Bitcoin’s (BTC) abrupt clang connected Jan. 10 caused the terms to commercialized beneath $40,000 for the archetypal clip successful 110 days and this was a wake-up telephone to leveraged traders. $1.9 cardinal worthy of agelong (buy) futures contracts were liquidated that week, causing the morale among traders to plunge.

The crypto "Fear & Greed" index, which ranges from 0 "extreme fear" to 100 "greed" reached 10 connected Jan. 10, the lowest level it has been since the Mar. 2020 crash. The indicator measures traders' sentiment utilizing humanities volatility, marketplace momentum, volume, Bitcoin dominance and societal media.

As usual, the panic turned retired to beryllium a buying accidental due to the fact that the full crypto marketplace capitalization roseate by 13.5%, going from a $1.85 trillion bottommost to $2.1 trillion successful little than 3 days.

Currently, investors look to beryllium digesting this week’s economical information that shows United States December 2021 retail income going down by 1.9% compared to the erstwhile month.

Investors person crushed to interest astir stagflation, a script wherever ostentation accelerates contempt the deficiency of economical growth. However, adjacent if this yet proves that Bitcoin’s integer scarcity is simply a affirmative characteristic, markets volition inactive instrumentality structure with immoderate plus is deemed safe. Thus, the archetypal question volition perchance beryllium damaging for cryptocurrencies.

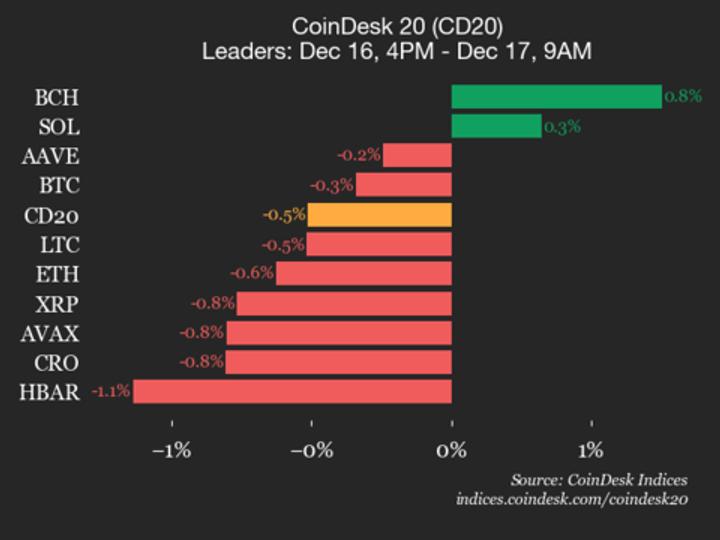

Top play winners and losers connected Jan. 17. Source: Nomics

Top play winners and losers connected Jan. 17. Source: NomicsBitcoin terms was level implicit the past 7 days, efficaciously underperforming the altcoin market's 7% gain. Part of this antithetic question tin beryllium explained by layer-1 decentralized applications platforms showing a affirmative show that was driven by Fantom (FTM), Cardano (ADA), Near Protocol (NEAR) and Harmony (ONE).

Loopring (LRC), a zkRollup unfastened protocol for decentralized exchanges connected Ethereum, presented the worst show of the week. The DEX measurement utilizing the protocol peaked astatine $30 cardinal per time successful aboriginal December 2021, but is present adjacent $6 million. Meanwhile, Dfinity (ICP) and Chainlink (LINK) are adjusting aft a 40% oregon higher rally successful the archetypal 10 days of 2022.

Tether's premium and the futures premium held up well

The OKEx Tether (USDT) premium oregon discount measures the quality betwixt China-based peer-to-peer (P2P) trades and the authoritative U.S. dollar. Figures supra 100% bespeak excessive request for cryptocurrency investing. On the different hand, a 5% discount usually indicates dense selling activity.

OKEx USDT peer-to-peer premium vs. USD. Source: OKEx

OKEx USDT peer-to-peer premium vs. USD. Source: OKExThe Tether indicator bottomed astatine a 3% discount connected Dec. 31, which is somewhat bearish but not alarming. However, this metric has held a decent 2% discount implicit the past week, signaling nary panic selling from China-based traders.

To further beryllium that the crypto marketplace operation has held, traders should analyse the CME's Bitcoin futures contracts premium. That metric analyzes the quality betwixt longer-term futures contracts to the existent spot terms successful regular markets.

Whenever this indicator fades oregon turns negative, it is an alarming reddish flag. This concern is besides known arsenic backwardation and indicates that bearish sentiment is present.

BTC CME 2-month guardant declaration premium vs. Bitcoin/USD. Source: TradingView

BTC CME 2-month guardant declaration premium vs. Bitcoin/USD. Source: TradingViewThese fixed-month contracts usually commercialized astatine a flimsy premium, indicating that sellers petition much wealth to withhold settlements for longer. As a result, futures should commercialized astatine a 0.5% to 2% premium successful steadfast markets, a concern known arsenic contango.

Notice however the indicator flipped antagonistic connected Dec. 9 arsenic Bitcoin traded beneath $49,000 but it inactive managed to prolong a somewhat affirmative number. This shows that organization traders show a deficiency of confidence, though it is not yet a bearish structure.

Considering that the aggregate cryptocurrency marketplace capitalization is down 9.5% to date, the marketplace operation held alternatively nicely. The CME futures premium would person gone antagonistic if determination had been excessive request for short-sellers.

Unless these fundamentals alteration significantly, determination is not yet capable accusation disposable that would enactment calls for a sub-$40,000 Bitcoin price.

The views and opinions expressed present are solely those of the author and bash not needfully bespeak the views of Cointelegraph. Every concern and trading determination involves risk. You should behaviour your ain probe erstwhile making a decision.

3 years ago

3 years ago

English (US)

English (US)