Bitcoin (BTC) has breached captious terms enactment to deed one-month lows arsenic the U.S. taxation play draws to a close.

The starring cryptocurrency by marketplace worth fell to $38,577 during the Asian hours, a level past seen connected March 15, according to CoinDesk data. Per analytics steadfast IntoTheBlock, $40,000 was important support, arsenic important buying enactment has happened astir that level successful the past. The latest diminution means the cryptocurrency has mislaid implicit 17% since investigating waters supra $48,000 3 weeks ago.

The weakness appears to person stemmed from tax-related selling and a murky macro environment. For U.S. investors, the deadline to taxable 2021 taxation returns oregon an hold to record and wage the taxation is Monday, April 18, 2022. Last year, marketplace players sold integer assets during the taxation season, betwixt Jan. 1 and April 15, Coinbase's David Duong said successful a caller play email.

"Tax-related selling has decidedly played a relation successful caller weeks, Jeff Anderson, CIO astatine the quantitative trading steadfast and liquidity supplier Folkvang Trading, said successful a Telegram chat. "However, it's hard to accidental precisely however overmuch of the weakness has been owed to the impending taxation deadline."

Anderson added that "people were positioned for an extremity of taxation selling Monday and the [continued rise] successful yields has scuppered that."

The U.S. 10-year Treasury output roseate to a 2.88% aboriginal connected Monday, the highest level since December 2018, per information provided by charting level TradingView. The nominal and existent oregon inflation-adjusted U.S. enslaved yields person been connected a teardrop successful caller weeks, acknowledgment to precocious ostentation and the Federal Reserve's (Fed) plans to present rapid-fire complaint hikes. So, hazard assets, including exertion stocks and cryptocurrencies, person come nether pressure.

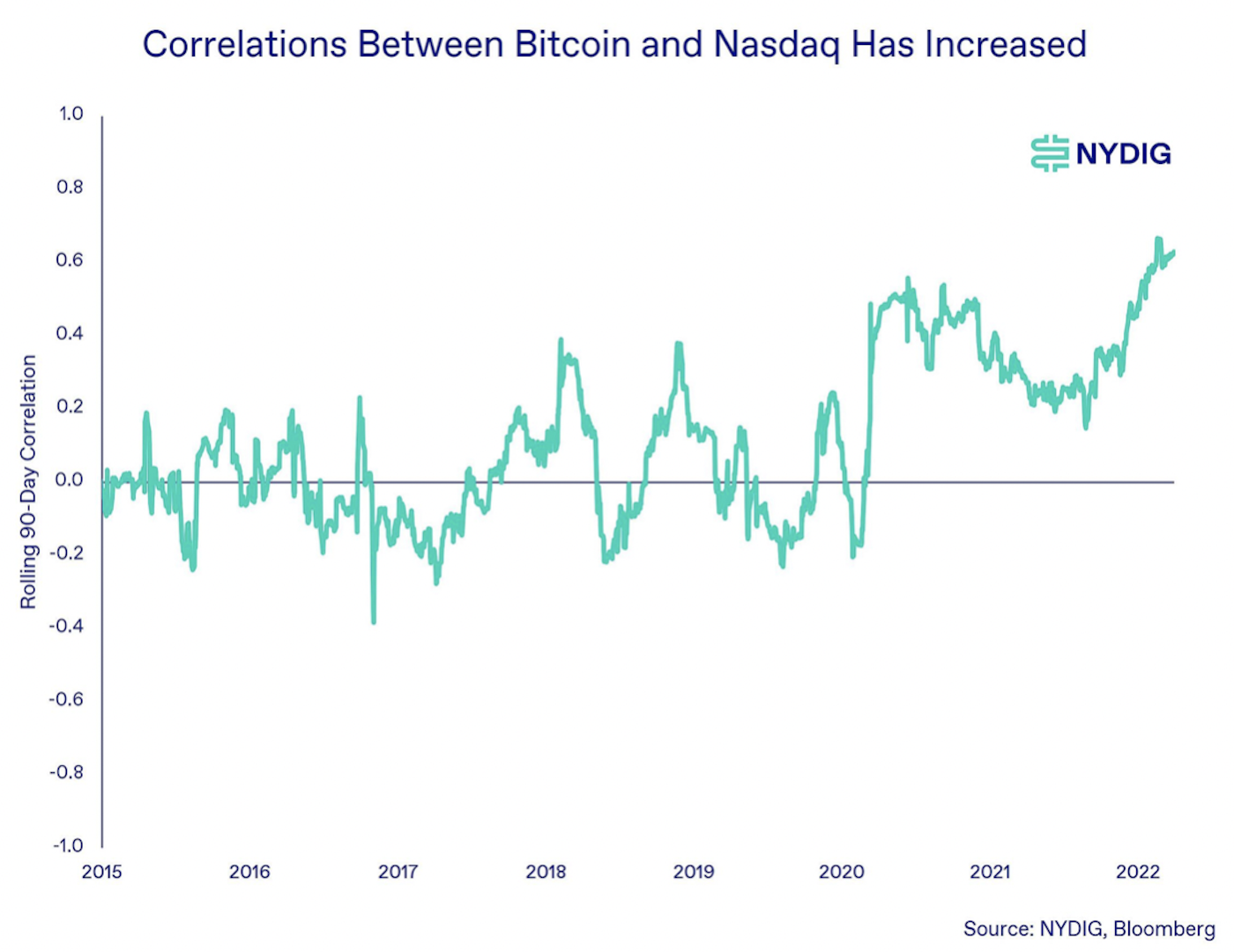

According to George Liu, caput of derivatives astatine Babel Finance, bitcoin's strengthening correlation to stocks could beryllium the much ascendant crushed down the dip beneath $40,000.

