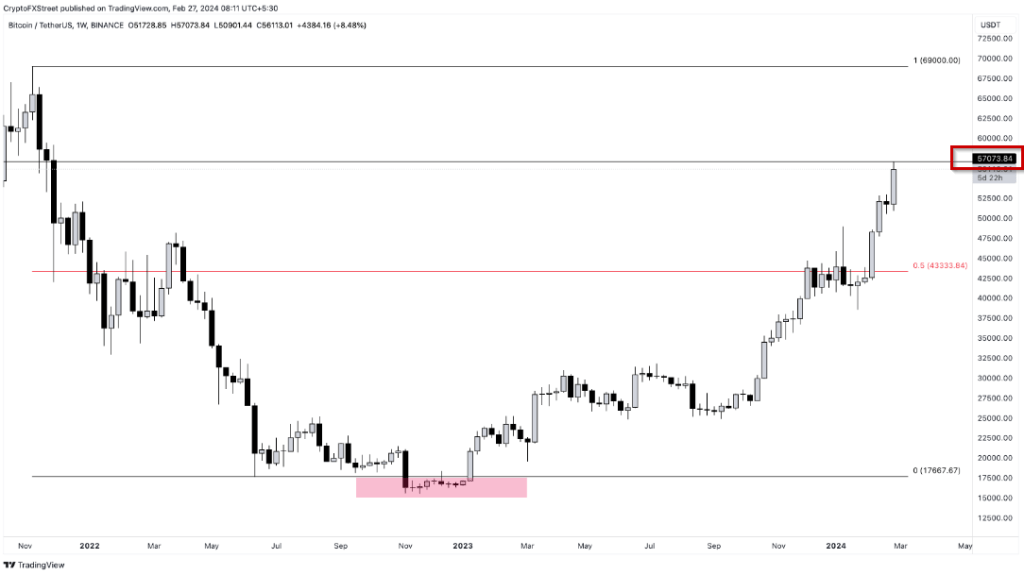

In a not-so unexpected crook of events, Bitcoin (BTC) has surged to caller heights, breaking the $57,000 barrier during the aboriginal hours of Tuesday successful the Asian market. This terms level, not seen since November 2021, marks a important resurgence for the starring cryptocurrency.

Bitcoin ETFs Experience Unprecedented Activity

Remarkably, the surge successful Bitcoin’s price has triggered important enactment successful US-based spot Bitcoin ETFs, excluding Grayscale’s GBTC. According to Bloomberg, these ETFs recorded a record-high $2.4 cardinal successful trading measurement connected Monday. This surge successful trading enactment underscores the expanding involvement and engagement of organization investors successful the cryptocurrency market.

As of the clip of publication, bitcoin had somewhat decreased to $56,437, but it was inactive up astir 10% from the erstwhile day. Since the opening of the year, the terms of bitcoin has risen by much than 30%, continuing a protracted surge that has besides spurred involvement successful smaller currencies similar Ether and Solana, among speculators.

The request for Bitcoin is not confined to spot trading alone; a important influx of astir $5.6 cardinal has poured into precocious launched Bitcoin ETFs successful the US, which began trading connected January 11. This influx of concern signals a broadening involvement successful Bitcoin, extending beyond the accepted basal of integer plus enthusiasts.

It’s official..the New Nine Bitcoin ETFs person breached each clip measurement grounds contiguous with $2.4b, conscionable hardly beating Day One but astir treble their caller regular average. $IBIT went chaotic accounting for $1.3b of it, breaking its grounds by astir 30%. pic.twitter.com/MiCs1rzttM

— Eric Balchunas (@EricBalchunas) February 26, 2024

Bitcoin’s Rally Outshines Traditional Assets

Surprisingly, Bitcoin’s rally this twelvemonth has outpaced accepted assets specified arsenic stocks and gold. The ratio comparing Bitcoin’s terms to that of the precious metallic has reached its highest level successful implicit 2 years, indicating a shifting penchant among investors towards integer assets.

The wide worth of integer assets, including assorted cryptocurrencies, present stands astatine a staggering $2.2 trillion, a important summation from the lows experienced during the carnivore marketplace of 2022 erstwhile the marketplace worth dipped to astir $820 billion. This resurgence demonstrates the resilience and increasing prominence of integer assets successful the fiscal landscape.

Contrary Market Indicators Fail To Deter Crypto Momentum

In an intriguing development, contempt a emergence successful US Treasury yields, which typically signals expectations for tighter monetary policy, the bullish momentum successful the cryptocurrency marketplace remains resilient. Digital tokens similar Bitcoin are experiencing notable upward movements, defying accepted marketplace indicators.

Fundstrat Global Advisors’ Head of Digital-Asset Strategy, Sean Farrell, noted successful a caller connection that the “bullish momentum successful crypto is unfolding contempt an uptick successful rates,” highlighting the unsocial dynamics influencing the cryptocurrency market.

MicroStrategy Boosts Corporate Bitcoin Holdings

In the midst of this ongoing rally, MicroStrategy, a notable endeavor bundle steadfast recognized for incorporating Bitcoin into its firm strategy, has announced a important summation to its cryptocurrency holdings.

The institution revealed that it had purchased an further 3,000 Bitcoin tokens this month, bringing its full Bitcoin holdings to astir $10 billion. This strategical determination by MicroStrategy highlights the increasing acceptance of cryptocurrencies arsenic a invaluable plus by firm entities.

Featured representation from, illustration from TradingView

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)