By Omkar Godbole (All times ET unless indicated otherwise)

Bitcoin (BTC) remains successful an uptrend, contempt the overnight pullback. The world's largest cryptocurrency is connected fire, having rallied astir 10% successful 1 week.

While the buzz astir BTC is natural, different sub-sectors, specified arsenic real-world assets (RWAs), are lighting up large clip and merit attention.

On Monday, Ondo Finance, 1 of the apical 5 RWA projects by marketplace value, announced the acquisition of Oasis Pro, a U.S. steadfast with afloat SEC broker-dealer, ATS, and Transfer Agent licenses.

The takeover enables Ondo to connection compliant tokenized securities products successful the U.S., including the issuance, trading, and absorption of tokenized assets specified arsenic equities, firm debt, and structured products. The ONDO token roseate astir 5% to 96 cents, portion continuing to commercialized good beneath its December 2024 highest of $2.14.

In a parallel development, the RWA-focused Layer 2 blockchain, Plume Network, said that it has been registered by the SEC arsenic a transportation agent.

The licence allows Plume to negociate integer securities and shareholder records straight onchain, supporting interoperability with the U.S. Depository Trust & Clearing Corporation (DTCC) colony network. The network's autochthonal token (PLUME) roseate by 25% to implicit 12 cents connected the announcement.

Taken together, these announcements awesome that the digitization and tokenization of accepted assets are gaining regulated traction, bridging the spread betwixt accepted concern and blockchain innovation.

In different news, Cathie Wood’s ARK Venture Fund invested astir $10 cardinal successful Securitize, a BlackRock-backed tokenization firm. The involvement makes it ARK’s eighth-largest holding.

Speaking of the marketplace outlook, the way of slightest absorption for BTC remains connected the higher side, supported by ETF inflows. However, determination is an absorbing constituent to consider: Each of the erstwhile times ETFs pulled successful $1 cardinal oregon much successful a time oregon two, bitcoin's terms enactment successful an interim apical and subsequently corrected lower, according to CoinDesk expert James Straten.

Additionally, the dollar index, which tracks the worth of the greenback against large currencies, remains resilient contempt discussions of faster Fed complaint cuts against the backdrop of the U.S. authorities shutdown.

A imaginable rally successful the greenback could measurement connected cryptocurrencies and gold. The second is accelerated closing connected the $4,000 mark, a rally that has likes of Citadel concerned. Stay alert!

What to Watch

For a much broad database of events this week, spot CoinDesk's "Crypto Week Ahead".

- Crypto

- Nothing scheduled.

- Macro

- Oct. 7, 10:05 a.m.: Fed Vice Chair for Supervision Michelle W. Bowman delivers welcoming remarks astatine the 2025 Community Banking Research Conference, St. Louis, Mo. Watch live.

- Oct. 7, 10:30 a.m.: Conversation with Fed Governor Stephen I. Miran astatine the Managed Funds Association (MFA) Policy Outlook 2025 successful New York. Watch live.

- Earnings (Estimates based connected FactSet data)

- Nothing scheduled.

Token Events

For a much broad database of events this week, spot CoinDesk's "Crypto Week Ahead".

- Governance votes & calls

- Gnosis DAO is voting connected GIP-138 to money NodeSentinel, a validator monitoring instrumentality utilized by 94 operators for 60k+ validators. Voting ends Oct. 7.

- Unlocks

- No large unlocks.

- Token Launches

- Oct. 7: KGeN (KGEN) to beryllium listed connected Binance, MEXC, BingX, KuCoin, and others.

- Oct. 7: Klink Finance (KLINK) to beryllium listed connected Binance, KuCoin, and others.

Conferences

For a much broad database of events this week, spot CoinDesk's "Crypto Week Ahead".

- Day 2 of 2: London Fintech Summit

- Day 1 of 2: FinTech LIVE London 2025

Token Talk

By Oliver Knight

- Plasma's XPL token shrugged disconnected past week's antagonistic sentiment connected Tuesday, rising by much than 11% arsenic it approaches the $1.00 people aft sliding to $0.87 connected Monday.

- The task battled disapproval implicit alleged founding squad token sales, a assertion laminitis Paul Faecks adamantly refuted past week.

- There was besides complaints astir the Plasma squad pursuing links to the less-than-impressive furniture 2 web Blast.

- "Of our squad of 50, 3 spent clip astatine Blur oregon Blast," Faecks wrote connected X. "Our squad members besides travel from Google, Facebook, Square, Temasek, Goldman Sachs, and Nuvei. To accidental our squad is 'ex-Blast' is to accidental it is 'ex' immoderate of these firms. We are arrogant of the squad we've assembled astatine Plasma."

