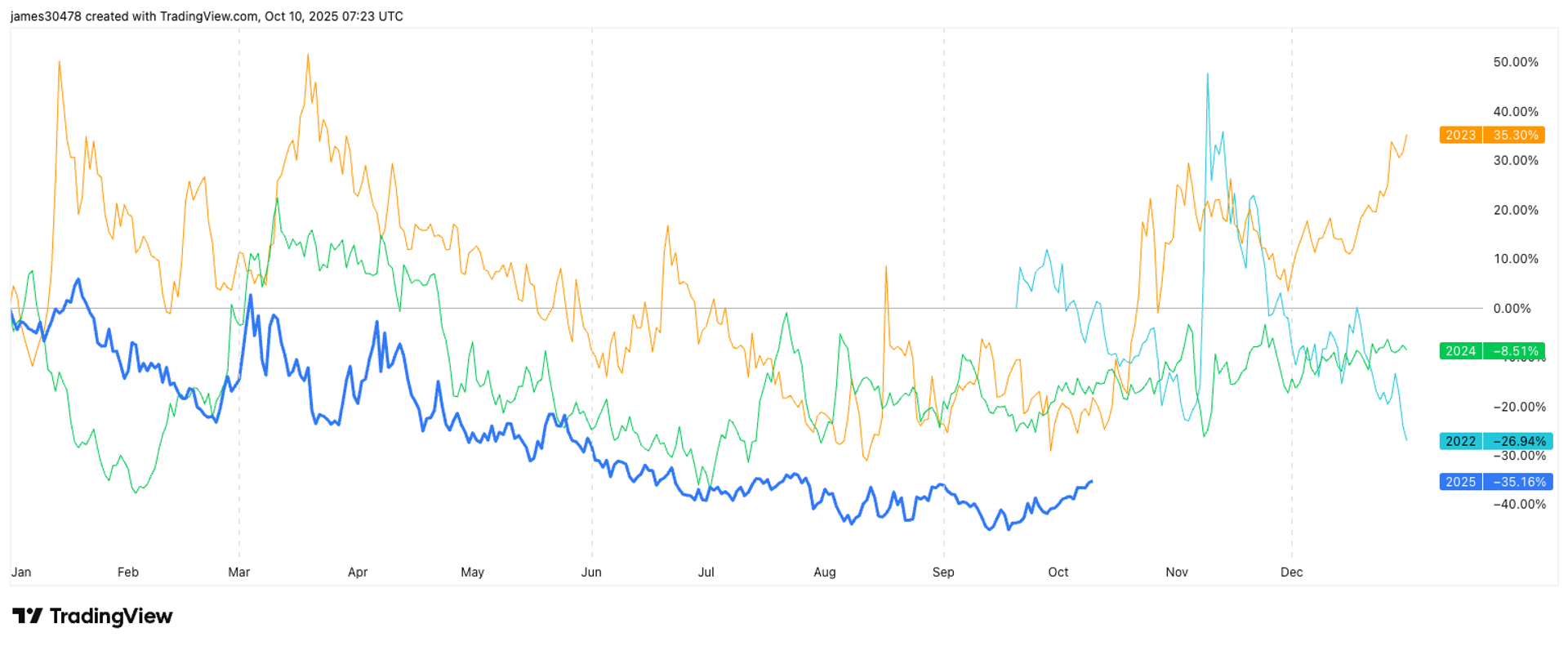

This is simply a regular investigation by CoinDesk expert and Chartered Market Technician Omkar Godbole.

Bitcoin (BTC) whitethorn not person rallied connected Friday's dismal jobs data, which strengthened the Federal Reserve’s complaint cuts, but each anticipation is not lost.

A shorter-duration illustration reveals that BTC is forming a bullish inverse head-and-shoulders signifier – a classical reversal setup – suggesting a imaginable surge toward $120,000.

An inverse Head and Shoulders (H&S) is simply a bullish reversal signifier characterized by 3 troughs: a deeper cardinal trough (the "head") flanked by 2 smaller but astir adjacent troughs (the "shoulders"). The signifier includes a neckline, which is simply a horizontal trendline connecting the peaks of terms recoveries betwixt the troughs.

A decisive breakout supra this neckline confirms the reversal from a downtrend to an uptrend. The resulting rally is typically expected to beryllium astir adjacent successful tallness to the region betwixt the deepest trough (head) and the neckline.

As of writing, BTC looked to beryllium forming the close enarthrosis of the inverted H&S pattern, with the neckline absorption astatine $113,378. A determination supra that would trigger the bullish breakout, opening the doorway for a rally to astir $120,000.

The signifier would beryllium invalidated successful lawsuit of a determination beneath $107,300, reinforcing the bearish setup connected the regular chart. In that case, the absorption would displacement to the 200-day elemental moving mean enactment adjacent $101,850.

Read: Bitcoin Stays Below $112K After Tough Jobs Report and Fed Cut Bets.

1 month ago

1 month ago

English (US)

English (US)