Activity connected bitcoin (BTC) options suggests rising bearish sentiment among investors arsenic the plus ranges betwixt the $29,000 and $30,000 terms levels.

Bitcoin dropped to nearly $24,000 successful the past week amid systemic risks wrong the crypto ecosystem and inflation fears successful the broader market. The plus has slid for 7 consecutive weeks arsenic of Friday.

The asset’s terms movements person been highly correlated to the U.S. markets successful the past fewer months, with mediocre net reports and hawkish comments from the Federal Reserve (Fed) showing an interaction connected bitcoin prices.

Investors are placing bets accordingly.

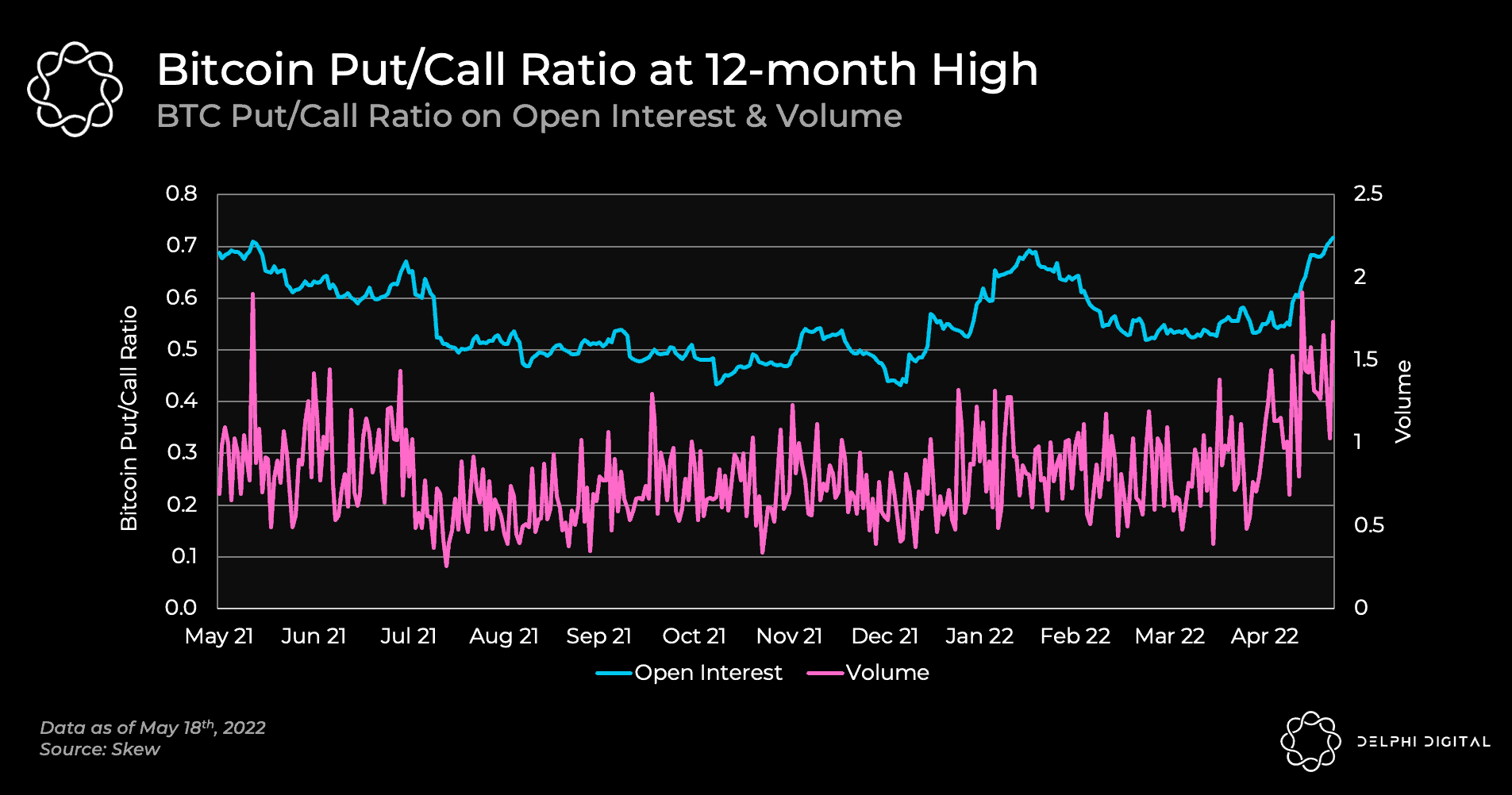

Put/call ratios for bitcoin unfastened involvement deed a 12-month precocious of 0.72 yesterday, probe steadfast Delphi said successful a enactment Friday, adding that the information indicated “bearish sentiment among investors.” Similar ratio levels were reached past May.

“The put/call ratio measures the magnitude of enactment buying comparative to calls,” Delphi analysts explained successful the note. “A precocious put/call ratio indicates that investors are speculating whether bitcoin volition proceed to merchantability off, oregon it could mean investors are hedging their portfolios against a downward move.”

“Last April, the put/call ratio traded arsenic precocious arsenic 0.96 earlier Bitcoin’s terms dropped implicit 50% successful May 2021,” the steadfast added.

