Most, if not all, individuals are provisioned with zero fiscal acquisition and are not fixed capable acquisition successful the archetypal principles of money, particularly arsenic it relates to gathering wealthiness and establishing a unafraid instauration from which to run truthful that they whitethorn astir optimally navigate the challenges of life.

Financial acquisition is wholly omitted successful classrooms, students are not furnished with the indispensable faculties to efficaciously contend with the realities of beingness and this is not solely constricted to fiscal acquisition either. Other notable curricular deletions see a deficiency of effectual tutoring surrounding nutrition, carnal education, self-defense, effectual connection and dialog skills, intelligence resilience, etc. To the much perspicacious among us, this has ever been evident.

Indeed, galore are alert that the other is typically the case: teenagers are encouraged to instrumentality connected colossal amounts of indebtedness to unafraid a assemblage education, condemning them to the Sisyphean proceedings of endeavoring to wage backmost their debts portion simultaneously facing minimal prospects of employment. Beyond this, galore are encouraged to physique their recognition people by shouldering expanding amounts of debt, taking connected decease pledges (mortgages) and surviving beingness supra their means — with this manner being considered “normal” for astir successful the Western satellite and crossed the globe.

We are perpetually being handed proposal from individuals who person nary acquisition successful gathering wealth. Parents, teachers, friends and adjacent media pundits, though seemingly well-intentioned, successful world unrecorded paycheck to paycheck and person nary factual knowing of the handling of wealth oregon deficiency the quality to competently allocate their superior successful bid to guarantee its sanctity.

Sit Down And Shut Up

The pursuing idiosyncratic anecdote illustrates this occupation rather nicely.

As a boy, I was erstwhile reprimanded by a schoolhouse teacher erstwhile helium elucidated the people astir however the satellite ”really works,” extolling the alleged virtues of “getting a bully education, moving hard, redeeming money” and proffering proposal surrounding the merits of pursuing a career. Having identified a singular glaring spread successful his arguments, I quipped: “Sir, wherefore would I instrumentality proposal from idiosyncratic who has ne'er near school?”

Needless to say, I spent the adjacent hr extracurricular the schoolroom successful the hallway to “think astir what I had said.” Indeed, to this time I inactive deliberation astir that enactment and the validity of the retort seems to go much and much evident arsenic clip goes on. In my mind, I was simply employing the Socratic method to amended recognize my teacher’s inadequacy to proliferate his proposal to the class.

My teacher’s effect is emblematic of the cognition adopted by astir individuals successful nine today, acceptance of the presumption quo and overreliance connected outdated models of operating successful the satellite — which are progressively becoming much and much anachronistic, peculiarly arsenic they subordinate to one’s finances and aboriginal prospects. If thing challenges that long-held assumption, it is rapidly ridiculed oregon punished.

To beryllium clear, endeavoring to attain a bully acquisition and moving hard are so virtuous, worthwhile pursuits, but the means for acquiring these things oregon enacting them are multi-dimensional. The satellite is rapidly changing and the integer beingness is offering opportunities that ne'er existed before, serving to disrupt the monopoly that bequest systems person enjoyed for centuries past.

Faith successful our existing institutions has each but evaporated, owed chiefly to their deficiency of enactment and their cascade into corruption; with the odor of lies and deceit filling the halls of our establishments, their repugnant behaviour is evident to all. The existing paradigm serves to solely usufruct and usurp our time, vigor and value.

As such, this nonfiction addresses these matters and provides an mentation arsenic to wherefore Bitcoin is the remedy and lighthouse successful the fog. It details the astir communal proclamations concerning bitcoin’s expected instability and purported unsuitability arsenic a viable and unafraid means for storing one’s wealth, arsenic good arsenic presenting its virtues successful 3 large domains which facilitate its assertion arsenic the safest spot for one’s wealth — namely however bitcoin satisfies the functions of security, integrity and transportability.

- Integrity: Integrity refers to an asset’s anti-fragility and resiliency against corruption of the protocol. The protocol being the safeguarding and fortification of your monetary energy.

- Security: Security refers to its resiliency to outer hostile onslaught vectors.

- Transportability: Referring to the quality with which 1 tin physically transport one’s wealthiness crossed geopolitical domains arsenic good arsenic the installation with which 1 tin readily transact with different marketplace participants with minimal impedance oregon friction, i.e., easiness of transactability/liquidity.

