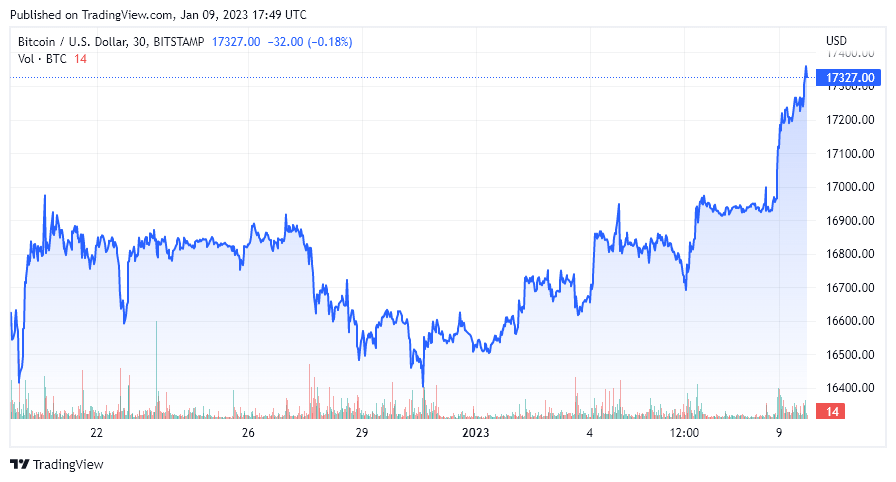

Crypto’s benchmark cryptocurrency, Bitcoin, has pushed past $17,000 for the archetypal clip successful 2023 aft being scope bound for respective weeks betwixt $16,380 and $16,975.

Bitcoin has present been connected a affirmative inclination since the commencement of January erstwhile it opened the twelvemonth astatine $16,482. Bitcoin is up 3.72% implicit the past 7 days and 2.33% successful the erstwhile 24 hours, according to CryptoSlate data.

BTC-USD

BTC-USDWhy is Bitcoin pumping?

With a deficiency of important on-chain developments wrong the Bitcoin ecosystem, the rally appears unlinked to immoderate quality related to the network. Further, noteworthy developments wrong the crypto abstraction astatine ample to which Bitcoin could respond person been scarce.

However, arsenic the particulate begins to settee connected the FTX quality cycle, the usage lawsuit for Bitcoin successful self-custody is stronger than ever. A planetary fiscal situation is looming with continually steep inflation, nary extremity successful show for the warfare successful Ukraine, and increasing tensions betwixt China and the West. In addition, the interest implicit which plus people volition enactment arsenic the champion store of worth successful 2023 whitethorn beryllium strengthening investors’ resoluteness successful Bitcoin.

While Bitcoin acted arsenic a risk-on plus passim the bulk of 2022, eyes present determination to whether Bitcoin volition repetition its beardown show erstwhile the Ukraine warfare started arsenic we determination further into 2023.

The adjacent Bitcoin halving lawsuit is astir 18 months away, truthful humanities metrics suggest the bull marketplace is not yet astir the corner. However, plentifulness of investors person fled crypto aft the tumultuous events of 2022. The illness of large exchanges, projects, hedge funds, and lending platforms shook retired plentifulness of investors portion removing atrocious actors from the space.

Forbes precocious discussed imaginable Bitcoin terms predictions for 2023 with Alistair Milne, laminitis of Altana Digital Currency Fund, suggesting it could scope arsenic precocious arsenic $300,000 by 2024. Others had much blimpish estimates predicting prices betwixt $30,000 and $50,000, specified arsenic the Professor of Finance astatine Sussex University, Carol Alexander.

Eric Wall, the CIO of Arcane Assets, besides stated the bottommost is successful for Bitcoin, and it volition present contention toward a $30,000 terms people successful 2023.

Potential carnivore trap

The biggest elephant successful the room, however, is the destiny of Digital Currency Group and, therefore, Genesis and the Grayscale Trust. A caller CryptoSlate market study showcased the predicament facing DCG and the imaginable havoc it could wreak connected the crypto manufacture should it beryllium forced to liquidate assets to debar bankruptcy.

CryptoSlate is keeping a keen oculus connected developments astatine DCG arsenic determination person been nary further updates pursuing the Winklevoss Twin‘s ultimatum regarding Genesis Earn funds. The Winklevoss brothers acceptable a deadline of Jan. 8 for DCG to respond to an unfastened letter, a day which has present passed without a word.

