By Omkar Godbole (All times ET unless indicated otherwise)

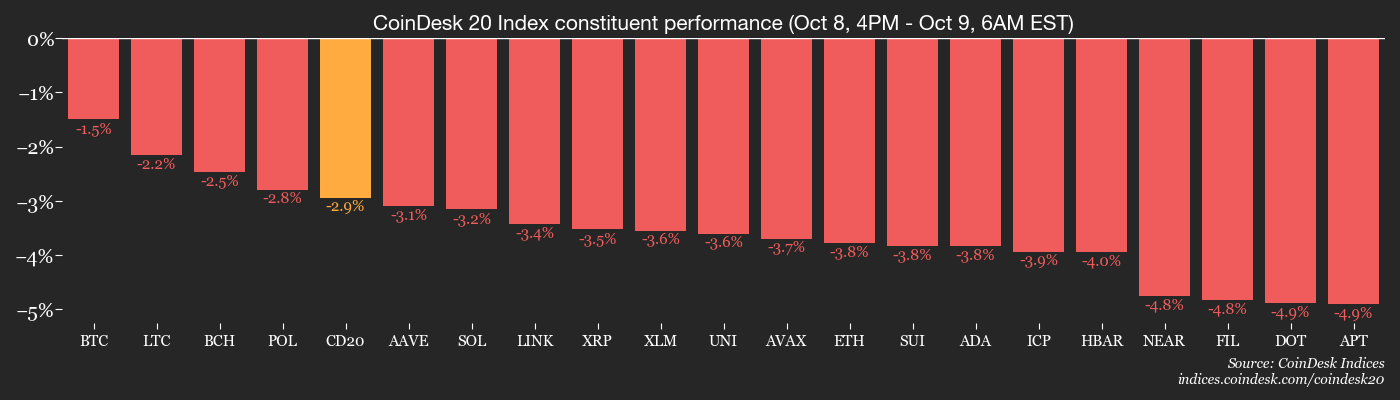

After a little rebound connected Wednesday, BTC and the broader crypto marketplace slipped backmost into the reddish connected Thursday — contempt the Fed minutes showing a bias towards much complaint cuts. The CoinDesk 20 Index (CD20) besides fell implicit 1% to 4,163 points.

What’s down the caller stumble? Much of it apt comes down to the dependable spot successful the dollar scale (DXY), which continues to dim the entreaty of USD-denominated assets, including crypto.

Meanwhile, the U.S. authorities shutdown drags on, leaving traders successful a holding signifier arsenic they anxiously await Fed Chair Jerome Powell’s code aboriginal Thursday for hints connected argumentation direction, particularly with caller jobs and ostentation information temporarily connected pause.

In planetary news, aboriginal Thursday brought a glimmer of anticipation arsenic President Trump announced a bid woody betwixt Israel and Hamas with imaginable hostage releases by Monday, confirmed by Qatar media. Still, lipid prices nudged somewhat supra $62, suggesting traders stay cautious astir the durability of the agreement.

On the crypto front, solana (SOL) integer plus treasury institution Helius disclosed plans to get astatine slightest 5% of Solana's supply, Coinbase launched decentralized speech (DEX) trading wrong its app for U.S. users (except successful New York), and Polymarket’s laminitis teased a imaginable motorboat of their autochthonal token, POLY.

Switching gears to accepted markets, golden held beardown supra $4,000, defying the dollar’s rally, portion S&P 500 futures hovered level adjacent grounds highs. Jamie Dimon, main enforcement of JP Morgan, told the BBC helium is “far much disquieted than others” astir the anticipation of a large banal marketplace driblet successful the coming months.

Stay alert!

What to Watch

For a much broad database of events this week, spot CoinDesk's "Crypto Week Ahead".

- Crypto

- Macro

- Oct. 9, 8 a.m.: Brazil Sept. header ostentation complaint YoY Est. 5.22%, MoM Est. 0.22%.

- Oct. 9, 8 a.m.: Mexico Sept. ostentation rate. Headline YoY Est. 3.79%, MoM Est. 0.27. Core YoY Est. 4.28%, MoM Est. 0.32%.

- Oct. 9, 8:30 a.m.: U.S. Jobless Claims. Initial ((for week ended Oct. 4) Est. 223K, Continuing (for week ended Sept. 27) Est. 1930K. (Report delayed owed to existent national authorities shutdown)

- Oct. 9, 8:30 a.m.: Fed Chair Jerome H. Powell delivers invited remarks astatine the Community Bank Conference, Washington, D.C. Watch live.

