Bitcoin (BTC) disappointed bulls connected upside anterior to the May 26 Wall Street unfastened arsenic BTC/USD returned nether $29,000.

BTC/USD 1-hour candle illustration (Bitstamp). Source: TradingView

BTC/USD 1-hour candle illustration (Bitstamp). Source: TradingViewMarkets "eerily calm" station FOMC

Data from Cointelegraph Markets Pro and TradingView tracked an uninspiring time for Bitcoin, with $800 of losses coming successful a azygous hourly candle respective hours earlier the commencement of trading.

The largest cryptocurrency had avoided volatility connected the merchandise of minutes from the United States Federal Reserve's Federal Open Markets Committee (FOMC).

These had avoided immoderate superior divergence from already known facts astir economical policy, and contempt concerns anti-inflation measures could pb to a recession, nary notation of the connection "recession" appeared successful the minutes.

Even bequest markets remained comparatively cool, with expert Dylan LeClair describing the concern arsenic "eerily calm" based connected volatility data.

Cointelegraph contributor Michaël van de Poppe, who connected May 25 had predicted a determination towards $32,800 for BTC/USD, reiterated that a breakout from its existent trading portion was "coming comparatively soon."

Breakout is coming comparatively soon for #Bitcoin and if we harvester that with FA, past we tin intelligibly presume that;

- Jobless claims

- PCE ostentation

Are going to beryllium the trigger. If ostentation slows down oregon jobless claims are fine, the FED mightiness beryllium slowing down the policy. pic.twitter.com/WCEgQhMvXm

For the meantime, however, on-chain signals meant that determination was apt nary impetus for important terms changes, according to chap trader and analyst, Rekt Capital.

Analyzing on-chain volumes, it became wide that neither buyers nor sellers were prepared to marque a bold connection astatine existent levels.

"Previous periods of precocious sell-side BTC measurement preceded periods wherever purchaser measurement started trickling successful in the pursuing weeks. But now, we're seeing that a) seller measurement is declining implicit time. And b) nary $BTC purchaser measurement has travel successful pursuing the precocious seller volume," helium explained to Twitter followers connected the day.

BTC/USD 1-week annotated chart. Source: Rekt Capital/ Twitter

BTC/USD 1-week annotated chart. Source: Rekt Capital/ TwitterAs Cointelegraph reported, NVT Golden Cross, a semipermanent metric designed to drawback terms tops and bottoms utilizing volume, flashed reddish this week arsenic it appeared that on-chain transactions were not important capable to enactment adjacent $30,000 levels.

