Day traders bored of bitcoin's caller slumber whitethorn soon person to stay glued to their screens, arsenic a ample fig of unfastened futures positions awesome renewed terms turbulence ahead.

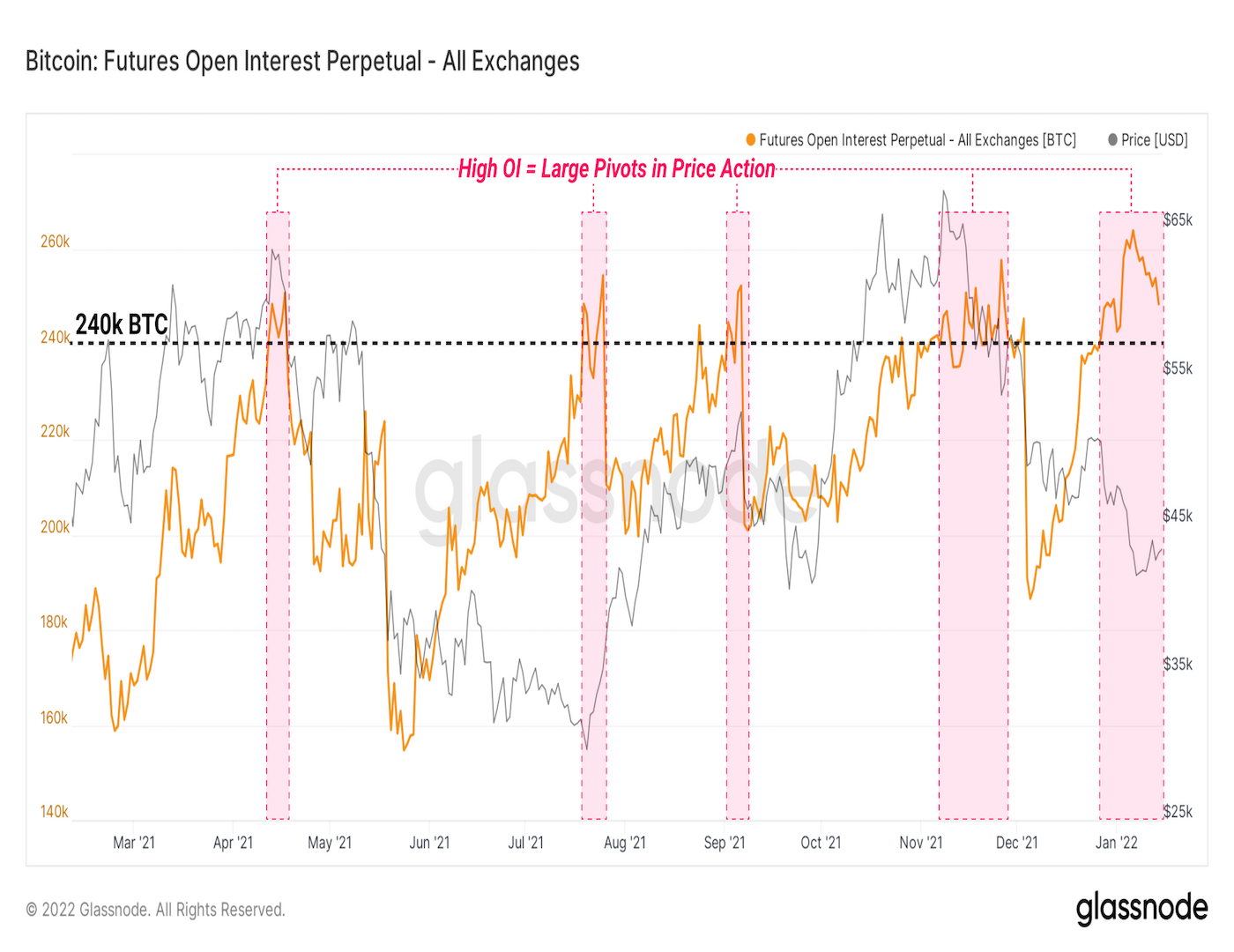

"Futures markets stay a pulverization keg for short-term volatility with Perpetual Futures Open Interest astatine ~250,000 BTC- a historically elevated level," blockchain analytics steadfast Glassnode said successful a probe enactment published connected Monday.

An above-250,000 BTC unfastened involvement has coincided with volatility spikes successful the past. "Since April 2021, this has paired with ample pivots successful terms enactment arsenic the hazard for a abbreviated oregon agelong compression increases, resolved successful a marketplace wide deleveraging events," Glassnode added.

A futures declaration is the work to merchantability oregon bargain an plus astatine an agreed-upon terms connected oregon earlier a circumstantial date. Perpetuals are futures with nary expiry. Open involvement refers to the fig of contracts traded but not liquidated with an offsetting position.

Abnormally precocious unfastened involvement indicates excess leverage – funds borrowed to amplify returns from the trade. In specified situations, the marketplace becomes susceptible to liquidations and resulting terms turbulence. Liquidations notation to the forced closure of agelong oregon abbreviated positions by exchanges owed to borderline shortage. These pb to exaggerated terms moves, arsenic seen respective times implicit the past 12 months.

As a standalone indicator, unfastened involvement doesn't reason directional views connected the marketplace but lone indicates the magnitude of wealth allocated to derivatives.

However, unfastened involvement coupled with funding rates oregon the outgo of holding long/short positions successful perpetual futures reveals the market's bias. A affirmative backing complaint means longs wage shorts for bullish exposure, portion a antagonistic complaint implies outgo from shorts to longs.

Per Glassnode, bitcoin's backing rates precocious dipped to antagonistic territory. This, coupled with precocious unfastened interest, suggests leverage is skewed to the bearish side. So, if bitcoin continues to determination sideways, the backing outgo would go a load for shorts, and they whitethorn determine to unwind their position, starring to volatility connected the higher side.

Similarly, a determination higher tin besides pb to forced liquidation of shorts, which, successful turn, could output much volatility.

Bitcoin was past seen trading adjacent $41,970, representing a 0.6% driblet connected the day. The starring cryptocurrency has been restricted to the constrictive trading scope of $40,000 to $44,000 since Jan. 7, CoinDesk information show.

Subscribe to Crypto for Advisors, our play newsletter defining crypto, integer assets and the aboriginal of finance.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)