- Earnings (Estimates based connected FactSet data)

- Nothing scheduled.

Token Events

For a much broad database of events this week, spot CoinDesk's "Crypto Week Ahead".

- Governance votes & calls

- Decentraland DAO is voting to regenerate the DAO Committee with a 3-of-5 multisig of ecosystem representatives, shifting execution-only duties portion the Council retains oversight. Voting ends Oct. 10.

- Unlocks

- Oct. 10: Linea (LINEA) to unlock 6.57% of its circulating proviso worthy $27.9 million.

- Token Launches

- No large launches.

Conferences

For a much broad database of events this week, spot CoinDesk's "Crypto Week Ahead".

- Day 2 of 2: Digital Assets Week London 2025

- Day 2 of 2: Fintech Forward 2025 (Bahrain)

- Oct. 9: Hedgeweek’s Digital Assets Summit US 2025 (New York)

- Day 1 of 2: North American Blockchain Summit (Dallas)

Token Talk

By Oliver Knight

- Crypto speech Binance has introduced Meme Rush, a level designed for users to capitalize connected a question of Chinese-language memecoins.

- The level taps straight into the memecoin craze by embedding early-stage meme token curation and trading wrong its Wallet.

- It sources listings via assemblage motorboat hubs (for illustration Four.Meme connected BNB Chain), ranking by some on-chain measurement and societal traction, letting Binance seizure speculative involvement pre-DEX listing.

- Its built-in reward mechanics (4× Binance Alpha points) align idiosyncratic enactment with monetization. The roar successful Chinese-language memecoin projects connected BNB Chain is amplifying hype and driving attraction crossed the ecosystem.

- On PancakeSwap v2, regular trading measurement precocious deed $15.55 billion, according to CoinMarketCap, underscoring however progressive DEX memecoin markets remain.

- The bulk of measurement has taken spot connected lesser known memecoins similar 币安Holder, which racked up astir $1 cardinal successful measurement crossed 163,000 transactions.

Derivatives Positioning

- AVAX, ASTER, PUMP and XPL pb the diminution successful futures unfastened involvement successful the past 24 hours. OI successful BTC and ETH has dropped by 1% and 3%, respectively. These superior outflows apt stem from nett taking connected longs.

- OI successful USDT and USD-denominated BNB perpetuals listed connected large exchanges continues to hover beneath its September peak, diverging bearishly from the rising spot price.

- Annualized perpetual backing rates proceed to hover astatine oregon beneath 10% for astir large tokens, a motion that the marketplace remains steadfast without immoderate signs of froth.

- On the CME, positioning remains elevated successful ether futures comparative to bitcoin. OI successful SOL futures hovers astatine a grounds precocious supra 9 cardinal SOL, with premiums falling to 13%, the lowest since aboriginal September.

- On Deribit, the communicative remains the same: BTC, ETH puts proceed to commercialized astatine a premium to calls retired to the December extremity expiry. Block flows implicit Paradigm featured hazard reversals.

Market Movements

- BTC is down 0.84% from 4 p.m. ET Wednesday astatine $121,875.74 (24hrs: -0.87%)

- ETH is down 11.10% astatine $4,005.03 (24hrs: -3.5%)

- CoinDesk 20 is down 2.49% astatine 4,161.60 (24hrs: -1.63%)

- Ether CESR Composite Staking Rate is down 4 bps astatine 2.85%

- BTC backing complaint is astatine 0.0054% (5.9141% annualized) connected Binance

- DXY is unchanged astatine 98.90

- Gold futures are down 0.37% astatine $4,055.60

- Silver futures are down 0.45% astatine $48.78

- Nikkei 225 closed up 1.77% astatine 48,580.44

- Hang Seng closed down 0.29% astatine 26,752.59

- FTSE is down 0.45% astatine 9,506.23

- Euro Stoxx 50 is up 0.11% astatine 5,655.94

- DJIA closed connected Wednesday unchanged astatine 46,601.78

- S&P 500 closed up 0.58% astatine 6,753.72

- Nasdaq Composite closed up 1.12% astatine 23,043.38

- S&P/TSX Composite closed up 0.5% astatine 30,501.99

- S&P 40 Latin America closed up 1.17% astatine 2,873.25

- U.S. 10-Year Treasury complaint is down 0.2 bps astatine 4.129%

- E-mini S&P 500 futures are unchanged astatine 6,801.00

- E-mini Nasdaq-100 futures are unchanged astatine 25,324.25

- E-mini Dow Jones Industrial Average Index are unchanged astatine 46,887.00

Bitcoin Stats

- BTC Dominance: 59.38% (0.63%)

