Nasdaq-listed crypto speech Coinbase's Layer 2 scaling solution, Base, has gone from being the person successful 2024 successful presumption of superior inflows done cross-chain bridges to the apical loser this year.

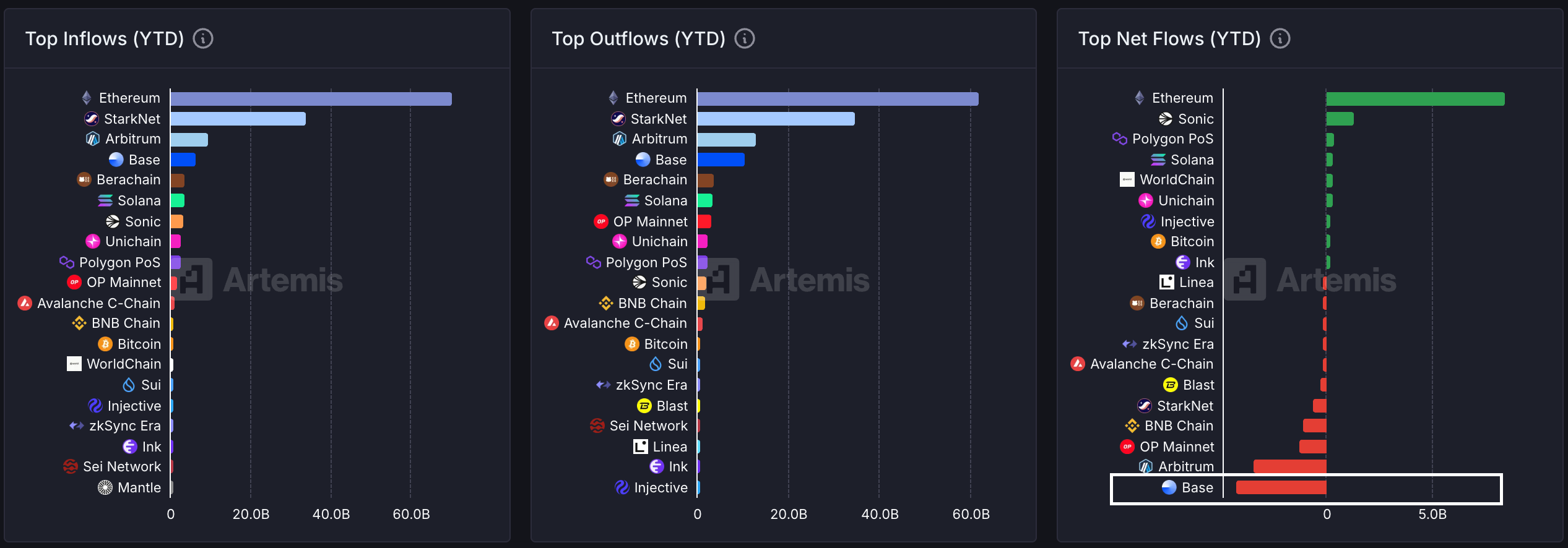

Data from the Artemis Terminal shows Base has seen a nett outflow of $4.3 cardinal this year, a stark opposition to the nett inflow of $3.8 cardinal successful 2024, which was the highest among the apical 20 blockchains.

Meanwhile, Ethereum, the world's largest astute declaration blockchain, has registered a nett inflow of $8.5 cardinal this year, compared to a nett outflow of $7.4 cardinal successful the erstwhile year.

The information amusement the momentum down the Base concatenation has decelerated, with Ethereum reclaiming its apical spot.

Crypto bridges are protocols that facilitate connection and enactment betwixt antithetic blockchains, enhancing interoperability. Bridging, therefore, refers to the enactment of moving tokens betwixt antithetic networks.

