There is simply a clam successful the bitcoin (BTC) market, the likes of which we past saw earlier the opening of the precocious 2020 bull run.

The starring cryptocurrency's 30-day volatility, which measures the modular deviation of regular returns implicit 4 weeks, has declined to 2.20%, the lowest since November 5, 2020, according to information provided by Arcane Research.

The gauge peaked supra 6% successful June 2021 and has been connected a declining inclination ever since, barring the impermanent spike to 4.5% astir the March Federal Reserve (Fed) meeting.

The dependable diminution could beryllium attributed to respective factors, including ascendant crypto exchanges Binance and FTX's determination to cut down leverage, declining involvement successful crypto-margined futures, and, much recently, reduced speculative interest, arsenic evidenced by the diminution successful trading volumes.

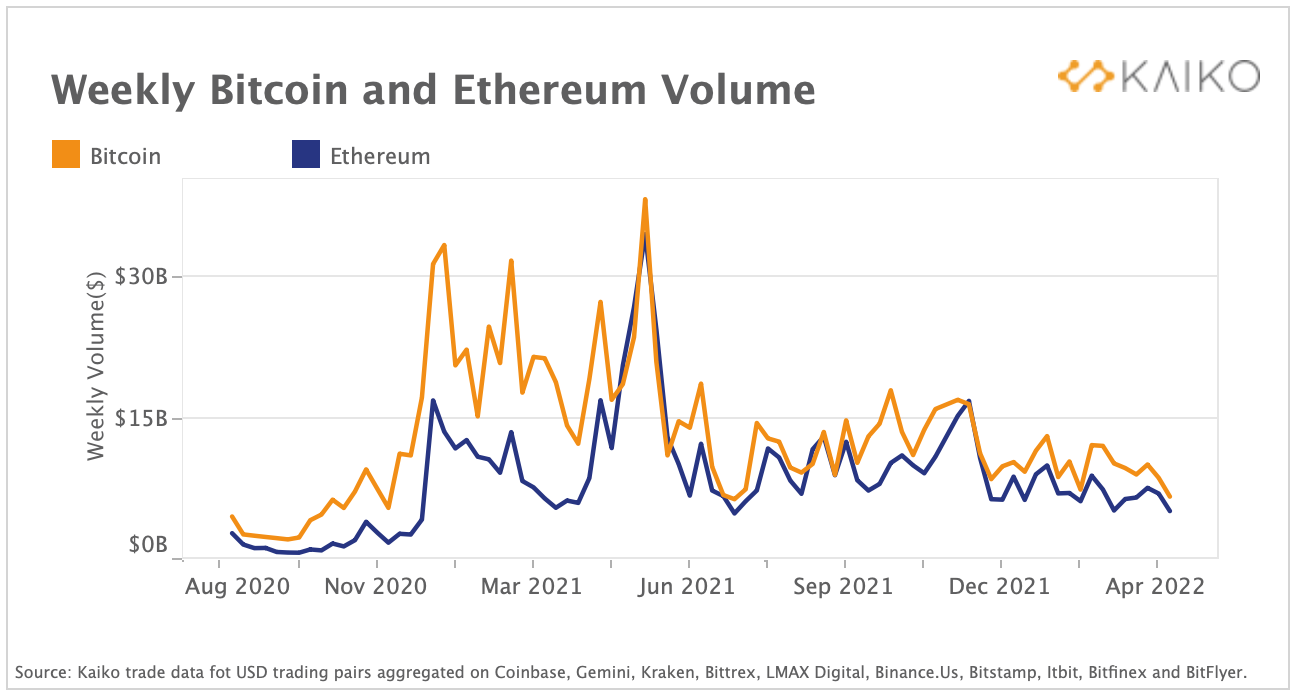

Data tracked by Kaiko Research shows that bitcoin and ether's (ETH) play trading volumes person slipped to the lowest levels since the summertime of 2021.

Weekly bitcoin and ether volumes (Kaiko Research)

"Both bitcoin and ethereum commercialized volumes person declined importantly since December, arsenic investors de-risked their portfolios amid increasing macro uncertainty," Kaiko Research's play newsletter published connected Monday said. "The inclination accelerated successful aboriginal April with BTC and ETH play commercialized measurement down by implicit 30% to $7B and $5B respectively, comparative to the extremity of March."

While bitcoin is down 10% connected a year-to-date basis, ether has mislaid astir 15%, per charting level TradingView.

There are method factors astatine play, too, helping bring tranquility to the bitcoin market.

According to Two Prime, marketplace makers, who bargain the out-of-the-money telephone and enactment options auctioned by decentralized enactment vaults (DOV) each Friday, hedge their bullish/bearish vulnerability done other positions successful the futures and perpetual futures market, successful the process creating a bound for prices wrong each expiration cycle.

Market makers are individuals oregon entities with a contractual work to support a steadfast level of liquidity connected an exchange. They marque definite determination is capable extent successful the bid publication by offering to bargain oregon merchantability an asset, futures declaration oregon a telephone oregon enactment enactment astatine immoderate fixed constituent successful time. These entities ever instrumentality the other broadside of investors' trades and support a market-neutral publication by buying and selling the underlying plus arsenic the terms swings.

The DOVs person grown exponentially since the 2nd fractional of 2021 and present adhd implicit $100 cardinal of notional vulnerability to the marketplace each week. In different words, the sensitivity of marketplace makers' books to directional moves is increasing. As such, their hedging enactment could beryllium helping apprehension chaotic terms swings successful the market.

"Holding larger unfastened involvement requires larger hedging activity. This acts arsenic a earthy terms level oregon ceiling for spot prices astatine abbreviated strikes [levels astatine which DOVs sold options]," Two Prime said successful a DOV explainer enactment published connected April 8. "By holding these options to expiration, arsenic DOVs do, the gamma of the underlying enactment increases, frankincense requiring much delta hedging from market-makers, further intensifying this terms level and ceiling dynamic."

A prolonged play of debased terms turbulence often ends with convulsive terms enactment connected either side.

For instance, the erstwhile debased volatility authorities lasted for implicit 2 months, from precocious September to aboriginal November, with the cryptocurrency trading chiefly successful the scope of $10,000 to $13,000. The breakout happened connected Nov. 5, with prices rallying good supra the June 2019 precocious of $13,800.

Whether past volition repetition itself is anybody's guess. That said, determination are signs a large determination could hap soon.

"The 7-day volatility has climbed supra the 30-day volatility, which could suggest that the marketplace is waking up," Arcane Research's play newsletter published connected Tuesday said.

Bitcoin was past seen trading adjacent $41,500, representing a 2% summation connected a 24-hour basis, according to CoinDesk data.

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for Crypto Long & Short, our play newsletter featuring insights, quality and investigation for the nonrecreational investor.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)