On-chain information shows signs aren’t looking bully for Bitcoin arsenic the NVT ratio is indicating that the crypto is inactive overvalued close now.

Bitcoin NVT Ratio Continues To Be At High Values

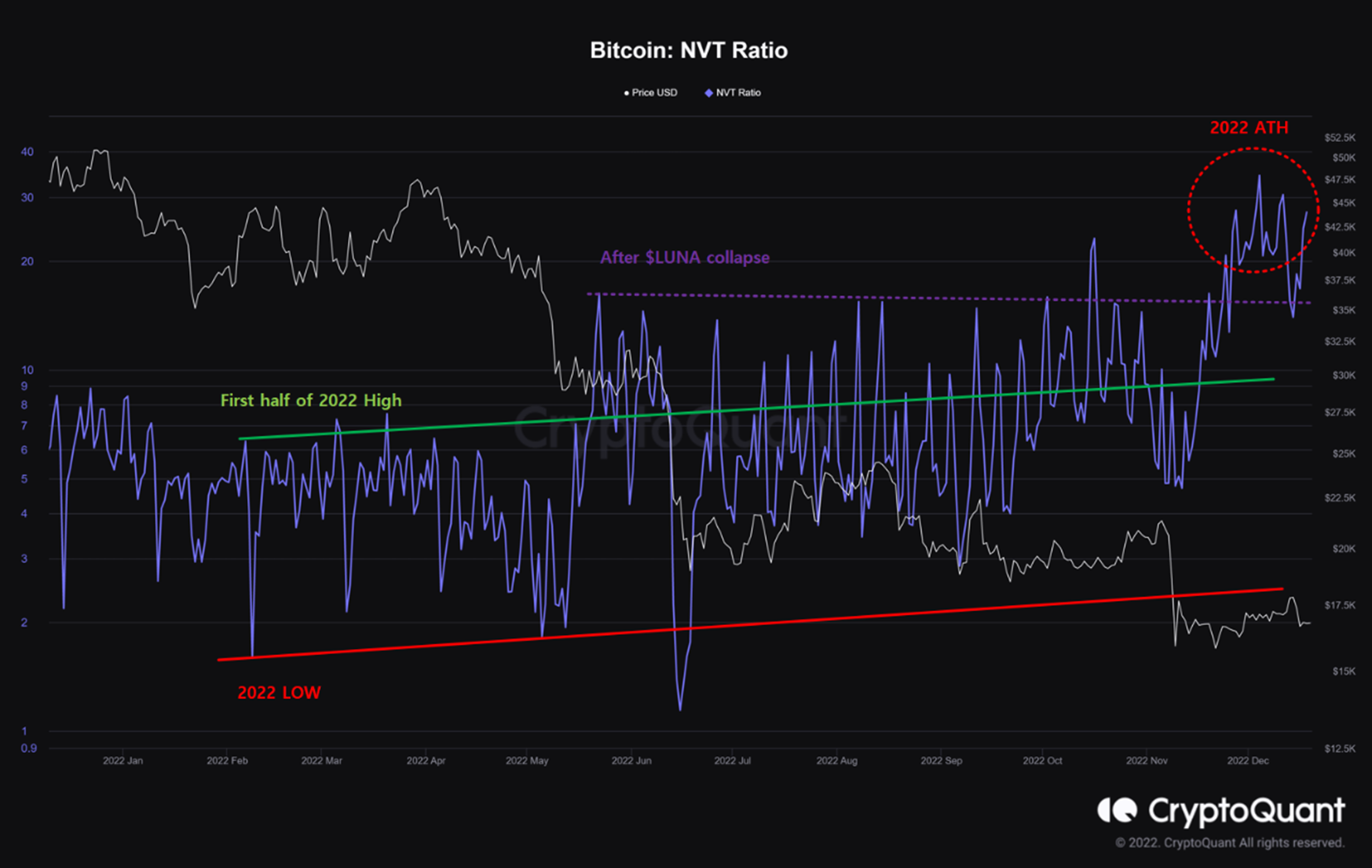

As pointed retired by an expert successful a CryptoQuant post, BTC is presently overvalued from an on-chain perspective. The “Network Value to Transactions (NVT) ratio” is an indicator that measures the ratio betwixt the marketplace headdress of Bitcoin and its transaction measurement (both successful USD).

This ratio judges whether the existent worth of Bitcoin (that is, the marketplace cap) is just oregon not, by comparing it against the network’s quality to transact coins close present (the transaction volume). When the metric has a precocious value, it means the terms of BTC is precocious compared to the volume, and frankincense the coin could beryllium wrong a bubble astatine the moment. On the different hand, debased values suggest BTC whitethorn beryllium undervalued arsenic the concatenation has a precocious quality to transact coins (in examination to the marketplace cap) close now.

Here is simply a illustration that shows the inclination successful the Bitcoin NVT ratio implicit the past year:

As the supra graph highlights, the Bitcoin NVT ratio jumped up pursuing the LUNA collapse backmost successful May of this twelvemonth and has since mostly stayed astatine akin oregon higher levels. This means that contempt the terms observing aggregate crashes successful the period, the coin’s worth inactive became progressively overvalued arsenic volumes crossed the marketplace sharply dropped.