- Ether to bitcoin ratio: 0.03568 (-2.78%)

- Hashrate (seven-day moving average): 1,011 EH/s

- Hashprice (spot): $50.97

- Total Fees: 3.37 BTC / $414,551

- CME Futures Open Interest: 146,530 BTC

- BTC priced successful gold: 30 oz

- BTC vs golden marketplace cap: 8.47%

Technical Analysis

- Ether has dropped to $4,350 from $4,750 successful 2 days, invalidating the bullish breakout from the emblem pattern.

- The failed breakout indicates that sellers person regained control, and the pullback could deepen successful the coming days.

- The stochastic has turned sharply little from supra 80 oregon overbought reading, confirming the bearish case.

Crypto Equities

- Coinbase Global (COIN): closed connected Wednesday astatine $387.27 (+3.06%), -1.6% astatine $381.07

- Circle Internet (CRCL): closed astatine $150.46 (+1.17%), -1.12% astatine $148.77

- Galaxy Digital (GLXY): closed astatine $41.39 (+4.57%), -0.8% astatine $41.06

- Bullish (BLSH): closed astatine $67.41 (+3.55%), -1.5% astatine $66.40

- MARA Holdings (MARA): closed astatine $20.2 (-0.25%), -0.89% astatine $20.02

- Riot Platforms (RIOT): closed astatine $21.99 (+2.42%), -1% astatine $21.77

- Core Scientific (CORZ): closed astatine $17.53 (+2.51%), -0.11% astatine $17.51

- CleanSpark (CLSK): closed astatine $18.98 (+5.68%), +0.47% astatine $19.07

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $55.38 (+3.75%), unchanged successful pre-market

- Exodus Movement (EXOD): closed astatine $30.07 (+1.21%)

Crypto Treasury Companies

- Strategy (MSTR): closed astatine $330.8 (+0.73%), -1.69% astatine $325.21

- Semler Scientific (SMLR): closed astatine $28.2 (-0.56%), +0.39% astatine $28.31

- SharpLink Gaming (SBET): closed astatine $17.57 (-1.13%), -2.39% astatine $17.15

- Upexi (UPXI): closed astatine $7.17 (+1.7%), -3.07% astatine $6.95

- Lite Strategy (LITS): closed astatine $2.5 (+2.04%)

ETF Flows

Spot BTC ETFs

- Daily nett flow: $440.7 million

- Cumulative nett flows: $62.53 billion

- Total BTC holdings ~ 1.35 million

Spot ETH ETFs

- Daily nett flow: $69.1 million

- Cumulative nett flows: $15.11 billion

- Total ETH holdings ~ 6.88 million

Source: Farside Investors

While You Were Sleeping

- Bitcoin Crash Off the Table arsenic Four-Year Cycle is Dead: Arthur Hayes (CoinDesk): The Maelstrom CIO says bitcoin’s accustomed post-halving slump won’t materialize, arguing casual planetary monetary argumentation nether Trump and others volition widen the bull marketplace beyond its accepted cycle.

- Ethereum Foundation Expands Privacy Push With Dedicated Research Cluster (CoinDesk): The inaugural centralizes Ethereum’s privateness enactment connected zero-knowledge payments, individuality and endeavor tools, aiming to marque backstage blockchain enactment secure, compliant, and accessible to mainstream users.

- Citi Backs Stablecoin Firm BVNK As Wall Street Warms to Crypto (CNBC): Citi’s task limb invested successful BVNK, whose exertion enables cross-border payments utilizing stablecoins, arsenic U.S. banks unreserved to follow regulated integer wealth infrastructure nether the GENIUS Act.

- Bank of France Urges Direct European Oversight of Crypto Firms (Bloomberg): Governor Francois Villeroy de Galhau urged EU authorities to adjacent regulatory gaps by tightening stablecoin passporting and granting the European Securities and Markets Authority supervisory power implicit ample crypto firms.

- Crypto Helped Get Trump Elected. Now It’s Wooing UK’s Farage (Bloomberg): The propulsion to align with Reform UK reflects heavy manufacture vexation implicit dilatory crypto regularisation nether Labour and increasing willingness to instrumentality governmental risks for friendlier policies.

3 months ago

3 months ago

English (US)

English (US)