The past week was mostly defined by the Bitcoin terms climbing supra $45,800 for the archetypal clip successful implicit 20 months, marking a large commencement to the year. However, the premier cryptocurrency soon experienced a sharp terms pullback owed to antagonistic quality astir the BTC spot (ETF).

Interestingly, the latest on-chain information has revealed that investors look not to person wholly mislaid religion successful Bitcoin, the largest cryptocurrency by marketplace capitalization.

$2.5 Billion Flows Into Crypto Market Following Bitcoin Crash

In a station connected the X platform, crypto expert Ali Martinez has offered on-chain penetration into the aftermath of the clang that affected Bitcoin and the full crypto market. The pundit noted successful his station that a important magnitude of funds flooded backmost into the assemblage a time aft the marketplace downturn.

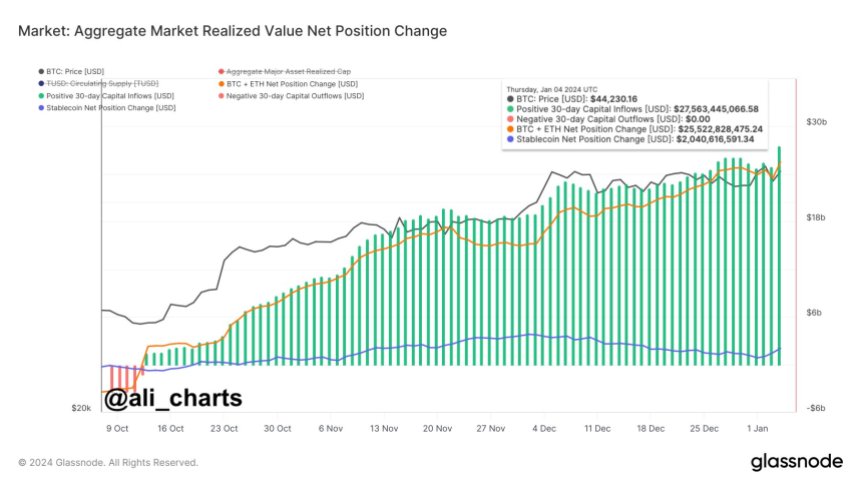

This revelation was based connected on-chain information from blockchain analytics level Glassnode. The applicable indicator present is the “positive 30-day superior inflows”, which tracks the nett influx of superior into the crypto marketplace implicit a 30-day period.

The illustration supra shows that a important magnitude of funds person been entering the cryptocurrency marketplace implicit the past fewer months. According to Glassnode’s data, much than $2.5 cardinal flowed backmost into the cryptocurrency marketplace connected Thursday, January 4, bringing the affirmative 30-day superior inflows to astir $27.5 billion.

This latest inflow of superior into the marketplace offers penetration into the affirmative displacement successful sentiment and marketplace condition. It fundamentally signals renewed investor assurance successful crypto assets pursuing a abbreviated play of uncertainty and terms correction.

As of this writing, the Bitcoin price stands astatine $43,661, reflecting a 0.2% diminution successful the past 24 hours. However, the marketplace person seems to beryllium recovering well, with $44,000 not excessively acold retired of reach.

How BTC Holders Reacted To The Market Downturn

A recent analysis shows however assorted classes of Bitcoin investors reacted to the antagonistic ETF quality and the consequent decline. This valuation was based connected the Spent Output Age Bands USD (SOAB) indicator connected the CryptoQuant analytics platform.

The investors were divided into 5 classes based connected the property of their holdings. According to the analysis, short-term holders who fell wrong the 1-week-to-1-month and 1-month-to-3-month classes exited the marketplace astatine break-even and profits, respectively.

Meanwhile, semipermanent holders who purchased Bitcoin successful the archetypal fractional of 2023, falling betwixt the 6-month-to-12-month class, dumped astir $7.6 cardinal worthy of BTC. The 1-year-to-5-year holder class, connected the different hand, hardly made a determination aft the marketplace downturn.

Featured representation from iStock, illustration from TradingView

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)