Bitcoin (BTC) investors should inactive expect a further dip successful the terms arsenic the bottommost is yet to signifier fully, Glassnode reported.

Bitcoin’s terms mightiness person crashed by implicit 72% from its all-time precocious and precocious consolidated astir the $20,000 range, but a examination with the erstwhile carnivore marketplace showed that the bottommost is not yet formed.

Bitcoin’s breakpoint

During December 2017 to March 2019 carnivore market, Bitcoin reached its breakpoint astir $6,000, erstwhile it saw a 50% driblet successful 1 month. This carnivore marketplace breakpoint was $30,000 erstwhile Bitcoin’s worth fell by implicit 40% successful 2 weeks.

Source: Glassnode

Source: GlassnodeFurthermore, a redistribution of wealthiness owed to falling prices played retired during the 2018 carnivore market. The aforesaid tin beryllium seen successful the existent carnivore marketplace arsenic caller buyers get into the enactment astir the $20,000 scope arsenic semipermanent investors capitulated.

Long-term holders astatine loss

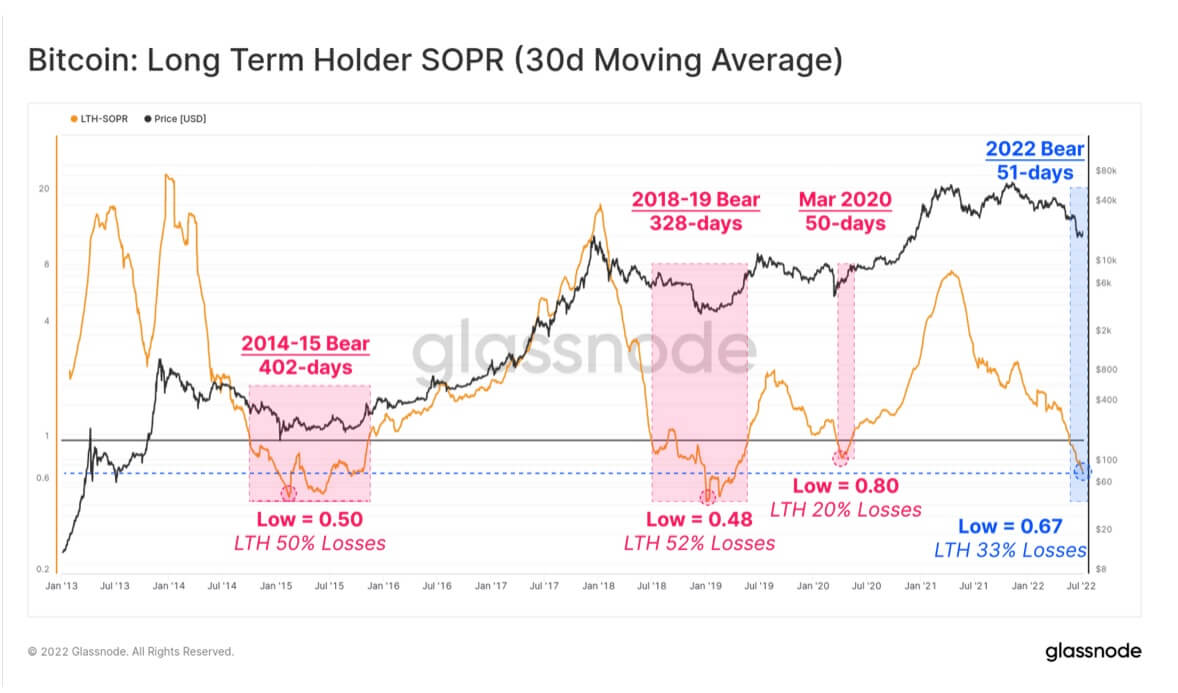

Per Glassnode, semipermanent holders person been nether unit since Bitcoin’s terms fell beneath $30,000. The study measured profitability utilizing spending (actualized losses) and coins held beneath outgo (unrealized losses).

The blockchain analytics steadfast continued that the Long-Term Holder Spent Output Profit Ratio (SOPR) is astatine 0.67. The mean semipermanent holder spending has an actualized nonaccomplishment of 33%, and those hodling person an aggregate unrealized nonaccomplishment of -14%.

