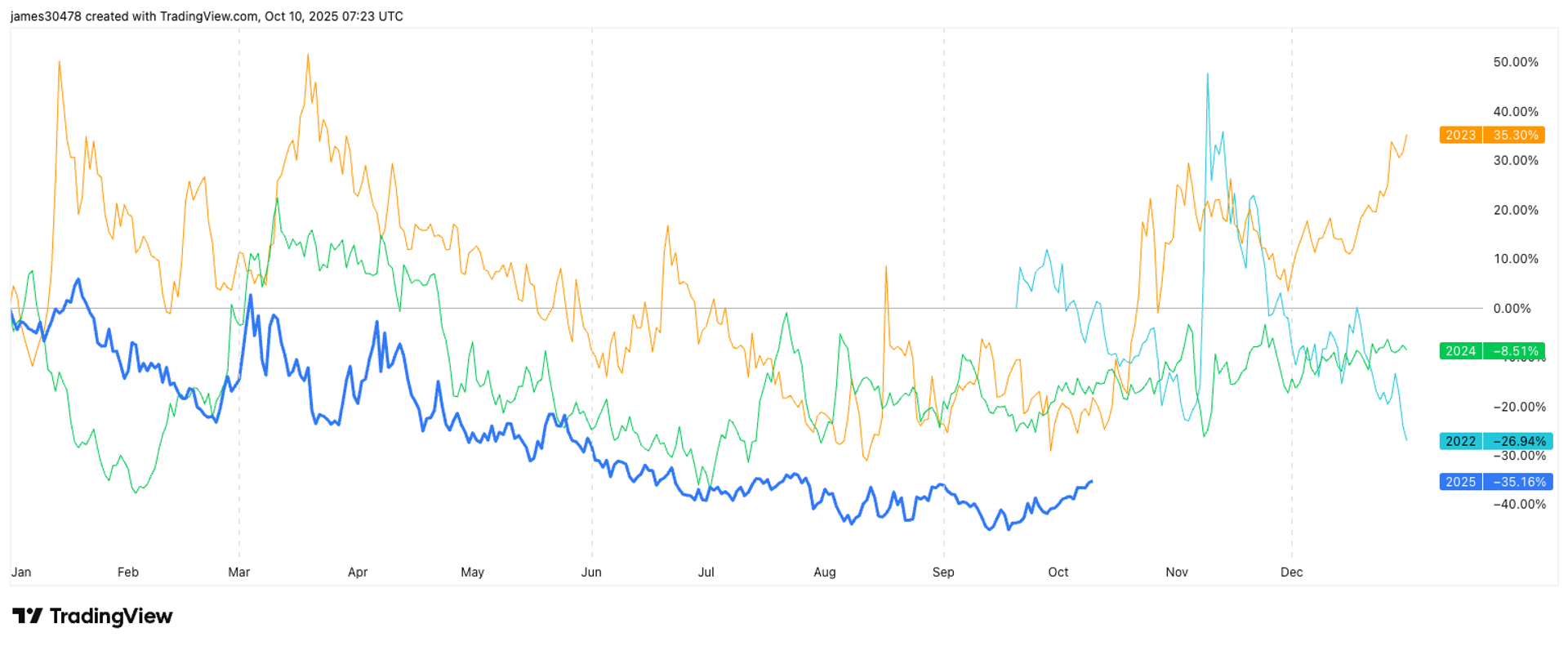

Bitcoin's (BTC) terms betterment has gathered traction successful the pb up to Friday's U.S. jobs report.

The starring cryptocurrency by marketplace worth roseate to $113,000, its highest level since Aug. 28, and recorded its archetypal higher precocious since the mid August each clip highest of $124,000, according to CoinDesk data.

In method terms, a higher precocious signals a imaginable bullish reversal successful inclination arsenic the terms surpasses its erstwhile abbreviated word peak.

Bitcoin’s marketplace dominance, representing its stock of the full crypto market, besides climbed to a 2 week precocious of astir 59%, up from a debased of 57.5%. It points to renewed superior inflows into bitcoin, a displacement from caller marketplace dynamics characterized by whales rotating retired of BTC and into ether.

Max pain-led bounce?

BTC's terms bounce from Asian league lows whitethorn person been catalyzed by the max symptom theory, which suggests that prices gravitate toward the max symptom level arsenic options expiry nears.

Bitcoin (BTC) options worthy $3.28 billions expired astatine 8:00 UTC connected Deribit, with max symptom astatine $112,000. It is the terms level wherever options buyers endure the biggest loss.

According to the theory, arsenic expiry nears, enactment sellers, typically institutions with ample superior supply, look to propulsion the spot terms toward the max symptom constituent successful a bid to inflict maximum symptom connected enactment buyers. They bash truthful by trading the underlying plus successful the spot/futures market.

BTC's terms roseate supra $112,000 aboriginal Friday successful the pb up to the expiry, aligning with the max symptom mentation astir perfectly for the archetypal time. The max symptom mentation is wide discussed and considered valid successful accepted markets, wherever it is utilized to expect terms movements adjacent options expiry. However, immoderate crypto pundits stay uncertain astir whether the mentation operates efficaciously successful the bitcoin market.

Traders are present awaiting the U.S. jobs report astatine 8:30 ET for the adjacent imaginable driver.

1 month ago

1 month ago

English (US)

English (US)