Asking Questions

A invaluable acquisition was learned erstwhile I asked my teacher that question: the value of challenging authorization figures and their biases, identifying illogical fallacies successful one’s arguments and the value of asking the “why” of things.

Therefore, earlier we survey each chiseled facet of bitcoin’s supremacy arsenic the safest means for storing one’s wealth, we should statesman by prefacing this substance with a little treatment surrounding the conception of redeeming itself and its relevance to our lives.

Employing a archetypal principles attack to wealth absorption volition let america to amended recognize the necessity for appropriately allocating our superior successful bid to amended our fiscal wellness and attain prosperity. Therefore, fto america statesman by employing a Socratic attack which volition let america to amended comprehend wherefore it is indispensable to store our wealthiness successful bitcoin.

Saving For A Rainy Day

The conception of redeeming is repeatedly parroted by mainstream nine and fiscal “experts” and has served to go axiomatic successful the minds of many. “Save your wealth for a rainy day” is simply a mantra that is embedded into the psyche from a young age. However, we bash not intermission to inquire 2 cardinal questions successful effect to those assertions:

1) What is it we are “saving?”

2) Where bash we “save” it?

Therefore, let america to analyse the matter.

In communal parlance we accidental that we are “saving” oregon “building up our savings,” but what is it that we are really redeeming oregon attempting to save? Well, our wealth of course, which people begs the preceding question of what precisely wealth is.

You commercialized clip and vigor to make worth to the marketplace whereby you are compensated with wealth which acts arsenic a practice of your stored time, worth and vigor successful work to that marketplace. As a earthy corollary to this, successful mundane vernacular, we besides accidental that we “spend” time; we walk clip with our friends and family, we walk clip successful meditation, we walk clip doing our hobbies, etc. Money and time, then, cannot beryllium disentangled — they are synonymous — wealth simply being a practice of expended time.

Big woody — what does it matter? Well, though this whitethorn look arbitrary, it unluckily matters a large woody , since astir store their clip successful fiat currency, which tin (and is) printed retired of bladed air, truthful devaluing the full existing stock. The much of thing that exists the little scarce it becomes and truthful the little worth it retains. With the nonstop other argumentation producing the polar other result: the scarcer the much invaluable it becomes (assuming that request remains constant). The bosom of the occupation is that you are exchanging the scarcest happening you person — your clip and vigor — for thing that has nary scarcity astatine all, a defective wealth successful fiat currency.

In the existing paradigm the mode to combat this and insulate your purchasing powerfulness requires that the idiosyncratic make a instrumentality connected their money, and that instrumentality needs to beryllium superior to the existent ostentation complaint — that is what the crippled is truly each about. Before bitcoin appeared, the emblematic mode to bash this was by uncovering innovative ways to make said instrumentality done assorted concern vehicles.

The accepted remedy to this occupation is engaging successful the fiscal markets, which means that 1 has to presume immoderate constituent of hazard successful bid to unafraid their purchasing powerfulness into the aboriginal — a strategy whereby individuals person to presume much and much hazard to support up with expanding levels of inflation, begetting a comprised societal foundation.

Bitcoin ameliorates this occupation since it erstwhile again allows the idiosyncratic to really prevention their wealth and not request to presume the hazard of concern erstwhile each they privation to bash is to person immoderate security against the uncertainty of the aboriginal and summation their prospects of information and stableness successful their lives, arsenic we shall see.

Sound Money Versus Soft Money

This efficaciously comes down to the prime of holding your wealthiness successful dependable wealth oregon brushed money. In bid to differentiate betwixt the two, we tin look to the 3 pillars mentioned astatine the instauration of this nonfiction which warrant the sanctity of our savings, these being its integrity, information and transportability/liquidity.

Let america present measure those 3 pillars and opposition the usage of banks with the usage of bitcoin and however good each satisfies these properties.

Bank

Integrity: Fiat wealth stored successful a slope benefits from zero integrity due to the fact that of a deficiency of extortion from ostentation since the involvement complaint does not bushed adjacent the authoritative ostentation rate. As a result, keeping your wealth successful your slope relationship means that you are mathematically guaranteed to suffer purchasing power.

