The marketplace worth to realized worth (MVRV) ratio is 1 of the astir important indicators for analyzing the Bitcoin market. It measures the ratio betwixt the marketplace headdress (the existent terms of Bitcoin multiplied by the full fig of coins successful circulation) and the realized headdress (the sum of the worth of each coins successful circulation astatine the terms they were past moved).

While determination are galore uses for the MVRV ratio depending connected which metric they’re analyzed with, it fundamentally provides penetration into whether Bitcoin is undervalued oregon overvalued astatine a fixed time.

A higher MVRV ratio suggests that Bitcoin’s terms is perchance overvalued, arsenic it indicates the realized worth is higher than the marketplace value, which means investors are holding onto unrealized profits. An summation successful unrealized profits leads to accrued merchantability unit arsenic a important information of those investors are bound to capitalize connected their gains.

Conversely, a little MVRV ratio tin bespeak an undervalued marketplace with minimal merchantability pressure, arsenic investors aren’t holding unrealized gains. This ratio becomes adjacent much important erstwhile applied to semipermanent holders (LTHs) and short-term holders (STHs), arsenic the quality betwixt their MVRV ratios tin connection invaluable insights into marketplace sentiment and aboriginal terms movements.

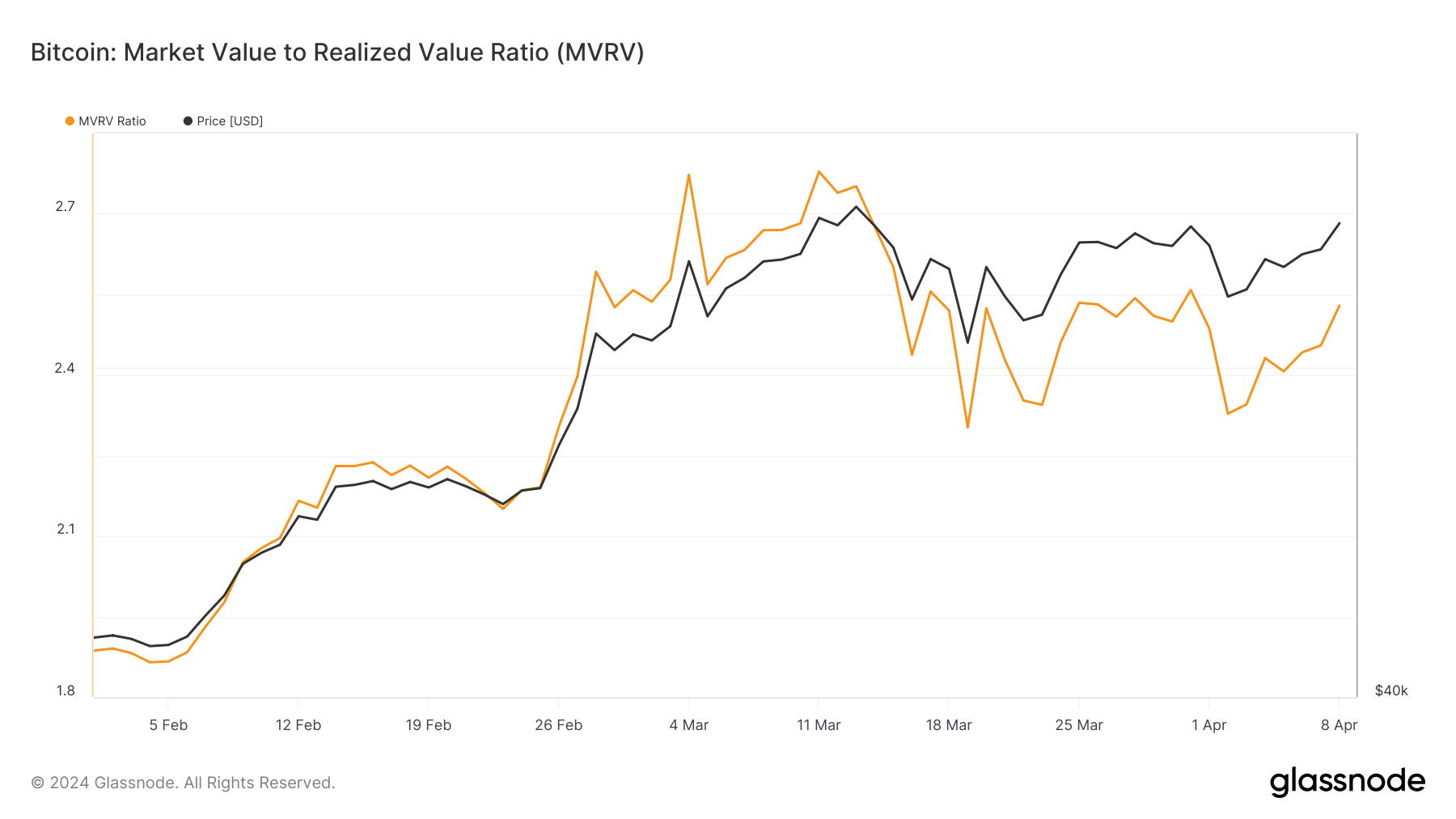

CryptoSlate’s investigation of Glassnode information showed that changes successful the MVRV ratio mirrored Bitcoin’s terms volatility successful the past six weeks. The ratio fluctuated alongside Bitcoin’s price, which peaked astatine $73,104 connected Mar. 18 and was followed by volatility that saw it set down to $61,000 earlier uncovering footing astatine supra $71,600 connected April 8. The MVRV ratio peaked astatine 2.751 connected March 13 arsenic well.

Graph showing Bitcoin’s MVRV ratio and terms from Feb. 1 to Apr. 8, 2024 (Source: Glassnode)

