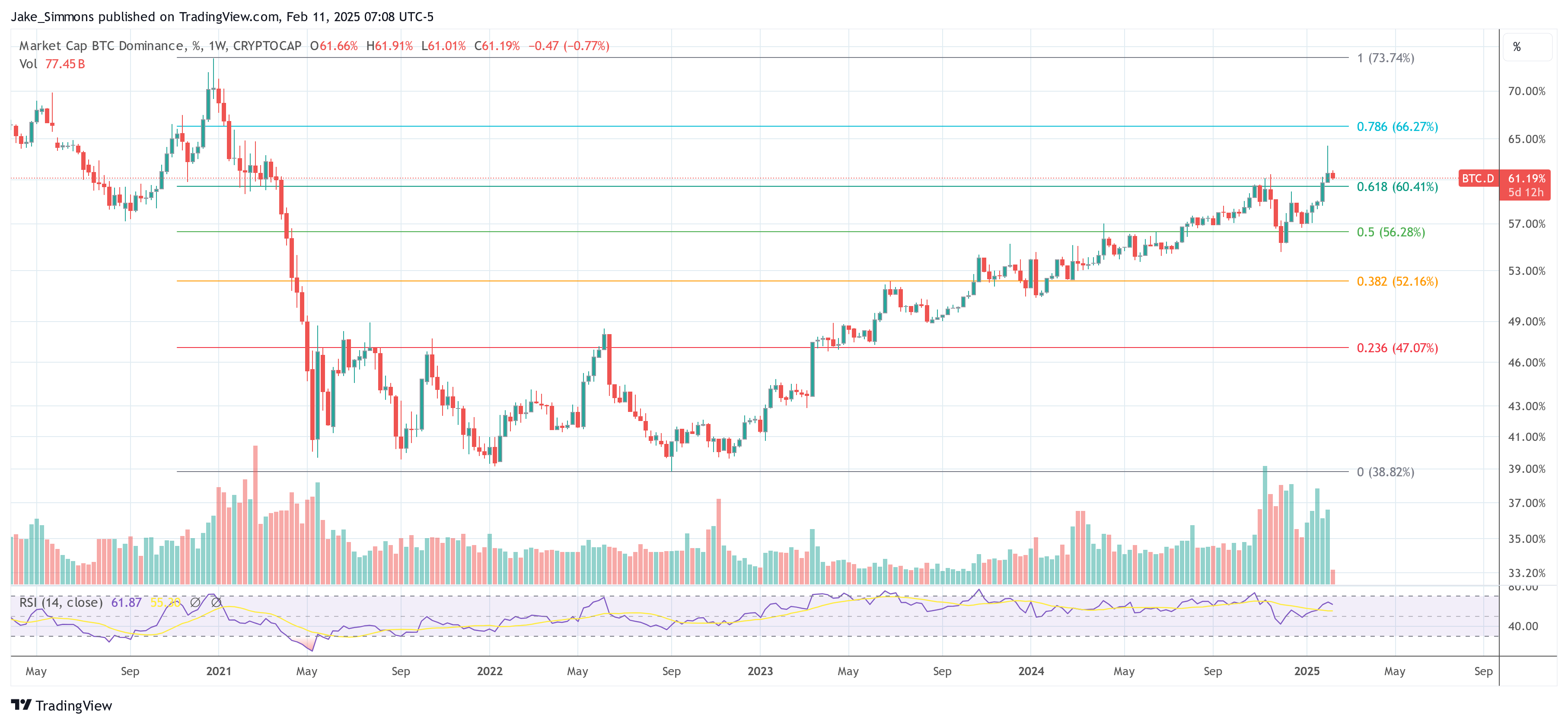

The Bitcoin dominance (BTC.D) surged supra 64% this week, its highest level since March 2021, sparking statement implicit an impending abbreviated compression that could nonstop its terms skyward. The stark informing comes from Joe Consorti, Head of Growth astatine Theya, who took to X connected Monday to outline what helium views arsenic a decisive turning constituent for Bitcoin versus the remainder of the integer plus market.

A Historic Break In Bitcoin’s Correlation Patterns

In his post, Consorti contends that Bitcoin’s caller terms enactment marks the archetypal clip successful its 16-year past that some its terms and marketplace dominance person risen successful tandem. Historically, Bitcoin’s dominance would emergence initially, lone to wane arsenic speculation spilled into altcoins. However, Consorti states: “This is the archetypal clip successful past that bitcoin’s stock of the full integer plus marketplace is rising portion its terms is climbing. In past cycles, retail-driven speculation pushed bitcoin’s terms up and aboriginal funneled wealth into altcoins, causing bitcoin dominance to decline. That dynamic is gone.”