Even aft the FTX crash, which has delivered different coagulated stroke to the crypto’s marketplace cap, the metric has lone climbed higher arsenic it has registered a caller precocious for the twelvemonth recently. BTC has lone been getting much and much overpriced arsenic the carnivore has gotten deeper, suggesting the dire authorities of the marketplace successful presumption of trading volumes.

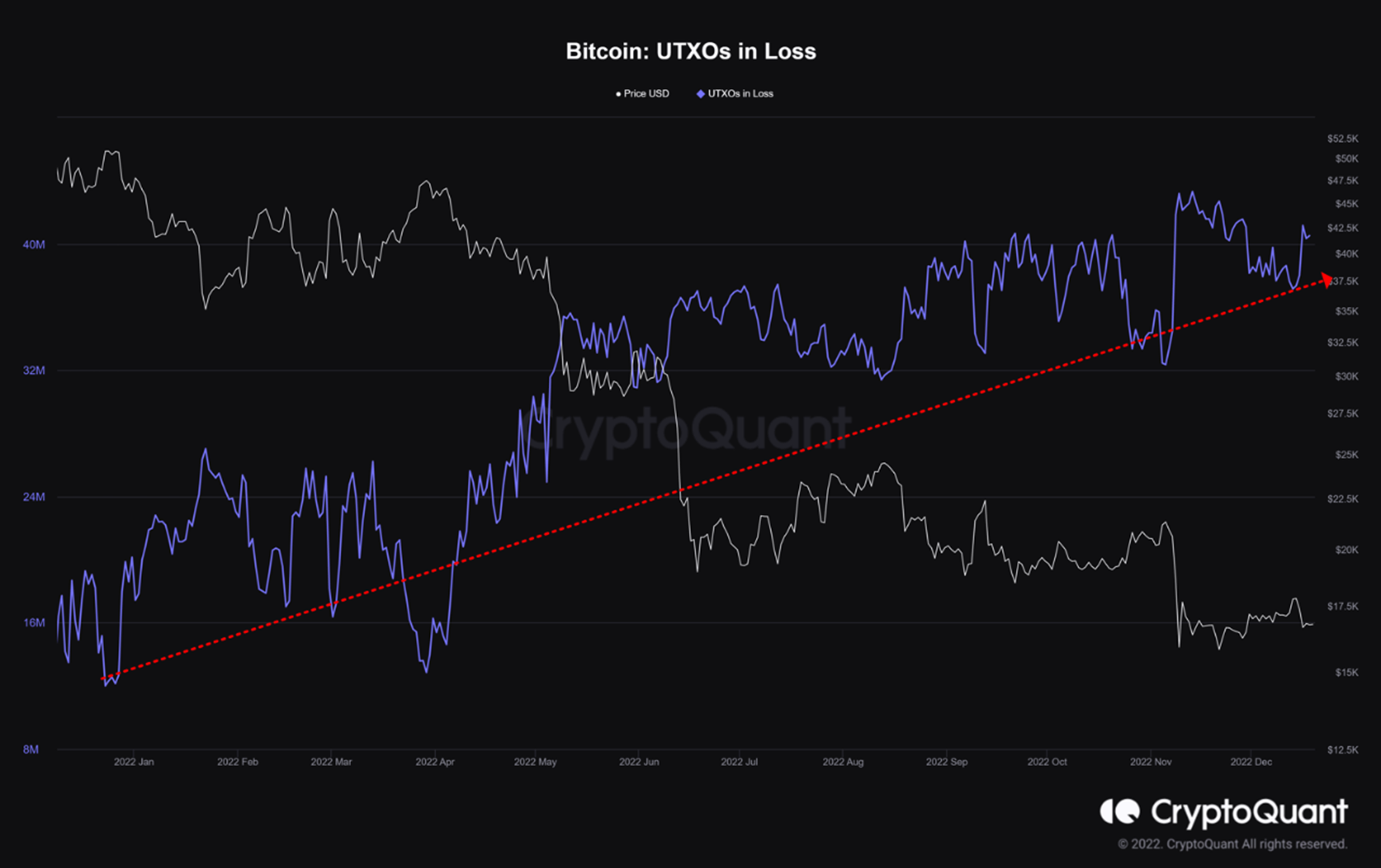

The quant besides notes that the fig of UTXOs successful nonaccomplishment (basically the magnitude of wallets/investors successful loss), has been consistently rising passim the bear.

Both these signs are surely not successful the favour of Bitcoin and whitethorn connote determination is further symptom up for investors. “A much extended carnivore marketplace could beryllium seen arsenic a imaginable hazard that could adhd selling pressure,” explains the analyst.

BTC Price

At the clip of writing, Bitcoin is trading astir $16,800, down 5% successful the past week.

Featured representation from Maxim Hopman connected Unsplash.com, charts from TradingView.com, CryptoQuant.com

2 years ago

2 years ago

English (US)

English (US)