- Now, with the antagonistic sentiment successful Plasma's rear-view mirror, the stablecoin-focused blockchain is opening to find its groove, bolstered by $5.1 cardinal successful full worth locked (TVL), $1.2 cardinal of which is successful the Plasma Savings Vault protocol.

- Attention connected the XPL token is besides rising arsenic regular trading measurement jumped by much than 90% connected Tuesday to $5 billion.

Derivatives Positioning

- BNB is starring maturation successful futures unfastened involvement successful astir large tokens, including bitcoin, a motion of continued superior inflows into the market.

- One concerning sign: OI successful non-serious token FARTCOIN has risen by implicit 12% successful the past 24 hours. That typically represents froth, often observed astatine interim marketplace tops.

- Volatility successful XRP whitethorn increase, arsenic unfastened involvement successful USD- and USDT-denominated perpetuals listed connected large exchanges has surged to 938 cardinal XRP, the highest level since precocious July.

- Despite BTC hovering adjacent to grounds highs, the marketplace doesn't look overheated. Annualized backing rates astir tokens, including memecoins, stay astatine astir 10%.

- On the CME, BTC unfastened involvement has seen a humble bounce to three-week highs, but remains good beneath 211K BTC successful December past year. Meanwhile, ether OI has deed a grounds precocious of 2.2 cardinal ETH.

- On Deribit, traders are chasing BTC bull telephone spreads, with immoderate taking profits successful agelong telephone positions and moving to higher onslaught bets. Overall, calls inactive look inexpensive comparative to puts.

Market Movements

- BTC is down 0.84% from 4 p.m. ET Monday astatine $124,220.89 (24hrs: +0.27%)

- ETH is down 0.17%at $4,683.25 (24hrs: +2.58%)

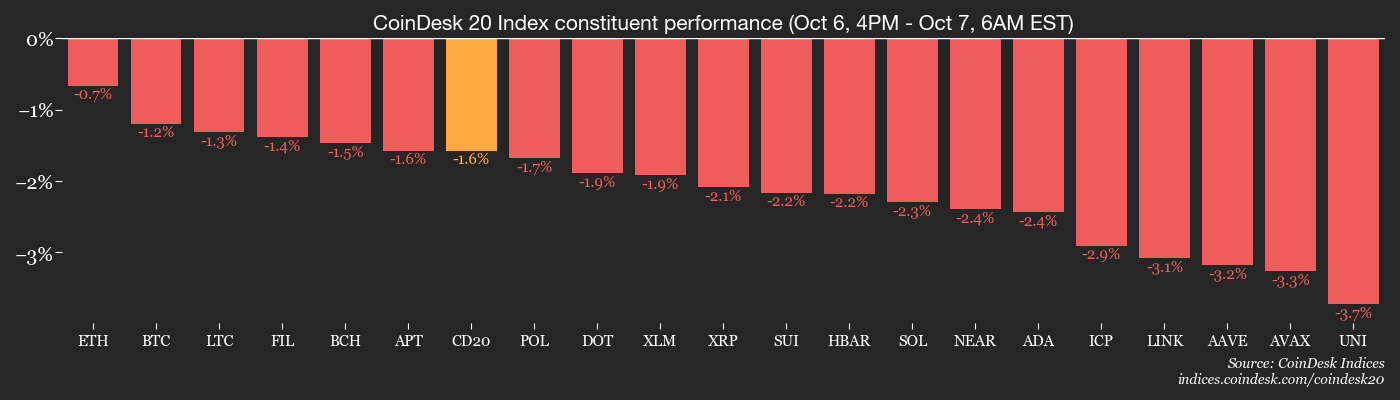

- CoinDesk 20 is down 1.09% astatine 4,360.28 (24hrs: +0.43%)

- Ether CESR Composite Staking Rate is up 3 bps astatine 2.85%

- BTC backing complaint is astatine 0.0076% (8.3132% annualized) connected Binance

- DXY is up 0.34% astatine 98.44

- Gold futures are unchanged astatine $3,978.10

- Silver futures are down 0.57% astatine $48.17

- Nikkei 225 closed unchanged astatine 47,950.88

- Hang Seng closed down 0.67% astatine 26,957.77

- FTSE is unchanged astatine 9,479.43

- Euro Stoxx 50 is unchanged astatine 5,627.61

- DJIA closed connected Monday down 0.14% astatine 46,694.97

- S&P 500 closed up 0.36% astatine 6,740.28

- Nasdaq Composite closed up 0.71% astatine 22,941.67

- S&P/TSX Composite closed up 0.2% astatine 30,531.88

- S&P 40 Latin America closed down 0.86% astatine 2,877.42

- U.S. 10-Year Treasury complaint is up 0.6 bps astatine 4.168%

- E-mini S&P 500 futures are unchanged astatine 6,785.25

- E-mini Nasdaq-100 futures are unchanged astatine 25,186.00

- E-mini Dow Jones Industrial Average Index are down 0.17% astatine 46,878.00

Bitcoin Stats

- BTC Dominance: 58.82% (-0.17%)