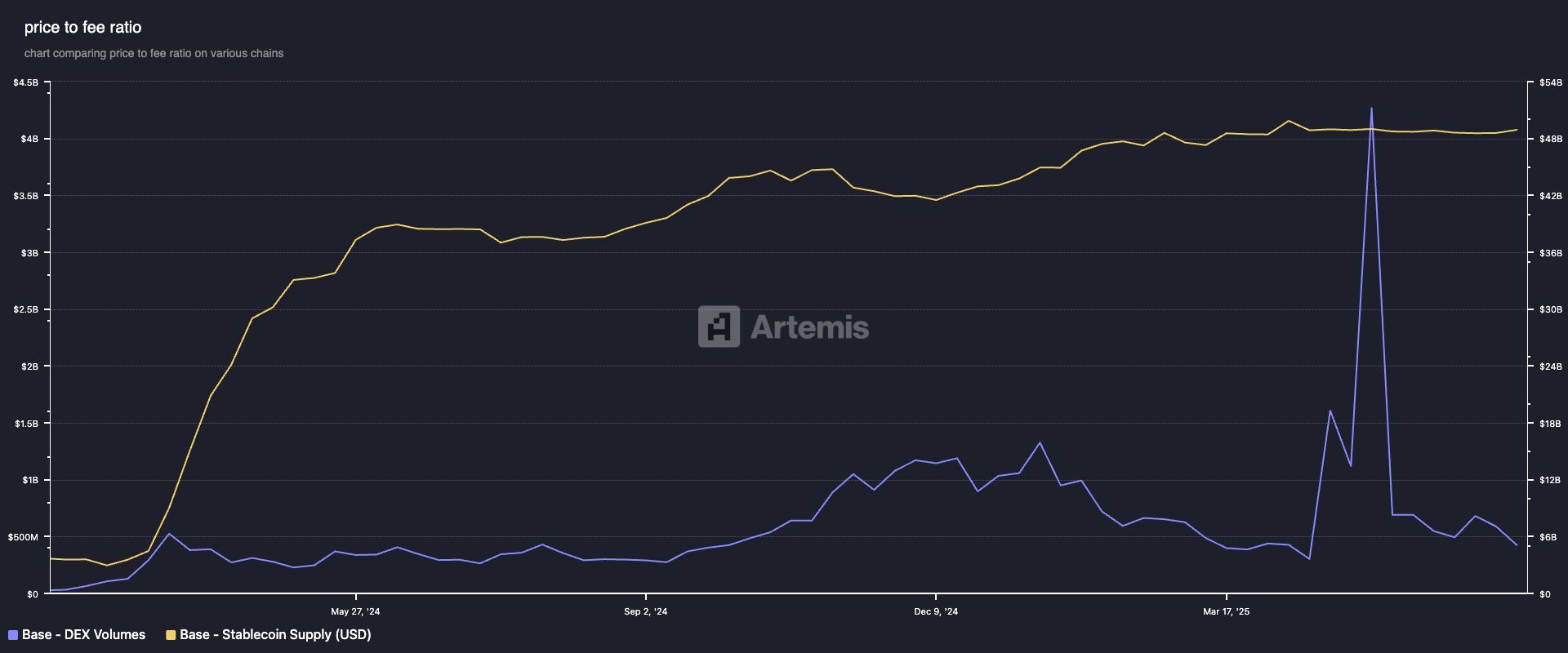

The cumulative proviso of stablecoins connected Base has besides flattened supra $4 cardinal since mid-May alongside slower trading volumes, arsenic the illustration beneath shows.

BASE bleeding ETH

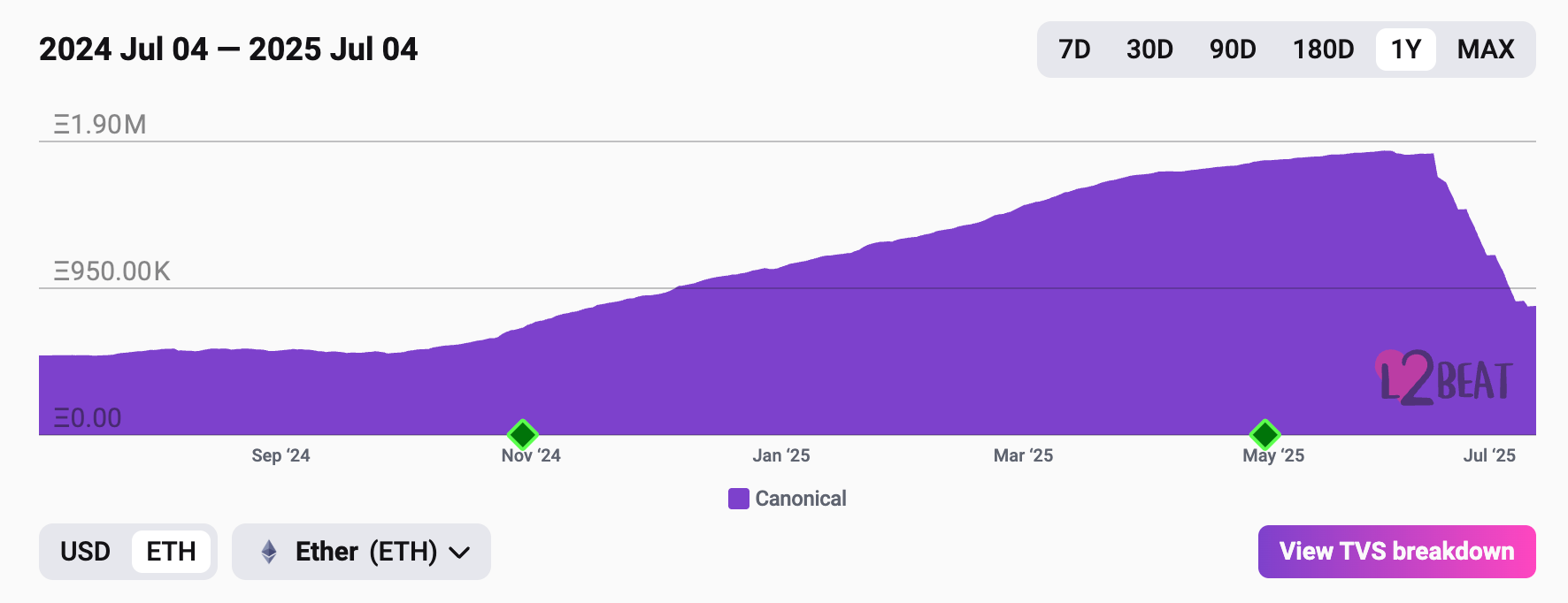

According to the information root L2BEAT, the full fig of ether (ETH) deposited connected BASE has crashed from 1.82 cardinal ETH to conscionable implicit 835,000 ETH successful 4 weeks.

The inclination is accordant with different Layer 2 solutions, which person seen notable ETH outflows successful caller weeks, according to Michael Nadeau of The DeFi Report connected X.

According to Coinbase's Protocol Specialist Viktor Bunin, the outflows are apt owed to Binance withdrawing superior to the Layer 1.

"The immense bulk is conscionable Binance withdrawing to L1. They kept an ungodly magnitude connected the L2s. Unclear if they were getting incentives to support it determination oregon conscionable didn't equilibrium crossed their supported chains," Bunin said connected X.

3 months ago

3 months ago

English (US)

English (US)