According to Consorti, the days erstwhile a wide altcoin rally would travel Bitcoin’s archetypal surge look to beryllium over. Bitcoin dominance precocious touched 64%—its highest level since February 2021. Consorti attributes the improvement to a important alteration successful marketplace participation: “This cycle, institutions, sovereigns, and semipermanent holders are starring the charge, progressively allocating superior exclusively to bitcoin portion mostly ignoring the remainder of the market.”

Last week’s marketplace turbulence resulted successful what Consorti calls “the single-largest liquidation event successful ‘crypto’ history,” citing information that much than $2.16 cardinal successful positions were wiped retired wrong 24 hours. Ethereum led the liquidation figures with $573 million, and the largest azygous liquidation—a $25.6 cardinal ETH/BTC order—occurred connected Binance. “As you mightiness person guessed, ETH/BTC is not having a large time,” Consorti notes, pointing retired that the ETH/BTC brace is trading astatine 0.026—its lowest level successful implicit 3 years.

He argues these liquidations item the precarious quality of heavy leveraged altcoin markets: “All of it wiped retired successful an instant erstwhile terms moved against them. This wasn’t your modular method correction, it marks the commencement of an extinction-level lawsuit for altcoins.”

The “Altcoin Casino” In Crisis

Consorti’s investigation suggests that what helium dubs “the altcoin casino” is present collapsing. He points to failed narratives astir fashionable projects—Ethereum, Solana, and DeFi among them—that person struggled to support capitalist confidence: “Altcoins person survived purely connected narratives. Each cycle, a caller batch of narratives emerged, promising world-changing innovation. None of them lasted.”

He contrasts this with Bitcoin’s halfway worth proposition, which, successful his view, requires nary marketing: “Bitcoin, connected the different hand, doesn’t request a narrative. It doesn’t request selling oregon hype. It exists, and it thrives due to the fact that it was built to bash 1 thing—protect wealthiness successful a satellite of perpetual monetary expansion.”

Consorti besides references Ethereum’s “merge” and its expected deflationary design, pointing retired that since the upgrade, ETH’s full proviso has accrued by 13,516 ETH—undermining the “ultra-sound money” claim.

Adding a argumentation magnitude to the market’s transformation, Consorti highlights a connection from Senator John Boozman during the White House Crypto Working Group’s archetypal property conference: “Some integer assets are commodities, immoderate are securities.”

This, helium suggests, is simply a tacit acknowledgment that Bitcoin stands isolated from different integer assets. In a further development, Consorti cites a remark from White House AI & Crypto Czar David Sacks, who mentioned the radical is evaluating the viability of a Strategic Bitcoin Reserve—a displacement from the erstwhile “National Digital Asset Stockpile” terminology utilized nether a Trump-era enforcement order.

Consorti frames this arsenic a “major development” that signals increasing designation of Bitcoin’s unsocial properties: “This connection displacement is monumental. A fewer years ago, the US authorities was openly hostile toward bitcoin. Today, they’re discussing stockpiling it.”

Amid this upheaval, Consorti suggests that the adjacent melodramatic determination successful Bitcoin could beryllium an explosive abbreviated squeeze. Funding rates connected perpetual futures, helium notes, person gone “deeply negative,” reminiscent of erstwhile Bitcoin traded adjacent $23,000 successful August 2023. This implies a tilt successful leverage toward traders betting against Bitcoin—a presumption that could rapidly unwind: “While past week’s leverage flush wiped retired astir agelong positions, the adjacent large determination could beryllium the opposite—an explosive rally fueled by forced abbreviated liquidations.”

Should the marketplace crook against these short-sellers, the forced buy-backs could thrust the terms higher with antithetic velocity and volume—especially if wide liquidity remains thin. He concluded, “Traders who overextended their leverage to abbreviated bitcoin volition yet person to bargain it backmost erstwhile the terms moves against them, conscionable similar overleveraged longs were wiped retired past week. Bitcoin is coiled. The signifier is being acceptable for a imaginable abbreviated squeeze. The longer this dynamic of abbreviated dominance persists, the greater the hazard of a forced garment liquidation cascade that sends bitcoin’s terms higher with force.”

At property time, BTC.D stood astatine 61.19%.

Bitcoin dominance, 1-week illustration | Source: BTCUSDT connected Tradingview.com

Bitcoin dominance, 1-week illustration | Source: BTCUSDT connected Tradingview.comFeatured representation created with DALL.E, illustration from TradingView.com

10 months ago

10 months ago

English (US)

English (US)