Source: Glassnode

Source: GlassnodeMeanwhile, astir semipermanent holders who are spending their Bitcoin are those who acquired the coin for higher prices. Investors who bought Bitcoin betwixt 2017 and 2020 are inactive hodling their assets.

Short-term investors are inactive successful the market

According to Glassnode, successful erstwhile carnivore marketplace stone bottoms, semipermanent holders usually held implicit 34% of Bitcoin proviso portion short-term holders held betwixt 3-4% of the supply.

Presently, short-term holders clasp astir 16% of Bitcoin’s supply, which suggests determination is inactive country for a maturation play to trial their conviction. This besides means that the carnivore marketplace bottommost is yet to beryllium formed.

Miners

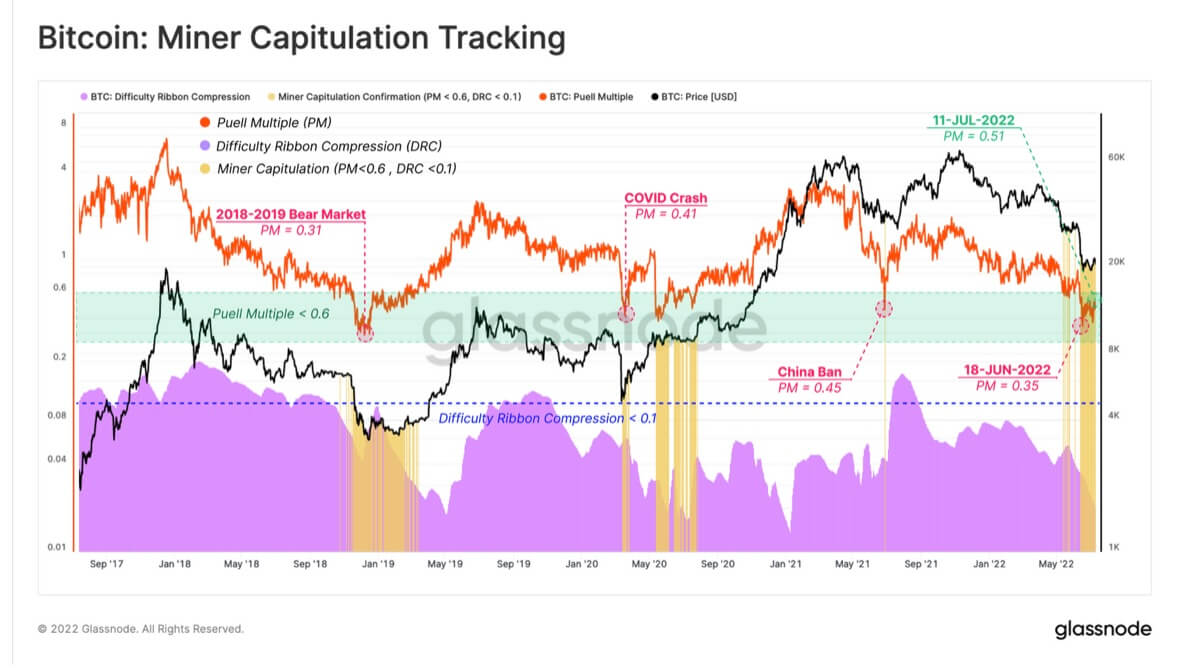

The study identified that miner capitulation is besides successful play presently. There is simply a accidental that the adjacent 4th volition spot much miner capitulation if the terms were to spell lower.

Source: Glassnode

Source: GlassnodeGlassnode continued that miners’ capitulation successful the 2018-2019 carnivore marketplace lasted for astir 4 months, but the existent 1 has lasted for conscionable a month.

The blockchain analytics steadfast concluded that the measurement of Bitcoin proviso successful nonaccomplishment had reached 44.7%, which is little terrible than successful erstwhile carnivore markets. So, determination is simply a accidental for much drops earlier Bitcoin tin found a resilient bottom.

The station Bitcoin holders should expect further terms decline appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)