- BTC recorded its highest regular progressive code number connected 2 August.

- The caller summation successful web activity, surge successful loss-making transactions, and increasing antagonistic sentiment are each indicators of a short-term terms rally for Bitcoin.

The fig of regular progressive addresses that commercialized Bitcoin [BTC] has surged successful August, reaching a three-month precocious of 1.07 cardinal connected 2 August, information from Santiment showed. Still growing, the fig of addresses that person completed BTC transactions contiguous was 1.03 million.

📈 #Bitcoin's code enactment has surged to its highest level successful 3.5 months successful August. This inferior increase, combined with large nonaccomplishment transactions & antagonistic sentiment, is simply a beardown motion that a short-term (at minimum) $BTC terms bounce is much probable. https://t.co/5PzjYROX5T pic.twitter.com/G2tevAWdSM

— Santiment (@santimentfeed) August 3, 2023

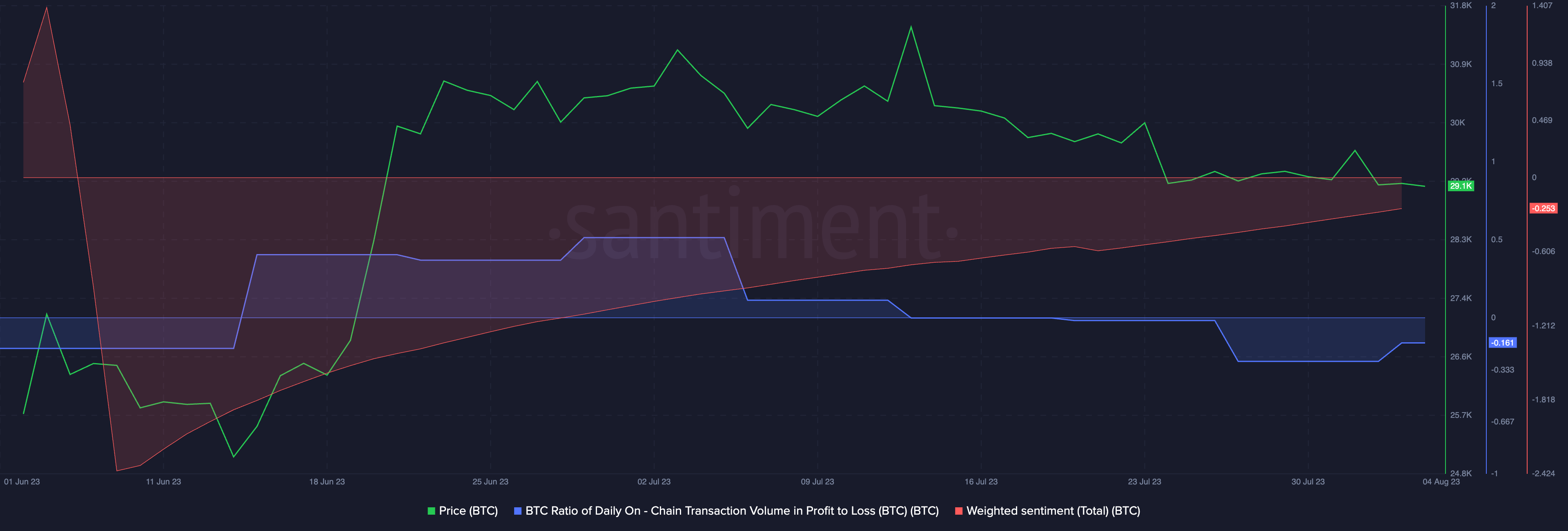

As the fig of regular progressive BTC addresses increases, the fig of transactions involving the cryptocurrency that has resulted successful losses has besides grown. An introspection of the coin’s ratio of regular on-chain transaction measurement successful nett to nonaccomplishment revealed this.

This indicator measures the worth of an asset’s transactions that instrumentality profits to the worth of its transactions resulting successful a nonaccomplishment wrong a azygous day. When the indicator logs an uptick and is supra the zero line, marketplace participants are making much profits than losses. Conversely, marketplace participants are signaling much losses erstwhile this metric returns a worth beneath zero.