The Forbes nonfiction mentioned supra besides highlighted respective accepted concern companies that predicted Bitcoin would autumn beneath $10,000 this year. Most notably, Eric Robertsen, the Global Head of Research for Standard Chartered, called for $5,000 arsenic “crypto firms and exchanges find themselves with insufficient liquidity, starring to further bankruptcies and a illness successful capitalist assurance successful integer assets.”

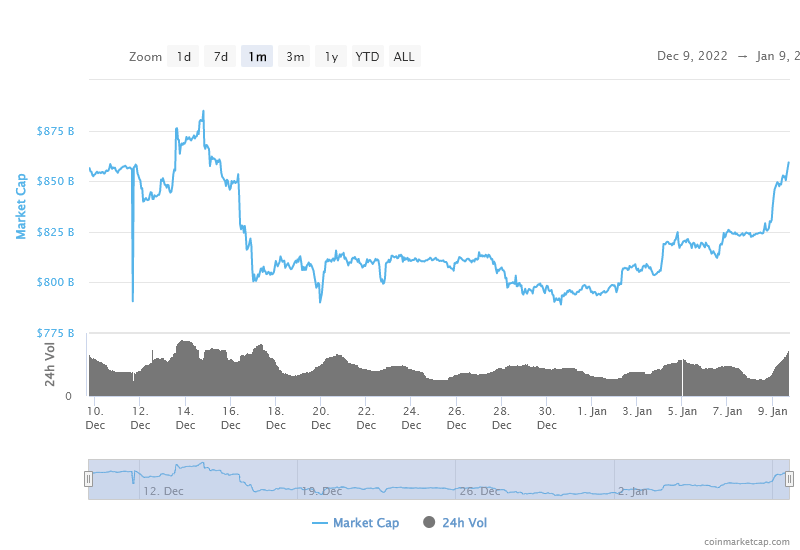

Yet, arsenic the illustration beneath indicates, the wide crypto marketplace headdress has been rallying since 2023. Over the past 9 days, implicit $50 cardinal has been injected into the crypto markets. As we welcomed successful the caller year, the full marketplace headdress was $795 cardinal but has since deed $859 billion, according to CoinMarketCap.

The planetary crypto marketplace headdress with Bitcoin removed stood astatine $477 cardinal connected Jan. 1. It has steadily grown to $525 billion, an summation of $58 billion. Thus, portion Bitcoin is performing good successful 2023, the broader crypto marketplace is outperforming the flagship crypto network. Only $18 cardinal has been injected into Bitcoin, a specified 4.7% summation successful marketplace headdress compared to the remainder of the full marketplace (minus Bitcoin), which roseate by 10%.

Global Crypto Market Cap

Global Crypto Market CapNothing has changed regarding Bitcoin’s fundamentals, and 2023 is acceptable to beryllium a twelvemonth wherever either the FIAT strategy solves the ostentation problem, oregon the events of 2008 travel backmost to wound cardinal banks harder than ever.

The FIAT problem

A satellite wherever the FIAT strategy is connected its past legs is simply a satellite wherever Bitcoin has the imaginable to reign supreme. Time volition archer whether the U.S. Federal Reserve, Bank of England, European Central Bank, and Bank of Japan tin regain economical control.

While Bitcoin has remained level earlier starting to emergence successful value, the Dollar has been downward since precocious September. The illustration beneath shows the highest spot of the Dollar being reached connected Sept. 22, 2022. Since then, it has fallen implicit 10%, astir the aforesaid diminution seen connected the Bitcoin illustration for the aforesaid period.

Bitcoin’s volatility has been astatine immoderate of the lowest levels successful its past betwixt November and January, moving astir 12% successful some directions during the period.

Today’s terms enactment successful Bitcoin mirrors the Dollar’s mediocre show implicit the past 24 hours. Since Jan. 6, the DXY has declined by 2.49%, portion Bitcoin has risen by 2.9%. Of course, neither of these moves is unprecedented. However, should the DXY proceed to autumn passim 2023, it could springiness Bitcoin the spot it needs to instrumentality to levels past seen earlier the atrocious actors caused a market-wide sell-off during 2022.

DXY

DXYBitcoin is intelligibly positioning itself arsenic a formation from FIAT successful a satellite wherever planetary currencies are perchance successful superior jeopardy. Of course, determination are aggregate moving parts, immoderate historically correlated and immoderate not, but 2023 is undoubtedly acceptable to beryllium an absorbing experimentation successful however Bitcoin performs amid further planetary economical uncertainty.

The station Bitcoin surpasses $17K for archetypal clip since aboriginal December appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)