Since aboriginal 2023, Bitcoin (BTC) has chalked retired a classical stairstep bull run, characterized by incremental terms increases followed by periods of consolidation that acceptable the signifier for the adjacent determination higher.

The cryptocurrency's ongoing terms consolidation betwixt $90,000 and $100,000 is the 3rd of the broader bull tally from $20,000. The statement is that it volition extremity successful a bull breakout, conscionable arsenic those successful mid-2024 and 2023 did.

However, the pursuing 3 developments, suggest otherwise.

Tightening USD liquidity

If there's 1 happening that immoderate plus class, not conscionable crypto, typically dislikes, it's the tightening of fiat liquidity, peculiarly the planetary reserve currency, the U.S. Dollar (USD). To the dismay of BTC bulls, the dollar liquidity is tightening owed to respective factors, arsenic Arthur Hayes, main concern serviceman astatine Maelstrom, noted connected X.

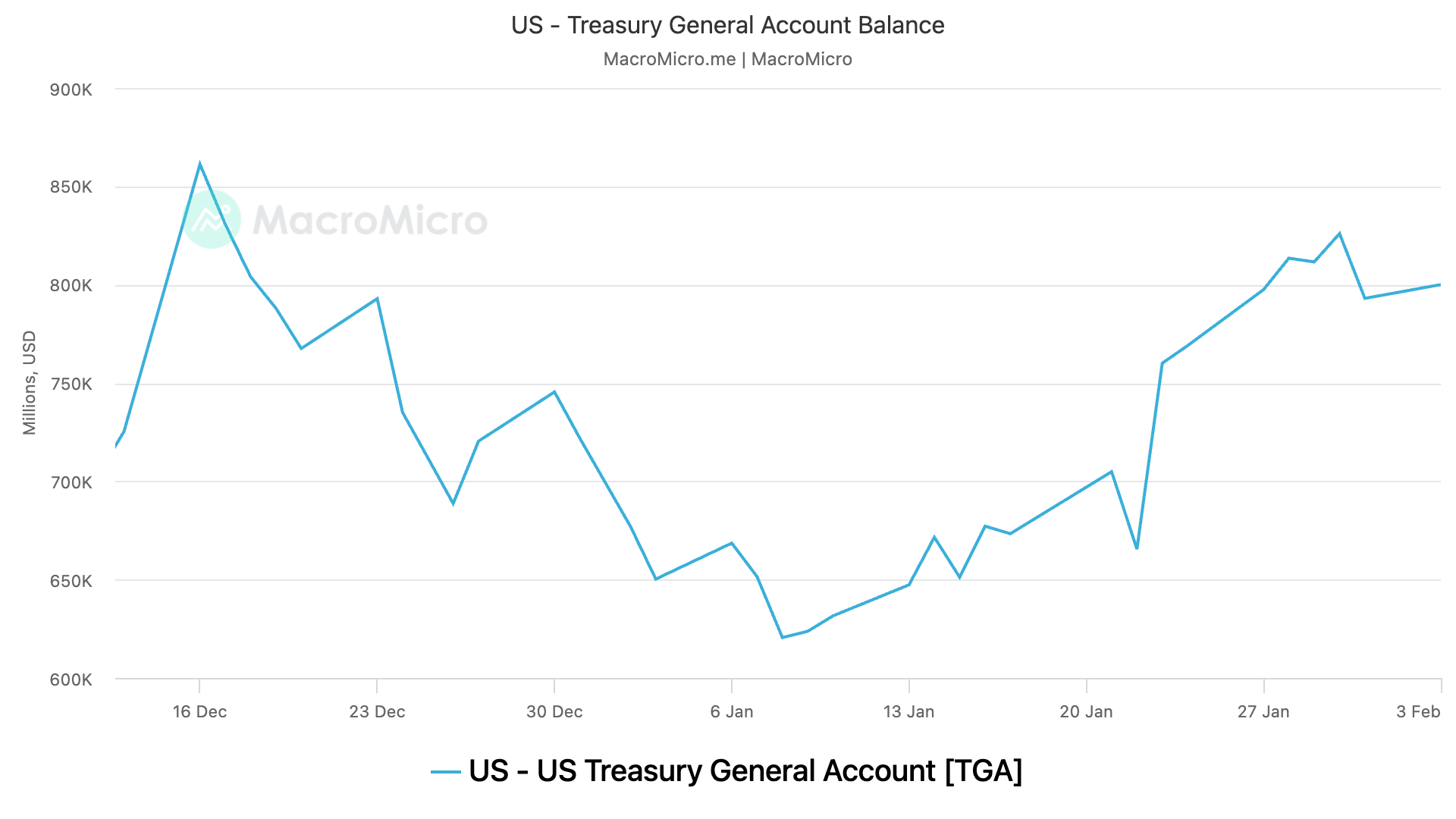

Notably, the USD currency equilibrium held successful the Treasury General Account (TGA), the U.S. government's checking relationship astatine the Fed, has accrued from $623 cardinal to $800 cardinal successful 4 weeks, according to information root MacroMicro.

After the U.S. deed its self-imposed indebtedness bounds of $36 trillion past month, markets hoped that the Treasury would tally down the TGA equilibrium arsenic portion of bonzer measures to support the authorities functioning, inadvertently enhancing liquidity successful the system and markets. That's what the Treasury did during the erstwhile indebtedness ceiling contented of aboriginal 2023, spurring accrued risk-taking successful equity and crypto markets.

