On Dec. 23, 2022, Matthew Russell Lee from the Inner City Press published the precocious unsealed blameworthy plea transcript of Caroline Ellison, Alameda Research’s erstwhile CEO. In her statements, Ellison describes that she was the co-CEO and CEO of Alameda, and nether those roles, she reported straight to the erstwhile FTX CEO Sam Bankman-Fried (SBF). The ex-Alameda CEO’s grounds details that she was afloat alert from 2019 to 2022, that Alameda Research had entree to a peculiar borrowing installation that allowed the institution to support an unlimited enactment of recognition with zero collateral. The ‘borrowing facility,’ according to Ellison, was FTX’s lawsuit funds.

Caroline Ellison Details FTX’s Misconduct With Alameda and the Co-Mingling of Customer Funds Started From the Very Beginning

Following the unsealing of Caroline Ellison’s plea deal, Inner City Press newsman Matthew Russell Lee published a tweet storm that featured screenshots of Ellison’s unsealed blameworthy plea transcript. Russell Lee said that the plea arraignment was “held successful secret, and not docketed until today, erstwhile Bankman-Fried was freed connected $250 [million] bond.” If Ellison’s grounds is true, the papers highlights a fig of infractions some FTX and Alameda executives partook successful since 2019.

“From 2019 to 2022, I was alert that Alameda was provided entree to a borrowing installation connected FTX.com, the cryptocurrency speech tally by Mr. Bankman-Fried. I understood that executives had implemented peculiar settings connected Alameda’s FTX.com relationship that permitted Alameda to support antagonistic balances successful fiat currencies and cryptocurrencies,” Ellison’s grounds details. “In applicable terms, this statement permitted Alameda entree to an unlimited enactment of recognition without being required to station collateral, without having to wage involvement connected antagonistic balances, and without being taxable to borderline calls oregon FTX.com’s liquidation protocols,” the ex-Alameda CEO added.

Ellison’s relationship of the concern continued:

I understood that if Alameda had important antagonistic balances successful a peculiar currency, it meant that Alameda was borrowing funds that customers had deposited connected the exchange.

Ellison Understood FTX Customer Funds Were Used to ‘Finance FTX’s Loans to Alameda,’ Ex-Alameda CEO Is ‘Truly Sorry’ for What She Did

Ellison was alert that galore of Alameda’s investments were illiquid, and she said she afloat agreed to get funds from FTX’s coffers. “While I was co-CEO and past CEO, I understood that Alameda had galore ample illiquid investments and had lent a batch of wealth to Mr. Bankman-Fried and different FTX executives,” Ellison’s grounds explains. “I besides understood that Alameda had financed the investments with short-term and open-term loans worthy respective cardinal dollars from outer lenders successful the cryptocurrency industry. In oregon astir June 2022, I agreed to get respective cardinal dollars from FTX to repay those loans. I understood that FTX would request to usage lawsuit funds to concern its loans to Alameda.”

Ellison further added:

I besides understood that galore FTX customers invested successful crypto derivatives and that astir FTX customers did not expect that FTX would lend retired their integer plus holdings and fiat currency deposits to Alameda successful this fashion.

Furthermore, Ellison said successful oregon astir July 2022 to October 2022, she agreed with SBF to “provide materially misleading fiscal statements to Alameda’s lenders.” Ellison said that the squad served lenders botched quarterly reports that obfuscated “the grade of Alameda’s borrowing.” The ex-Alameda CEO besides elaborated that she was alert that FTX’s equity investors were kept successful the acheronian astir the quality of FTX’s and Alameda’s co-mingled relationship. “I agreed with Mr. Bankman-Fried and others not to publically disclose the existent quality of the narration betwixt Alameda and FTX, including Alameda’s recognition arrangement. I besides understood that Mr. Bankman-Fried and others concealed the root and quality of those funds,” Ellison’s relationship of the concern details.

Caroline Ellison is simply a Stanford postgraduate who graduated successful 2016 with a bachelor’s grade successful mathematics. She past worked for the quantitative trading steadfast Jane Street earlier moving for Alameda Research. Ellison became an Alameda worker successful March 2018 and aft Sam Trabucco near successful August 2022, she became CEO. Ellison was fired from her presumption by John J. Ray III connected Nov. 11, 2022, erstwhile FTX filed for Chapter 11 bankruptcy protection.

Caroline Ellison is simply a Stanford postgraduate who graduated successful 2016 with a bachelor’s grade successful mathematics. She past worked for the quantitative trading steadfast Jane Street earlier moving for Alameda Research. Ellison became an Alameda worker successful March 2018 and aft Sam Trabucco near successful August 2022, she became CEO. Ellison was fired from her presumption by John J. Ray III connected Nov. 11, 2022, erstwhile FTX filed for Chapter 11 bankruptcy protection.According to SBF’s alleged ex-girlfriend, Ellison said she was precise atrocious for what she has done. At the extremity of her transcript, she apologizes a large woody for what she did. The grounds from Ellison is precise antithetic than that of SBF’s stories, erstwhile helium managed to bash a media tour for a period earlier helium was arrested and helium apologized a large deal. While SBF apologized a lot, helium ne'er admitted to doing immoderate wrongdoing successful presumption of fraud oregon committing immoderate fiscal misconduct. SBF further said that helium did not tally Alameda Research, and stressed that helium had small cognition of the trading firm’s concern dealings. Speaking virtually astatine the New York Times’ Dealbook Summit with Andrew Ross Sorkin, SBF insisted helium “didn’t knowingly co-mingle funds.”

