Key takeaways:

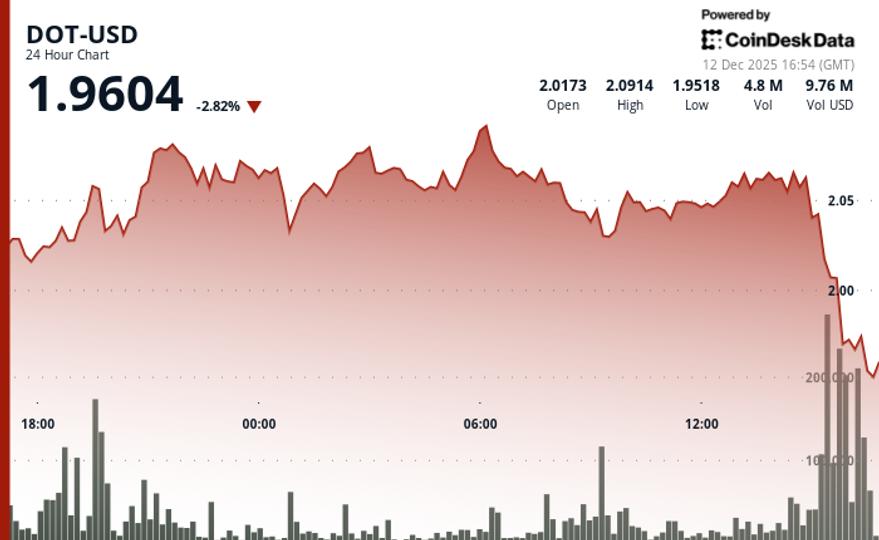

Bitcoin is down 4.3% successful October contempt historically beardown monthly returns.

The CME FedWatch instrumentality shows a 96.7% probability of a 25% involvement complaint cut, fueling optimism.

Inflows into the spot Bitcoin ETFs and equities correlation hint astatine a imaginable rebound.

Bitcoin (BTC) whitethorn beryllium down 4.3% successful October truthful far, but optimism astir the month’s historically bullish inclination remains intact. Since 2019, Bitcoin’s mean October summation has stood adjacent 20%, with a median instrumentality of astir 15%. While this year’s show presently lags, marketplace participants are looking to macroeconomic argumentation shifts for imaginable fuel.

According to the CME FedWatch tool, the probability of a Federal Reserve involvement complaint chopped present stands at 96.7% for a 25-basis-point reduction. A chopped successful involvement rates mostly signals much liquidity entering the system, reducing borrowing costs and supporting risk-on sentiment crossed plus classes, including cryptocurrencies similar Bitcoin.

Institutional flows appeared to beryllium front-running this narrative. Spot Bitcoin exchange-traded funds (ETFs) person absorbed astir $5 cardinal successful nett inflows successful the archetypal 2 weeks of October, indicating renewed assurance from ample investors.

Meanwhile, Cointelegraph reported that full organization holdings crossed nationalist companies person present climbed to $117 billion, a 28% quarterly rise, with implicit 1 cardinal BTC collectively held successful firm treasuries. 48 caller entities joined the cohort successful Q3, expanding organization scope further into integer assets.

Related: Bitcoin to $74K? Hyperliquid whale opens caller 1,240 BTC short

Stock correlation hints astatine Bitcoin’s adjacent move

Bitcoin’s existent weakness tin besides beryllium linked to the US equities market. Macroeconomic expert Jesse Colombo said that Bitcoin’s 92% correlation with the Nasdaq makes it a “leveraged play connected tech stocks.” This was connected show past Friday erstwhile the S&P 500 fell 2.7%, the Dow Jones 1.9%, and the Nasdaq 100 Composite implicit 4.2%, their sharpest regular drops since April, dragging Bitcoin down alongside them.

The sell-off stemmed from renewed commercialized tensions betwixt the US and China, aft reports of imaginable 100% tariffs connected Chinese imports, which rattled hazard sentiment. However, arsenic markets stabilized aboriginal this week, US stocks began recovering, though Bitcoin’s rebound has lagged.

According to the Director of Global Macro astatine Fidelity, Jurrien Timmer, the caller pullback resembled the late-1990s “super bull” phase, erstwhile speculative assets saw crisp but impermanent drawdowns earlier surging higher again.

If US equities prolong their betterment heading into net season, it could make favorable conditions for Bitcoin’s ain upside revival. A renewed rally successful tech and maturation stocks, bolstered by easier monetary policy, mightiness assistance widen “Uptober” optimism into a stronger decorativeness for the month.

Related: Bitcoin metric shows ‘euphoria’ arsenic $112.5K BTC terms squeezes caller buyers

This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision.

1 month ago

1 month ago

English (US)

English (US)