"Hey bitcoin, Do Something!"

The viral meme — starring a instrumentality fig poking the crushed and depicting a request for absorption — mightiness conscionable sum up the existent country astatine integer assets trading desks during the slow, aboriginal summertime days.

Sure, bitcoin BTC conscionable deed caller caller highs and is inactive trading supra $100,000, but the P&L is diminishing regular for short-term volatility chasers.

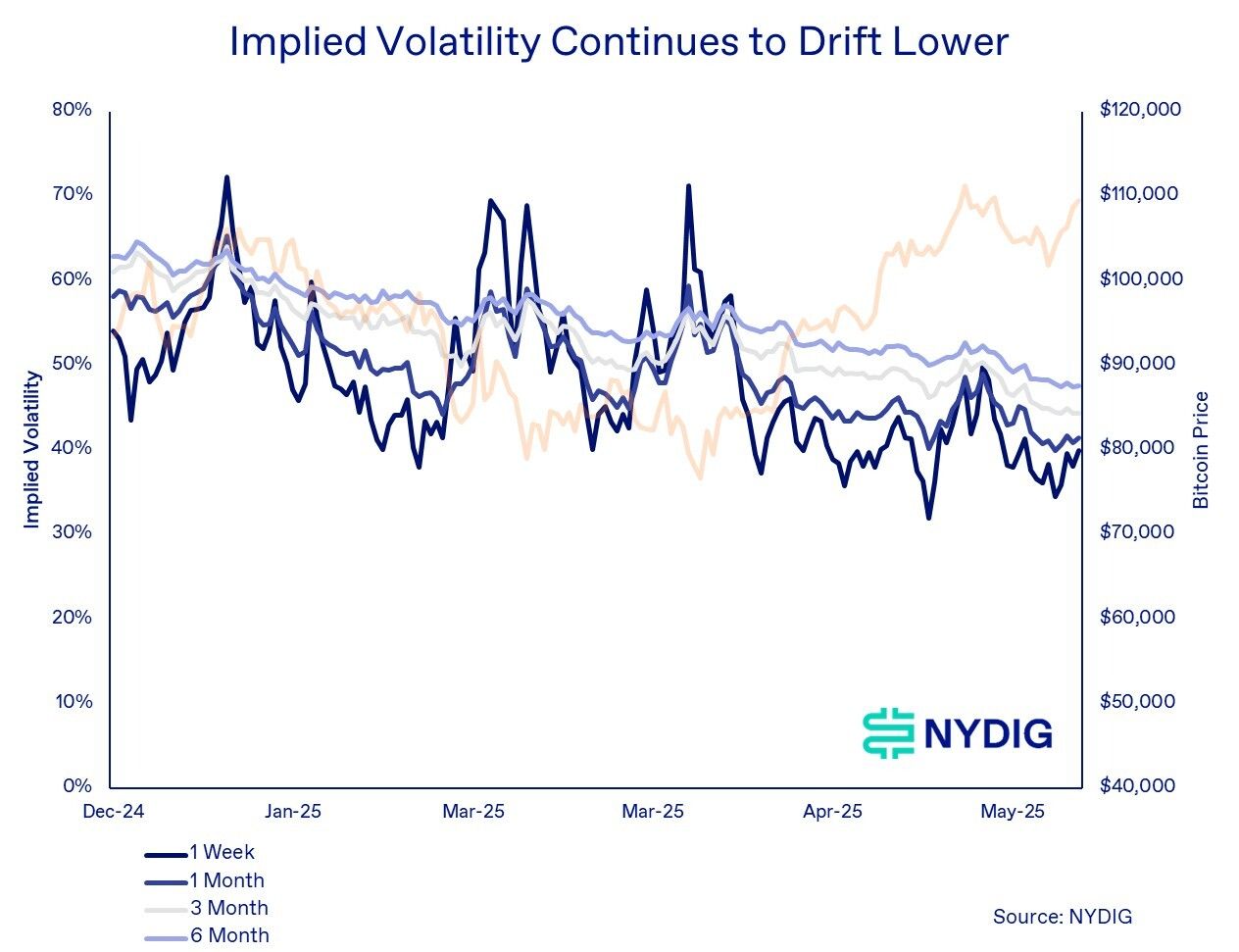

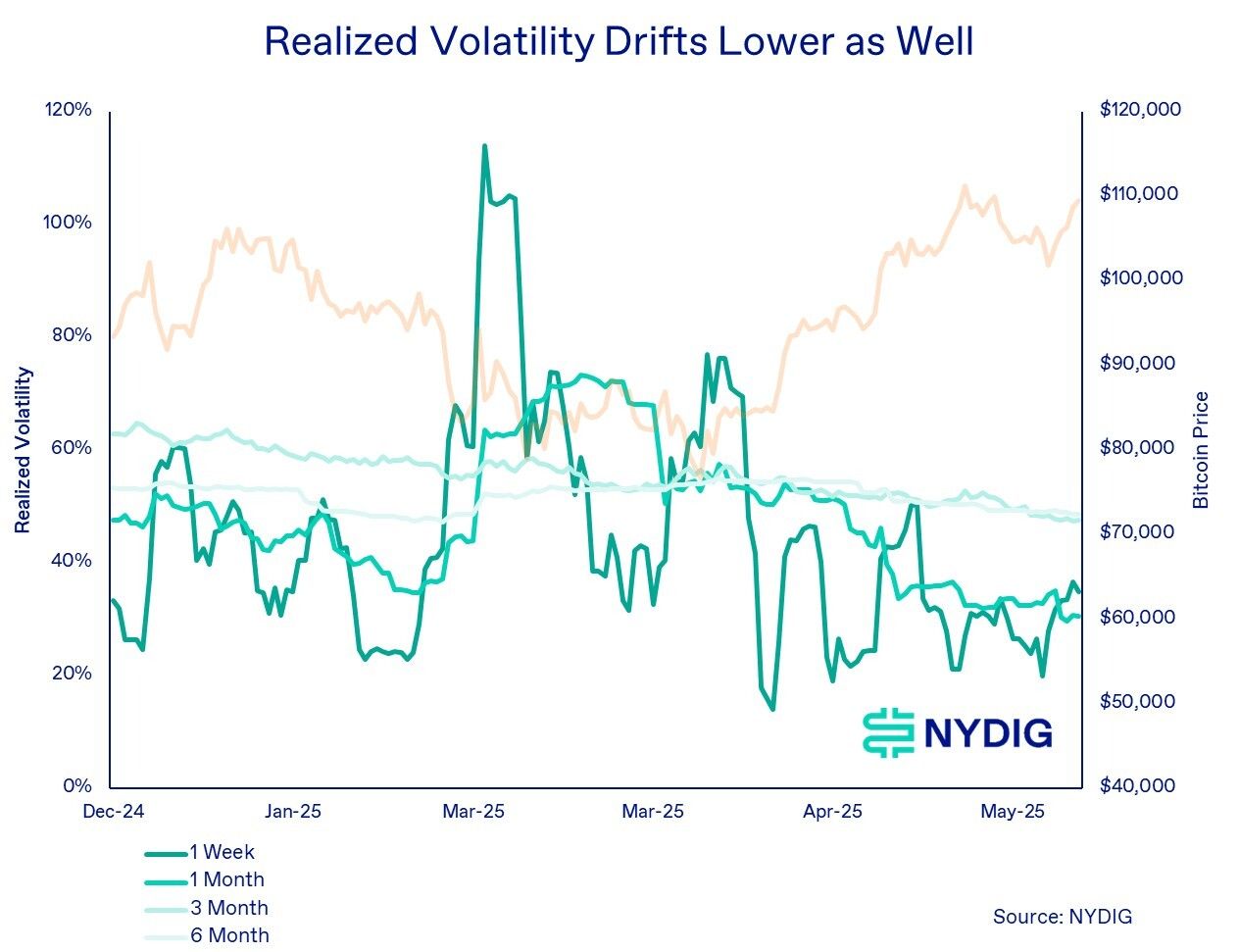

"Bitcoin’s volatility has continued to inclination lower, some successful realized and implied measures, adjacent arsenic the plus reaches caller all-time highs. This diminution successful volatility is peculiarly notable amid historically precocious terms levels," said NYDIG Research successful a caller enactment shared with CoinDesk.

And contempt macro and geopolitical headwinds hitting accepted assets hard, bitcoin has gone into a chill summertime vibe.

"With the marketplace present entering the typically quieter summertime months, this downtrend whitethorn good persist successful the adjacent term," NYDIG added.

Of course, this is possibly a affirmative inclination for bitcoin arsenic it depicts a much maturing marketplace and perchance speaks to its archetypal committedness of "store of value," arsenic the terms reaches caller fresh highs.

However, traders emotion volatility, arsenic the greater the movement, the bigger the P&L opportunities are. While caller grounds highs mightiness beryllium large for semipermanent HODLers, for short-term traders, those juicy breakouts are getting hard to marque wealth on.

Why the calm?