- Ether to bitcoin ratio: 0.03768 (0.29%)

- Hashrate (seven-day moving average): 1,022 EH/s

- Hashprice (spot): $52.18

- Total Fees: 4.41 BTC / $550,867

- CME Futures Open Interest: 147,835 BTC

- BTC priced successful gold: 31.2 oz

- BTC vs golden marketplace cap: 8.80%

Technical Analysis

- ETH jumped to $4,740, marking an upside interruption of a counter-trend consolidation identified by trendlines connecting Aug. 24 and Sept. 13 highs and lows connected Sept. 1 and Sept. 25.

- The breakout points to resumption of the broader uptrend, and scope for grounds highs.

- On the downside, Monday's debased of $4,489 is the level to bushed for the bears. That would invalidate the bullish breakout.

Crypto Equities

- Coinbase Global (COIN): closed connected Monday astatine $386.07 (+1.59%), -1.44% astatine $380.51 successful pre-market

- Circle Internet (CRCL): closed astatine $148.51 (+1.87%), +1.96% astatine $151.42

- Galaxy Digital (GLXY): closed astatine $38.84 (+7.41%), +2.70% astatine $2.70%

- Bullish (BLSH): closed astatine $68.79 (+6.14%), -0.36% astatine $68.54

- MARA Holdings (MARA): closed astatine $20.57 (+9.3%), -1.12% astatine $20.34

- Riot Platforms (RIOT): closed astatine $21.56 (+10.91%), -0.42% astatine $21.47

- Core Scientific (CORZ): closed astatine $17.91 (+0.51%), +0.28% astatine $17.96

- CleanSpark (CLSK): closed astatine $17.43 (+9.35%), +0.75% astatine $17.56

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $52.29 (+8.51%), +1.36% astatine $53.00

- Exodus Movement (EXOD): closed astatine $31.7 (+5.46%), -3.03% astatine $30.74

Crypto Treasury Companies

- Strategy (MSTR): closed astatine $359.69 (+2.29%), -1.58% astatine $354.00

- Semler Scientific (SMLR): closed astatine $30.75 (+0.62%)

- SharpLink Gaming (SBET): closed astatine $19.24 (+5.83%), -0.73% astatine $19.10

- Upexi (UPXI): closed astatine $7.7 (+3.49%), -2.6% astatine $7.50

- Lite Strategy (LITS): closed astatine $2.6 (+1.56%), -0.77% astatine $2.58

ETF Flows

Spot BTC ETFs

- Daily nett flow: $1,190 million

- Cumulative nett flows: $61.20 billion

- Total BTC holdings ~ 1.34 million

Spot ETH ETFs

- Daily nett flow: $176.6 million

- Cumulative nett flows: $14.61 billion

- Total ETH holdings ~ 6.75 million

Source: Farside Investors

While You Were Sleeping

- FOMOing into Bitcoin? Check Out These Bullish BTC Plays Favored by Analysts (CoinDesk): Analysts item out-of-the-money and put-financed telephone spreads arsenic cost-efficient ways to enactment bullish connected bitcoin’s rally portion limiting downside vulnerability astatine grounds terms levels.

- U.S. Bitcoin ETFs Log $1B Inflows Again, a Level That’s Marked Local Tops Six Times Before (CoinDesk): U.S. spot bitcoin ETFs saw $1.2 cardinal successful inflows Monday, mostly into IBIT, present managing astir $100 billion. Historically, specified $1 cardinal surges person coincided with short-term bitcoin peaks.

- NYSE Owner Near Deal for $2 Billion Stake successful Polymarket (The Wall Street Journal): Intercontinental Exchange's planned determination would springiness Polymarket large organization backing and assistance the crypto-based betting level rebuild its U.S. foothold aft past regulatory battles.

- Uniswap, Aave Lead DeFi’s Fee Rebound to $600M arsenic Buybacks Take Center Stage (CoinDesk): Uniswap, Aave and Ethena are driving decentralized finance’s gross betterment arsenic protocols displacement toward buybacks and fee-sharing models designed to fortify tokenholder worth and task sustainability.

- MetaMask Confirms $30M Rewards Program, Links to Future Token (CoinDesk): The programme rewards progressive users with $30 cardinal successful LINEA tokens and assorted different perks to thrust adoption of the Linea blockchain and MetaMask’s mUSD stablecoin.

3 months ago

3 months ago

English (US)

English (US)