By Omkar Godbole (All times ET unless indicated otherwise)

It's a pugnacious marketplace to commercialized arsenic bitcoin's (BTC) terms swings sharply. Following a precocious Thursday driblet from $123,000 to $120,000, BTC has recovered to commercialized astir $121,400, with privateness coins specified arsenic Zcash (ZEC) and dash (DASH) rising sharply. The CoinDesk 20 Index has bounced to 4,178 points from the overnight debased of 4,097.

BTC's volatility has picked up, apt successful anticipation of different Fed complaint chopped aboriginal this month.

"Bitcoin volatility is poised for a breakout. Implied volatilities crossed 14, 30, and 90-day expiries person surged to their highest levels successful the past 30 days, pointing to accrued anticipation of large moves ahead," Nick Forster, laminitis of decentralized speech Derive, said.

Forster added that the alleged vol spike comes arsenic markets terms successful a near-certain 25 ground constituent complaint chopped by the Federal Reserve aboriginal this month.

Polymarket bettors price successful a 91% chance that the Fed volition trim rates by 25 ground points astatine the Oct. 28-29 meeting, adjacent arsenic the ongoing authorities shutdown has delayed cardinal information releases. The cardinal slope chopped rates to 25 bps to 4% past month.

In different news, State Street's 2025 Digital Assets Outlook showed that astir 60% of organization investors are readying to boost their integer plus vulnerability successful the coming year, with the mean vulnerability expected to treble wrong 3 years.

Several U.S. Democratic senators reportedly made a antagonistic proposal to the marketplace operation bill, involving a "restricted list" for DeFi protocols deemed excessively risky. Crypto lawyer Jake Chervinsk said it could derail regulatory advancement portion undermining the bipartisan enactment for the Clarity Act seen successful the House successful July.

Meanwhile, Chainlink launched a Chainlink-grade RPC endpoint for the HyperEVM testnet, providing builders successful the @HyperliquidX ecosystem with infrastructure for developers moving connected innovative solutions similar HIP-3, vaults, liquid staking tokens (LSTs), and spot deployment.

In accepted markets, the dollar scale continues to hover astatine two-month highs, arsenic China tightened its grip connected uncommon world exports, ratcheting up trends up of an expected Xi-Trump gathering successful South Korea aboriginal this month. Stay alert!

What to Watch

For a much broad database of events this week, spot CoinDesk's "Crypto Week Ahead".

- Crypto

- Nothing scheduled.

- Macro

- Oct. 10, 8 a.m.: Brazil Aug. PPI YoY (Prev. 1.36%), MoM (Prev. -0.3%).

- Oct. 10, 8:30 a.m.: Canada Sept. Unemployment Rate Est. 7.2%.

- Oct. 10, 10 a.m.: Michigan Consumer Sentiment Oct. (Preliminary) Est. 54.2.

- Earnings (Estimates based connected FactSet data)

- Nothing scheduled.

Token Events

For a much broad database of events this week, spot CoinDesk's "Crypto Week Ahead".

- Governance votes & calls

- Decentraland DAO is voting to regenerate the DAO Committee with a 3-of-5 multisig of ecosystem representatives, shifting execution-only duties portion the assembly retains oversight. Voting ends Oct. 10.

- Unlocks

- Oct. 10: Linea (LINEA) to unlock 6.57% of its circulating proviso worthy $26.73 million.

- Oct. 11: Aptos (APT) to unlock 2.15% of its circulating proviso worthy $59.98 million.

- Oct. 12: Aethir (ATH) to unlock 16.08% of its circulating proviso worthy $67.7 million.

- Token Launches

- No large launches.

Conferences

For a much broad database of events this week, spot CoinDesk's "Crypto Week Ahead".

- Day 2 of 2: North American Blockchain Summit (Dallas)

Token Talk

By Oliver Knight

- The caller Chinese memecoin frenzy which sent tokens similar GIGGLE, 四, and 哈基米 connected PancakeSwap V2 soaring, has abruptly fizzled out.

- Within 24 hours, galore of these assets mislaid much than 95% of their value, wiping retired speculative gains built connected hype and societal momentum.

- The clang coincided with a broader memecoin marketplace downturn that Binance laminitis Changpeng “CZ” Zhao described arsenic a “blood bath,” fueled by FUD and mendacious rumors astir token listings.

- The plunge comes aft Binance rolled retired its "Meme Rush" level that was expected to supply a structured way for tokens earlier being tradable connected assorted decentralized and centralized exchanges.

- However, overmuch similar however Solana memecoins faded successful February pursuing the motorboat of TRUMP and MELANIA, BNB Chain memes look to beryllium pursuing the aforesaid way to demise.