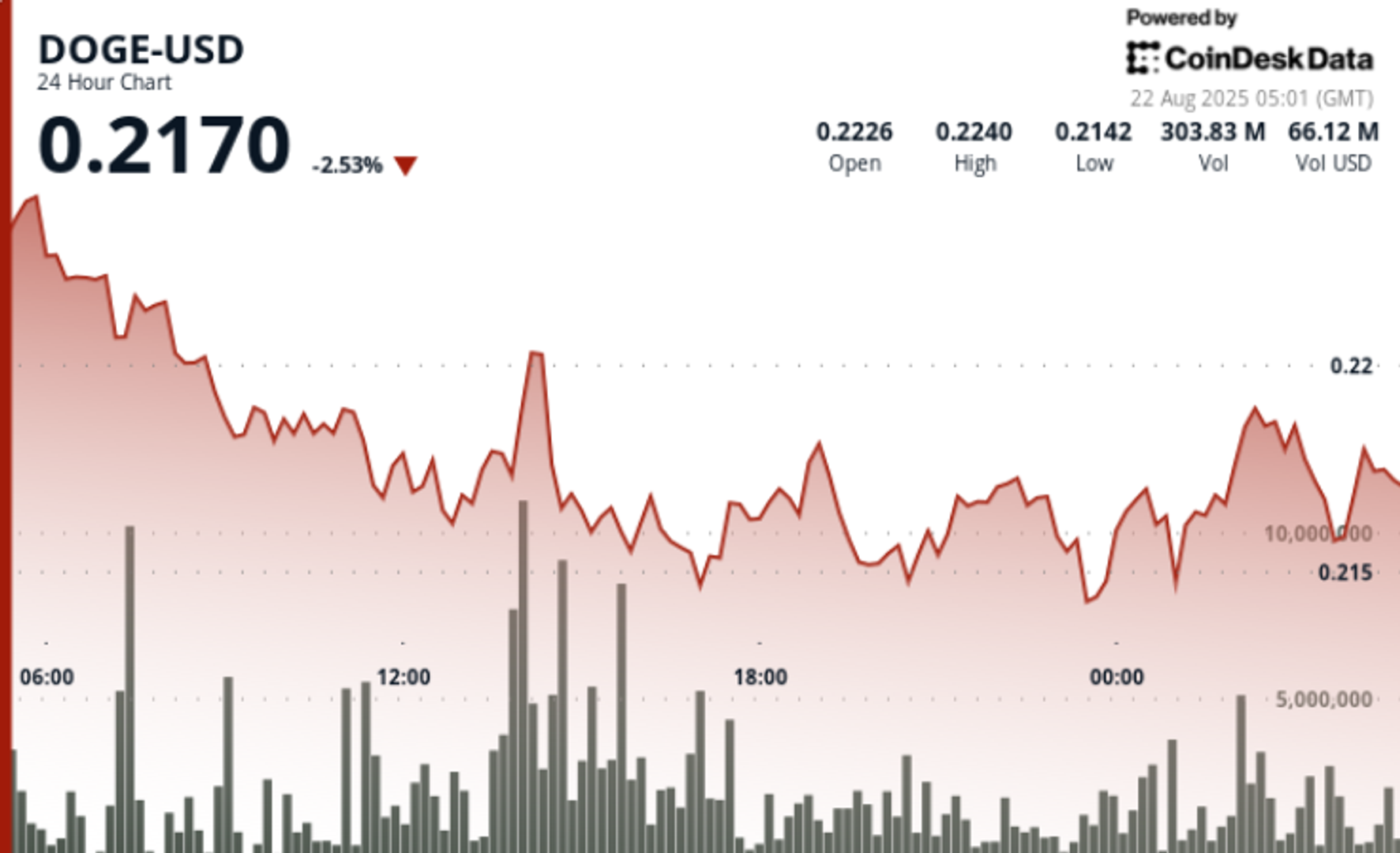

Dogecoin targets caller yearly lows successful altcoin rout

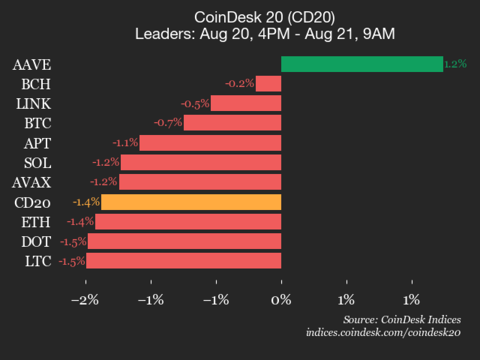

Altcoins presented a mixed container connected the day, with Ether (ETH) noticeably among the weakest of the large headdress tokens.

With the objection of the May 12 wick, ETH/USD traded astatine its lowest successful 10 months connected May 26, hitting $1,815 connected Bitstamp.

"The question volition beryllium whether we tin bounce from present and interruption the $1,940 level," Van de Poppe said.

"If that happens, I'm assuming we'll proceed $2,050. If it doesn't, past the markets are looking astatine <$1,800 probably." ETH/USD 1-day candle illustration (Binance). Source: TradingView

ETH/USD 1-day candle illustration (Binance). Source: TradingViewSolana's (SOL) regular losses meantime approached 10%, portion Dogecoin (DOGE) was astatine it lowest levels since April 2021.

DOGE/USD 1-week candle illustration (Binance). Source: TradingView

DOGE/USD 1-week candle illustration (Binance). Source: TradingViewThe views and opinions expressed present are solely those of the writer and bash not needfully bespeak the views of Cointelegraph.com. Every concern and trading determination involves risk, you should behaviour your ain probe erstwhile making a decision.

3 years ago

3 years ago

English (US)

English (US)