Put/Call ratios reached a yearly highest connected Thursday. (Delphi)

Put options are a declaration that gives the enactment purchaser the right, but not the obligation, to merchantability a specified magnitude of an underlying plus astatine a fixed price. Call options, connected the hand, let telephone buyers to acquisition the plus astatine a predetermined terms successful the future.

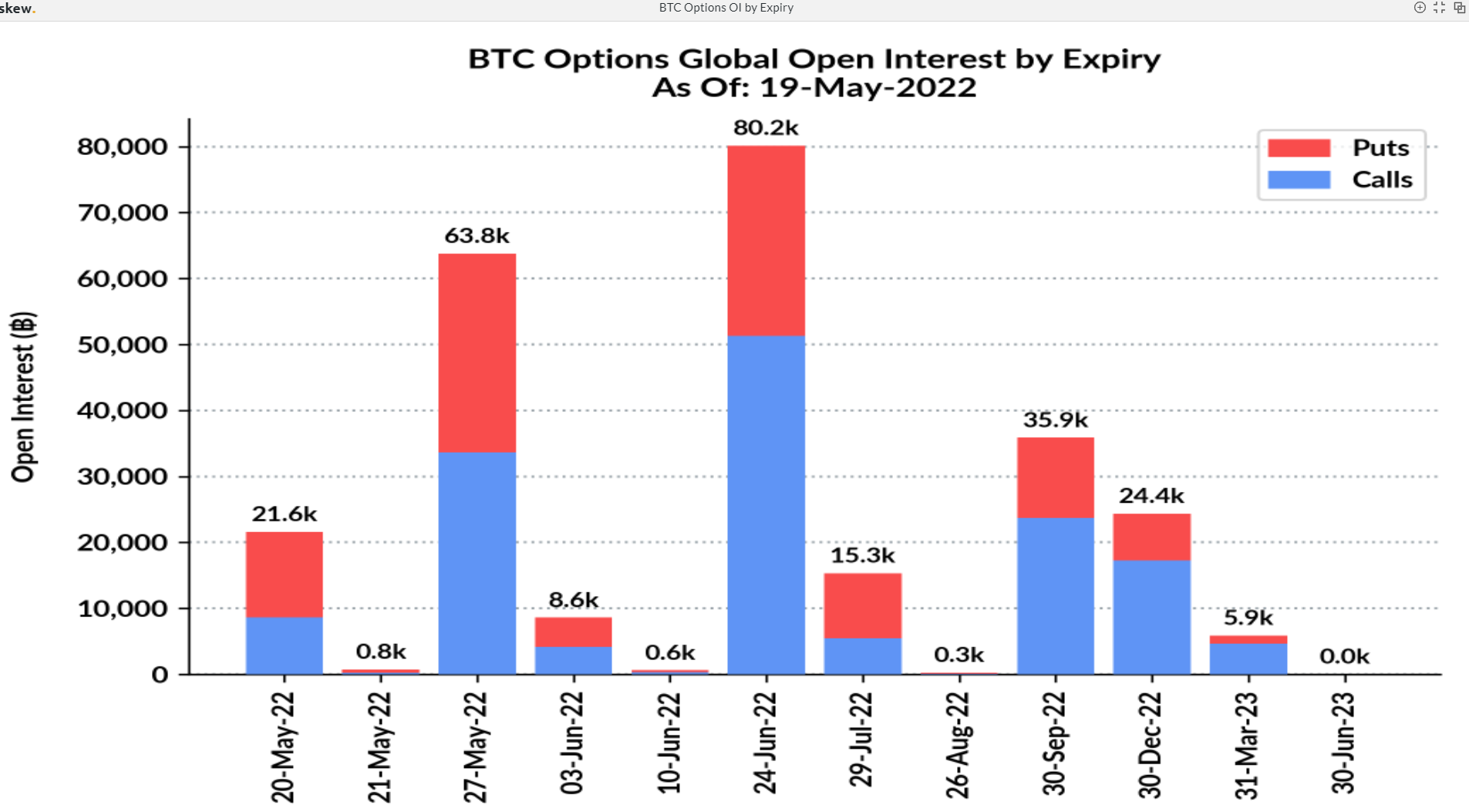

At the clip of writing, determination implicit 63,000 bitcoin worthy of unfastened involvement connected options are acceptable to expire connected May 27.

May 27 would spot the expiry of implicit 63,000 successful bitcoin options. (Skew)

Thursday’s surge successful the put/call ratios surpassed erstwhile 2022 highs of 0.69 successful February, and are up 38% from one-year lows of 0.44 successful December, data from analytics instrumentality skew shows.

Crypto speech Deribit leads options volumes with implicit $7 cardinal successful unfastened involvement arsenic of May 17. Those levels are a betterment from precocious past month, which saw a $2 cardinal plunge successful unfastened involvement implicit 2 days from April 28 to April 30.

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

Please enactment that our

cookies, and

do not merchantability my idiosyncratic information

has been updated.

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a

strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of

Digital Currency Group, which invests in

and blockchain

startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of

stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for Market Wrap, our regular newsletter explaining what happened contiguous successful crypto markets – and why.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)