- Pancake Swap trading measurement has remained inflated astatine $18 bilion implicit the past 24 hours, with a fistful of newly-launched tokens catching a bid, though it's worthy noting that liquidity remains comparatively low; with w

Derivatives Positioning

- Data from Coinglass shows that galore BTC perpetual abbreviated positions look the hazard of liquidation supra $121,600. So, a sustained determination supra the said level could trigger a abbreviated squeeze, starring to a speedy rally toward grounds highs.

- The marketplace is undergoing a leverage reset, with volatility flushing retired excess positioning connected some sides, Glassnode said. Still, the wide positioning successful the planetary BTC futures marketplace remains elevated, with unfastened involvement conscionable shy of the grounds 755K BTC.

- BNB, XRP, ADA, and TRX person seen a driblet successful futures unfastened involvement (OI) successful the past 24 hours, indicating superior outflows. BTC's OI has risen by 1%, with ETH up conscionable 0.4%.

- The XMR marketplace is looking a spot overheated, with annualized backing rates nearing 60%, a motion of frenzied request for bullish bets. Funding rates for different large tokens, including BTC and ETH, overgarment a bullish picture, but thing retired of the ordinary.

- On decentralized speech Derive, unfastened involvement successful the Oct. 31 expiry options is concentrated successful calls astatine strikes $128K and $145K, reflecting a bullish bias. ETH options enactment is arsenic bullish, with OI concentrated successful $5K and $6K calls.

- On Deribit, however, the call-put skew for BTC and ETH remains mildly antagonistic crossed timeframes, reflecting a bias for protective puts. Block flows connected Paradigm featured ETH puts and straddles.

Market Movements

- BTC is up 0.17% from 4 p.m. ET Thursday astatine $121,389.27 (24hrs: -0.59%)

- ETH is down 0.37% astatine $4,323.41 (24hrs: -0.54%)

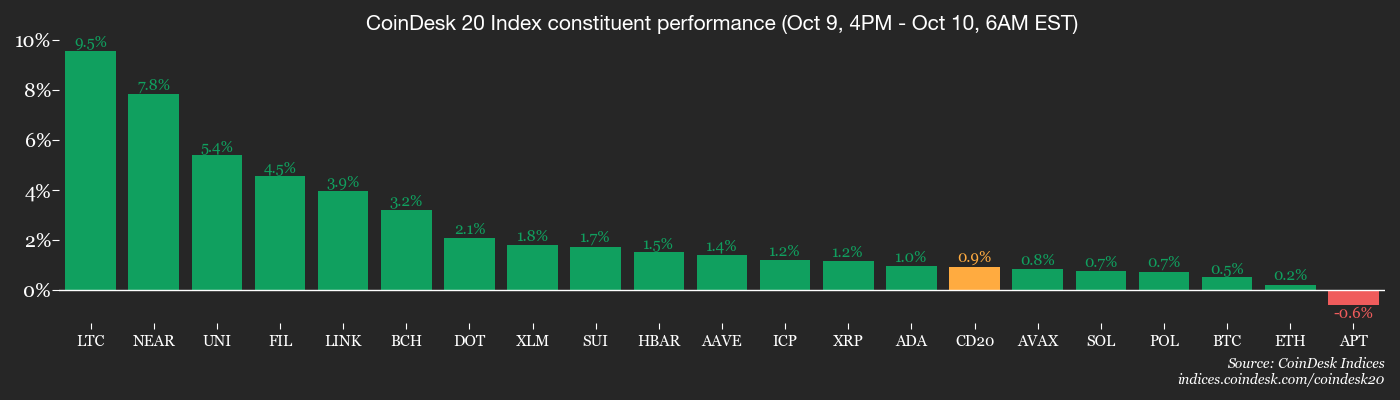

- CoinDesk 20 is up 0.4% astatine 4,162.46 (24hrs: +0.02%)

- Ether CESR Composite Staking Rate is up 1 bp astatine 2.86%

- BTC backing complaint is astatine 0.0045% (4.8968% annualized) connected Binance

- DXY is down 0.24% astatine 99.29

- Gold futures are up 1.00% astatine $4,012.20

- Silver futures are up 2.45% astatine $48.31

- Nikkei 225 closed down 1.01% astatine 48,088.80

- Hang Seng closed down 1.73% astatine 26,290.32

- FTSE is down 0.14% astatine 9,495.88

- Euro Stoxx 50 is unchanged astatine 5,627.22

- DJIA closed connected Thursday down 0.52% astatine 46,358.42

- S&P 500 closed down 0.28% astatine 6,735.11

- Nasdaq Composite closed unchanged astatine 23,024.62

- S&P/TSX Composite closed down 0.76% astatine 30,269.98

- S&P 40 Latin America closed down 0.51% astatine 2,858.54

- U.S. 10-Year Treasury complaint is down 3.5 bps astatine 4.113%

- E-mini S&P 500 futures are unchanged astatine 6,785.00

- E-mini Nasdaq-100 futures are up 0.1% astatine 25,313.50

- E-mini Dow Jones Industrial Average Index are up 0.11% astatine 46,643.00

Bitcoin Stats

- BTC Dominance: 59.36% (unchanged)

