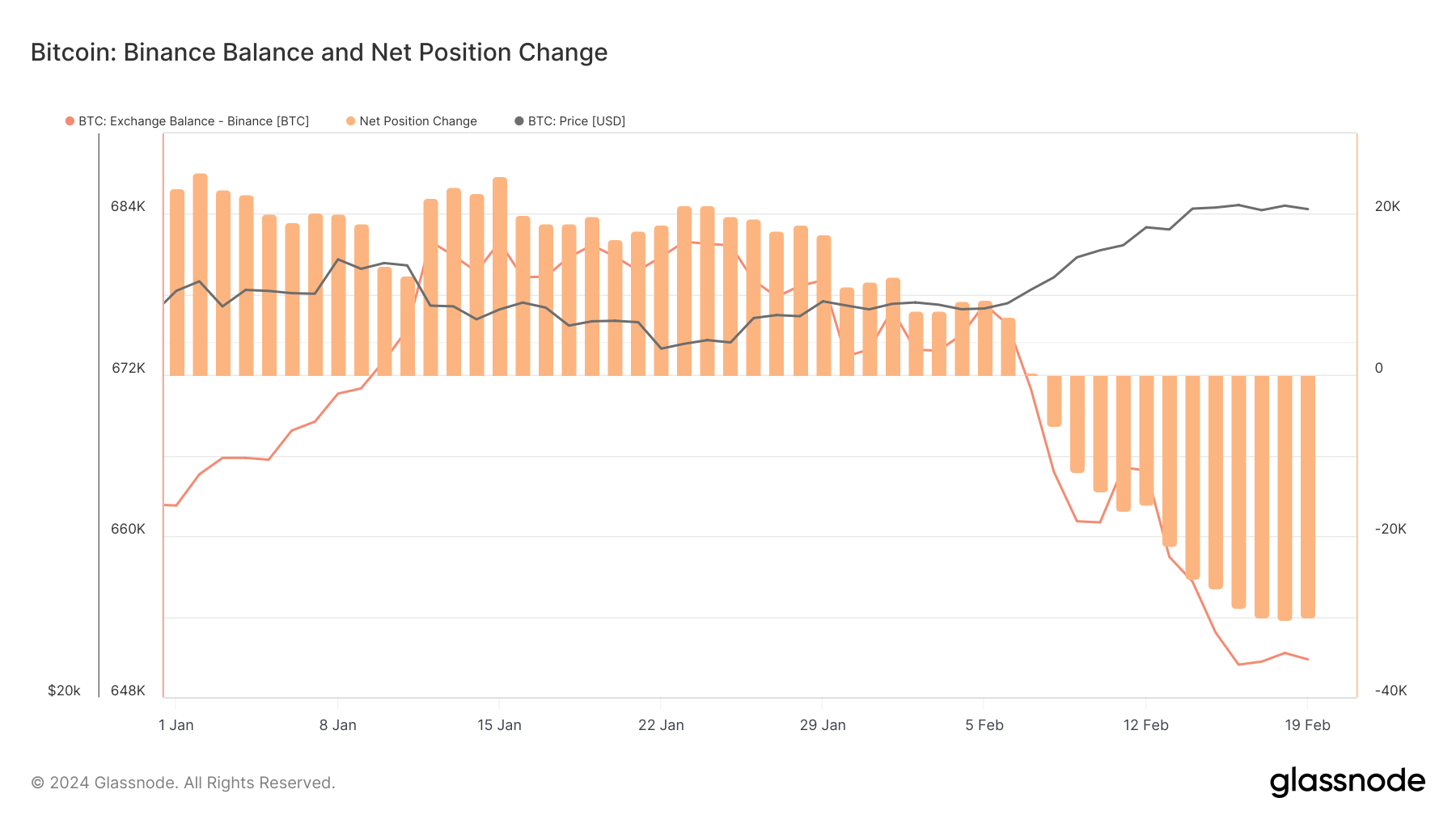

Graph showing the Bitcoin equilibrium and nett presumption alteration connected Binance successful 2024 (Source: Glassnode)