"The taxation contented has been known and anticipated successful the markets already, truthful we don't spot that arsenic a decisive origin for the existent terms dip," Liu said. "Basically, the short-term correlation betwixt bitcoin and U.S. stocks has reached a caller peak."

Crypto services supplier Amber Group voiced a akin opinion, saying, "a batch has to bash with the mediocre macro conditions... look astatine equities and Nasdaq [tech-heavy index] and the emergence successful the existent yields."

The rolling 90-day correlation betwixt bitcoin and the Nasdaq Composite precocious broke supra 0.6, according to organization bitcoin broker NYDIG.

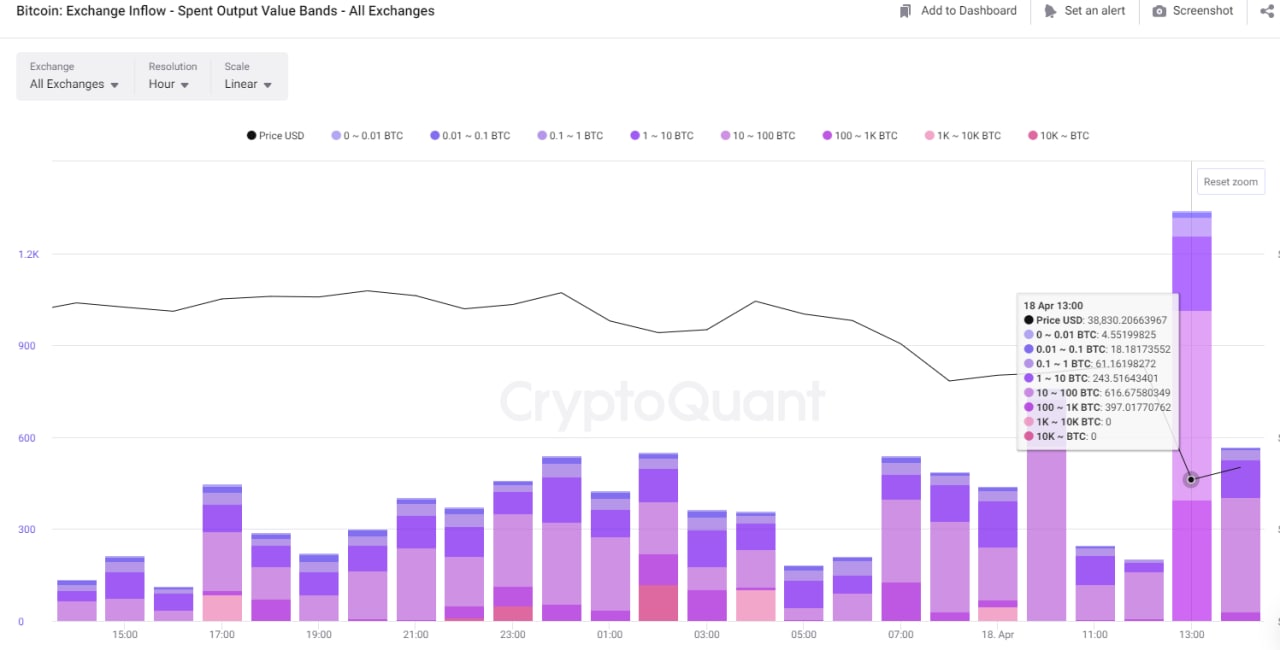

Blockchain information shows that the selling unit is apt coming from short-term traders with important holdings.

"Checking connected the wide bitcoin web question from spent output property set USD and spent output worth set USD, it seems similar the cohort astir progressive during the terms alteration seen a fewer hours agone was mostly 0~1 week aged coins + UTXO measurement successful 1M+ USD," Chan Chung, caput of selling from Korea-based analytics steadfast CryptoQuant told CoinDesk successful a Telegram chat.

The spent output property set is simply a acceptable of each spent outputs created wrong a specified property set that flowed into speech wallets. As Chung said, mostly 0-1 week aged coins were successful enactment connected Monday, meaning the selling unit apt stemmed from short-term traders.

Further, the spent output worth band, which shows the organisation of each spent outputs according to their value, shows astir of the coins that moved into exchanges aboriginal contiguous were from 10-100 BTC and 100 BTC and 1,000 BTC cohorts.

However, the information is taxable to antithetic interpretations; fixed blockchain metrics person their limitations. A whale tin clasp its stack successful aggregate addresses for years. "Whales mightiness person divided their wallet yesterday, which makes it look similar 0~1 time UTXO; successful reality, it could person been aged for much than 3 years," Chung noted.

