Bitcoin's existent valuation possibly presents diligent investors with an charismatic accidental to instrumentality vulnerability to the world's largest cryptocurrency.

That's the awesome from an indicator called Reserve Risk, which measures the risk-reward ratio of allocating to bitcoin based connected the condemnation of semipermanent holders. The metric compares the inducement to merchantability offered by the going marketplace terms to semipermanent holders resisting the temptation to liquidate.

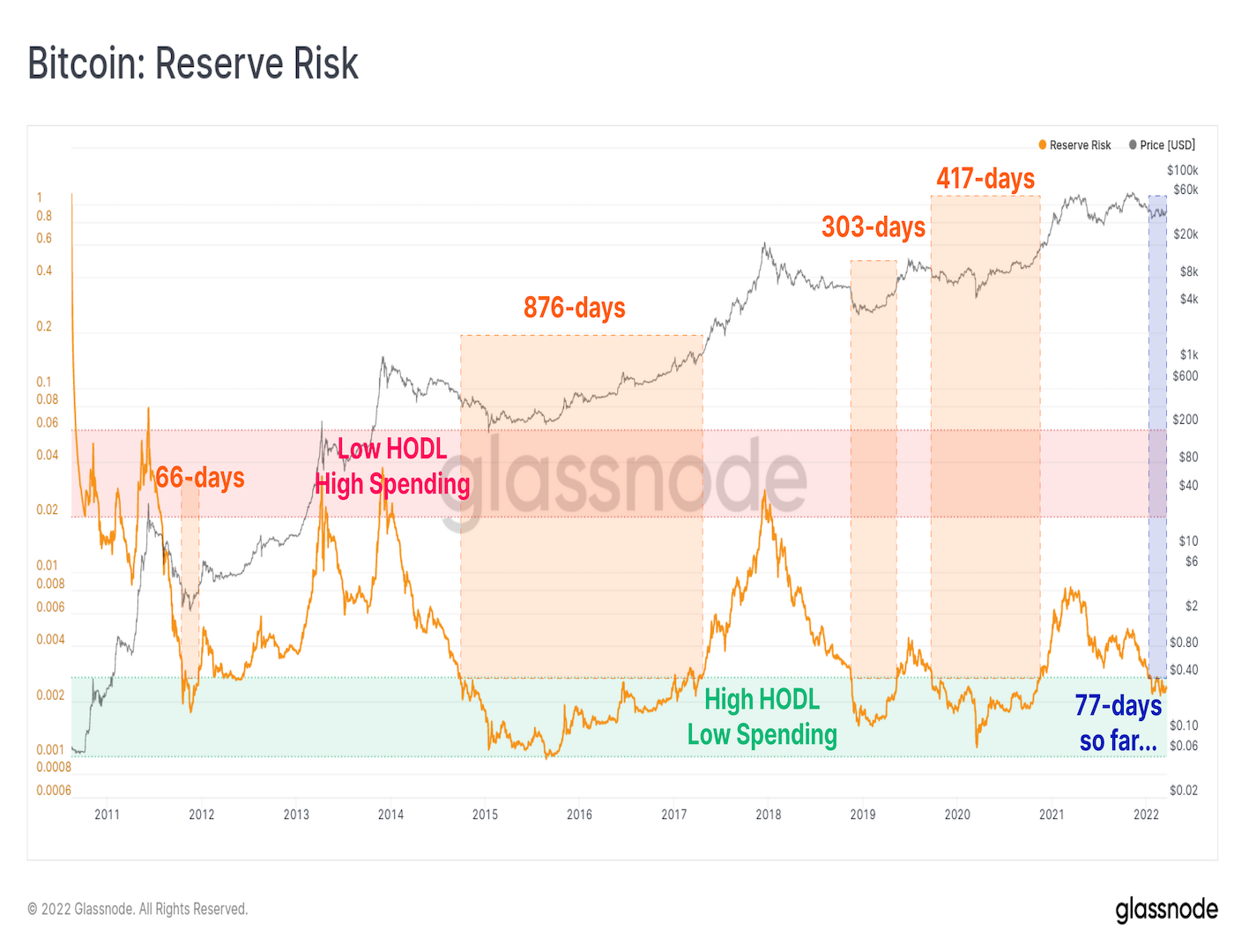

Reserve Risk stood astatine 0.0024 astatine property time, having recovered acceptance nether the greenish portion beneath 0.0027 successful precocious January. The risk-reward ratio is considered charismatic erstwhile the metric hovers successful the greenish area.

"This metric volition commercialized astatine debased levels erstwhile determination is dense capitalist accumulation and HODLing is the preferred marketplace strategy," blockchain analytics steadfast Glassnode's play newsletter published Monday said.

In different words, a debased speechmaking indicates that condemnation among HODLers – slang from semipermanent crypto investors – is precocious and they garbage to walk their coins. Therefore, determination is an charismatic risk/reward for prospective buyers to dip their toes into the market.

However, successful the past, Reserve Risk has hovered successful the greenish portion for prolonged periods, marking a dilatory modulation from the last signifier of the carnivore marketplace to the mid-stages of a bull market. So, investors looking to adhd vulnerability to bitcoin, tracking the debased Reserve Risk request to beryllium diligent oregon person the quality to endure agelong periods of underperformance earlier large returns manifest.

"Reserve Risk has traded astatine historically undervalued levels for 77-days truthful far, though this is acold shorter than the multi-year periods seen successful 2015-17 and 2018-20. Note, however, that Reserve Risk mostly signals undervaluation good into the bull marketplace arsenic HODLers typically commence organisation lone aft a caller terms ATH is set," Glassnode's play study said.

Bitcoin was trading mostly unchanged connected the time astatine $46,600 astatine property time, according to CoinDesk data.

Reserve hazard is calculated by dividing bitcoin's terms astatine immoderate constituent successful clip by the "HODL Bank," arsenic detailed by Glassnode, which represents the accidental outgo of holding an asset. "Each time a coin is held, the proprietor defers the quality to speech it for its currency value," according to Glassnode.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for Crypto Long & Short, our play newsletter featuring insights, quality and investigation for the nonrecreational investor.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)