- Ether to bitcoin ratio: 0.03563 (-0.75%)

- Hashrate (seven-day moving average): 997 EH/s

- Hashprice (spot): $51.21

- Total Fees: 3.79 BTC / $462,241

- CME Futures Open Interest: 147,025 BTC

- BTC priced successful gold: 30.4 oz

- BTC vs golden marketplace cap: 8.59%

Technical Analysis

- BTC's dominance rate, oregon its stock successful the full marketplace cap, is looking to found a caller uptrend, having risen from 57% to implicit 59% successful 2 weeks.

- The summation indicates that superior is again flowing into the marketplace leader.

- In different words, the altcoin play is inactive not here.

Crypto Equities

- Coinbase Global (COIN): closed connected Thursday astatine $387 (-0.07%), -0.22% astatine $386.15

- Circle Internet (CRCL): closed astatine $150.48 (+0.01%), -0.19% astatine $150.19

- Galaxy Digital (GLXY): closed astatine $42.22 (+2.01%), +2.08% astatine $43.10

- Bullish (BLSH): closed astatine $66.71 (-1.04%), +0.13% astatine $66.80

- MARA Holdings (MARA): closed astatine $20.2 (0%), +1.53% astatine $20.51

- Riot Platforms (RIOT): closed astatine $22.28 (+1.32%), +0.4% astatine $22.37

- Core Scientific (CORZ): closed astatine $18.04 (+2.91%), +1.16% astatine $18.25

- CleanSpark (CLSK): closed astatine $20.09 (+5.85%), +4.03% astatine $20.90

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $57.57 (+3.95%), +3.42% astatine $59.54

- Exodus Movement (EXOD): closed astatine $29.67 (-1.33%), +1.08% astatine $29.99

Crypto Treasury Companies

- Strategy (MSTR): closed astatine $320.29 (-3.18%), +0.53% astatine $322.00

- Semler Scientific (SMLR): closed astatine $28.32 (+0.43%)

- SharpLink Gaming (SBET): closed astatine $16.95 (-3.53%), -1.47% astatine $16.70

- Upexi (UPXI): closed astatine $6.85 (-4.46%), -0.44% astatine $6.82

- Lite Strategy (LITS): closed astatine $2.54 (+1.6%), +11.42% astatine $2.83

ETF Flows

Spot BTC ETFs

- Daily nett flow: $197.8 million

- Cumulative nett flows: $62.73 billion

- Total BTC holdings ~ 1.36 million

Spot ETH ETFs

- Daily nett flow: -$8.7 million

- Cumulative nett flows: $15.1 billion

- Total ETH holdings ~ 6.89 million

Source: Farside Investors

While You Were Sleeping

- ‘Bitcoin Is Not an Asset Class’: UK’s Biggest Investment Platform Has a Stark Warning for Investors (CNBC): Hargreaves Lansdown warned bitcoin’s volatility, deficiency of intrinsic worth and unpredictable show marque it unsuitable for portfolios, adjacent arsenic the U.K.'s fiscal regulator gives retail investors entree to crypto ETNs.

- Bitcoin Implied Volatility Reaches 2.5-Month High arsenic Seasonal Strength Kicks In (CoinDesk): Bitcoin implied volatility index, which represents the annualized expected terms turbulence implicit 4 weeks, surged supra 42, mirroring akin seasonal spikes seen successful October 2023 and 2024.

- Monero Releases Privacy Boost Against Sneaky Network Nodes (CoinDesk): The "Fluorine Fermi" upgrade changes however nodes take peers, preventing aggregate connections wrong the aforesaid IP subnet and making it harder for malicious clusters to hint transaction activity.

- Hyperliquid Introduces 'Based Streams,' a DEX-Powered Live Streaming Platform (CoinDesk): The livestreaming diagnostic lets creators broadcast trades, judge token donations and reward viewers via the decentralized perpetual swaps exchange's Hypercore protocol.

- Ray Dalio Warns of Soaring Debt and 'Civil War' Brewing successful US (Bloomberg): The Bridgewater Associates laminitis urged Congress to brace taxation hikes with spending cuts to curb ballooning nationalist debt, portion besides citing wealthiness inequality and geopolitical tensions arsenic large concerns.

3 months ago

3 months ago

English (US)

English (US)