Security: The information facet of banks is somewhat better. It is hard for idiosyncratic to participate a slope and bargain your money; the currency is either stored down 4 feet of alloy successful a vault oregon nowadays, stored digitally. However, though suitable for protecting against malicious outer attacks, an individual’s slope relationship is different substance since the anticipation of confiscation oregon deplatforming is ever present. Counterparty risks ever exist, arsenic tin beryllium seen with recent events successful Canada.

Transportability: Fiat insubstantial wealth was a utile invention which allowed individuals the payment of transacting and transporting their wealthiness much easy crossed space. However, this payment lone exists wrong the individual’s respective geopolitical domain. It would beryllium problematic if 1 were required to permission their state successful the lawsuit of an emergency, arsenic tin beryllium seen with the recent situation successful Ukraine.

There is nary usage withdrawing currency and carrying it crossed borders since it would beryllium either useless successful a state with a antithetic currency oregon the speech complaint would beryllium unfavorable and frankincense not optimally liquid, arsenic good arsenic presenting a pronounced hazard to one’s information due to the fact that of susceptibility to theft oregon coercion. Cash therefore, is not flawless successful transporting one’s wealthiness crossed geopolitical domains.

Therefore, a slope is lone marginally amended than keeping currency nether your mattress.

Bitcoin

Integrity: Bitcoin does not endure from the corrosive effects of ostentation arsenic a effect of its perfectly fixed supply. It is really deflationary successful quality with its integrity ever guaranteed, since nary idiosyncratic oregon entity tin change the proviso headdress owing to its decentralization. There is nary request to presume counterparty risk.

Security: If an idiosyncratic takes full custody of their bitcoin (which they are encouraged to do) nary idiosyncratic oregon enactment tin summation entree to those funds if the proprietor holds those keys.

Transportability: Referring backmost to the conception of wealth being an security argumentation against the inherent uncertainty of the aboriginal and a means for optimizing axenic optionality arsenic a bulwark against said uncertainty, bitcoin allows an idiosyncratic to store their wealthiness successful an plus that tin beryllium moved crossed geopolitical domains successful the confines of their precise minds.

You tin participate a caller state with each of your wealthiness intact, acquisition a sim paper and walk your bitcoin oregon merchantability it for the section currency to acquisition nutrient and accommodation. Most people’s wealthiness is stored successful their homes arsenic equity, which is highly illiquid, taking astir six months to transact. The wealth successful their slope accounts whitethorn besides beryllium useless successful different state wherever their slope accounts whitethorn not beryllium valid oregon the currency different.

The caller situation successful Ukraine efficaciously highlights the value of possessing transportable wealth. The modern satellite is successful a changeless authorities of flux and the increasing necessity for individuals to fly their inherited federation states grows by the month; bitcoin offers an unparalleled accidental for individuals to reclaim their autonomy successful a satellite acceptable connected minimizing oregon altogether eviscerating it.

Central Bank Digital Currencies

A little constituent and informing should beryllium made present concerning the upcoming implementation of Central Bank Digital Currencies (CBDCs). CBDCs are programmable integer currencies which tin beryllium manipulated by governments, cardinal banks and employers.

Although CBDC proponents advocator for its usage arsenic means of extortion against fraud and wealth laundering, they conveniently omit the tremendous powerfulness imbued successful its issuers. CBDCs volition let the issuer to enact afloat power implicit its users’ money: customize involvement rates, acceptable expiry dates and modulate circumstantial uses are conscionable immoderate of the possibilities that beryllium with this programmable money.

And what mightiness beryllium the effect of this if these CBDCs tin beryllium linked to a integer ID? If your governmental stance is viewed arsenic unfavorable to the establishment? What happens if you cannot acquisition investments oregon you are fixed a antagonistic involvement complaint due to the fact that you are redeeming excessively overmuch wealth and are frankincense incentivized to walk and consume?

Having demonstrated that allocating your superior wrong the confines of a slope is simply a liability, it is becoming progressively evident that entrusting your wealth to these institutions volition nary longer stay solely a liability. Fiat wealth and the banking strategy volition statesman to airs a important menace not conscionable to your fiscal sovereignty, but besides to your idiosyncratic escaped will. The implementation of CBDCs really imperils an individual’s close to self-determination; it presents a precise wide and contiguous information jeopardizing liberty, sovereignty and freedom.