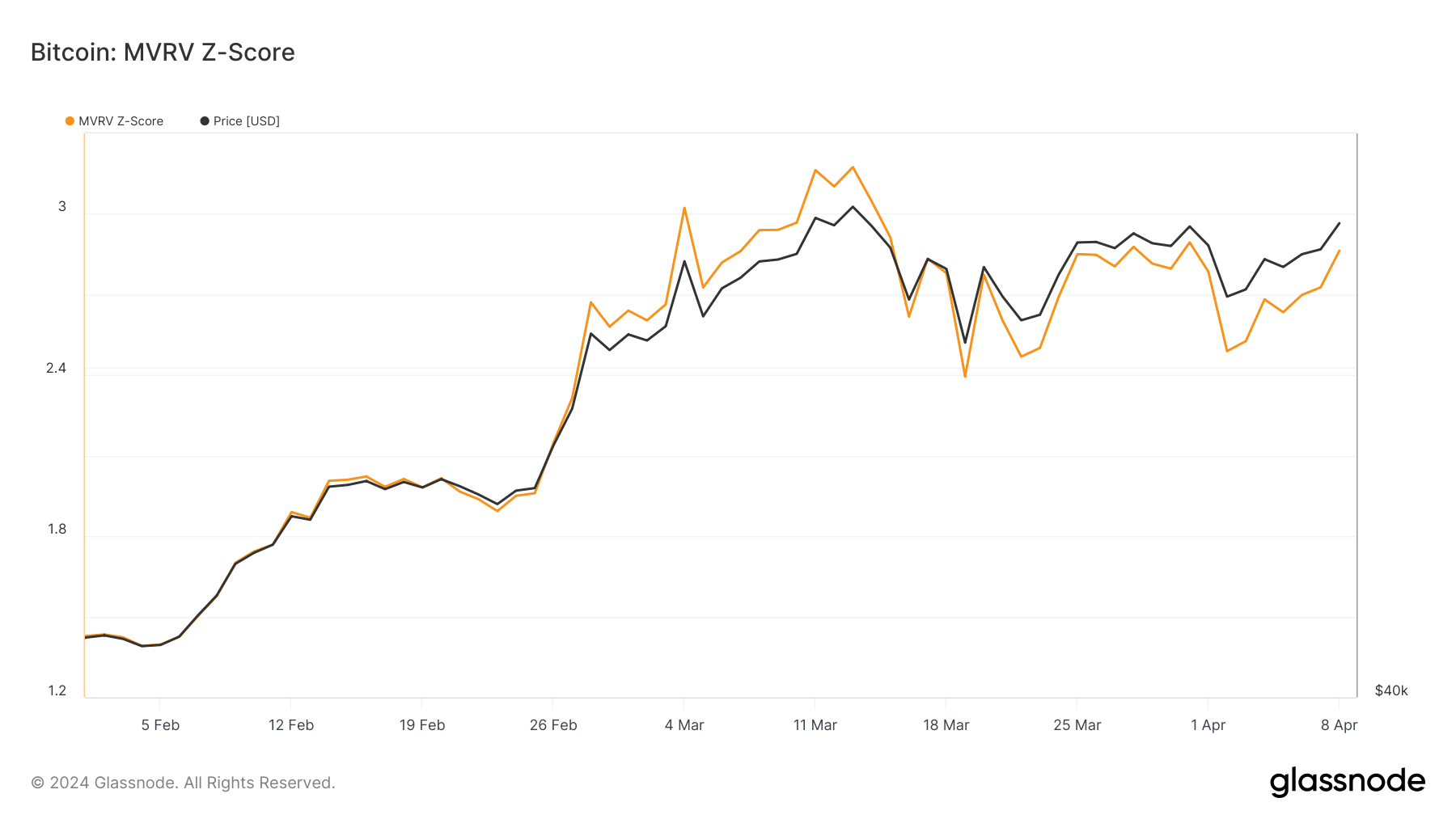

Graph showing Bitcoin’s MVRV ratio and terms from Feb. 1 to Apr. 8, 2024 (Source: Glassnode)The MVRV ratio Z-score, which standardizes the MVRV ratio to place extremes of marketplace worth compared to realized value, provides a clearer representation of the narration betwixt Bitcoin’s marketplace headdress and realized cap. With values peaking alongside some the MVRV ratio and Bitcoin’s price, it reinforces the conception of imaginable overvaluation astatine these points.

As some the wide ratio and the Z-score decreased notably since their highest connected March 13, it suggests the play saw accrued speculative enactment and profit-taking.

Graph showing the Z-score for Bitcoin’s MVRV ratio from Feb. 1 to April 8 (Source: Glassnode)