BTC’s ratio of regular on-chain transaction measurement successful nett to nonaccomplishment was -0.161 astatine property time, suggesting that much BTC trades returned losses astatine the clip of writing.

Further, weighted sentiment remains antagonistic arsenic the coin continues to linger successful a constrictive terms range. Per Santiment, BTC’s weighted sentiment was -0.25 astatine property time.

Source: Santiment

Source: SantimentAccording to Santiment:

“This inferior increase, combined with large nonaccomplishment transactions & antagonistic sentiment, is simply a beardown motion that a short-term (at minimum) $BTC terms bounce is much probable.”

But is the king coin acceptable for specified a leap?

Finally, a crushed to smile?

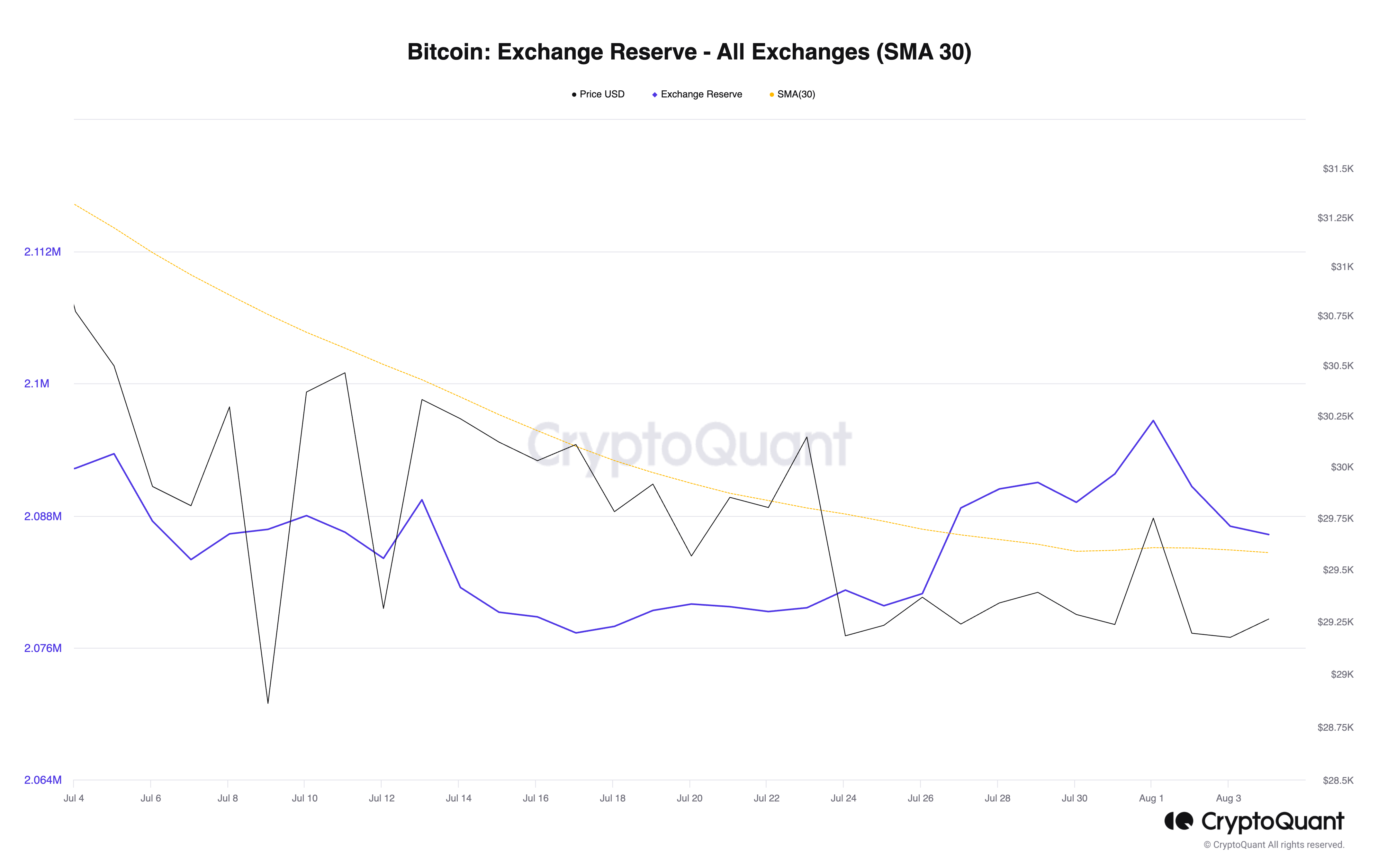

Despite facing beardown absorption astatine $30,000 and trading successful a choky scope for the past 2 months, BTC holders person been reluctant to merchantability their coins, according to an investigation of speech activity.