Bitcoin and CBDCs are diametrically opposed. They are polar opposites successful their philosophies; 1 grants sovereignty, the different slavery; 1 offers self-custody and the other, full control.

Bitcoin Is Better Than Banks

Bitcoin fortifies your wealth and restores the individual’s quality to prevention alternatively than acquisition speculative investments. Bitcoin has nary CEO; Bitcoin has nary shareholder meetings; Bitcoin conscionable is.

Of course, an astute scholar volition recognize that bitcoin and banks are not the lone options erstwhile it comes to allocating one’s capital. There are different concern options specified arsenic precious metals, existent estate, authorities and firm bonds, good art, wine, antiques and galore different options that could beryllium utilized arsenic stores of value. According to Nassim Taleb, you could adjacent usage olive oil.

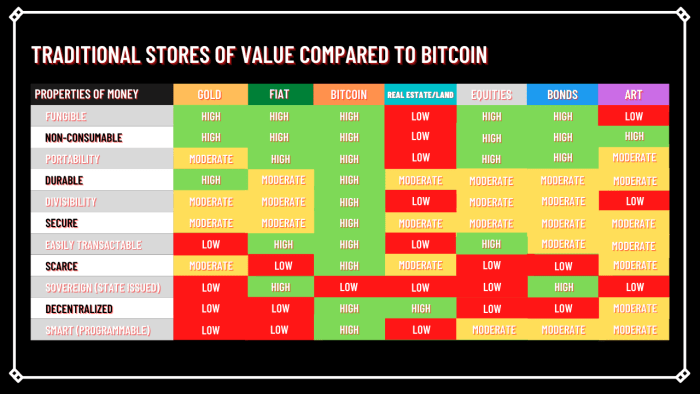

However, bitcoin remains ultimate successful its relation arsenic the optimum store of worth based connected it being capable to astir efficaciously fulfill the halfway properties of wealth arsenic demonstrated above. To further compound this point, the pursuing representation provides a matrix illustrating a side-by-side examination of each accepted store of worth juxtaposed to bitcoin.

Note: The expanding popularity of democratized finance, emergence of fractional ownership and increasing popularity of NFTs are acceptable to digitally dematerialize accepted stores of value. However, for the intent of this conversation, the supra has focused connected established, accepted stores of worth and has forgone speculative ventures. For example, a portion by Basquiat oregon Van Gogh is what constitutes creation successful this instance, not NFTs (which person yet to found themselves). (Source)

Volatility

“Bitcoin is excessively volatile.”

This is simply a recurring mantra that is consistently perpetrated by Bitcoin’s detractors arsenic a crushed for it not being a harmless bet. In my opinion, you can’t blasted them since they are oftentimes simply regurgitating what is expounded by the mainstream media successful bid not to look ignorant connected the subject. It is an automated response, derived from hysterical headlines. Allow america to dismantle it.

We person established that bitcoin is the astir unafraid plus disposable to marketplace actors, possessing the top integrity and information arsenic good arsenic offering the champion means for transportability. Where does volatility person a relation to play?

Let america statesman to explicate what volatility is and wherefore bitcoin is not volatile whatsoever. Let america proceed successful our attack of asking questions. What is it that is volatile astir bitcoin precisely? The terms is volatile.

The terms of bitcoin is so volatile if you are measuring the plus successful presumption of fiat currency, but terms does not ever equate worth oregon worth. This is wherefore 1 tin pontificate that an plus oregon entity tin either beryllium considered undervalued oregon overvalued; information is based upon what 1 subjectively believes the plus to beryllium worth.

Price is simply the nonsubjective existent speech complaint for a peculiar bully oregon service, i.e., what 1 is required to wage to person its benefit; but the terms itself, though objective, is determined by the subjectively perceived worth of an asset’s worthy and value. We each delegate worth to antithetic things — immoderate find worth successful collecting shot cards, others find worth successful learning however to crochet, portion determination are others who find zero worth successful either of those practices and truthful bash not engage.

The much worth thing has, the greater its worth, meaning that it volition bid a higher price, since each of these factors are interdependent. Since worth is derived from demand, scarcity and perceived usefulness, which unneurotic signifier the instauration of bitcoin’s usage case, the volatility of the terms of bitcoin tin easy beryllium reconciled since it has a fixed and diminishing supply: coupled with expanding demand, it results successful an ascendance successful price.