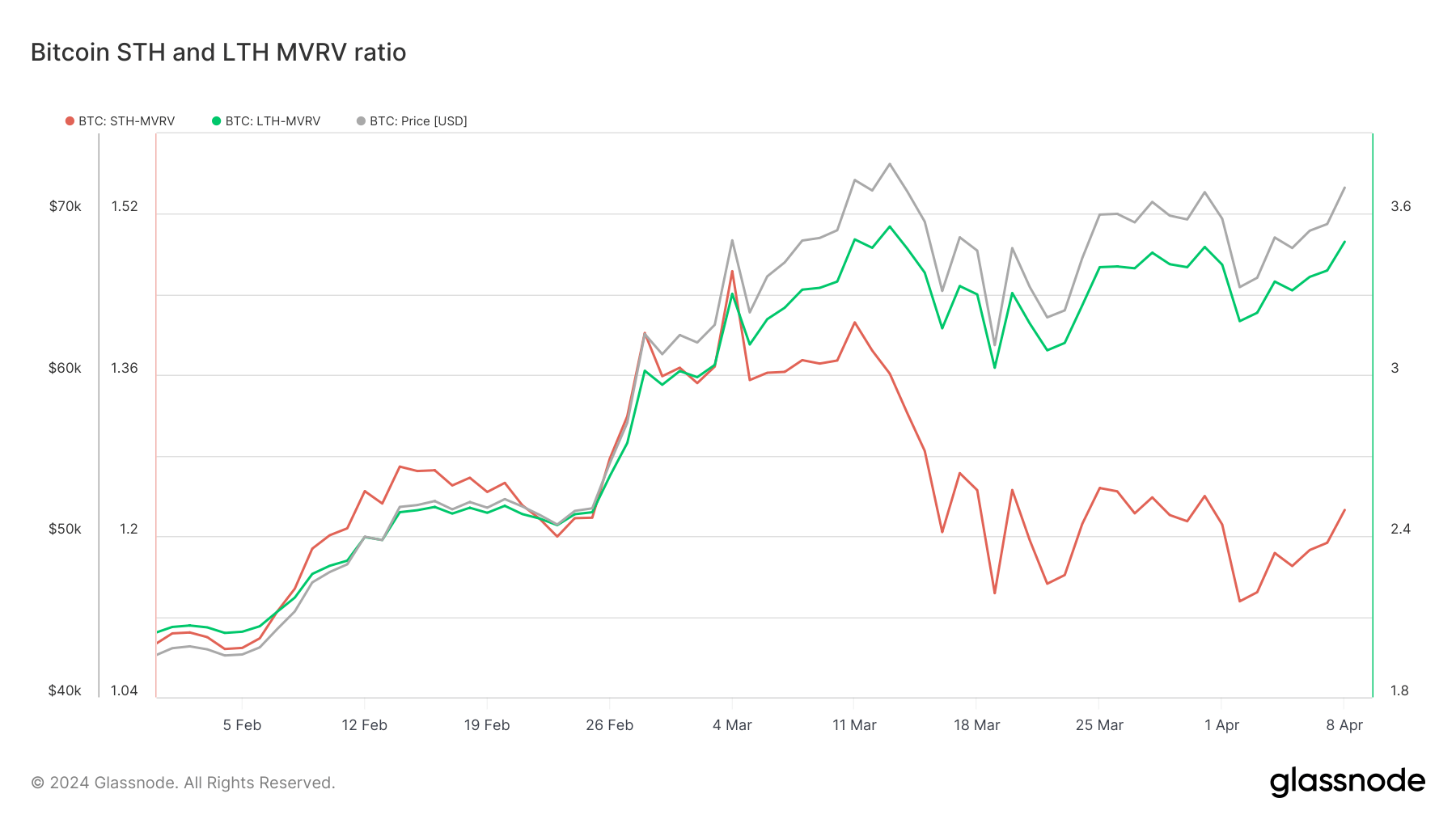

Graph showing the Z-score for Bitcoin’s MVRV ratio from Feb. 1 to April 8 (Source: Glassnode)Diving deeper into the behaviour of LTHs and STHs helps america recognize which conception of the marketplace saw the astir unrealized profit.

The LTH MVRV ratio was consistently higher than the wide MVRV ratio, indicating that semipermanent holders were seeing substantially much unrealized nett compared to the marketplace average. This is peculiarly noteworthy astir March 13, erstwhile the LTH MVRV ratio reached 3.553, importantly higher than the wide MVRV ratio of 2.751.

The disparity suggests that semipermanent holders could person been successful a beardown presumption to merchantability and recognize profits, perchance contributing to consequent terms corrections. As of April 8, this disparity is inactive significant, showing the cohort’s realized worth is importantly little than the marketplace value.

Conversely, the STH MVRV ratio remained notably little than the wide MVRV ratio passim the period, reflecting that short-term holders were either astatine interruption adjacent oregon experiencing minimal unrealized profits.

While this tin beryllium interpreted arsenic STHs having little power connected the market’s direction, the cohort has seen accordant accumulation passim this rhythm and is liable for expanding amounts of trading volume. This shows that contempt their higher acquisition outgo and little unrealized profit, the sheer size of the cohort and the worth it creates surely person a important interaction connected the market.

Graph showing the MVRV people for LTHs and STHs from Feb. 1 to Apr. 8, 2024 (Source: Glassnode)

Graph showing the MVRV people for LTHs and STHs from Feb. 1 to Apr. 8, 2024 (Source: Glassnode)Glassnode’s information showed that the elevated LTH MVRV ratio created the imaginable for accrued selling unit during terms peaks arsenic semipermanent investors offload their holdings astatine precise charismatic profit-taking levels. When coupled with STHs’ minimal unrealized gains, this information indicates a marketplace driven chiefly by seasoned investors’ actions and sentiment, with short-term holders playing a much reactive role.

Looking forward, the trends observed suggest a heightened sensitivity to shifts successful semipermanent holder behavior. Should LTHs proceed to clasp contempt precocious unrealized profits, it could awesome a beardown content successful further upside potential, perchance stabilizing the marketplace during pullbacks.

However, important sell-offs by this radical could pb to crisp corrections, particularly if accompanied by a rising wide MVRV ratio and Z-score, indicating overvaluation.

The station Bitcoin’s MVRV ratio shows LTHs determination the marketplace portion STHs react appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)