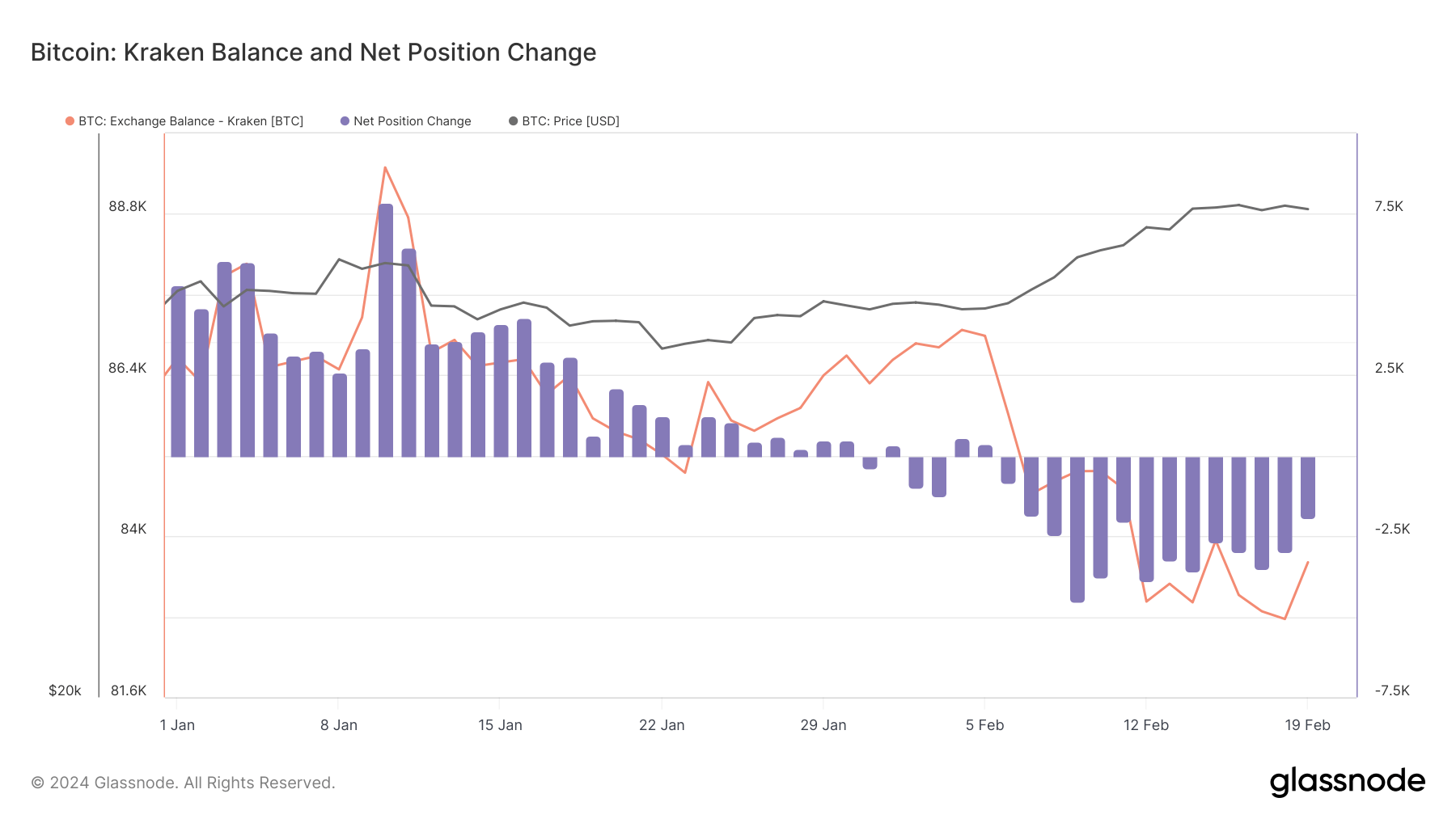

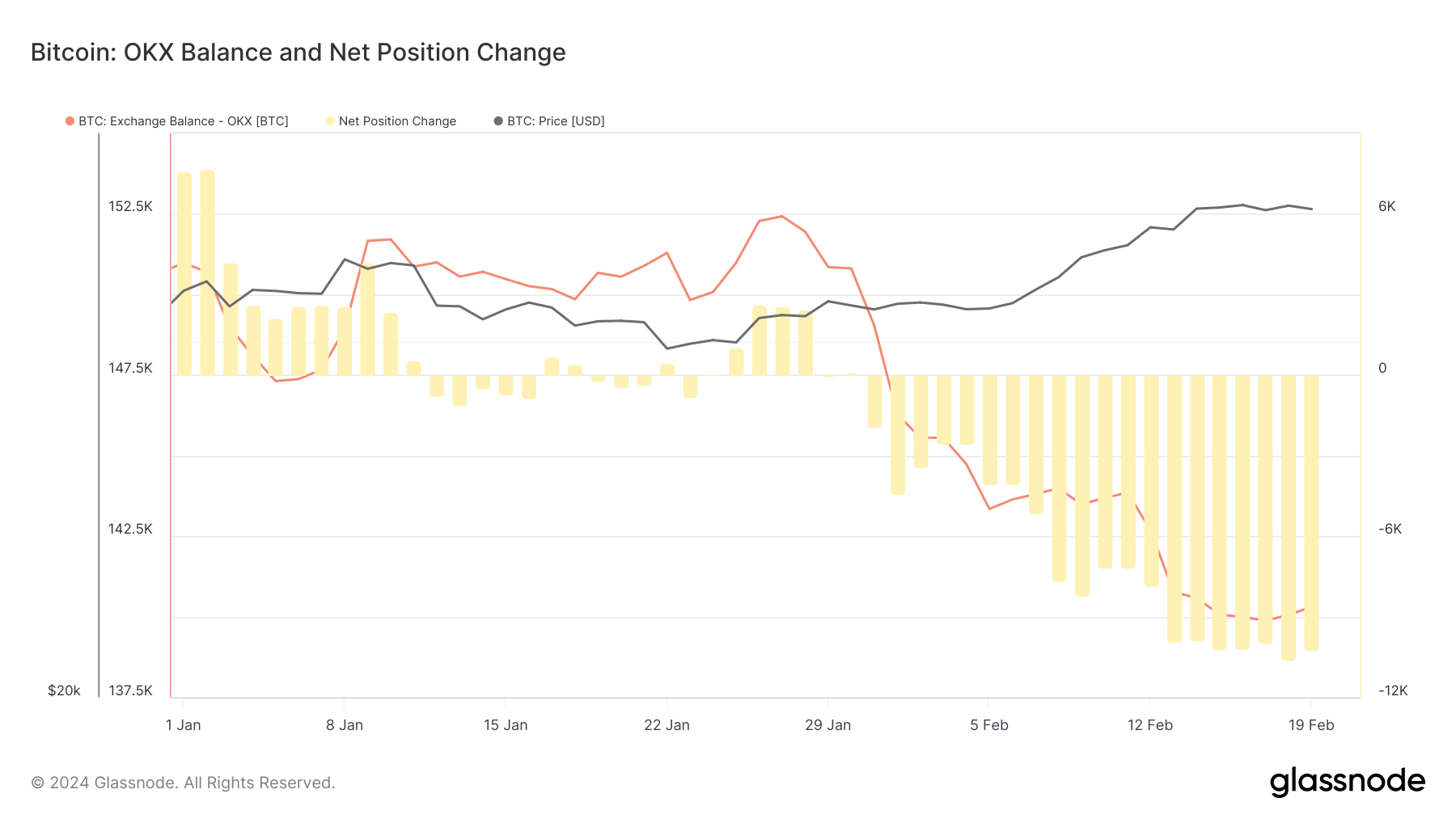

Graph showing the Bitcoin equilibrium and nett presumption alteration connected Binance successful 2024 (Source: Glassnode)Kraken and OKX aligned with this trend, signaling nett outflows and a important alteration successful their Bitcoin balances.

Graph showing the Bitcoin equilibrium and nett presumption alteration connected Kraken successful 2024 (Source: Glassnode)

Graph showing the Bitcoin equilibrium and nett presumption alteration connected Kraken successful 2024 (Source: Glassnode) Graph showing the Bitcoin equilibrium and nett presumption alteration connected OKX successful 2024 (Source: Glassnode)