So what's driving these calm terms actions?

NYDIG is chalking it up to accrued request from bitcoin treasury companies, which look to beryllium popping up everywhere, and a emergence successful blase trading strategies, specified arsenic options overwriting, arsenic good arsenic different forms of volatility selling.

The marketplace is getting much professional, and unless we spot immoderate existent Black Swan events (FTX, anyone?) for crypto, prices volition proceed to stay calm.

The opportunity

But each is not mislaid — determination are ever opportunities to marque wealth adjacent erstwhile it's not arsenic lucrative arsenic it seems.

"The diminution successful volatility has made some upside vulnerability done calls and downside extortion via puts comparatively inexpensive," said NYDIG.

Translation: Hedging and catalyst-driven plays are wherever the wealth mightiness beryllium successful this market. If 1 thinks thing large is coming, this is possibly the clip to presumption with directional bets. And determination are a fewer large ones coming.

"For traders anticipating market-moving catalysts, specified arsenic the SEC’s determination connected the GDLC conversion (July 2), the decision of the 90-day tariff suspension (July 8), oregon the Crypto Working Group’s findings deadline (July 22), this presents a cost-effective accidental to presumption for directional moves," said NYDIG.

So bitcoin's summertime lull mightiness not beryllium a full dormant zone; rather, it's a setup for those who are consenting to play the patience crippled and hedge accordingly to commercialized imaginable market-moving events.

3 months ago

3 months ago

English (US)

English (US)