"We're looking astatine a script wherever cardinal liquidity sources are drying up oregon being much tightly controlled. This could pb to a slowdown successful economical activity, higher borrowing costs, and perchance a much challenging situation for hazard assets, including crypto," Anddy Lian, thought person and intergovernmental blockchain expert, said connected X.

Trump medication to 'evaluate' strategical BTC reserve

Since President Donald Trump took bureau connected Jan. 20, helium has been actively pursuing done connected assorted run promises related to tariffs, amerciable migrants and planetary affairs.

But, determination is 1 notable exception: the constitution of a strategical BTC reserve. It was a important catalyst down BTC's surge from $70,000 to implicit $100,000.

The Trump medication seems to beryllium much cautious, opting to "evaluate" the feasibility of creating specified a reserve. It's a disappointing displacement for crypto investors anticipating swift enactment connected this initiative, akin to Trump's speedy responses connected different issues.

"Wait, Trump said helium would bash a $BTC Reserve, not committedness to 'evaluate it.' Evaluate/Study is what Washington does erstwhile they don't privation to bash something," Jim Bianco, president and macro strategist astatine Bianco Research, LLC, said.

BTC fell from implicit $100,000 to $96,000 during the overnight commercialized aft Trump's crypto Czar told CNBC that a apical docket point for his caller task unit is evaluating the feasibility of a bitcoin reserve.

Reappearance of a 2021 topping pattern

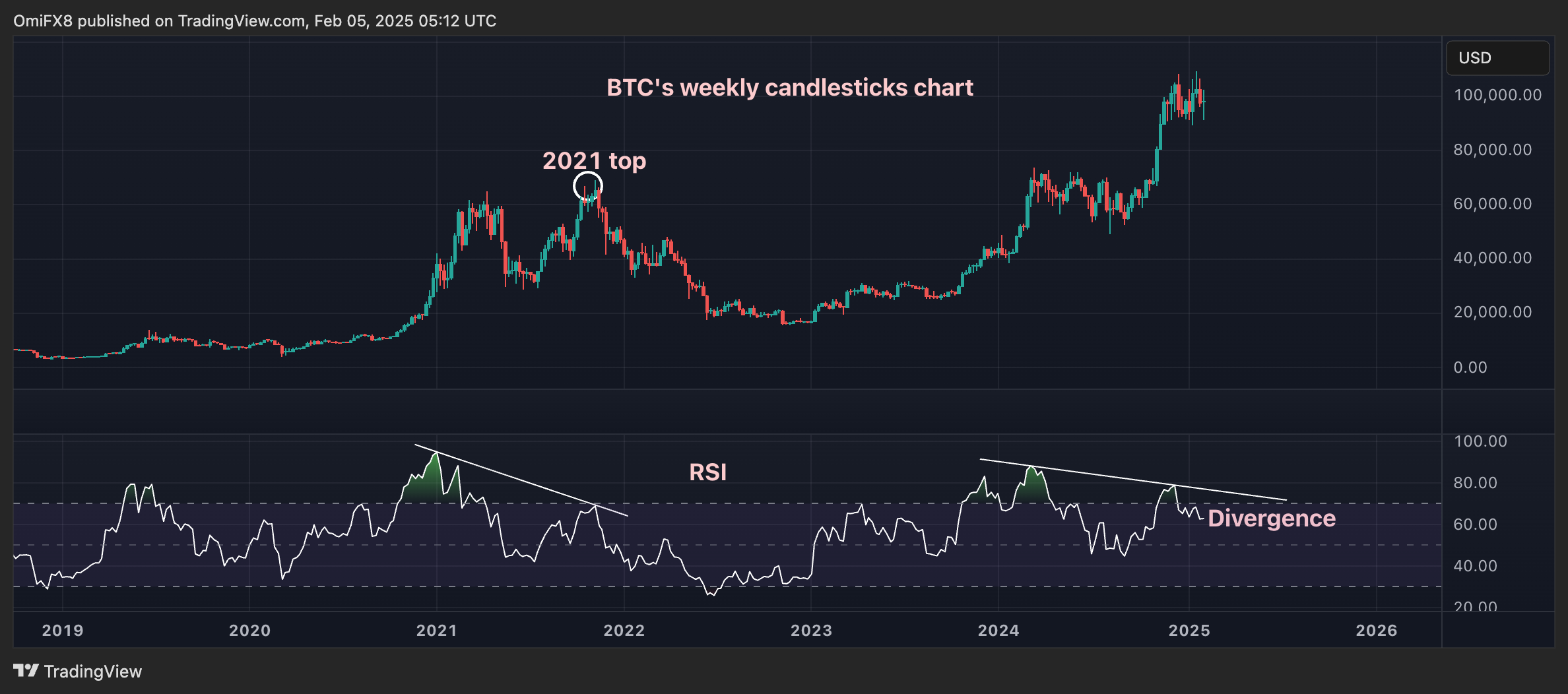

Finally, those looking astatine method charts to gauge the adjacent determination mightiness privation to propulsion up the 14-week comparative spot scale (RSI) connected their screens.

That's due to the fact that the oscillator has precocious diverged bearishly successful a determination that marked the 2021 top. A bearish RSI divergence contradicts the higher precocious successful prices, signaling a slowdown successful the bullish momentum.

The RSI has produced a little precocious comparative to its December high, diverging bearishly from the continued terms uptrend. That's akin to the 2021 pattern.

The antagonistic setup would beryllium invalidated should the RSI transverse supra the falling trendline, representing the divergence, indicating a renewed bullish momentum.

7 months ago

7 months ago

English (US)

English (US)