Wall Street banking and probe steadfast Compass Point has initiated sum of crypto level Bullish (BLSH), the genitor institution of CoinDesk, with a neutral standing and a $45 terms target.

Despite a content that Bullish’s little interest operation could assistance it spot distant astatine Coinbase’s (COIN) U.S. marketplace stock successful the future, the expert Ed Engel cited concerns astir the timing arsenic good arsenic the stock's valuation.

“We person a hard clip seeing Bullish entering U.S. markets until Congress passes marketplace operation authorities (i.e. the CLARITY Act),” Engel wrote. The CLARITY ACT, a measure aiming to clarify jurisdiction betwixt the CFTC and SEC, however, mightiness not beryllium passed until the archetypal fractional of 2026.

Even then, New York’s notoriously strict BitLicense authorities could airs a hurdle, according to Engel. Regulators whitethorn beryllium wary of Bullish’s model, which allows the institution to enactment arsenic its ain marketplace shaper via its automated marketplace shaper (AMM) — a setup that could rise conflict-of-interest concerns, helium said.

“We deliberation determination could beryllium a amended buying accidental wrong 1-2 quarters,” wrote Engel, pointing to the stock’s existent 110x aggregate connected 2026 projected EBITDA.

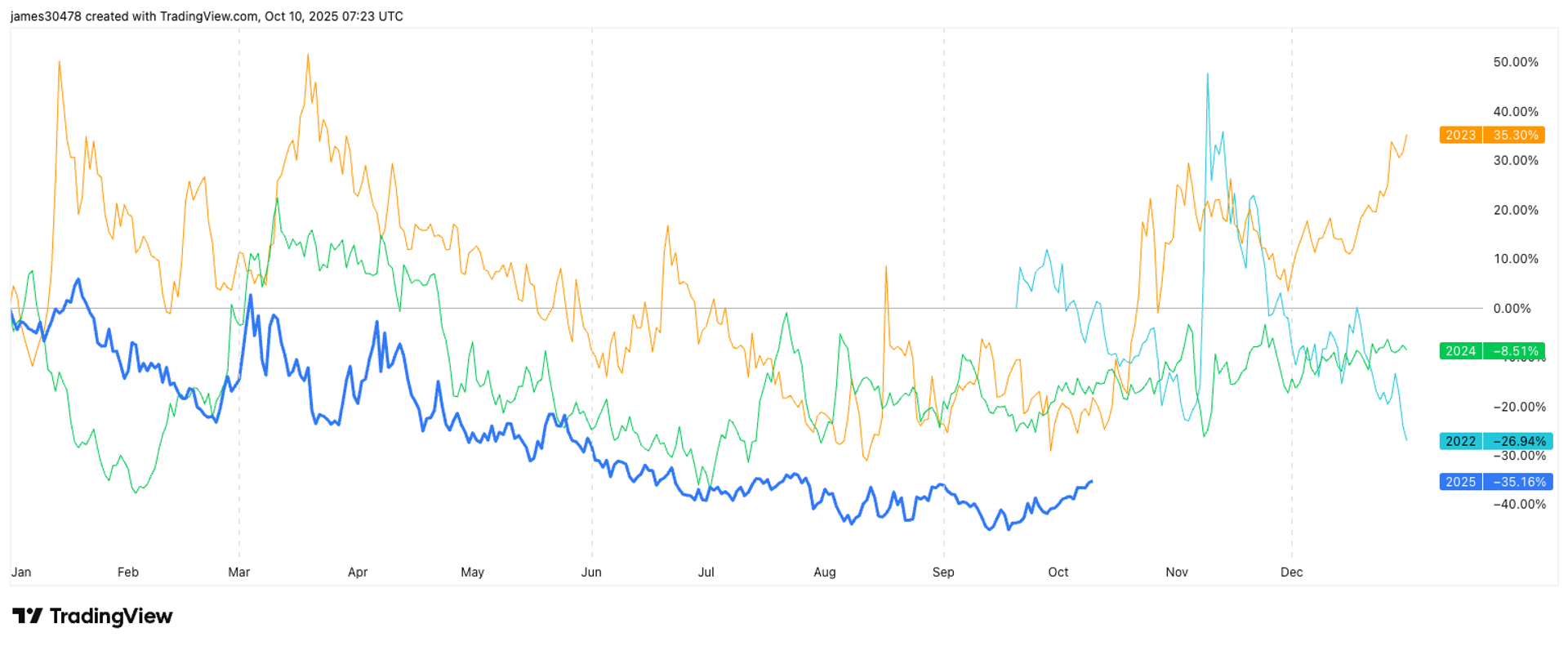

Bullish besides holds a $2.7 cardinal crypto treasury, mostly successful bitcoin (BTC), which ties the stock’s show intimately to BTC terms swings. That tin beryllium a double-edged sword, said Engel, reminding of bitcoin's notorious volatility.

Engel’s $45 people assumes bitcoin hits $160,000 and includes a 50% probability that Bullish volition interruption into the U.S. market. That imaginable enlargement unsocial could adhd an estimated $12 per stock successful value, according to Engel.

Bullish went nationalist successful August astatine $37 per stock and changeable sharply higher earlier closing astatine $68 connected its opening day.

Shares were down 4.6% Wednesday to $59.20.

1 month ago

1 month ago

English (US)

English (US)