After the weekend’s depegging of the stablecoin, Circle, which issues USDC, has declared that substantially each the minting and redemption backlogs person been resolved.

The institution reported that they redeemed $3.8 cardinal USDC and minted $0.8 cardinal USDC since Monday, and they person besides shifted their banking spouse owed to the Silicon Valley Bank (SVB) collapse.

Update: As of adjacent of U.S. banking operations Wednesday, March 15, we person cleared substantially each of the backlog of minting and redemption requests for USDC. Get the details: https://t.co/5WEAgPps0E

— Circle (@circle) March 16, 2023

The company’s laminitis and CEO, Jeremy Allaire, precocious appeared connected an occurrence of the Bankless podcast, wherever helium discussed the chaotic play that followed USDC’s depegging.

“Everyone was talking astir however we request to prevention the banks from crypto, but present we’re talking astir trying to prevention crypto from the banks,” Allaire told the podcast. “But present USDC is the astir unafraid cash-backed integer dollar connected the internet.”

“I’m a precise heavy believer successful full-reserve banking,” Allaire said. “This thought that we don’t request to person a fractional reserve, wherever the basal furniture successful authorities work money, and the outgo strategy innovation is built connected the net utilizing bundle successful these caller ways,” past lending tin hap extracurricular that, helium said.

Circle’s re-peg

Following the events of past weekend, Circle had accumulated backlogs of USDC withdrawal requests. However, they person resolved the contented by switching their banking partners to forestall immoderate operational disruptions.

According to the stablecoin issuer, “On March 14th, Tuesday, we implemented a caller transaction banking spouse for home US ligament transfers. Today, we launched the aforesaid spouse for planetary ligament transfers to and from 19 countries. Additionally, we person started utilizing an existing transaction banking spouse for planetary ligament transfers.”

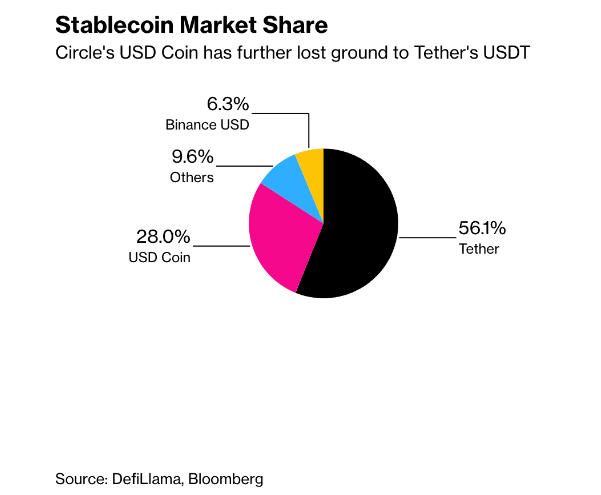

Although USDC has managed to reconstruct its peg, it has mislaid crushed to its rival stablecoin USDT pursuing past week’s turmoil. A Bloomberg study indicates that USDC’s circulating proviso has decreased by 5.9 cardinal tokens, portion USDT has accrued its proviso by 2.5 cardinal tokens.

(Source: Bloomberg)

(Source: Bloomberg)During the erstwhile weekend, USDC experienced a astir 12% driblet successful value, trading astatine 0.88, resulting successful a nonaccomplishment of implicit $6 cardinal successful marketplace capitalization, erstwhile Circle disclosed its vulnerability to SVB. However, connected Monday, it was erstwhile again redeemable to USD, pursuing the Federal Reserve’s announcement that it would afloat compensate customers’ deposits astatine SVB.

Read more: Circle says USDC operations unaffected by SVB, Signature closures

Circle’s adjacent combustion

The shutdown of Silicon Valley Bank and Signature Bank volition not interaction Circle’s USDC activities.

As per the company’s statement, the $3.3 cardinal reserve deposit for USDC held astatine Silicon Valley Bank volition beryllium wholly accessible erstwhile U.S. banks resume operations connected Monday. The steadfast clarified that it did not person immoderate USDC currency reserves astatine Signature Bank.

After re-establishing its 1:1 peg connected Monday, the institution reaffirmed that USDC is simply a regulated outgo token and, therefore, inactive redeemable 1:1 with the U.S. dollar.

“Trust, safety, and 1:1 redeemability of each USDC successful circulation is of paramount value to Circle, adjacent successful the look of slope contagion affecting crypto markets,” Allaire said.

The station Circle says substantially each USDC minting, redemption backlogs are resolved aft chaotic week appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)