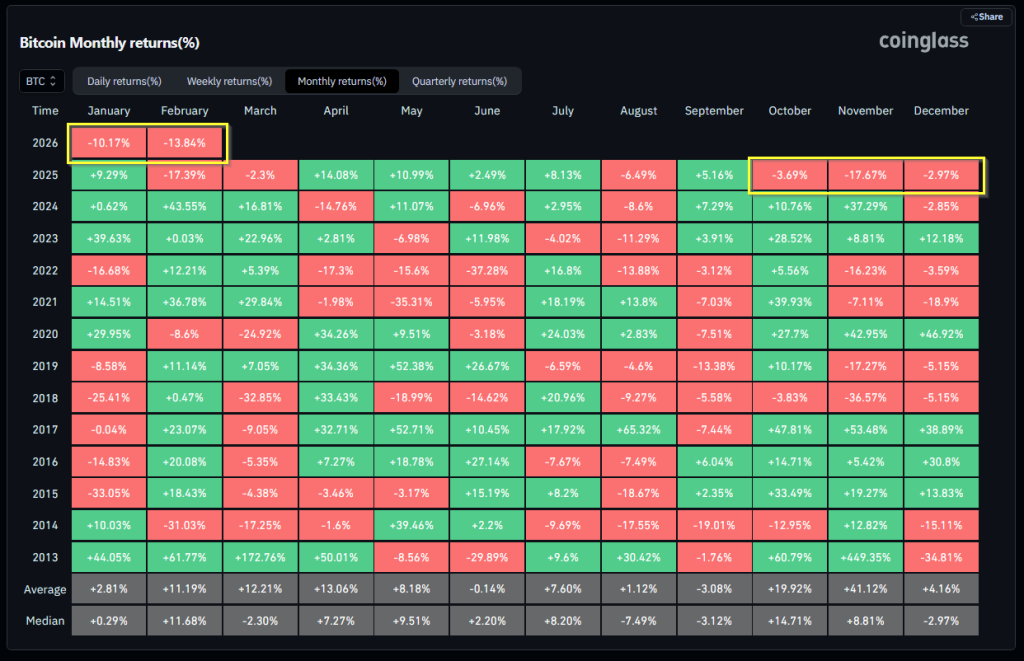

The Bitcoin terms enactment has taken a grim code this period arsenic trading rolls toward what whitethorn go a 5th consecutive reddish monthly candle. According to CoinGlass, BTC is down astir 15% this period aft closing the erstwhile 4 months lower, a tally not seen since 2018.

Reports enactment that akin multimonth selloffs successful the past were sometimes followed by sudden, beardown rebounds, but those outcomes were not automatic. Traders are watching enactment adjacent caller lows portion sentiment indicators amusement rising caution among some retail and organization players.

Historical Streaks And Reversals

Reports from Milk Road constituent to a striking example: aft a agelong losing streak successful 2018/19, the marketplace produced ample gains successful the months that followed. That occurrence is often referenced by bulls who reason that compressed prices tin acceptable the signifier for large percent moves to the upside. Yet discourse matters. Market cycles are messy, and earthy percent comparisons skip implicit differences successful liquidity, subordinate mix, and macro settings.

Weekly And Quarterly Signals

Weekly charts are shouting caution successful immoderate corners. Analyst Solana Sensei highlighted a tally of reddish play candles that echoes parts of 2022, erstwhile extended selling drove BTC to the mid-$20,000s. At the aforesaid time, quarterly information from the 2022 drawdown shows losses tin stack up for agelong stretches, and those patterns were achy for holders who expected speedy turns.

Some analysts person argued that the existent rhythm looks antithetic due to the fact that the monthly RSI ne'er saw the aforesaid overbought enlargement that preceded immoderate anterior carnivore phases; their presumption suggests rebounds mightiness not travel the aged script.

$BTC is looking to log its 5th reddish month.

Last clip this happened was successful 2018/19 erstwhile we saw 6 reddish months.

Silver lining: it led to a reversal w/ 316% returns implicit the pursuing 5 months.

If past repeats – the reversal begins April 1st.

Bookmark this. pic.twitter.com/IZwmdg0peV

— Milk Road (@MilkRoad) February 18, 2026

Bitcoin Price Action

The apical crypto’s price question has been mixed: bladed sessions, crisp swings connected headlines, muted measurement betwixt moves. The marketplace has been some brittle and occasionally steady, depending connected who is trading and wherever liquidity pools sit.

Geopolitics And Market Mood

Geopolitical flareups person acted arsenic a volatility amplifier, and traders are pricing successful header hazard much readily than before. Events tied to policies oregon nationalist comments person dented assurance crossed hazard assets.

US policy shifts and high-profile governmental statements — including ones linked to US President Donald Trump — are being watched for immoderate spillover into dollar flows and capitalist hazard tolerance. Thin marketplace conditions tin crook tiny quality into large moves. That’s precisely what’s been happening connected juncture implicit the past fewer weeks.

Based connected reports and the premix of indicators, a rebound successful March oregon April is possible, but it cannot beryllium counted on. Some traders volition hole for a speedy bounce; others volition support adust pulverization and hold for clearer confirmation.

Featured representation from Pexels, illustration from TradingView

14 hours ago

14 hours ago

English (US)

English (US)