Bitcoin’s (BTC) dip below the $39,000 mark resulted successful important liquidations totaling astir $115 cardinal crossed the cryptocurrency marketplace during the past hour.

Red market

In the past 24 hours, BTC experienced a 4% decline, trading astatine $38,915 arsenic of property time, according to information from CryptoSlate. This downturn reduced its marketplace capitalization by astir $40 billion, settling astatine $767 billion.

BitMEX co-founder Arthur Hayes suggested that Bitcoin’s existent terms inclination could persist until the extremity of the month, influenced by the US Treasury’s quarterly refunding announcement.

Simultaneously, Ethereum (ETH) witnessed a 6% drop, reaching $2,230. The diminution successful ETH’s terms tin beryllium attributed to important selling unit from its Foundation and money movements related to the distressed crypto entity Celsius.

Celsius transferred astir 13,000 ETH (approximately $30.87 million) to Coinbase and 2,200 ETH (roughly $5.12 million) to FalconX, portion the Ethereum Foundation sold $1.6 cardinal of the integer asset.

Long traders stunned

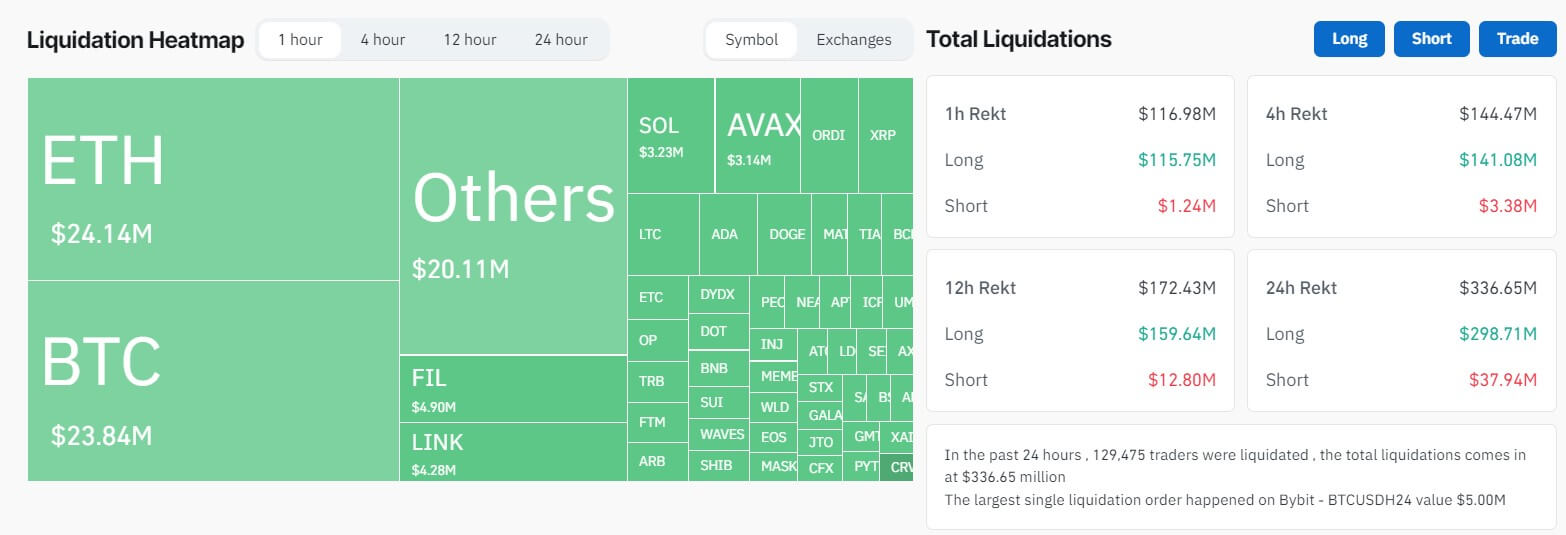

Data from Coinglass reveals important losses for traders anticipating further marketplace terms increases. For context, agelong traders mislaid $115 cardinal during the past hr alone.

When the clip framework is extended to 24 hours, agelong traders’ losses magnitude to astir $300 million, portion those with bearish marketplace positions incurred a much humble $38 cardinal successful losses during this reporting period.

Crypto Market Liquidation. (Source: Coinglass)

Crypto Market Liquidation. (Source: Coinglass)Bitcoin traders bore the brunt of the downturn, losing much than $80 million, with much than 60% of these losses attributed to agelong positions. The astir important idiosyncratic liquidation was a $5 cardinal wager connected BTC’s terms summation connected Bybit.

Similarly, Ethereum speculators faced full liquidations of astir $70 million, with the bulk of losses—approximately $60 million—stemming from traders betting connected ETH terms increases.

Traders holding positions successful different large integer currencies besides experienced important losses, with Solana, XRP, Dogecoin, and Ordinal seeing liquidations of $16 million, $4 million, $5 million, and $6 million, respectively.

Examining exchanges, Binance, the largest cryptocurrency speech by trading volume, saw traders collectively suffer $98 million, portion OKX reported liquidations totaling $71 million. Other crypto platforms, including ByBit and HTX, witnessed a combined nonaccomplishment of $63.52 cardinal among their traders.

The station Bitcoin tumbles nether $39,000 triggering $115M liquidation successful 1 hour appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)