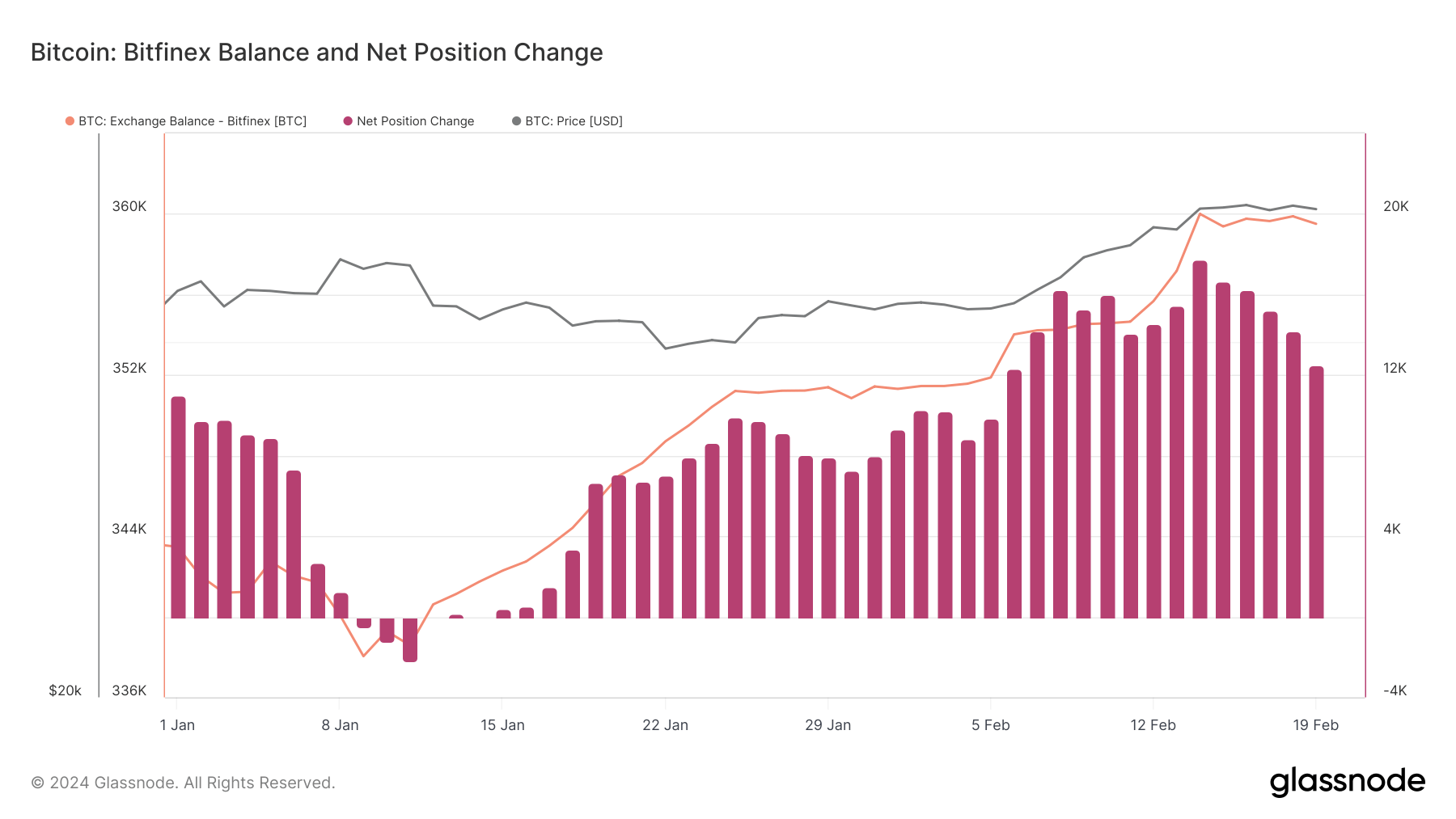

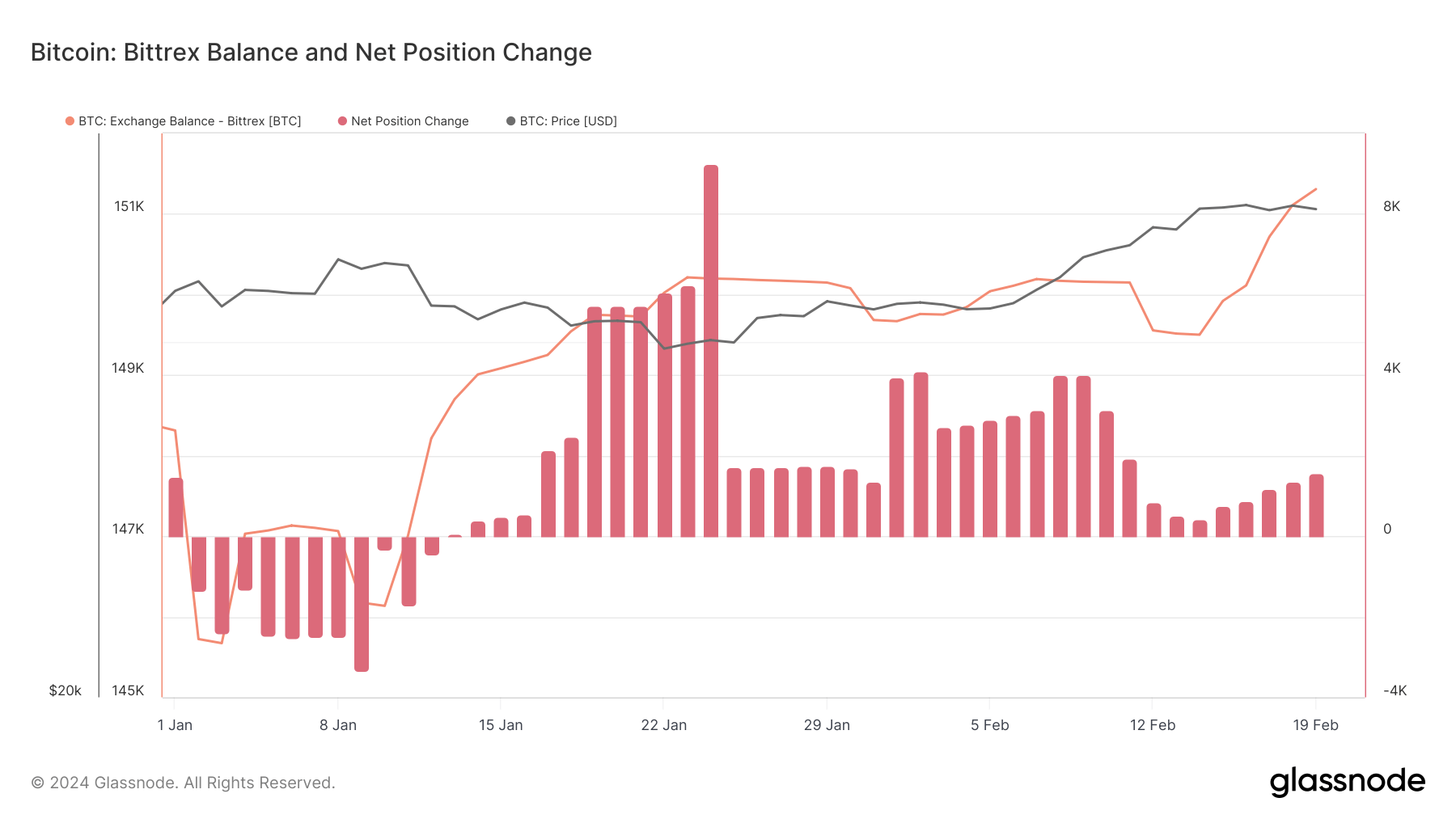

Graph showing the Bitcoin equilibrium and nett presumption alteration connected OKX successful 2024 (Source: Glassnode)Contrary to the wide trend, Bitfinex and Bittrex person seen nett inflows since mid-January.

Bitfinex saw implicit 16,000 BTC added to its Bitcoin equilibrium since the opening of the year, helped by accordant nett inflows since Jan. 15.

Graph showing the Bitcoin equilibrium and nett presumption alteration connected Bitfinex successful 2024 (Source: Glassnode)

Graph showing the Bitcoin equilibrium and nett presumption alteration connected Bitfinex successful 2024 (Source: Glassnode)Bittrex besides saw a spike successful its balance, but this clip by a humble 3,000 BTC since Jan. 1. The speech besides witnessed accordant nett inflows since Jan. 14.

Graph showing the Bitcoin equilibrium and nett presumption alteration connected Bittrex successful 2024 (Source: Glassnode)

Graph showing the Bitcoin equilibrium and nett presumption alteration connected Bittrex successful 2024 (Source: Glassnode)The wide alteration successful Bitcoin balances connected exchanges correlates with a bullish sentiment successful the market. Investors withdrawing Bitcoin to idiosyncratic wallets for semipermanent holding reduces the selling unit connected exchanges. This strategy is underscored by Bitcoin’s terms surge from $44,152 connected Jan. 1 to $52,000 by Feb. 19, contempt experiencing a dip successful mid-January.

The motorboat of Spot Bitcoin ETFs successful the US has apt influenced these trends, but different important factors person besides played pivotal roles. The anticipation and instauration of these ETFs mightiness person bolstered marketplace sentiment, contributing to Bitcoin’s terms rebound and further emergence successful February.

Additionally, the migration of Bitcoin distant from exchanges could beryllium attributed to increasing optimism among investors, who foresee further terms gains driven by broader acceptance and concern successful Bitcoin.

However, the illness of FTX and Celsius and Binance’s ineligible challenges person been important catalysts, prompting users to retreat funds from exchanges owed to information and regulatory compliance concerns.

These events person heightened consciousness astir the risks associated with keeping assets connected exchanges, starring to a displacement towards idiosyncratic wallets for enhanced power and safety.

As Bitcoin is removed from exchanges, the resulting liquidity simplification could summation terms volatility. Yet, this question besides shows a steadfast condemnation successful holding among investors, mounting the signifier for perchance much sustained terms maturation arsenic the disposable proviso becomes progressively constrained.

The station Bitcoin speech equilibrium dips to lowest since 2018 arsenic marketplace shifts to HODLing appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)