Changes successful futures and options unfastened involvement supply penetration into marketplace sentiment, liquidity, and imaginable terms movements. Futures and options uncover however traders presumption themselves and amusement their expectations for aboriginal terms action. Open involvement measures the travel of money, showing whether caller superior is entering oregon exiting the market.

Looking astatine unfastened interest, we tin spot that Bitcoin’s caller rally has brought caller beingness into the derivatives market, which saw a comparatively calm and uneventful July. This stableness reflected the weeks of sideways terms enactment the marketplace saw. The lateral inclination turned affirmative past week, arsenic Bitcoin started astatine $56,680 connected July 9. The terms summation started dilatory but began picking up gait from July 14 onwards, erstwhile the terms surged from $59,205 to $65,025 connected July 17.

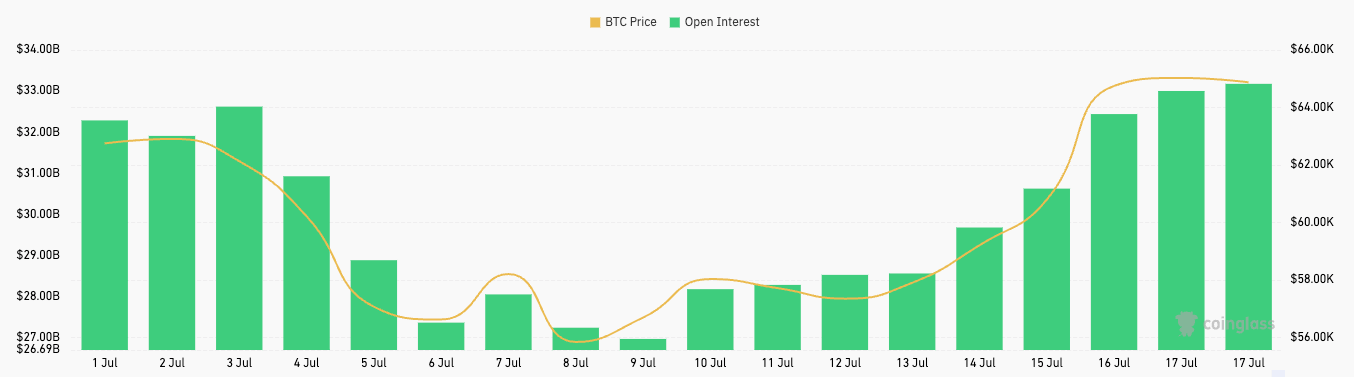

Futures unfastened involvement intimately mirrored this terms action. On July 9, unfastened involvement was $26.97 cardinal and roseate steadily, reaching $33.25 cardinal by July 17. This accelerated summation successful OI shows that traders were opening much contracts arsenic Bitcoin broke $60,000, astir apt anticipating further terms increases.

Graph showing the unfastened involvement for Bitcoin futures from July 1 to July 17, 2024 (Source: CoinGlass)

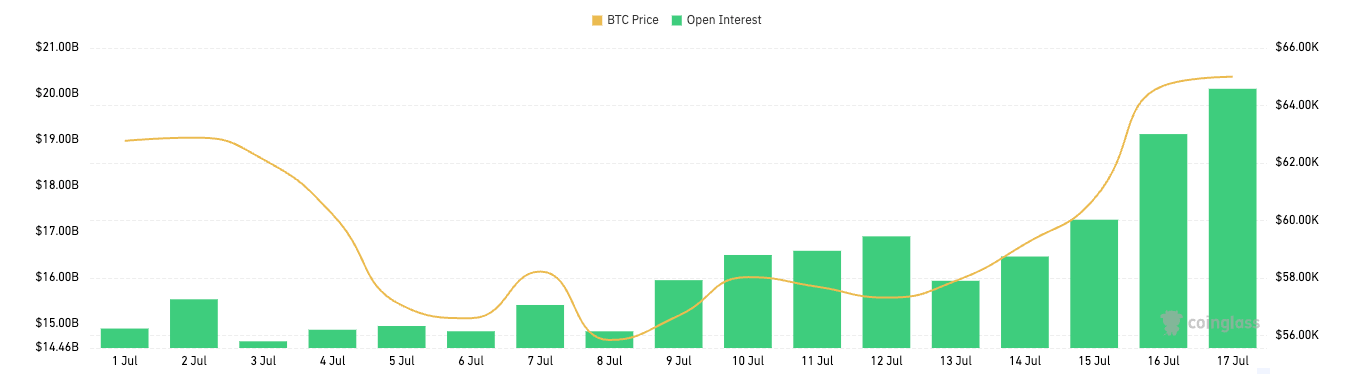

Graph showing the unfastened involvement for Bitcoin futures from July 1 to July 17, 2024 (Source: CoinGlass)The options marketplace followed the aforesaid trend. On July 9, unfastened involvement was $15.94 billion. It roseate steadily implicit the pursuing week, reaching $20.11 cardinal by July 17. Like the futures market, a notable spike successful options unfastened involvement was seen from July 15 onwards, mirroring Bitcoin’s terms increase. This surge besides shows a important summation successful enactment from traders, who rushed to capitalize connected terms movements.

Graph showing the unfastened involvement for Bitcoin options from July 1 to July 17, 2024 (Source: CoinGlass)

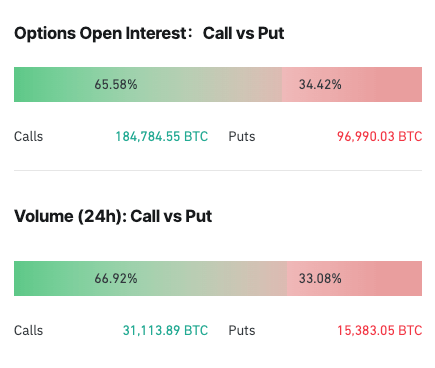

Graph showing the unfastened involvement for Bitcoin options from July 1 to July 17, 2024 (Source: CoinGlass)The organisation of calls and puts shows that implicit 65% of unfastened involvement and measurement are calls. This means that a smaller percent of traders are hedging against downside risks and anticipating further terms increases connected which they privation to capitalize. Options supply a mechanics for traders to leverage their positions with controlled risk, which is peculiarly charismatic during periods of terms volatility.

Screengrab showing the organisation of calls and puts successful Bitcoin options unfastened involvement and measurement connected July 17, 2024 (Source: CoinGlass)

Screengrab showing the organisation of calls and puts successful Bitcoin options unfastened involvement and measurement connected July 17, 2024 (Source: CoinGlass)The synchronized emergence successful some futures and options unfastened involvement alongside the terms summation shows however integrated the Bitcoin marketplace is. As the spot terms rallies, it attracts much futures contracts and prompts accrued options activity, indicating a broad effect from the marketplace utilizing analyzable trading instruments.

Furthermore, the correlation betwixt unfastened involvement and terms shows that the derivatives marketplace loves affirmative terms action. Sideways terms enactment leads to importantly little unfastened involvement successful futures and options, portion terms increases pull caller wealth into the derivatives market.

The station Bitcoin’s rally rekindles the derivatives market appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)