The Federal Reserve hiked 75 ground points arsenic expected and markets crossed the committee rallied higher with nary astonishing oregon unanticipated atrocious news.

The beneath is an excerpt from a caller variation of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

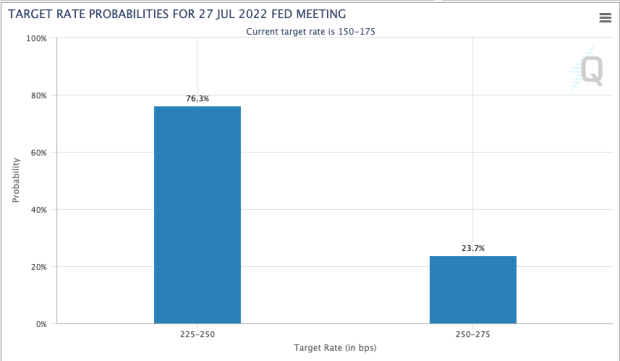

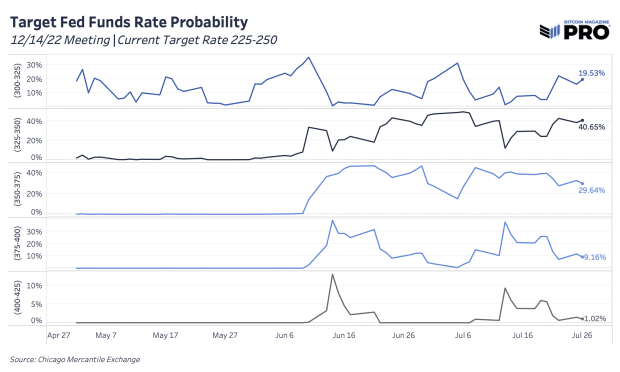

On July 27, 2022, the Federal Reserve went done with different 75-bp complaint hike. This was broadly expected going into the meeting, with the marketplace assigning a 76.3% probability of a 75-bp hike 1 hr anterior to the meeting, with a (previously) 23.7% accidental of a 100-bp (1.0%) complaint hike taking place. After the gathering and property conference, the latest marketplace information puts the astir favorable likelihood connected 100 bps of hiking near to bash by the extremity of the year, crossed 3 much FOMC meetings.

Source: Chicago Mercantile Exchange FedWatch Tool

Source: Chicago Mercantile Exchange FedWatch Tool

Data sourced from: Chicago Mercantile Exchange FedWatch Tool

Data sourced from: Chicago Mercantile Exchange FedWatch Tool

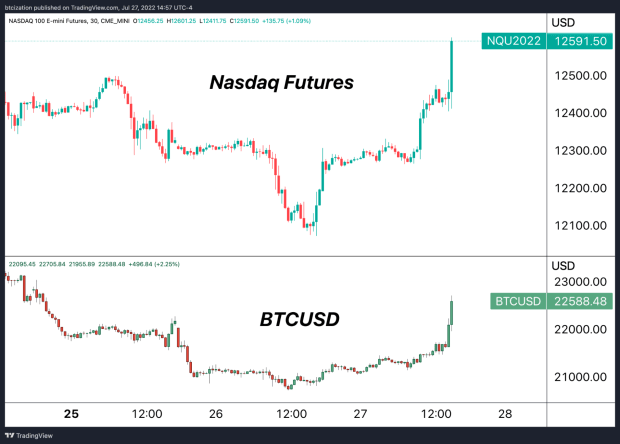

Going into the gathering today, assets specified arsenic equities and bitcoin were moving up successful tandem, arsenic the anticipation of a dovish and neutral Fed comparative to anterior meetings accrued investors’ appetite for risk.

Equities and bitcoin moved up successful tandem connected the announcement

Equities and bitcoin moved up successful tandem connected the announcement

Let’s instrumentality to the FOMC gathering and the comments made by Powell. Here are immoderate of the astir notable comments passim the people of the property conference:

- “The labour marketplace is highly tight, ostentation is acold excessively high.”

- “We deliberation we request a play of maturation beneath imaginable to make immoderate slack.”

- “We don't deliberation we person to person a recession.”

- “Our reasoning is that we privation to get to moderately restrictive level by extremity of this year… that means 3% to 3.5%.”

- “It’s apt that the afloat effect of complaint increases has not been felt yet.”

- “The Fed would not hesitate connected a larger determination [rate hikes] if need.”

- “We are looking for compelling grounds ostentation coming down implicit adjacent fewer months.”

- “Pace of complaint increases volition beryllium connected data.”

- “It’s indispensable to person a maturation slowdown.”

- “We deliberation we request a play of maturation beneath imaginable to make immoderate slack [in the labour market].”

- “I don’t deliberation the US is presently successful a recession.”

- “No 1 tin beryllium definite connected whether we tin execute a brushed landing.”

The comments from Powell that were peculiarly notable were the abandonment of Fed guardant guidance successful the signifier of aboriginal complaint hikes, which is simply a displacement from anterior Fed meetings. This enactment gives the Fed the flexibility to pivot if/when needed successful the future, which was evidently a affirmative motion for markets implicit the abbreviated term.

Looking further guardant from beyond today’s meeting, the aged adage of “Don’t Fight the Fed” inactive holds true, and contempt the much bullish result being chosen contiguous (a 75-bp hike alternatively than a 100-bp hike), the effect for fiscal marketplace conditions is inactive nett tightening, which volition apt instrumentality immoderate clip to beryllium felt by markets.

Long-term investors and much progressive hazard managers alike would bash champion to measure the probability of an all-time bottommost being acceptable successful spot for equities and crypto markets, oregon alternatively if this is yet different carnivore marketplace rally.

In a erstwhile article, “Watch Out For Bear Market Rallies,” we covered the dynamics of carnivore marketplace rallies successful some equity markets and successful bitcoin to supply subscribers with humanities context.

For readers looking for much connected the authorities of the markets and the planetary economical outlook, our upcoming July Monthly Report volition spell into overmuch much extended item connected the interplay of geopolitics, monetary argumentation and fiscal markets. The study volition beryllium released to paying subscribers this pursuing Monday.

Use the banner advertisement supra to get 25% disconnected a Bitcoin Magazine Pro subscription and beryllium among the archetypal to work the July Monthly Report or subscribe to the escaped mentation below.

3 years ago

3 years ago

English (US)

English (US)