Bearish derivative marketplace flows

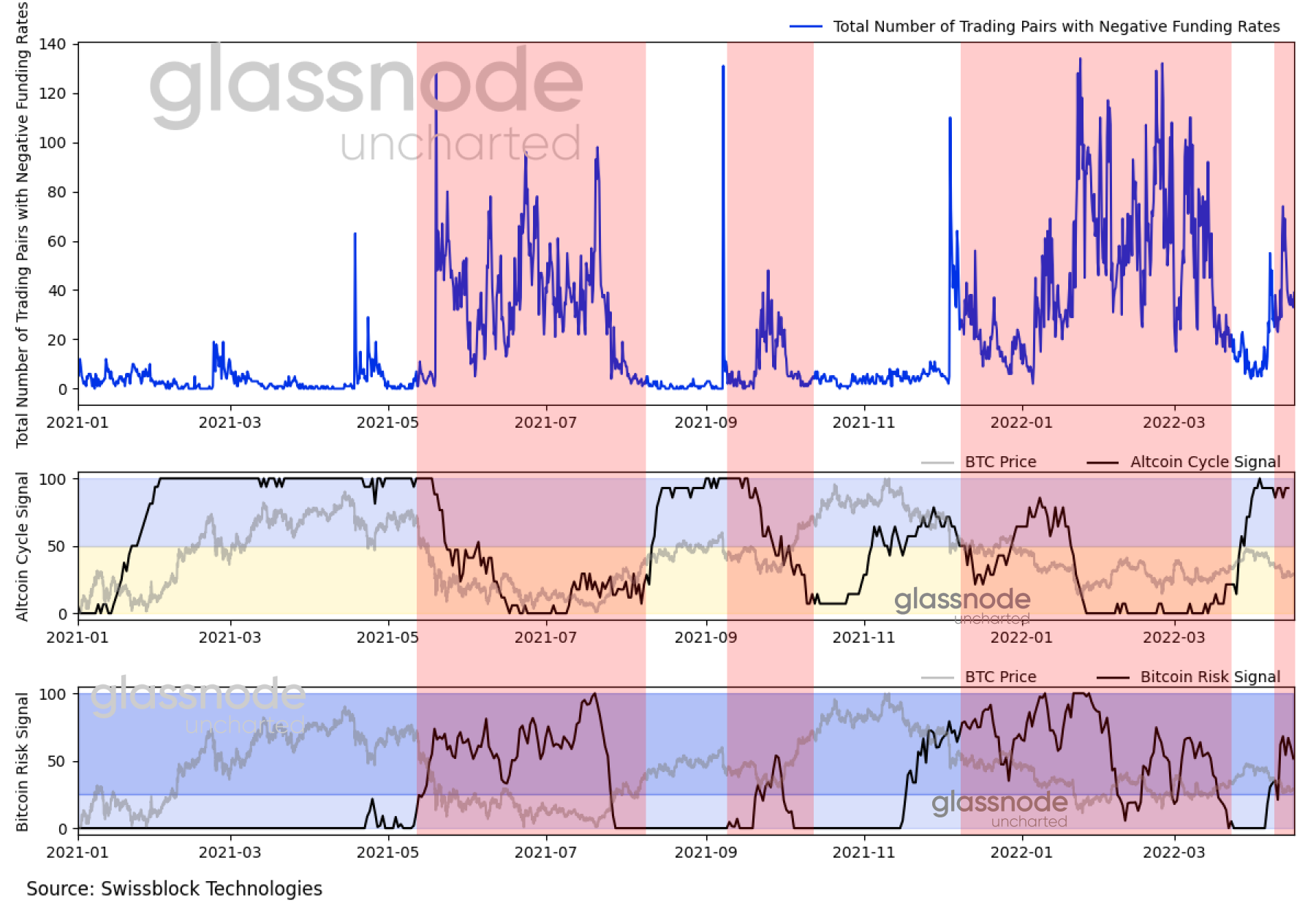

Derivative traders look to beryllium positioning for an extended diminution successful bitcoin, arsenic evidenced by the rising put-call skews, which measurement the outgo of puts comparative to calls.

According to Babel's Liu, unfastened involvement successful the cash-margined perpetual futures marketplace is expanding alongside the request for downside hedging. In different words, traders look to beryllium betting connected a downward move.

That could beryllium the lawsuit arsenic backing rates, oregon the outgo of holding agelong oregon abbreviated positions successful the perpetual futures market, person turned negative, according to information from Coinglass.com

"Selling unit resurfaced successful the perpetual marketplace arsenic bid transactions surpassed the inquire side," Glassnode's Uncharted newsletter, dated April 17 said. "The fig of perpetual contracts with antagonistic backing rates increased, reinforcing the downward pressure."

A antagonistic backing complaint implies that traders person a beardown content that the marketplace is going down and that they are paying a outgo to shorten it.

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for Crypto Long & Short, our play newsletter featuring insights, quality and investigation for the nonrecreational investor.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)