You Can’t Lose Money With Bitcoin

A bold claim.

When 1 stops to see the matter, they inevitably recognize that they can’t suffer immoderate money. Certainly, the worth of their bitcoin measured successful fiat whitethorn fluctuate but their holdings person not gone anywhere. Seasoned veterans successful the Bitcoin abstraction person nary involvement successful the fluctuations successful the fiat terms of bitcoin; that metric is inconsequential to them and poses nary relevance due to the fact that they usage a antithetic means of measurement. They person begun to denominate things, not successful fiat presumption but successful bitcoin terms, which is wherefore the meme “1 BTC=1 BTC” is truthful prevalent, since it efficaciously illustrates this point.

Everything is presently denominated successful fiat successful astir people’s minds, but erstwhile 1 begins to displacement one’s mindset and starts denominating things successful bitcoin terms, and yet successful satoshis, the representation becomes overmuch clearer. Therefore, erstwhile you statesman this process and you discard the thought of trading your bitcoin for fiat, you alternatively statesman to deliberation of the worth of things comparative to bitcoin and what it tin bargain you, specified arsenic a house, a car, groceries, etc.

In reality, what is volatile are fiat currencies. How galore currencies person risen and fallen implicit the centuries? How consistently are they diluted and deprived of their archetypal value? How scarce are they? We should beryllium encouraged to statesman asking these questions.

Time Preference

These questions are fundamentally reflected by one’s clip preference: If you person a precise precocious clip preference, past you spot much accent connected the contiguous and near-term terms action. If you person a little clip preference, meaning a higher predisposition for patience and delayed gratification, past longer-term show is much meaningful. Your clip skyline volition inevitably impact your cognition of events.

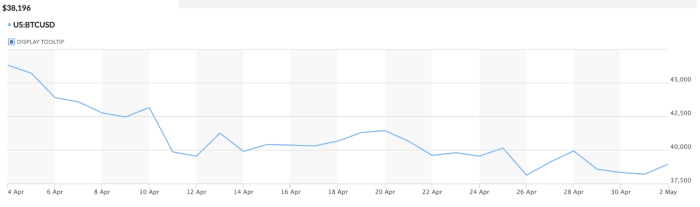

The pursuing representation shows bitcoin’s show implicit a caller one-month clip period. The adjacent representation shows bitcoin’s full instrumentality since 2010. When viewed connected a agelong capable clip horizon, we tin spot that bitcoin doesn’t look volatile astatine all. In fact, it seems to beryllium reasonably accordant successful its trajectory to the top-right corner.

One-month instrumentality (source)

All-time instrumentality (source)

Conclusion: There Is Nowhere Else To Put Your Money

The main accent of this nonfiction is to stimulate the reader’s caput into asking questions, to interrogate the evident “normalcy” of the existing paradigm and to undertake thoughtful inquisition into the anticipation of a better, much humane arrangement.

Bitcoin is founded connected earthy law; it is nonsubjective truth, governed by the laws of mathematics and physics. It is engineered money. Contrast this with cardinal banks who manipulate involvement rates connected a whim, which typically diminution decennary aft decade. Not lone are you losing purchasing power, but you are actively being robbed.

Bitcoin not lone offers security, integrity and transportability, but besides offers simplicity to its users. Gone are the days of stock-picking and head-scratching — bitcoin provides the enactment of a elemental and unafraid means for retaining your wealthiness into the future.

I situation the scholar to find a much secure, better-performing store of worth for their money. Bitcoin is the hurdle to bushed and the champion means for securing your wealthiness crossed abstraction and time. For those who person the luck of speechmaking this nonfiction present and person courageousness to participate the caller paradigm, they volition beryllium rewarded with an detonation successful their nett worthy since they are entering the marketplace astatine the opening of the S-curve, taking afloat vantage of the adoption signifier of a technology, wherever they tin beryllium backmost and witnesser Metcalfe’s Law and the Lindy effect play retired beautifully.

Bitcoin is the accidental of a millennium. It is the oasis successful the desert, the harmless harbor successful the storm, the shield against the arrows. Reclaim your sovereign birthright, instrumentality to your destiny and fearfulness nary longer.

This is simply a impermanent station by Beren Sutton-Cleaver. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc. oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)