On-chain information shows Bitcoin miners could beryllium dumping close now, a motion that could supply an impedance to the rally.

Bitcoin Miners’ Position Index Has Shot Up Recently

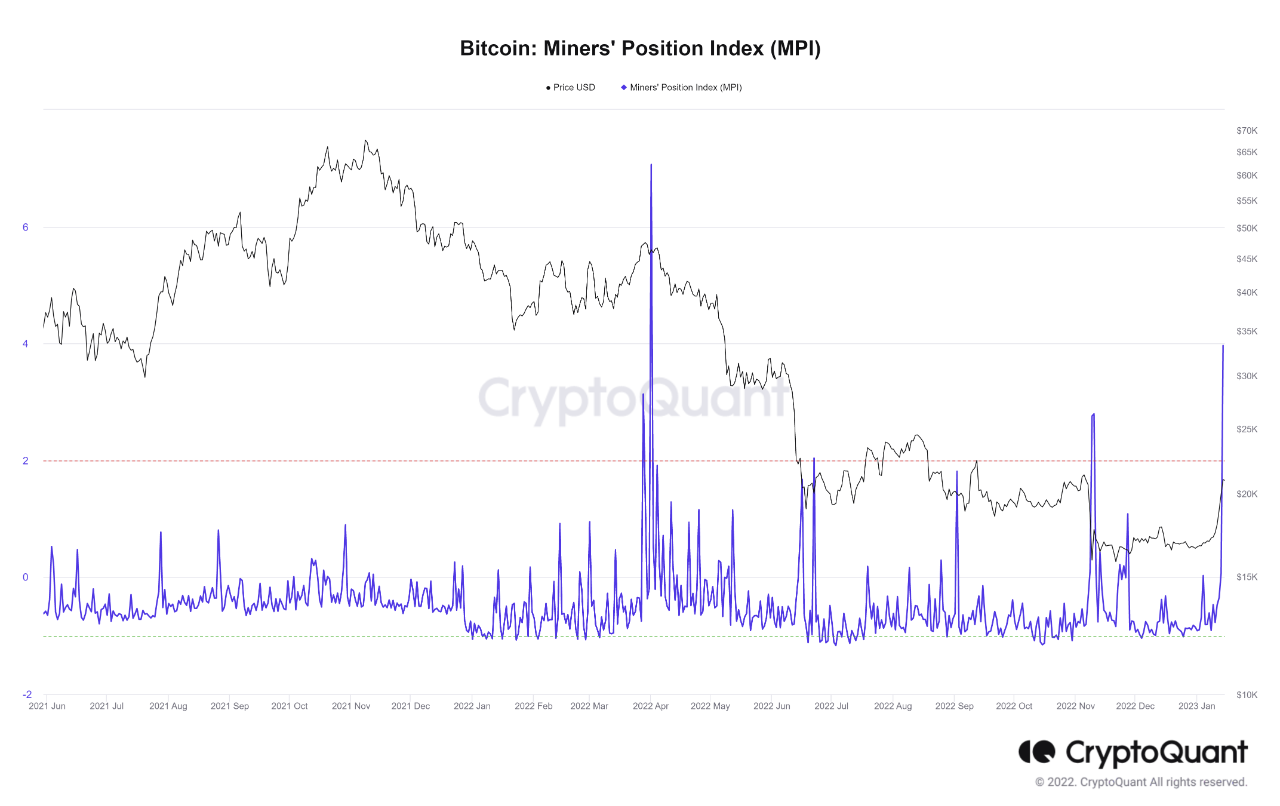

As pointed retired by an expert successful a CryptoQuant post, miners whitethorn beryllium putting selling unit connected the marketplace currently. The applicable indicator present is the “Miners’ Position Index” (MPI), which measures the ratio betwixt the miner outflows and the 365-day moving mean of the same.

The “miner outflows” notation to the full magnitude of Bitcoin that each these concatenation validators are transferring retired of their wallets astatine the moment. Usually, miners retreat coins from their reserves with the main intent of selling them. Thus, a precocious worth of the outflows tin suggest that this cohort is dumping ample amounts close now.

As the MPI compares these outflows with their yearly average, the metric’s worth tin archer america however the existent miner selling is compared with the mean for the past 365 days.

When this indicator has a precocious value, it means miners are selling astatine a higher grade than accustomed currently, portion the metric having a debased worth could suggest determination is lesser selling unit coming from these concatenation validators than the mean for the past year.

Now, present is simply a illustration that shows the inclination successful the Bitcoin MPI implicit the past twelvemonth and a half:

As shown successful the supra graph, the Bitcoin MPI has spiked up precocious and has deed a worth of astir 4, the highest level that the indicator has observed since April of past year. The metric having specified a ample worth would suggest miners are taking retired mode much coins than usual, and are truthful perchance putting bonzer selling unit connected the marketplace currently.

From the chart, it’s evident that spikes successful the metric person usually been followed by declines successful the terms of the crypto. The astir utmost illustration was backmost successful April 2022, erstwhile the terms saw a precise crisp drawdown not excessively agelong aft the metric recorded adjacent higher values than now.

The past clip the indicator observed precocious values were backmost during the illness of the crypto speech FTX when the terms erstwhile again saw a accelerated downward move.

Bitcoin has been engaged rallying during the past week oregon so, touching arsenic precocious arsenic $21,000 truthful far, truthful these accrued withdrawals close present would suggest miners privation to instrumentality vantage of this profit-taking accidental portion they inactive can, and dump their coins.

If this cohort so intends to merchantability with these transfers, past the crypto’s rally could perchance find immoderate impedance and temporarily halt here, if not outright reverse its direction.

BTC Price

At the clip of writing, Bitcoin is trading astir $20,800, up 20% successful the past week.

Featured representation from Kanchanara connected Unsplash.com, charts from TradingView.com, CryptoQuant.com

2 years ago

2 years ago

English (US)

English (US)