Dogecoin rallied connected Tuesday aft a drawstring of regulatory and firm catalysts shifted sentiment crossed the crypto sector. A $50 cardinal Trump-linked acquisition of a DOGE mining firm, Wyoming’s motorboat of a state-backed stablecoin, and comments from Federal Reserve officials signaling a softer stance connected integer assets each converged to trigger caller organization flows.

News Background

• Thumzup, a Trump-affiliated entity, acquired Dogehash for $50 million, creating what executives described arsenic the largest DOGE mining operation. The woody signals deep-pocketed assurance successful Dogecoin infrastructure.

• Wyoming unveiled the Frontier Stable Token, the archetypal government-backed authorities stablecoin, reinforcing the U.S. regulatory pivot toward integer assets.

• Fed Vice Chair Michelle Bowman warned banks astir competitory risks from delaying integer plus adoption, signaling a much crypto-accommodative posture.

• SoFi Technologies integrated Bitcoin’s Lightning Network, targeting the $740 cardinal remittance marketplace — different awesome of accepted concern edging deeper into crypto rails.

Price Action Summary

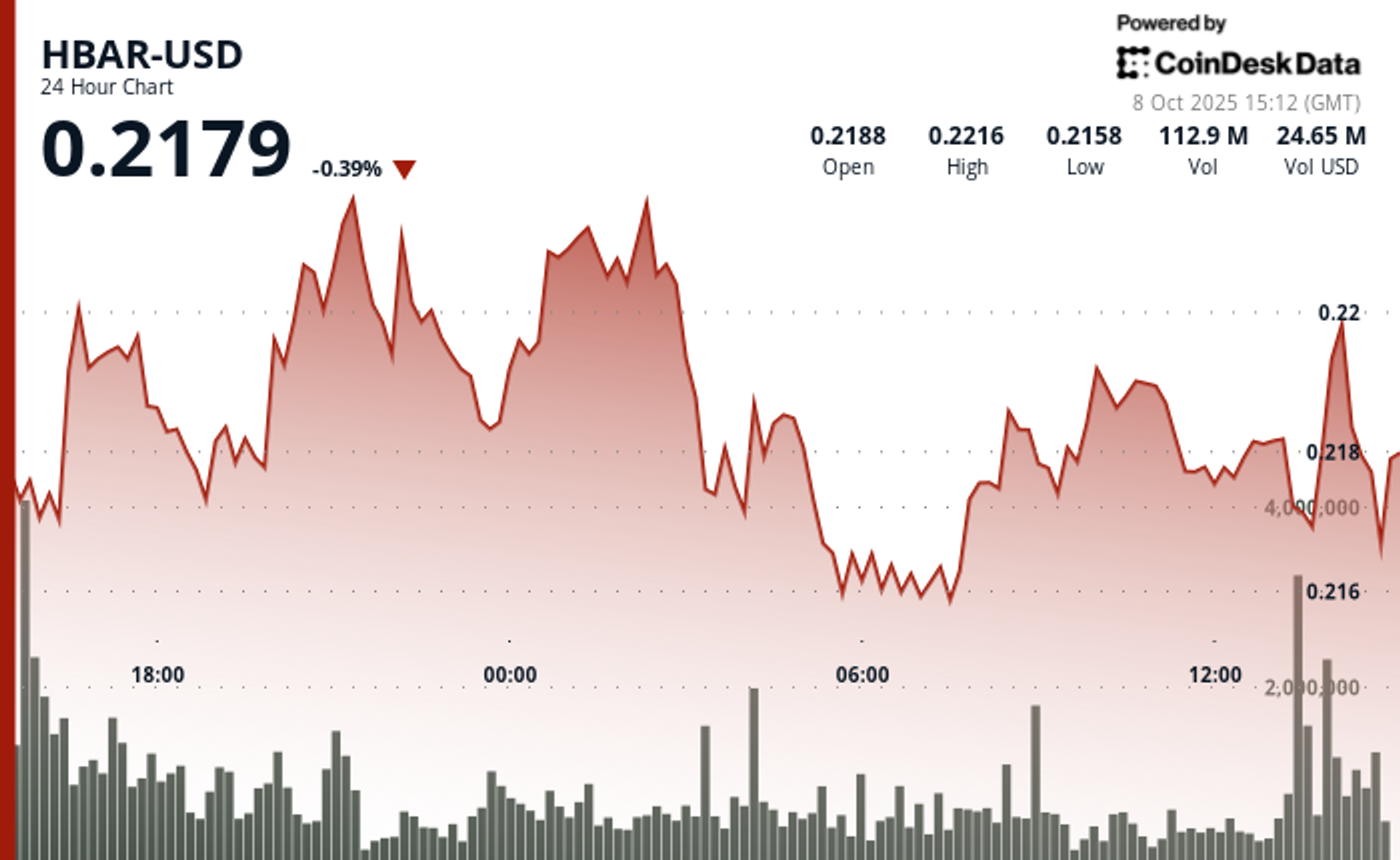

• DOGE traded successful a $0.01 set from $0.21 to $0.22 betwixt Aug. 20 15:00 and Aug. 21 14:00, marking ~4–5% intraday volatility.

• The token rallied 5% from $0.21 to $0.22 during the Aug. 20 evening session, establishing $0.22 arsenic near-term resistance.

• A late-session 60-minute model (Aug. 21 13:22–14:21) saw DOGE surge 1% from $0.22 to $0.22 with measurement spikes supra 61.8 million, confirming organization activity.

• Support consistently held successful the $0.21–$0.22 portion with bounces connected 320–380 cardinal measurement crossed cardinal investigating points.

Technical Analysis

• Support: $0.21–$0.22 established arsenic reliable level with repeated high-volume retests.

• Resistance: $0.22 cardinal pivot cleared, but bulls request follow-through toward $0.225 to corroborate breakout.

• Volume: Peak surges of 61.8 cardinal and 378.6 cardinal corroborate organization buying interest.

• Pattern: Classic consolidation followed by impulsive breakout; upward trajectory if enactment basal holds.

• Futures OI: Stable astir $3 billion, reflecting sustained leveraged involvement contempt macro volatility.

What Traders Are Watching

• Whether DOGE tin prolong supra the $0.22 pivot and propulsion toward $0.225–$0.23 resistance.

• The market’s absorption to Fed argumentation shifts and Wyoming’s stablecoin motorboat — imaginable sector-wide tailwind.

• Whale accumulation patterns, already totaling 2 cardinal DOGE ($500M) this week.

• Mining assemblage enlargement via Thumzup’s acquisition and its interaction connected DOGE’s hashpower distribution.

1 month ago

1 month ago

English (US)

English (US)