As acold arsenic Alameda Research was concerned, SBF said:

I didn’t cognize the size of their position. I wasn’t moving Alameda — I didn’t cognize precisely what was going on.

Ellison’s unsealed grounds wholly contradicts SBF’s presumption during his media tour, and not lone does she apologize, she explains a fig of misdeeds she personally committed. “I americium genuinely atrocious for what I did,” Ellison concluded. “I knew that it was wrong. I privation to apologize for my actions to the affected customers of FTX, lenders to Alameda, and investors successful FTX. Since FTX and Alameda collapsed successful November 2022, I person worked hard to assistance with the betterment of assets for the payment of customers and to cooperate with the government’s investigation. I americium present contiguous to judge my work for my actions by pleading guilty.” When the justice asked Ellison if she knew what she did was illegal, she replied “yes.”

Billionaire Bill Ackman’s Recent FTX Twitter Thread Slammed

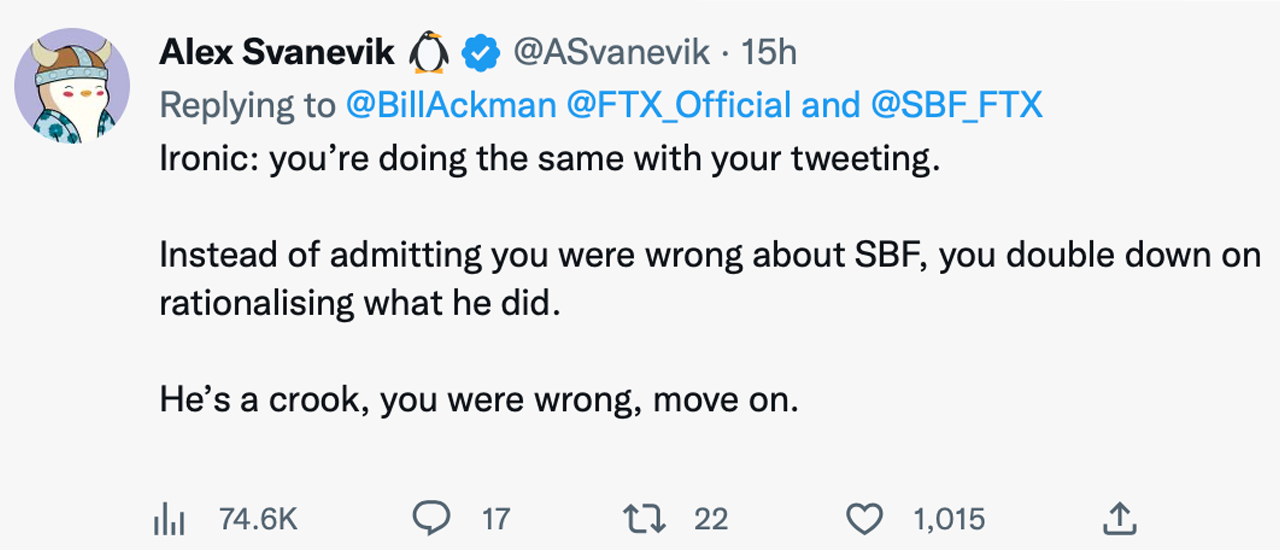

Interestingly, billionaire Bill Ackman tweeted astir SBF and cohorts the time anterior connected Dec. 22, and decided to picture the lawsuit arsenic a concern “failure.” “One that is “so frightening that they can’t admit it, and they bash anserine sh-t to debar the embarrassment and the travel down,” Ackman wrote. Ackman’s astir caller FTX Twitter thread wasn’t received good by a large bulk of commenters who told Ackman that SBF and FTX are being convicted of starting the fraud from the precise beginning. Ellison’s grounds adjacent notes that her peculiar Alameda attraction and the co-mingling of lawsuit funds began successful 2019.

Bitcoin proponent Nic Carter, for instance, replied to Ackman and said: “They were engaging successful fraud from time 1.” Coinshares enforcement Meltem Demirors besides responded to Ackman’s tweets and remarked: “They were depositing FTX lawsuit funds straight into Alameda’s slope relationship from time 1.” Ackman was reminded connected respective occasions successful the thread that possibly helium should work the SEC charges, earlier claiming that FTX was a “legitimate profitable speech started by an MIT grad with backing from apical VCs astatine a monolithic valuation.”

Tags successful this story

Alameda’s lenders, Bankman-Fried, Bill Ackman, billionaire Bill Ackman, Caroline Ellison, ceo, CFTC, Charges, Co-CEO, co-mingled relationship, Cooperation, Customer Money, FBI, federal court, Fraud Charges, ftx, FTX Bankruptcy, FTX collapse, FTX customers, Gary Wang, Inner City Press, Law Enforcement, Matthew Russell Lee, new york, NY, Sam Bankman-Fried, Sam Trabucco, sbf, SDNY, SEC, Unsealed Testimony

What bash you deliberation astir Caroline Ellison’s grounds and her broadside of the story? Let america cognize what you deliberation astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 6,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

2 years ago

2 years ago

English (US)

English (US)