A look astatine its speech reserves connected a 30-day moving mean revealed a 1.4% diminution successful the past month. This metric tracks the full fig of BTCs held wrong cryptocurrency exchanges.

When the worth of BTC’s speech reserves rises, it indicates higher selling unit arsenic much coins are being forwarded to exchanges for onward sales. On the different hand, a diminution suggests a simplification successful BTC organisation and is often a precursor to a terms uptick.

Source: Santiment

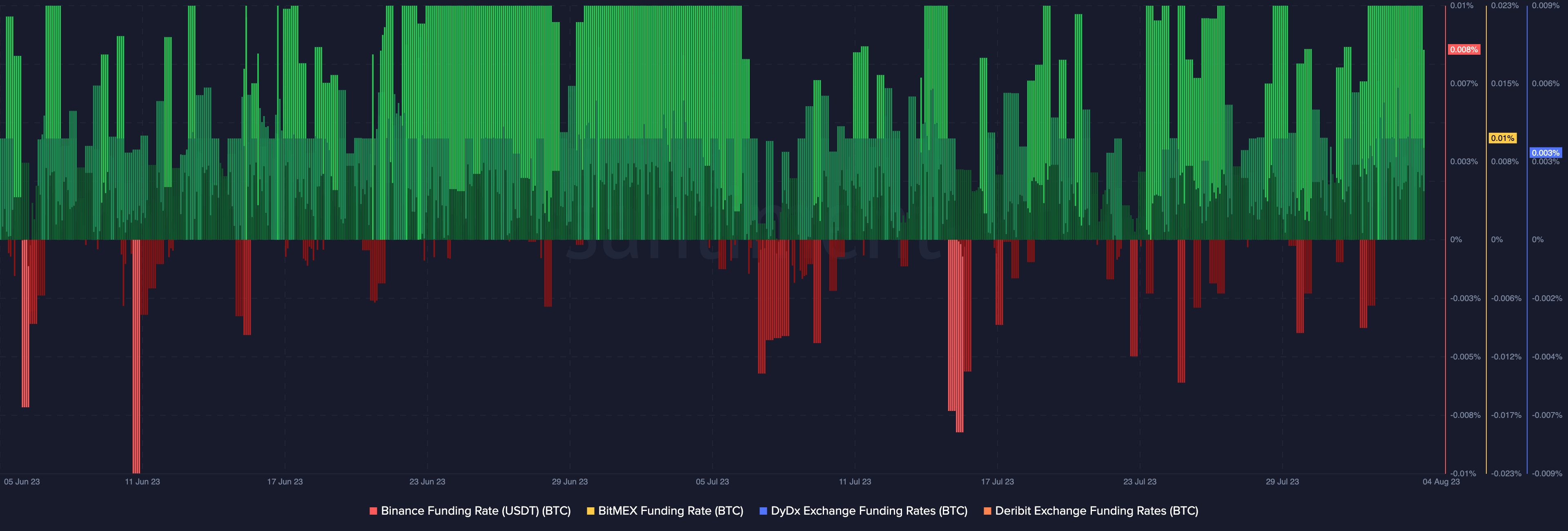

Source: SantimentIn summation the declining fig of BTC sell-offs, astir traders are betting connected a terms increase.. This is evident from the backing rates connected the futures marketplace crossed starring exchanges, which amusement that longs outnumber shorts. This is simply a affirmative sign, arsenic it suggests that galore traders judge that the terms of Bitcoin volition emergence successful the abbreviated term.

Source: Santiment

Source: SantimentWhile these on-chain indicators hint astatine a terms maturation successful the short-term, it remains important to wage attraction to macro factors that mightiness impact BTC’s terms negatively.

2 years ago

2 years ago

English (US)

English (US)